Quaternary Ammonium Salts Market Size (2024-2030)

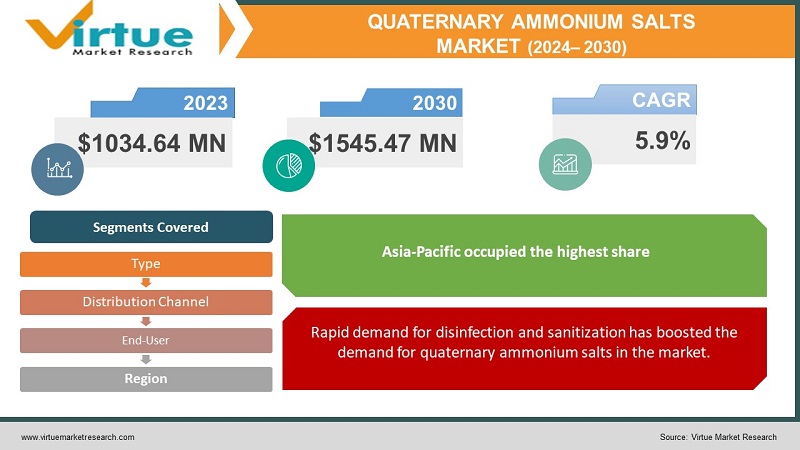

The Global Quaternary Ammonium Salts Market was valued at USD 1034.64 Million and is projected to reach a market size of USD 1545.47 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

In the past, quaternary ammonium salts were increasingly used in the disinfectants in healthcare and food-processing settings. Moreover, many of them were combine with harsh chemicals to achieve faster results, which had a negative impact on the environment and also on the health of humans and animals. However, continuous research and development in organic chemistry increased the applicability of quaternary ammonium salts in other sectors such as for water treatment, for consumer products, in agriculture, and others. In addition, trends in sustainable production and environmental concerns have increased the research and production in bio-based quaternary ammonium salts, ammonium salts with greener formulations, and others. Furthermore, the market for quaternary ammonium salts holds positive future, as more greener solutions develop in the market and more demand come from the healthcare and pharmaceutical sector for disinfecting and sanitization purposes.

Key Market Insights:

According to US Department of Health and Human Services/Centers for Disease Control and Prevention, 39% of adults in the USA used disinfectants and other cleaning products in harmful ways in the year 2020.

As per CDC (Center for Disease Control and Prevention), 70% of people have access to basic hygiene services in the year 2020, globally.

According to UN Report on Wastewater treatment 2021, 56% of household wastewater were treated safely in 2020.

Quaternary Ammonium Salts Market Drivers:

Rapid demand for disinfection and sanitization has boosted the demand for quaternary ammonium salts in the market.

Post-pandemic, there is an increase in demand for disinfection and sanitization of various surfaces, so as to reduce the impact of air-borne diseases. Moreover, quaternary ammonium salts are water soluble and possess excellent antimicrobial properties, which makes them ideal choice to be used in cleaning and disinfecting products. Moreover, public spaces such as restaurants, kitchens, cafes, and other food outlets increasingly use surface disinfectant to minimize the spread of germs and provide cleaner eating places to the customers. In addition, hospitals and clinics widely used strong sanitation for killing germs near patient’s bed and also use sterilizing equipment to clean medical instruments and devices, so as to eliminate the contact of germs from one patient to another.

Environmental concerns drive the demand for quaternary ammonium salts in the market.

Quaternary ammonium salts are organic compounds that are used in various industries due to their excellent properties such as antimicrobial properties, water solubility, odor neutralizing, no corrosive bleaching effect, low toxicity levels, and stable performance. Moreover, these compounds have gained popularity in the consumer product market, especially for cleaning products, personal care, and household care products, as these compounds are biodegradable in nature, thus minimize carbon footprint and resource wastage in the environment. Furthermore, quaternary ammonium salts are an excellent solution for reducing water pollution, as they are increasingly used in wastewater treatment facilities that help in reducing the growth of microorganisms and provide clean water for drinking and industrial purposes. Furthermore, increasing trends in sustainable production and consumption is inducing researchers and manufacturers to prepare more organic and environment-friendly formulations of quaternary ammonium salts in the market.

Quaternary Ammonium Salts Market Restraints and Challenges:

Health concerns caused by quaternary ammonium salts can slow down the market growth.

