Quinolones Market Size (2023 - 2030)

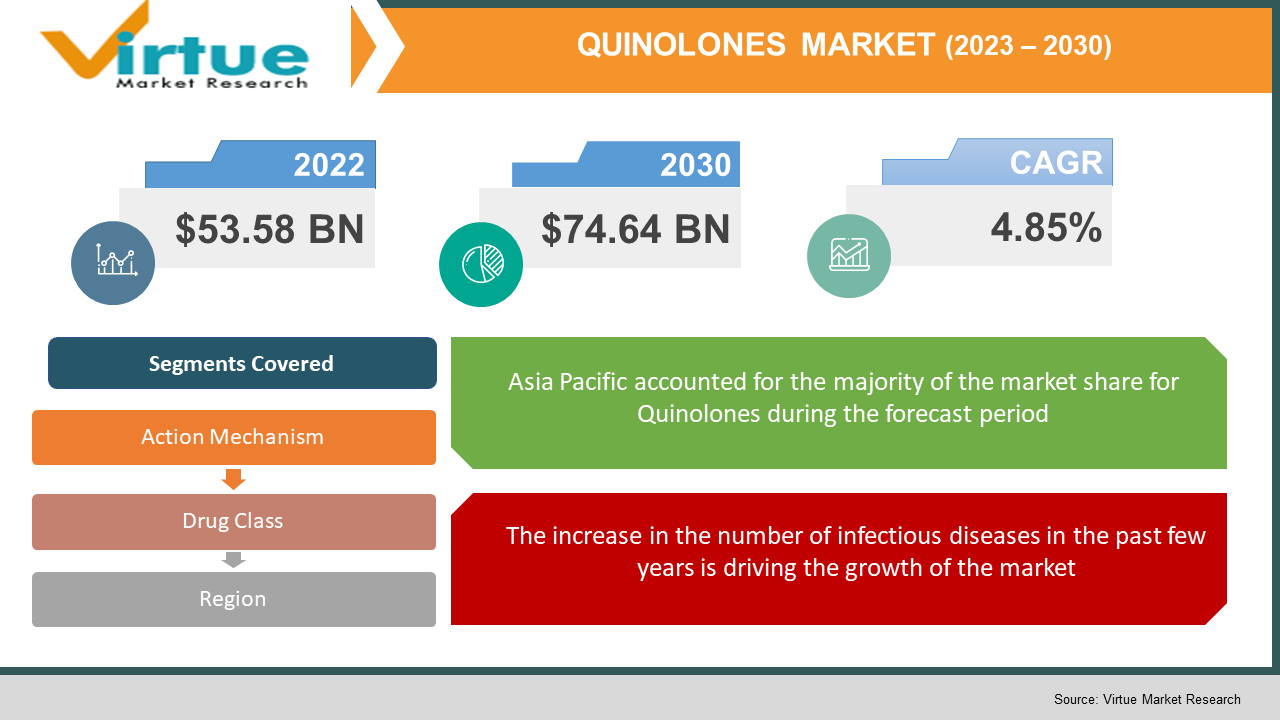

The Global Quinolones Market size is USD 53.58 billion in 2023 and is estimated to grow to USD 74.64 billion by 2030. This market is witnessing a healthy CAGR of 4.85% from 2024 - 2030.

Industry Overview:

Antibacterial agents are generally classified into macrolides, aminoglycosides, phenicol, various antibacterial agents, β-lactam, tetracycline, sulfonamides, and quinolones. Quinolones refer to the major class of antibacterial agents, synthetic antibacterial agents that exhibit specific functions that inhibit nucleic acid synthesis. Quinolones are effective against bacterial infections of the sinuses, stomach, urinary tract, skin, and lungs.

