Quote-to-Cash Software Market Size (2024 – 2030)

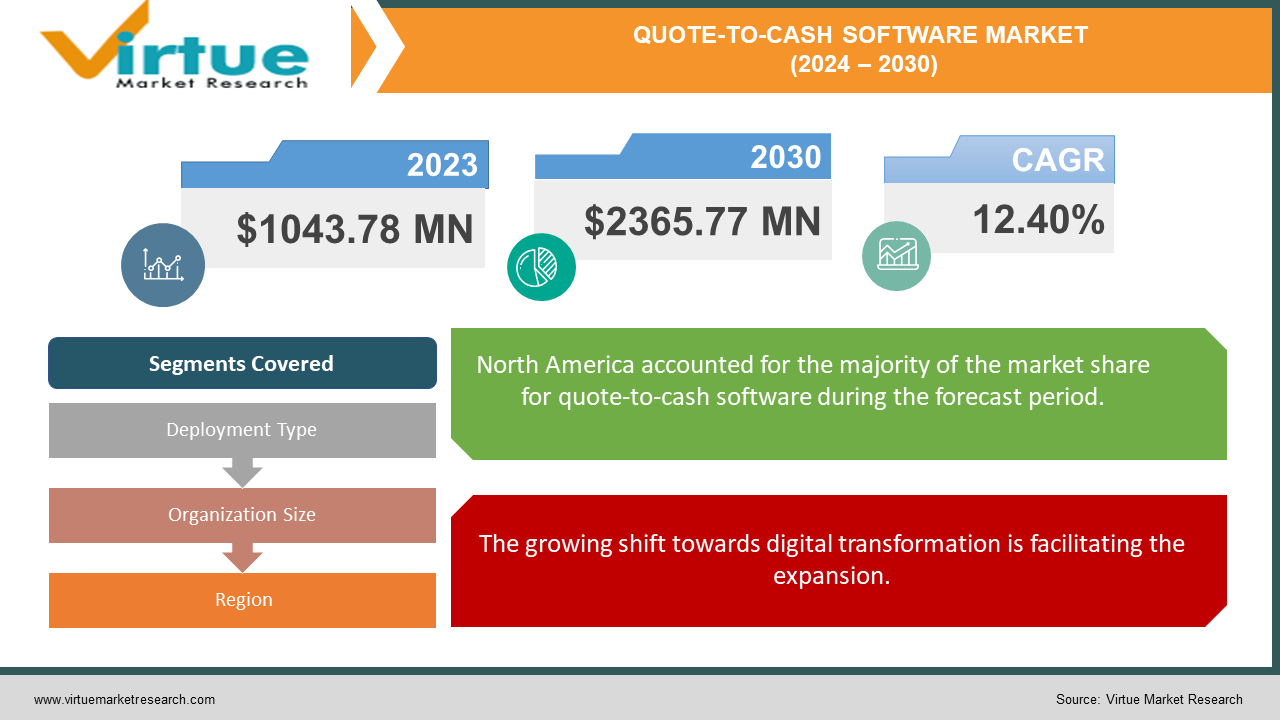

The global quote-to-cash software market was valued at USD 1043.78 million and is projected to reach a market size of USD 2365.77 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12.40%.

The phrase quote-to-cash refers to the complete set of business procedures associated with the sales lifecycle. The procedure includes presenting an offer to a potential customer as well as collecting, allocating, and recording income. Software known as quote-to-cash (Q2C) controls every step of the sales process, from product setup to deal closure and revenue management. To support sales teams, it automates contracting, ordering, and quoting procedures. The emergence of this software started in the early 2000s. Very few companies have started to adopt this software to streamline their sales processes. However, integration challenges were often faced by many organizations. Presently, with technological advancements and awareness, the market has witnessed notable growth. In the future, with a focus on user interfaces and cloud computing, an immense boost is anticipated.

Key Market Insights:

The primary obstacles impeding market expansion include complicated implementation, financial limitations, and data protection issues.

Opportunities may be found in designing mobile-friendly interfaces, focusing on small enterprises, and utilizing emerging technologies like blockchain and IoT.

The market is growing most quickly in North America, followed by Asia-Pacific, because of the presence of companies, government efforts, and greater awareness.

A significant trend in the QTC software market is the development of enhanced integration capabilities, which make it easier to integrate QTC solutions with other enterprise systems and enhance data flow and business operations.

Quote-to-Cash Software Market Drivers:

The growing shift towards digital transformation is facilitating the expansion.

