Pure Magnesium Metal Market Size (2023 – 2030)

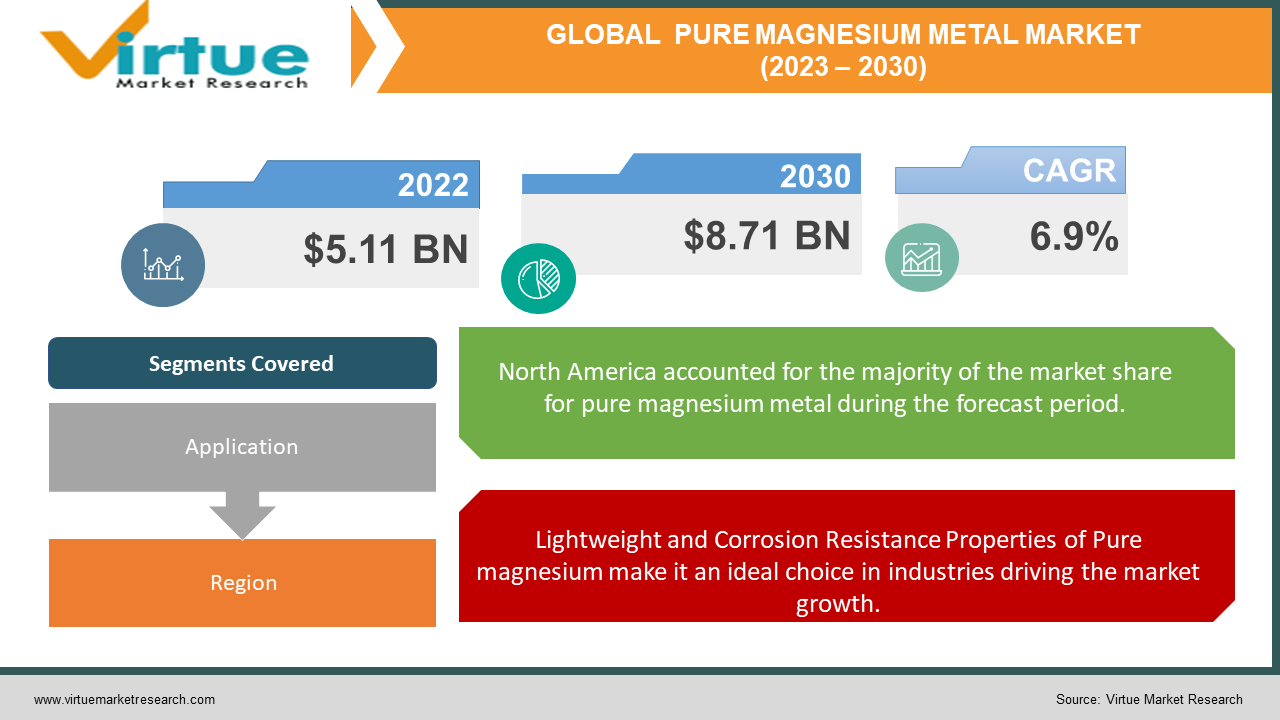

The Global Pure Magnesium Metal Market was valued at USD 5.11 billion and is projected to reach a market size of USD 8.71 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.9%.

The pure magnesium metal market has long held a pivotal role within the broader metals industry, owing to its diverse array of applications across sectors such as aerospace, automotive, and healthcare. Examining its historical trajectory, we observe a steady evolution. At present, this market is characterized by increasing demand fueled by its unique properties and sustainability advantages. Looking ahead, the future of the pure magnesium metal market appears promising, with a trajectory marked by continued growth driven by technological advancements, expanding applications, and a growing emphasis on environmentally friendly materials across industries.

Key Market Insights:

The automotive industry is a significant driver of the pure magnesium metal market. Magnesium's role in reducing vehicle weight to improve fuel efficiency and lower emissions has led to increased adoption. According to the International Magnesium Association (IMA), in 2020, the global automotive industry accounted for approximately 47% of total magnesium consumption, with this figure projected to rise. Leading automakers like BMW and Audi have incorporated magnesium alloys into their vehicle designs.

Innovations in magnesium production and alloy development have expanded the applications of pure magnesium metal. Researchers have focused on enhancing magnesium's strength and corrosion resistance, making it suitable for broader use in aerospace and medical applications. For instance, the development of biodegradable magnesium implants in healthcare showcases the evolving potential of this market.

