Rail Control System Market Size (2025 – 2030)

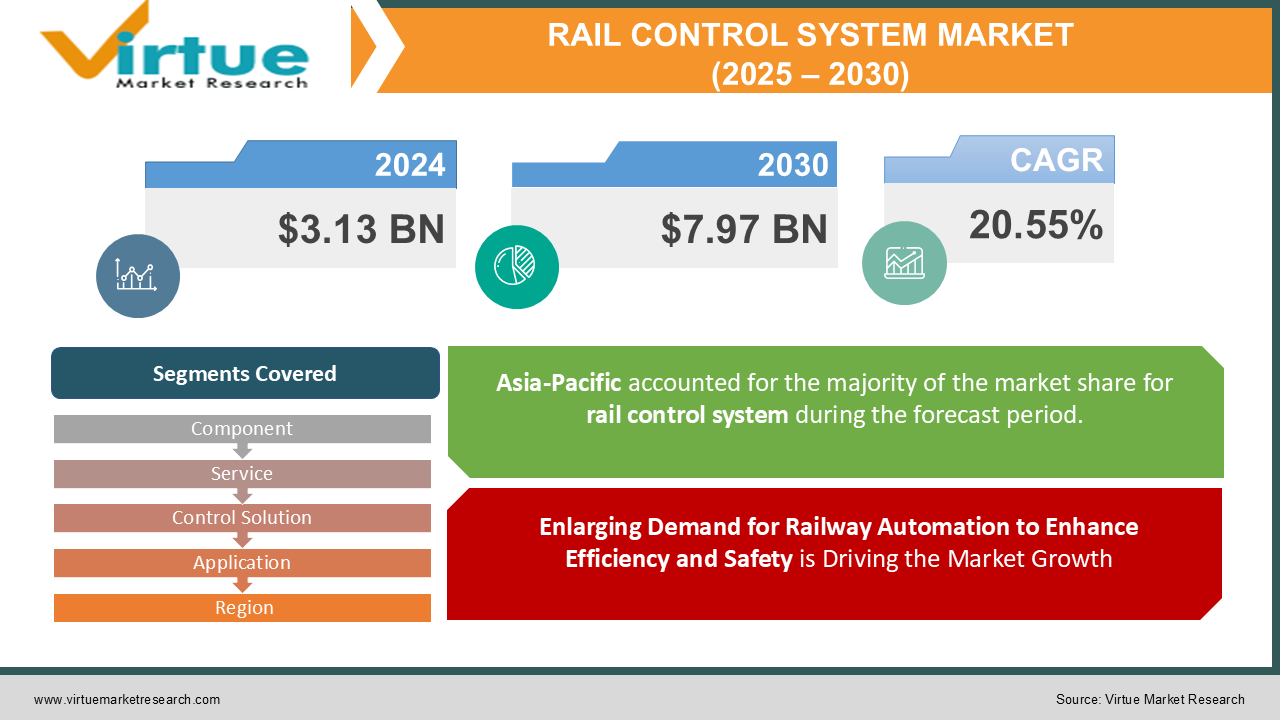

The Global Rail Control System Market was valued at USD 3.13 billion in 2024 and is projected to reach a market size of USD 7.97 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.55%.

The Rail Control System Market is a critical component of modern railway infrastructure, considering efficient, safe, and optimized train operations. These systems merge advanced signaling, automation, and communication technologies to enhance railway network performance, reduce delays, and improve passenger safety. With rapid urbanization and rising demand for high-speed rail networks, governments and railway operators worldwide are investing in cutting-edge rail control solutions such as Positive Train Control (PTC), Communication-Based Train Control (CBTC), and European Train Control System (ETCS).

The market is influenced by the need for real-time monitoring, predictive maintenance, and seamless rail traffic management. Additionally, the adoption of Artificial Intelligence (AI), the Internet of Things (IoT), and cloud-based analytics is revolutionizing rail control, resulting in automation and data-driven decision-making. As global railway modernization projects continue to expand, the Rail Control System Market is expected to grow significantly, shaping the future of intelligent transportation systems and sustainable mobility solutions.

Key Market Insights:

-

The Rail Control System Market is experiencing major advancements influenced by rapid urbanization and increased investments in railway infrastructure. Automation in rail networks has reduced delays by up to 30%, improving overall operational efficiency. With the integration of Communication-Based Train Control (CBTC), rail capacity utilization has increased by nearly 25%, rooting for smoother and more frequent train operations. Moreover, the adoption of Artificial Intelligence (AI) and predictive maintenance in rail control systems has led to a 40% reduction in unplanned downtime, enhancing both safety and reliability.