The COVID-19 pandemic played a significant role in a rapid transformation towards digitalization. Businesses have recognized the importance of having a virtual presence in the market. The adoption of this software helps automate sales and financial processes. Manual efforts are reduced, resulting in fewer errors and increasing efficiency. Additionally, repetitive tasks need not be performed. This software aids in a smooth process, starting from quoting to cash collection. Any sort of delay or inaccuracy is reduced. Besides, technological progress has enabled an advantage in this process. Organizations are prioritizing cloud-based solutions that offer better scalability, versatility, and flexibility. Artificial intelligence (AI) and machine learning (ML) fields have emerged, helping with predictive analysis, automating pricing strategies, and managing the entire procedure. These advancements help companies make data-driven decisions and optimize risks efficiently.

An increasing emphasis on enhanced customer experience has been accelerating the growth rate.

Customer satisfaction is crucial for any business and its products to succeed. Data analytics are incorporated into this software. This helps in delving into insights to get a better understanding of the client. Additionally, personalization is another opportunity. Services are tailored as per the needs and likes of the individual by analyzing their behavior, purchasing preferences, and patterns. Secondly, quote-to-cash software aids in generating quotes, managing orders, and avoiding delays. Quick and timely quotes, processing, and delivery are ensured by this software. This elevates the customer’s trust in the company.

Quote-to-Cash Software Market Restraints and Challenges:

Complex implementation, cost constraints, and data privacy are the main issues that the market is currently facing.

Integration challenges are very common for this software. Existing enterprise systems like CRM, ERP, and others can have different disks and data. These discrepancies need to be handled by trained experts. The whole process can be complex and time-consuming. Advanced resources are required in the IT systems for the sane. Secondly, the initial expenses can be very high. The implementation of the software requires infrastructure, licenses, consultation, and labor. Small and medium-sized companies can face hindrances if they have tight budgets. Concerns about return on investment can demotivate companies to adopt this software. Thirdly, sales, financial, and customer data are present in this software. There is a high possibility of cyberattacks and fraud involving this sensitive information. To avoid this damage, companies need to secure their data by enforcing strict policies and strategies.

Quote-to-Cash Software Market Opportunities:

Upcoming technologies can provide the market with an ample number of possibilities. Blockchain technology is one such field. This helps in providing advanced security, payment process, and transparency. Secondly, the Internet of Things (IoT) can enable real-time data collection, improve orders, track inventory, and enhance the customer experience. Besides this, focusing on small-sized companies can help with increasing revenue. QTC solutions can be designed specifically for these companies. These solutions can offer affordable pricing, tailored needs, and a simple interface that encourages startups and other organizations to reach out for their services. Apart from this, mobile-friendly interfaces are being developed to gain more users. Smartphones have become a necessity for day-to-day activities. By implementing user-friendly software that integrates with these devices, faster responses and timely delivery can be ensured. Sales teams can manage quotes and contracts from their phones. This trend is particularly useful for businesses that have limited resources and IT teams.

QUOTE-TO-CASH SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.40% |

|

Segments Covered |

By Deployment Type, Organization Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Salesforce, Oracle, SAP, Conga, IBM,Microsoft Workday, Zuora, Infor, PROS |

Quote-to-Cash Software Market Segmentation: By Deployment Type

-

Cloud-Based

-

Web Based

The largest and fastest-growing deployment method in the industry is cloud-based deployment. Because they facilitate remote work, are easier to integrate with other cloud-based applications, and have lower upfront costs, cloud-based QTC solutions are widely used across a variety of industries. Many businesses prefer cloud solutions because of their flexibility, scalability, and affordability. Furthermore, they offer the advantage of automatic upgrades without the need for any labor. This simplicity makes it an attractive option, broadening the consumer base.

Quote-to-Cash Software Market Segmentation: By Organization Size

-

Large-Scale Organization

-

Small and medium-scale organizations

Large-scale organizations are the largest growing category. They have the financial, infrastructure, and other resources needed for this technology. These businesses use this software to increase the visibility of their brands. They use this software to increase sales, track the entire sales process, elevate productivity, and optimize the client experience. Additionally, these organizations finance R&D initiatives that help enhance the existing features and launch new versions. Small and medium-sized organizations are expanding at the fastest rate. The government provides funding, subsidies, and other efforts to these businesses. SMEs are starting to understand how important it is to digitize and embrace these solutions. These organizations' endeavors are aided in growth by this program. Businesses can track the effectiveness of their sales due to its integrated analytics and reporting capabilities. The category is being driven by the requirement to use effective sales methods to stand out and expand.