China has been a dominant player in the pure magnesium metal market, both as a producer and consumer. The country accounted for over 80% of global magnesium production in recent years. However, other regions, such as North America and Europe, are also witnessing steady growth due to increased magnesium use in the automotive and aerospace sectors. In North America, the automotive industry's growing interest in magnesium alloys for lightweighting initiatives is bolstering market growth. Europe, too, has seen an upsurge in magnesium demand as automakers seek eco-friendly solutions to meet stringent emission standards.

Pure Magnesium Metal Market Drivers:

Lightweight and Corrosion Resistance Properties of Pure magnesium make it an ideal choice in industries driving the market growth.

Pure magnesium is highly sought after in industries due to its exceptional lightweight properties and corrosion resistance. Its low density makes it an attractive choice for applications where weight reduction is crucial. Moreover, its corrosion resistance ensures the durability of components, reducing maintenance and replacement costs. These qualities drive demand in industries like aerospace, automotive, and healthcare, where the combination of lightweight materials and long-term durability is essential.

The aerospace sector's need for lightweight materials for aircraft components is propelling the Pure Magnesium Metal market forward.

The aerospace industry places a premium on lightweight materials to enhance fuel efficiency and reduce emissions. Pure magnesium's low weight-to-strength ratio makes it a valuable resource for aircraft components. As the aviation sector continues to pursue innovations for lighter and more fuel-efficient aircraft, the demand for pure magnesium in aerospace applications is on the rise, bolstering market growth.

The automotive industry's focus on fuel efficiency and emissions reduction drives demand for magnesium alloys.

In the automotive sector, the push for improved fuel efficiency and reduced emissions is relentless. Magnesium alloys, derived from pure magnesium, play a vital role in achieving these objectives. Lightweight magnesium components help reduce a vehicle's overall weight, leading to better fuel economy and lower greenhouse gas emissions. With stringent environmental regulations and consumer demand for eco-friendly vehicles, the automotive industry's reliance on magnesium alloys is driving the growth of the pure magnesium metal market.

The healthcare sector's adoption of magnesium in medical implants and pharmaceuticals is expanding the Pure Magnesium Metal Market.

The healthcare industry recognizes the benefits of magnesium in medical implants and pharmaceuticals. Magnesium's biocompatibility, biodegradability, and low toxicity make it an ideal choice for implants and drug delivery systems. As healthcare providers and researchers continue to explore magnesium-based solutions, the pure magnesium metal market expands to meet the growing demand for medical applications. Its use in orthopedic implants, cardiovascular devices, and pharmaceutical formulations illustrates the versatility of pure magnesium in healthcare, contributing to market expansion.

Pure Magnesium Metal Market Restraints and Challenges:

Fluctuations in magnesium prices can impact production costs and market stability thus impacting the growth.

The pure magnesium metal market faces challenges from the volatility in magnesium prices. Price fluctuations can significantly impact production costs and market stability. Industries relying on pure magnesium for various applications may experience uncertainty in procurement and pricing, affecting their production decisions and budgets. Managing the impact of price variations is a constant challenge for market participants.

The production of pure magnesium can have environmental implications, posing challenges for sustainable practices.

The production of pure magnesium can have environmental implications, presenting challenges for sustainable practices. The extraction and refinement processes often involve energy-intensive methods and emissions, contributing to environmental concerns. Market players are increasingly pressured to adopt more sustainable and eco-friendly production practices, which can be challenging to implement while maintaining cost-effectiveness and competitiveness.

Supply chain disruptions, such as mining and refining issues, can affect market stability.

Supply chain disruptions, including issues related to mining and refining operations, can pose significant challenges to the pure magnesium metal market. Dependence on specific mining sources and refining facilities can create vulnerabilities in the supply chain. Disruptions due to natural disasters, geopolitical factors, or operational issues can lead to shortages and price fluctuations, affecting market stability and the ability to meet demand promptly. Managing and mitigating these supply chain risks are critical for market resilience.

Pure Magnesium Metal Market Opportunities:

Continued research and development in magnesium production techniques can improve efficiency and reduce costs.

Research and development (R&D) efforts play a pivotal role in the pure magnesium metal market. Innovations in magnesium production techniques are constantly evolving, with a focus on enhancing efficiency and cost-effectiveness. These advancements make magnesium a more attractive choice for various industries. For example, improved extraction methods and refining processes contribute to reducing production costs, thus increasing market competitiveness. Continuous R&D investments can lead to breakthroughs that unlock new applications and expand the market's scope, ultimately driving growth and industry evolution.