The increasing prevalence of infectious diseases around the world is one of the major drivers of growth in the quinolone market. The market growth is accelerating due to the increasing demand for drugs that inhibit the nucleic acid synthesis and interfere with human DNA synthesis and the emergence of multidrug-resistant bacteria. Increasing acceptance of these drugs due to beneficial properties such as good oral absorption, ease of tissue penetration, and reduced side effects, as well as growing medical concerns, continue to impact the market. In addition, improved health infrastructure, increased health care costs, an increasing elderly population, increased awareness and the spread of indoor and outdoor infectious diseases all have a positive impact on the quinolone market. In addition, the high demand for advanced therapies provides market participants with beneficial opportunities during the 2021-2028 forecast period.

On the other hand, the lack of availability or affordability of effective treatments, and the expiration of patents by many companies, are estimated to impede the market growth. Drug-related side effects and a shortage of trained staff are estimated to challenge the quinolone market. Demand for antibiotics has increased significantly due to the increased incidence of infectious diseases. The high prevalence of infectious diseases such as lower respiratory tract infections, pneumonia, malaria, and tuberculosis is also driving the market growth. The increasing burden of illness has forced governments and non-governmental agencies to invest in R & D initiatives to develop new antibiotics and supportive regulatory guidelines to speed up the approval process and research funding. .. For example, BARDA is working with the government to extend support to several companies to support the process of developing new treatments for infectious diseases.

COVID-19 impact on Quinolones Market

After the outbreak of the COVID 19 virus in December 2019, the World Health Organization declared a public health emergency. The disease has spread to more than 100 countries and has killed many people around the world. The global manufacturing, pharmaceutical, tourism, and financial markets have been particularly hit. The outbreak of a pandemic has added additional risk factors to the already weak growth of the global economy. Downward pressure on the global economy, which showed signs of improvement in the previous term, is increasing again.

The global negative impact of COVID19 is already here and will have a significant impact on the quinolone market in the coming years. This factor is estimated to have a significant negative impact on the industry's revenue growth.

MARKET DRIVERS:

The increase in the number of infectious diseases in the past few years is driving the growth of the market

With the increasing incidence of infectious diseases, the demand for antibiotics is skyrocketing. The high prevalence of infectious diseases such as lower respiratory tract infections, pneumonia, malaria, and tuberculosis is also driving the market growth. The increasing burden of illness has forced government and non-governmental agencies to invest in R & D initiatives to develop new antibiotics and supportive regulatory guidelines to speed up the approval process and research funding. .. For example, BARDA is working with the government to extend support to several companies to support the process of developing new treatments for infectious diseases.

Government support and advancements are driving the growth of the market

Supporting state laws such as the GAIN and REVAMP laws is estimated to accelerate the permitting process around the world. The launch of new antibiotics is estimated to support market growth during the forecast period41. Promising molecules are being studied to treat severe bacterial infections. Of these 41 investigational drugs, 17 are in Phase 3 clinical trials or have submitted NDAs for approval and will be commercialized during the forecast period. In late 2019, four new antibiotics were approved by the US FDA.

MARKET RESTRAINTS:

Quality decline and Not working on some bacteria types is restraining the growth of the market

Quinolones which are produced by some companies are not up to the mark and quality is very poor which is not good for the health of customers and hampers the growth of the market. They don’t pass the quality check. Also, some medicines don’t work on some types of bacteria which are also restraining the growth of the market.

QUINOLONES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.85% |

|

Segments Covered |

By Action Mechanism, Drug Class, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bayer AG, Merck & Co., Inc., ALLERGAN, Pfizer Inc, Novartis AG, LG Chem, Mylan N.V, Lupin, Hitech, Amneal Pharmaceuticals LLC, Zydus Cadila, Bausch Health, Teva Pharmaceutical Industries Ltd, Akron Incorporated, KYORIN Holdings, Inc, MerLion Pharmaceuticals GmbH, Wockhardt, Johnson & Johnson Services, Inc, and Sanofi |