-

Governments and private sectors worldwide are actively investing in smart railway solutions, with over 70% of new railway projects incorporating digital rail control technologies. The adoption of European Train Control System (ETCS) has improved train speeds by 20% while reducing energy consumption by approximately 15%, making it a preferred choice in high-speed rail networks. Additionally, cloud-based rail traffic management systems have enabled real-time tracking and optimization, increasing operational efficiency by 35% across major railway corridors.

-

Cybersecurity remains a significant concern, with nearly 60% of railway operators investing in advanced cybersecurity frameworks to safeguard rail control networks against digital threats. Meanwhile, AI-powered automation has cut operational costs by up to 25%, further encouraging the adoption of smart rail control systems. As technological advancements continue, the industry is expected to witness a shift toward fully autonomous train operations, revolutionizing the future of rail transportation.

Rail Control System Market Drivers:

Enlarging Demand for Railway Automation to Enhance Efficiency and Safety is Driving the Market Growth

The growing demand for automated rail control systems is driven by the rising need for improved railway efficiency, safety, and capacity management. Governments and railway operators are investing in technologies such as AI-powered traffic management, real-time monitoring, and predictive maintenance to reduce delays and optimize operations. Additionally, automation minimizes human errors, enhances scheduling accuracy, and improves energy efficiency, leading to significant cost savings for rail operators.

Increasing Urbanization and Expansion of Smart City Infrastructure is Fueling the Market Growth

With rapid urbanization, the demand for efficient and sustainable public transport systems has dominated, prompting investments in modern rail networks. Rail control systems play a crucial role in managing high-speed rail, metro networks, and suburban transit by ensuring smooth operations. As smart cities amalgamate digital solutions, rail control technologies, including intelligent signaling and IoT-enabled monitoring, are becoming essential components for optimizing urban mobility and reducing congestion.

Growing Adoption of AI, IoT, and Big Data for Rail Management

The integration of artificial intelligence, Internet of Things (IoT), and big data analytics is revolutionizing the rail control system market. These technologies optimize condition-based maintenance, real-time tracking, and automated scheduling, significantly improving rail network performance. AI-powered analytics help detect potential failures before they occur, reducing downtime and maintenance costs. As railway operators seek smarter and data-driven solutions, the adoption of AI-driven rail control systems is expected to increase exponentially.

Rail Control System Market Restraints and Challenges:

Raising Implementation Costs, Legacy Infrastructure, and Cybersecurity Concerns Hindering Market Growth

The adoption of advanced rail control systems faces significant challenges, majorly due to the high implementation and maintenance costs associated with upgrading legacy railway infrastructure. Many existing rail networks still rely on outdated signaling and control systems, constructing modernization a costly and time-consuming process. Additionally, integrating new digital solutions with older infrastructure poses technical difficulties, requiring extensive investments in compatibility and workforce training. Cybersecurity threats are another major concern, as rail control systems are increasingly reliant on digital technologies and connectivity. The risk of cyberattacks on critical rail infrastructure raises the need for robust security measures, further increasing operational costs. Moreover, regulatory and interoperability challenges vary across regions, making it difficult to establish standardized rail control systems globally. These factors collectively slow down the widespread adoption of advanced rail control technologies. Cybersecurity threats have also come across as a major challenge, as rail control systems are highly becoming more dependent on digital technologies, cloud-based solutions, and interconnected networks.

Rail Control System Market Opportunities:

The rail control system market represents substantial opportunities driven by the enlarging of smart rail networks, advancements in artificial intelligence (AI) and automation, and increasing global investments in railway infrastructure. As urbanization accelerates, governments and private investors are prioritizing the development of high-speed rail and metro systems, creating a demand for advanced rail control solutions that enhance safety, efficiency, and capacity. Emerging economies are investing heavily in railway modernization, offering significant growth potential for rail control system providers.

The integration of AI and predictive analytics in rail control systems is transforming operations by enabling real-time monitoring, automated decision-making, and predictive maintenance. AI-powered systems help minimize delays, optimize scheduling, and facilitate overall network efficiency. Additionally, the adoption of cloud-based rail control solutions and IoT-enabled sensors is providing enhanced visibility into train operations, reducing downtime, and increasing passenger safety. With the push towards green and sustainable transportation, digital rail control solutions are playing a crucial role in reducing carbon footprints and improving energy efficiency, further driving market opportunities.