The discovery of new applications for pure magnesium in various industries can drive market growth.

The pure magnesium metal market thrives on the exploration of fresh applications across industries. Its unique properties, such as lightweight and corrosion resistance, make it an appealing choice. In the aerospace sector, the demand for lightweight materials for aircraft components fuels market growth. Similarly, the automotive industry's pursuit of fuel efficiency and emissions reduction drives demand for magnesium alloys. Moreover, the healthcare sector's adoption of magnesium in medical implants and pharmaceuticals further expands the Pure Magnesium Metal Market's horizons. As industries continue to innovate and adapt, pure magnesium's versatility opens doors to new possibilities and market expansion.

As sustainability gains importance, magnesium's recyclability and low carbon footprint offer opportunities in eco-friendly markets.

Sustainability is a significant driver for the pure magnesium metal market. Its recyclability and minimal carbon footprint align with the growing emphasis on eco-friendly practices. Industries seeking to reduce their environmental impact are turning to magnesium-based solutions. This shift provides an opportunity for magnesium to establish a niche in sustainable practices and products. As sustainability gains importance in purchasing decisions, the market can leverage magnesium's eco-friendly properties to capture a broader customer base.

PURE MAGNESIUM METAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.9% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

US Magnesium LLC, Magontec GmbH, Dead Sea Magnesium Ltd., Nippon Kinzoku Co., Ltd., Solikamsk Magnesium Works OAO, RIMA Group, Shanxi Wenxi Hongfu Magnesium Co., Ltd., POSCO, Taiyuan Tongxiang Magnesium Co., Ltd., Marubeni Corporation |

Pure Magnesium Metal Market Segmentation: By Application

- Aerospace

- Automotive

- Healthcare

- Packaging

- Others

In 2022, The Aerospace industry commanded the largest market share in the pure magnesium metal market. Magnesium's exceptional lightweight properties make it a coveted material for aircraft components. In aerospace, weight reduction is paramount for enhancing fuel efficiency and overall performance. Magnesium's corrosion resistance further adds to its appeal, ensuring longevity and reliability in demanding aviation environments. The aerospace sector's continuous demand for lightweight materials and its expansion drive, as air travel grows globally, contribute to its dominant market position. For instance, magnesium alloys are used in aircraft parts like seat frames, gearbox casings, and helicopter transmissions.

Moreover, The automotive industry represents the fastest-growing segment in the pure magnesium metal market. The automotive sector increasingly focuses on fuel efficiency and emissions reduction. Magnesium alloys are used to manufacture lightweight components like engine blocks, transmission cases, and steering columns. This not only reduces vehicle weight but also enhances fuel economy. With the shift towards electric vehicles (EVs), magnesium's role in lightweight EV components, such as battery enclosures, is on the rise. The growing adoption of magnesium in automotive applications, coupled with the EV revolution, positions this segment as the fastest-growing in the market. The trend aligns with global efforts to reduce greenhouse gas emissions from transportation.

Pure Magnesium Metal Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2022, North America held the largest market share in the pure magnesium metal market. The region's robust aerospace and automotive industries drive significant demand for magnesium, given its lightweight and corrosion-resistant properties. In the aerospace sector, the presence of leading aircraft manufacturers and defense contractors fuels the use of magnesium alloys in aircraft components. Moreover, the automotive industry in North America emphasizes magnesium's role in lightweight vehicles to improve fuel efficiency. As sustainability gains importance, the adoption of magnesium in eco-friendly automotive designs, including electric vehicles (EVs), further solidifies North America's dominant position in the market.

Moreover, the Asia-Pacific region is the fastest-growing segment in the pure magnesium metal market. Factors contributing to this growth include the region's expanding automotive production, rising demand for lightweight materials in aerospace, and increasing healthcare investments. Asia-Pacific's thriving automotive sector, coupled with the shift towards EVs, amplifies the use of magnesium alloys in vehicle manufacturing. Additionally, the region's healthcare industry adopts magnesium for medical devices and pharmaceutical applications. With a growing middle-class population and urbanization, the Asia-Pacific region witnesses rising consumer demand, leading to an uptick in packaging applications for pure magnesium.