Quinolones Market - By Action Mechanism

-

Cell Wall Synthesis Inhibitors

-

Protein Synthesis Inhibitors

-

DNA Synthesis Inhibitors

-

RNA Synthesis Inhibitors

-

Mycolic Acid Inhibitors

-

Others

Based on the Action Mechanism, Cell wall synthesis inhibitors are estimated to dominate the market with a 52.1% share in 2020 and maintain their lead for the duration of the forecast. Massive consumption according to prescribing patterns and large amounts of government funding are key factors driving this segment. Cell wall synthesis inhibitors are the most widely used antibiotics due to their widespread activity against Gram-positive and Gram-negative bacteria. Cell wall synthesis inhibitors are estimated to witness significant growth during the forecast period due to increased research activity coupled with government funding. For example, in February 2019, Bicycle Therapeutics announced the development of a new cell wall synthesis inhibitor after receiving a US USD 640,000 grant from the UK Government.

The RNA synthesis inhibitor segment is estimated to grow significantly during the forecast period due to increased product launches and R & D efforts. For example, Cosmo Pharmaceuticals N.V., November 2018, Aemcolo as a sustained release tablet as a treatment for traveler's diarrhea in the United States. In addition, the US FDA has granted Fast Track designation, Certified Infectious Disease Product (QIDP) designation, and exclusive rights to sell the product until 2028.

Quinolones Market - By Drug Class

-

Cephalosporin

-

Penicillin

-

Fluoroquinolone

-

Macrolide

-

Carbapenem

-

Aminoglycoside

-

Sulfonamide

-

7-ACA

-

Others

Based on Drug Class, Penicillin will have the largest market share at 23.9% in 2020 and is projected to dominate the market during the forecast period with the largest number of generic manufacturers in prescription and space. These drugs are the first choice in the treatment of infections such as pharyngitis, skin infections, bronchitis, gonorrhea, and ear infections. Cephalosporins have emerged as the second-largest segment of the pharmaceutical class after penicillin and are estimated to grow at a significant rate over the forecast period. The cephalosporin and fluoroquinolone segments are estimated to rise at a significant rate from 2021 to 2028. Growth in these segments may be due to the commercialization of new drugs during the forecast period. Currently, three cephalosporins are in Phase 3 clinical trials and will be commercialized within the next 3-4 years. In addition, Shionogi's Fetroha (Sefiderocol) is estimated to gain market share when it is approved by the US FDA in November 2019. Similarly, PMDA in Japan approves Lasvic (lascufloxacin), and Wockhardt Ltd submits a new drug application. In India, we are driving the growth of the fluoroquinolone segment.

The “Other” segment is estimated to grow most rapidly in the coming years due to the pipeline of new therapies that are estimated to enter the market during the forecast period. This segment includes a variety of existing classes of antibiotics, as well as several newly developed antibiotics such as tetracycline, lincosamide, imidazole, amphenicol, oxazolidinone and concomitant medications. The commercialization of icraplim, gepotidacin, ridinilazole, and zoliflodacin is estimated to spur market growth over the forecast period.

Quinolones Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East

-

Africa

Geographically, The Asia Pacific region will hold the largest share at 45.2% in 2020 and is estimated to witness significant growth during the forecast period. This may be due to the high consumption of antibiotics, increased prevalence of infections, and increased government initiative to develop new therapies to treat drug-resistant infections. In addition, the presence of generic drug suppliers contributes to the growth of regional markets. India and China are the largest markets for antibiotics in the region. Unregulated sales and overconsumption of antibiotics are key factors driving market growth in these countries. North America emerged as the second-largest regional antibiotic market in 2020, followed by Europe. North America and Europe together held a market share of over 48.0% in 2020. These markets are tightly regulated and have a well-developed medical infrastructure. The incidence of infectious diseases and rising government health care costs are one of the key drivers of the North American market. The US government is taking various steps, including promoting antibiotic management initiatives and research and development of innovative therapies to combat infectious diseases.

Quinolones Market Share by company

Companies like

-

Bayer AG

-

Merck & Co., Inc.