Quote-to-Cash Software Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The market with the largest growth is North America. Leading the market are the US and Canada. This region has a total share of around 36%. The economy in this region is strong, which facilitates project funding. Businesses regularly take part in joint ventures and product launches. This area is home to several reputable businesses, including Salesforce, Conga, Oracle, and SAP. Their widespread presence around the globe results in increased income generation. In addition, the region's businesses are adopting digital solutions at a higher rate because of increased awareness, which drives up demand. Furthermore, the area is prominent for its research and developmental activities. Many prestigious institutions, universities, and other companies are constantly conducting studies and testing software to commercialize advanced features. The market with the fastest growth is Asia-Pacific. At the top are nations like South Korea, Japan, China, and India. This region holds an approximate share of around 26%. The quality of life has improved as a result of urbanization. Growth in the economy has made investing easier. Governmental initiatives, incentives, and training programs have also improved growth. The digitization of enterprises is another significant aspect driving up the growth rate. Moreover, the creation of software with advanced features has been facilitated by the presence of qualified specialists in several Asian nations. Apart from this, many startups are coming up with innovative solutions tailored to a particular industry. This is helping in gathering better clients.

COVID-19 Impact Analysis on the Global Quote-to-Cash Software Market:

On the market, the viral epidemic had a favorable effect. Movement limitations, social isolation, and lockdowns became the new standards. All of these regulations caused disruptions to traditional commerce. This led to a change in favor of remote work. A vast majority of people began working from home. As a result, there was a swift shift towards digitalization, forcing businesses to acquire the tools required for online presence. The need for QTC software increased due to the need for remote access to sales and financial data. Remote collaborations between multiple teams were possible because of this. There was economic uncertainty, due to which companies had to plan their budgets. This software streamlined operations, reduced errors and repetition, and increased efficiency. Advanced analytics features in QTC products enable companies to monitor cash flow, assess sales success, and make swift strategy adjustments. To give clients more flexible payment alternatives, several firms shifted to usage- and subscription-based structures in response to the economic impact. Demand for QTC solutions supporting these models surged. During the economic crisis, these models assisted companies in keeping clients who were trying to control their cash flow and cut expenses upfront. According to WebinarCare, there was a 4% increase in the proportion of firms with a dedicated budget for content marketing, reaching 59%. Post-pandemic, the market has continued to grow owing to demand and rapid adoption.

Latest Trends/ Developments:

As concerns about data security and privacy grow, Q2C software is putting more of a focus on putting strong security measures in place and making sure that laws like the CCPA and GDPR are followed. Secure data storage, multi-factor authentication, and advanced encryption are a few such measures that are being implemented in organizations for better security measures.

In the market for quote-to-cash (QTC) software, enhanced integration capabilities are a major trend. To guarantee smooth data flow and efficient business procedures, these capabilities concentrate on establishing seamless links between QTC solutions and other corporate systems. A lot of QTC platforms include strong APIs that enable unique integrations and increase the functionality of the program to suit certain business requirements. The network of interconnected apps, services, and APIs that operate together to provide data interchange, functionality, and interactions across different software components is referred to as an API ecosystem. To enable collaboration between all software developers, an API links them. By connecting programs that wouldn't typically operate together, developers may take advantage of benefits and bridge gaps in their products' capabilities.

Key Players:

-

Salesforce

-

Oracle

-

SAP

-

Conga

-

IBM

-

Microsoft

-

Workday

-

Zuora

-

Infor

-

PROS

Chapter 1. Quote-to-Cash Software Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Quote-to-Cash Software Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Quote-to-Cash Software Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Quote-to-Cash Software Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Quote-to-Cash Software Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Quote-to-Cash Software Market – By Deployment Type

6.1 Introduction/Key Findings

6.2 Cloud-Based

6.3 Web Based

6.4 Y-O-Y Growth trend Analysis By Deployment Type

6.5 Absolute $ Opportunity Analysis By Deployment Type, 2024-2030

Chapter 7. Quote-to-Cash Software Market – By Organization Size

7.1 Introduction/Key Findings

7.2 Large-Scale Organization

7.3 Small and medium-scale organizations

7.4 Y-O-Y Growth trend Analysis By Organization Size

7.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 8. Quote-to-Cash Software Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Deployment Type

8.1.3 By Organization Size

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Deployment Type

8.2.3 By Organization Size

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Deployment Type

8.3.3 By Organization Size

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Deployment Type

8.4.3 By Organization Size

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Deployment Type

8.5.3 By Organization Size

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Quote-to-Cash Software Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Salesforce

9.2 Oracle

9.3 SAP

9.4 Conga

9.5 IBM

9.6 Microsoft

9.7 Workday

9.8 Zuora

9.9 Infor

9.10 PROS

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global quote-to-cash software market was valued at USD 1043.78 million and is projected to reach a market size of USD 2365.77 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 12.40%.

The growing shift towards digital transformation and an increasing emphasis on enhanced customer experience are the main factors propelling the global quote-to-cash software market.

Based on organization size, the global quote-to-cash software market is segmented into large-scale organizations and small and medium-scale organizations.

North America is the most dominant region for the global quote-to-cash software market.

Salesforce, Oracle, SAP, Conga, and IBM are the key players operating in the global quote-to-cash software market.