COVID-19 Impact Analysis on the Global Pure Magnesium Metal Market:

The COVID-19 pandemic had a notable impact on the global pure magnesium metal market. The initial disruption in supply chains and manufacturing operations led to a temporary slowdown in the market. However, as industries adapted to the new normal and demand for lightweight materials persisted in aerospace, automotive, and healthcare applications, the market demonstrated resilience. The pandemic accelerated the automotive industry's shift toward electric vehicles (EVs), driving the use of magnesium in battery casings and structural components. Additionally, increased emphasis on hygiene and healthcare infrastructure further sustained magnesium demand in medical equipment and pharmaceuticals. Overall, the market exhibited adaptability and recovery in the face of pandemic challenges.

Latest Trends/Developments:

The market has witnessed a surge in demand from the automotive industry, driven by the shift towards electric vehicles (EVs). Magnesium's lightweight properties make it an ideal choice for EV components, including battery enclosures and structural parts. This trend aligns with the global push for reduced carbon emissions and improved fuel efficiency, with magnesium playing a pivotal role in achieving these goals.

Advancements in magnesium production techniques have been notable. Researchers and manufacturers are exploring innovative processes to enhance the efficiency of extracting pure magnesium. These developments aim to reduce production costs, making magnesium more competitive in various applications, including aerospace and healthcare. Additionally, such innovations align with sustainability goals by potentially reducing the environmental impact of magnesium production.

The market is witnessing increasing investments in research and development to discover new applications for pure magnesium. This includes exploring its potential in eco-friendly packaging solutions and other emerging sectors. The focus on sustainability and recyclability has opened up opportunities for magnesium in markets where environmental concerns are paramount, further expanding its potential applications and market reach. Overall, these trends reflect the adaptability and growth potential of the pure magnesium metal market in an evolving industrial landscape.

Key Players:

-

US Magnesium LLC

-

Magontec GmbH

-

Dead Sea Magnesium Ltd.

-

Nippon Kinzoku Co., Ltd.

-

Solikamsk Magnesium Works OAO

-

RIMA Group

-

Shanxi Wenxi Hongfu Magnesium Co., Ltd.

-

POSCO

-

Taiyuan Tongxiang Magnesium Co., Ltd.

-

Marubeni Corporation

In February 2023, Western Magnesium Corporation and CCMA, LLC, successfully converted their memorandum of understanding (MOU) into a definitive agreement. CCMA will collaborate with Western Magnesium to develop and identify demand for new magnesium alloys in industries such as automotive, aerospace, and eco-friendly technologies. This agreement secures CCMA's purchase of 25,000 metric tonnes of magnesium from Western Magnesium's future production.

Chapter 1. Pure Magnesium Metal Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pure Magnesium Metal Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pure Magnesium Metal Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pure Magnesium Metal Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pure Magnesium Metal Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pure Magnesium Metal Market – Application

6.1 Introduction/Key Findings

6.2 Aerospace

6.3 Automotive

6.4 Healthcare

6.5 Packaging

6.6 Others

6.7 Y-O-Y Growth trend Analysis Application

6.8 Absolute $ Opportunity Analysis Application, 2023-2030

Chapter 7. Pure Magnesium Metal Market , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 Application

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 Application

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 Application

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 Application

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 Application

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. Pure Magnesium Metal Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 US Magnesium LLC

8.2 Magontec GmbH

8.3 Dead Sea Magnesium Ltd.

8.4 Nippon Kinzoku Co., Ltd.

8.5 Solikamsk Magnesium Works OAO

8.6 RIMA Group

8.7 Shanxi Wenxi Hongfu Magnesium Co., Ltd.

8.8 POSCO

8.9 Taiyuan Tongxiang Magnesium Co., Ltd.

8.10 Marubeni Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Pure Magnesium Metal Market was valued at USD 5.11 billion and is projected to reach a market size of USD 8.71 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.9%.

Key drivers include the aerospace industry demand, automotive weight reduction, healthcare applications, and sustainable packaging trends.

Prominent applications include aerospace components, lightweight automotive parts, healthcare implants, and sustainable packaging materials.

North America is the dominant region, driven by its aerospace and automotive industries.

US Magnesium LLC, Magontec GmbH, Dead Sea Magnesium Ltd., Nippon Kinzoku Co., Ltd., Solikamsk Magnesium Works OAO, and RIMA Group are some of the key players in the Pure Magnesium Metal Market.