Health concerns such as allergies can reduce the demand for quaternary ammonium salts in the market. Personal care products such as body lotions, bodywashes, gels, and creams containing quaternary ammonium salts can affect some individuals with sensitive skin and cause allergies such as rashes and inflammation, leading to declined demand for them in the market. Improper handling of quaternary ammonium salt products such as disinfectant, sanitizer, and other cleaning products can lead to respiratory issues in people, leading to decline in market demand for them.

Environmental concerns associated with quaternary ammonium salts might pose challenges for the market.

Some quaternary ammonium salts products such as surfactants, that are not only made of these salts but also of other chemicals can slowly decompose in the environment, leading to environmental degradation. This can further decline the demand for quaternary ammonium salts in the market.

Quaternary Ammonium Salts Market Opportunities:

The Quaternary Ammonium Salts Market is witnessing an upward trend in the market due to increased demand for disinfectants and sanitization products in the market. Moreover, many companies are shifting their production towards green products, which is further inducing researchers and chemical manufacturers devise more eco-friendly formulations of quaternary ammonium salts in the market. Moreover, commercial settings such as restaurants, resorts, hotels, and other food and recreation outlets increasingly use cleaning products containing these salts, which is further anticipated to boost the market growth of quaternary ammonium salts by manifolds.

QUATERNARY AMMONIUM SALTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, END User Industry, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Loba Chemie, Dishman Carbogen Amcis, DKSH, TCI Chemicals OTAVA, Chemicals, BASF, Chematek, ShivShaktiIndia, Delta Finochem, Intech Organics Ltd |

Quaternary Ammonium Salts Market Segmentation

Quaternary Ammonium Salts Market Segmentation: By Type

- Benzyl Quaternary Ammonium Salts

- Alkyl Quaternary Ammonium Salts

- Methyl Quaternary Ammonium Salts

In 2022, based on market segmentation by type, alkyl quaternary ammonium salts occupied the highest share of about 27% in the market. These salts are cationic compounds, which has alkyl groups. Moreover, they are widely used in the healthcare sector as disinfectants, as they are water soluble in nature and can help in damaging cell walls of bacteria easily. In addition, they are also used in the textile industry as an anti-bacterial dye.

The methyl quaternary ammonium salts are the fastest-growing segment during the forecast period. These salts are used for varied applications in healthcare settings due to their antimicrobial properties. Common usage of methyl quaternary ammonium salts in the healthcare industry includes disinfectants, sanitizers, cleaning products, and others. Moreover, these salts possess low toxicity levels and have high biodegradability, making them an ideal and eco-friendly source to be used in many industries.

Quaternary Ammonium Salts Market Segmentation: By End-User Industry

- Industrial

- Agricultural

- Healthcare

- Food & Beverage Industry

- Consumer & Retail

- Others

In 2022, based on market segmentation by end-user industry, healthcare occupied the highest share of about 37% in the market. Quaternary ammonium salts are increasingly used in disinfectants, sanitizers, sterilization of medical devices, and others, as they possess excellent anti-bacterial properties and water solubility making them effective material to be used to fight against various kinds of pathogens such as bacteria, viruses, and others. In addition, dental industry is the major consumer of quaternary ammonium salts, as they increasingly use oral sprays, and mouth washes to kill bacteria inside the mouth that cause oral health problems.

The consumer & retail segment is the fastest-growing segment during the forecast period. Quaternary ammonium salts find increased application in consumer products such as household cleaning products like surface cleaners, disinfectants, and others that kills bacteria and germs on the surface, giving a smooth and clean surface in kitchen and bathroom; these salts are used in personal care products such as shampoos, body washes, and others for giving a smooth and clean texture to the skin. In addition, due to their odor neutralizing properties, quaternary ammonium salts are increasingly used in air sprays, gels, and air fresheners for eliminating unpleasant and hard to remove odors from rooms or large spaces.

Quaternary Ammonium Salts Market Segmentation: By Distribution Channel

- Online

- Offline

In 2022, based on market segmentation by distribution channel, offline segment occupied the highest share of about 32% in the market. The offline segment comprises of pharmaceutical companies, cleaning agents stores, retail stores, and specialty chemicals stores that sell quaternary ammonium salts-based products such as sanitizers, cleaning agents, surface disinfectants, and others to consumers. The growth of this segment is attributed to increased consumer demand for quality and appropriate product for their requirements. Moreover, specialty chemicals and pharmaceutical companies have knowledgeable staff that offer appropriate information regarding the handling of the product and thus help consumers in making better purchase decisions.