RAIL CONTROL SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

20.55% |

|

Segments Covered |

By Component, Service, Control Solution, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG, Alstom SA, Hitachi Rail Ltd., Thales Group, Bombardier Transportation (Acquired by Alstom), Wabtec Corporation, Mitsubishi Electric Corporation, CAF Signalling, CRRC Corporation Limited, ABB Group, Ansaldo STS (A Hitachi Group Company), Nippon Signal Co., Ltd., Stadler Rail AG |

Rail Control System Market Segmentation: By Component

-

Vehicle Control Unit

-

Mobile Communication Gateway

-

Human Machine Interface

The Vehicle Control Unit (VCU) is the expanding as it plays a crucial role in ensuring efficient train operation, real-time monitoring, and automated control, making it indispensable in modern rail networks.

The Mobile Communication Gateway is the fastest-growing due to increasing adoption of digital rail solutions, IoT-enabled communication, and the need for real-time data transmission between trains and control centers, improving operational efficiency and safety.

The Human Machine Interface (HMI) is a critical component that enhances driver interaction, train diagnostics, and operational decision-making through intuitive displays and control systems.

Rail Control System Market Segmentation: By Service

-

Consulting

-

System Integration and Development

-

Support & Maintenance

The System Integration and Development segment is the dominant, as railway operators majorly invest in integrating advanced rail control technologies, automation, and digital signaling systems to enhance operational efficiency and safety.

The Support & Maintenance segment is the fastest-growing, affected by the increasing need for continuous monitoring, real-time troubleshooting, and predictive maintenance to make sure the smooth functioning of modern rail control systems and minimize downtime.

The Consulting segment plays a vital role in enabling rail operators adopt the latest technologies, comply with regulations, and optimize rail network efficiency through expert guidance and strategic planning.

Rail Control System Market Segmentation: By Control Solution

-

Positive Train Control

-

Integrated Train Control

The Integrated Train Control segment is the dominant sub-segment, as it integrates multiple control functions, including signaling, automation, and communication, ensuring enhanced coordination and efficiency in modern railway operations.

The Positive Train Control (PTC) segment is the fastest-growing, driven by strict government regulations and increasing safety concerns, resulting in widespread adoption to prevent train collisions, derailments, and human errors.

Rail Control System Market Segmentation: By Application

-

Metros

-

High-Speed Trains

-

Normal Trains

The Metros segment is the dominant application due to the raising demand for urban transit solutions, rapid urbanization, and government investments in smart city projects. These systems rely heavily on automated control technologies, reducing congestion and improving efficiency in densely populated cities. The integration of AI-driven predictive maintenance further enhances operational efficiency.

The High-Speed Trains segment is the fastest-growing, fueled by advancements in rail infrastructure, enlarging cross-border connectivity, and the rising preference for fast, long-distance travel. Countries investing in high-speed rail networks are adopting cutting-edge control systems to ensure passenger safety and operational excellence.

The Normal Trains segment remains significant, especially in regions with extensive conventional rail networks. These trains benefit from modernized rail control systems to enhance scheduling, minimize delays, and improve overall safety.

Rail Control System Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific dominates the rail control system market due to rapid urbanization, significant government investments in railway infrastructure, and increasing adoption of smart rail technologies. Countries like China, India, and Japan are expanding metro and high-speed rail networks, driving demand for advanced rail control solutions.

The Middle East and Africa are experiencing the fastest growth in the rail control system market, influenced by large-scale railway infrastructure projects and modernization efforts. Countries like Saudi Arabia and the UAE are investing heavily in high-speed rail and metro networks, boosting demand for advanced rail control solutions.

COVID-19 Impact Analysis on the Global Rail Control System Market:

The COVID-19 pandemic significantly disrupted the global rail control system market, resulting in project delays, supply chain disruptions, and decreased investments in new railway infrastructure. Lockdowns and travel restrictions resulted in reduced passenger traffic, forcing railway operators to cut costs and delay modernization plans. Many ongoing metro and high-speed rail projects were either postponed or slowed down due to financial constraints and workforce shortages. However, the pandemic also highlighted the need for automation and digitalization in railway operations to ensure efficiency and safety. Governments and transportation authorities are now prioritizing smart rail technologies, such as automated train control, remote monitoring, and predictive maintenance, to minimize human intervention and enhance operational resilience.