-

ALLERGAN

-

Pfizer Inc

-

Novartis AG

-

LG Chem

-

Mylan N.V

-

Lupin

-

Hitech

-

Amneal Pharmaceuticals LLC

-

Zydus Cadila

-

Bausch Health

-

Teva Pharmaceutical Industries Ltd

-

Akron Incorporated

-

KYORIN Holdings, Inc

-

MerLion Pharmaceuticals GmbH

-

Wockhardt

-

Johnson & Johnson Services, Inc

-

Sanofi

Recently Walgreens announced the expansion of its mobile app. It currently provides MDLive telemedicine services in 25 states. "Walgreens provides customers with convenient and connected services. Enhance the digital experience to give patients choices when using care," said Adam Pellegrini, Vice President of Digital Health at Walgreens.

The competition of healthcare retailers has been a problem for many practices for some time. With the addition of the telemedicine component, this option is more compelling for patients and can undermine patient loyalty if practices do not keep up with today's healthcare consumer preferences.

Philips Healthcare, Beam Healthcare, GE Healthcare, and Bosch Healthcare are vital players in the telemedicine market. Actors are always involved in producing this wide range of services and software that can be used for patient monitoring, self-care, and post-operative monitoring.

The beam is a top health medicine company and is a text-based intelligent telehealth service designed to enable billable telehealth for primary care providers. An end-to-end solution was captured for telemedicine visit reimbursement to create a doctor service that can streamline the reimbursement process for doctors' online visits. The app handles the billing process directly and sends the bill to the insurance provider without the doctor or patient spending a little effort.

Suppliers invest in research and development to develop technologically advanced systems that give them a competitive advantage over other providers and provide an economic benefit to the industry. The industry is estimated to see several mergers and acquisitions over the next few years. Companies are taking proactive steps to gain market share and provide a diversified product portfolio.

NOTABLE HAPPENINGS IN THE QUINOLONES MARKET IN THE RECENT PAST:

-

Product Launch - In April 2021, Melinta Therapeutics, Inc. launched Baxdela (delafloxacin, Baxdela is an oral fluoroquinolone used to treat adult patients with susceptible bacterial acute bacterial skin and skin structure infections (ABSSSI). Baxdela's introduction provides a new therapy alternative and accelerates the company's expansion in the infection therapies space.

-

Announcement - In April 2021, KYORIN Holdings, Inc. announced that the Japanese Ministry of Health, Labor, and Welfare approved Lasvic (lascufloxacin hydrochloride), a novel quinolone antibacterial agent indicated as a first-line monotherapy for the treatment of community-acquired respiratory and ENT infections.

Chapter 1.QUINOLONES MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.QUINOLONES MARKET– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-1 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.QUINOLONES MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.QUINOLONES MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. QUINOLONES MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.QUINOLONES MARKET – By Action Mechanism

6.1. Cell Wall Synthesis Inhibitors

6.2. Protein Synthesis Inhibitors

6.3. DNA Synthesis Inhibitors

6.4. RNA Synthesis Inhibitors

6.5. Mycolic Acid Inhibitors

6.6. Others

Chapter 7.QUINOLONES MARKET – By Drug Class

7.1. Cephalosporin

7.2.·Penicillin

7.3. Fluoroquinolon

7.4. Macrolide

7.5. Carbapenem

7.6. Aminoglycoside

7.7. Sulfonamide

7.8. 7-.AC

7.9. Others

Chapter 9.QUINOLONES MARKET – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. QUINOLONES MARKET – Key Players

10.1. Bayer AG

10.2. Merck & Co

10.3. ALLERGAN

10.4. Pfizer Inc

10.5. Novartis AG

10.6. LG Chem

10.7. Mylan N.V,

10.9 Lupin

10.9. Hitech

10.10. Amneal Pharmaceuticals LLC

10.11. Zydus Cadila

10.12. Bausch Health

10.13. Teva Pharmaceutical Industries Ltd,

10.14. Akron Incorporated

10.15. KYORIN Holdings

10.16. MerLion Pharmaceuticals GmbH

10.17. Wockhardt

10.18. Johnson & Johnson Services

10.19. Sanofi

Download Sample

Choose License Type

2500

4250

5250

6900