Online segment is the fastest-growing segment during the forecast period and the growth of this segment is attributed to increase in consumer demand for convenience shopping and door-step delivery of essential items such as household cleaning products in the market.

Quaternary Ammonium Salts Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle-East & Africa

In 2022, based on market segmentation by region, Asia-Pacific occupied the highest share of about 41% in the market. Prevalence of well-established textile industry, especially in countries such as India, and increase in health and hygiene awareness among consumers has boosted the demand for quaternary ammonium salts in the region.

North America is the fastest-growing region during the forecast period. Increasing demand for these salts in water treatment processes for preventing the growth of microorganisms in reservoirs and wastewater treatment facilities, and increasing demand for from the healthcare sector for sterilizing medical devices and equipment have contributed to the demand for quaternary ammonium salts in the region.

COVID-19 Impact Analysis on the Quaternary Ammonium Salts Market

The pandemic had a significant impact on the quaternary ammonium salts market. During the pandemic, increased hygiene awareness among the people increased the demand for disinfectants and sanitizers that contained compounds of quaternary ammonium salts. These sanitizing products were increasingly demanded by the healthcare sector for killing bacteria and germs in hospitals, such as patient beds, medical devices and equipment, and others. However, this was offset by the supply chain disruptions in the economy, as the movement of quaternary ammonium salts products witnessed a slowdown in distribution, leading to shortage of sanitizers and disinfectants during the pandemic. Moreover, this shortage led to increase in the price of sanitizers and disinfectants in the market, thus affecting the demand of consumers.

Key Players:

- Loba Chemie

- Dishman Carbogen Amcis

- DKSH

- TCI Chemicals

- OTAVA Chemicals

- BASF

- Chematek

- ShivShaktiIndia

- Delta Finochem

- Intech Organics Ltd

Chapter 1. Global Quaternary Ammonium Salts Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Quaternary Ammonium Salts Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Quaternary Ammonium Salts Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Quaternary Ammonium Salts Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Quaternary Ammonium Salts Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Quaternary Ammonium Salts Market– By Type

6.1. Introduction/Key Findings

6.2. Benzyl Quaternary Ammonium Salts

6.3. Alkyl Quaternary Ammonium Salts

6.4. Methyl Quaternary Ammonium Salts

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Global Quaternary Ammonium Salts Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Online

7.3. Offline

7.4. Y-O-Y Growth trend Analysis By Distribution Channel

7.5. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Global Quaternary Ammonium Salts Market– By End User

8.1. Introduction/Key Findings

8.2. Industrial

8.3. Agricultural

8.4. Healthcare

8.5. Food & Beverage Industry

8.6. Consumer & Retail

8.7. Others

8.8. Y-O-Y Growth trend Analysis End User

8.9. Absolute $ Opportunity Analysis End User , 2024-2030

Chapter 9. Global Quaternary Ammonium Salts Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type

9.1.3. By Distribution Channel

9.1.4. By End User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type

9.2.3. By Distribution Channel

9.2.4. By End User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Type

9.3.3. By Distribution Channel

9.3.4. By End User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Type

9.4.3. By Distribution Channel

9.4.4. By End User

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Type

9.5.3. By Distribution Channel

9.5.4. By End User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Quaternary Ammonium Salts Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Loba Chemie

10.2. Dishman Carbogen Amcis

10.3. DKSH

10.4. TCI Chemicals

10.5. OTAVA Chemicals

10.6. BASF

10.7. Chematek

10.8. ShivShaktiIndia

10.9. Delta Finochem

10.10. Intech Organics Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Quaternary Ammonium Salts Market was valued at USD 1034.64 Million and is projected to reach a market size of USD 1545.47 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Rapid demand for disinfection and Environmental concerns are the market drivers of the Quaternary Ammonium Salts market

Benzyl Quaternary Ammonium Salts, Alkyl Quaternary Ammonium Salts, and Methyl Quaternary Ammonium Salts, are the segments under the Quaternary Ammonium Salts Market by type

Asia-Pacific is the most dominant region for the Quaternary Ammonium Salts Market

Loba Chemie, Dishman Carbogen Amcis, DKSH, TCI Chemicals, OTAVA Chemicals and BASF are few of the leading players in the Quaternary Ammonium Salts Market.