Latest Trends/ Developments:

The rail control system market is experiencing rapid advancements driven by digitalization, automation, and the integration of artificial intelligence (AI) in railway operations. Smart signaling systems, such as Communication-Based Train Control (CBTC) and European Train Control System (ETCS), are being widely adopted to enhance operational efficiency, reduce delays, and improve passenger safety. Additionally, cloud-based rail management solutions are gaining traction, enabling real-time monitoring, predictive maintenance, and data-driven decision-making for railway operators.

Another key trend is the increasing focus on sustainability and green rail technologies. Governments and railway authorities worldwide are investing in energy-efficient rail infrastructure, including electrified rail lines and hybrid propulsion systems, to reduce carbon emissions. The rise of high-speed rail projects and urban metro expansions, particularly in Asia-Pacific and Europe, is further fueling demand for advanced rail control systems. As the industry moves towards greater automation and digital transformation, the adoption of cybersecurity solutions is also becoming a priority to safeguard critical railway networks from cyber threats.

Key Players:

-

Siemens AG

-

Alstom SA

-

Hitachi Rail Ltd.

-

Thales Group

-

Bombardier Transportation (Acquired by Alstom)

-

Wabtec Corporation

-

Mitsubishi Electric Corporation

-

CAF Signalling

-

CRRC Corporation Limited

-

ABB Group

-

Ansaldo STS (A Hitachi Group Company)

-

Nippon Signal Co., Ltd.

-

Stadler Rail AG

Chapter 1. Rail Control System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Rail Control System Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Rail Control System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Rail Control System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Rail Control System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Rail Control System Market – By Service

6.1 Introduction/Key Findings

6.2 Consulting

6.3 System Integration and Development

6.4 Support & Maintenance

6.5 Y-O-Y Growth trend Analysis By Service

6.6 Absolute $ Opportunity Analysis By Service, 2025-2030

Chapter 7. Rail Control System Market – By Component

7.1 Introduction/Key Findings

7.2 Vehicle Control Unit

7.3 Mobile Communication Gateway

7.4 Human Machine Interface

7.5 Y-O-Y Growth trend Analysis By Component

7.6 Absolute $ Opportunity Analysis By Component, 2025-2030

Chapter 8. Rail Control System Market – By Application

8.1 Introduction/Key Findings

8.2 Metros

8.3 High-Speed Trains

8.4 Normal Trains

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. Rail Control System Market – By Control Solution

9.1 Introduction/Key Findings

9.2 Positive Train Control

9.3 Integrated Train Control

9.4 Y-O-Y Growth trend Analysis By Control Solution

9.5 Absolute $ Opportunity Analysis By Control Solution, 2025-2030

Chapter 10. Rail Control System Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Service

10.1.2.1 By Component

10.1.3 By By Service

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Service

10.2.3 By Component

10.2.4 By By Service

10.2.5 By By Control Solution

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Service

10.3.3 By Component

10.3.4 By By Service

10.3.5 By By Control Solution

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Service

10.4.3 By Component

10.4.4 By By Service

10.4.5 By By Control Solution

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Service

10.5.3 By Component

10.5.4 By By Service

10.5.5 By By Control Solution

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Rail Control System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Siemens AG

11.2 Alstom SA

11.3 Hitachi Rail Ltd.

11.4 Thales Group

11.5 Bombardier Transportation (Acquired by Alstom)

11.6 Wabtec Corporation

11.7 Mitsubishi Electric Corporation

11.8 CAF Signalling

11.9 CRRC Corporation Limited

11.10 ABB Group

11.11 Ansaldo STS (A Hitachi Group Company)

11.12 Nippon Signal Co., Ltd.

11.13 Stadler Rail AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Rail Control System Market was valued at USD 3.13 billion in 2024 and is projected to reach a market size of USD 7.97 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 20.55%.

Rising demand for railway automation and safety enhancements is driving market growth.

Based on Service, the Global Rail Control System Market is segmented into Consulting, System Integration and Developments, and Support and Maintenance.

Asia-Pacific is the most dominant region for the Global Rail Control System Market.

Siemens AG, Alstom SA, Hitachi Rail Ltd., Thales Group are the key players of the Global Rail Control System Market.