Pumped Hydroelectric Storage Market Size (2025 – 2030)

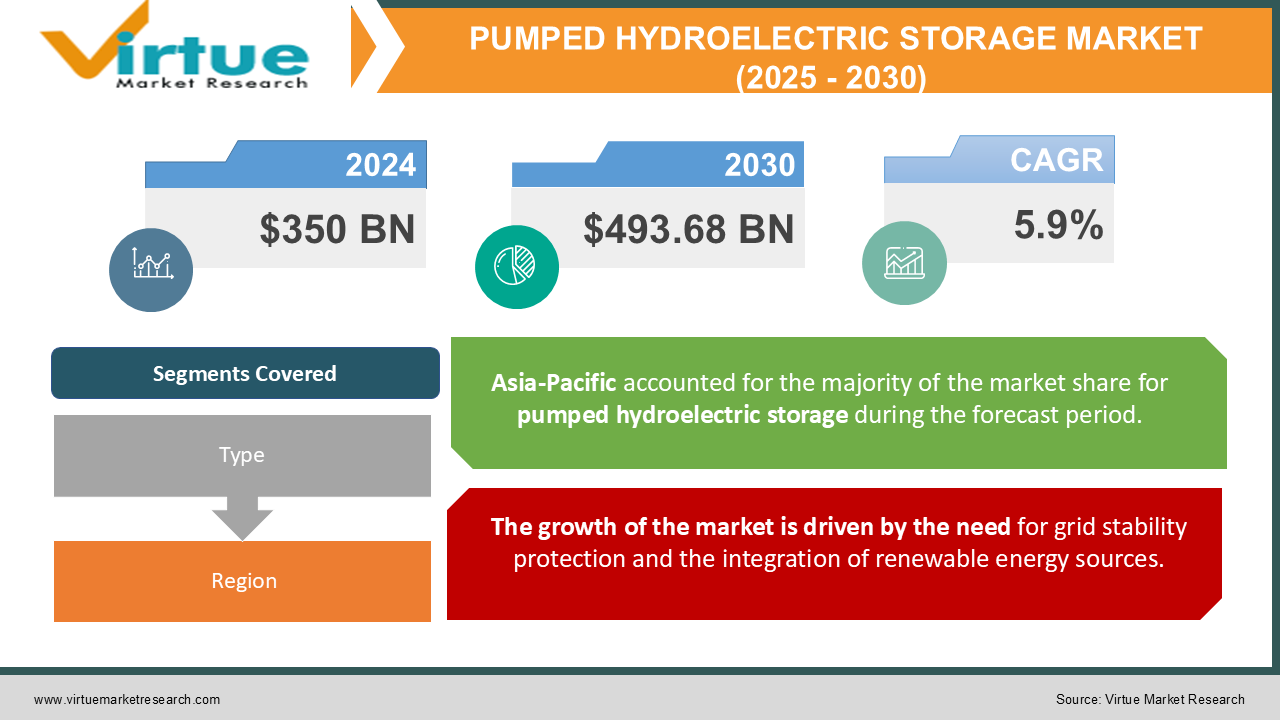

The Pumped Hydroelectric Storage Market was valued at USD 350 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 493.68 billion by 2030, growing at a CAGR of 5.9%.

Pumped-storage hydroelectricity (PSH), also known as pumped hydroelectric energy storage (PHES), is a technique employed by electrical power systems to manage load balancing. In a PSH system, energy is stored as gravitational potential energy by moving water from a lower elevation reservoir to a higher one. This process typically uses low-cost surplus electricity during off-peak times to operate the pumps.

Pumped-storage hydroelectricity enables the storage of energy from intermittent power sources, such as solar and wind, or surplus electricity from steady base-load sources like coal or nuclear, for use during periods of high demand. The reservoirs associated with pumped storage are generally smaller when compared to the large lakes found in conventional hydroelectric plants with similar generating capacities, and the periods of electricity generation are often less than 12 hours.

Key Market Insights:

Size and Production Duration:

- Pumped-storage reservoirs are typically smaller in size compared to traditional hydroelectric dams with equivalent power output.

- Their production durations are generally limited to under 12 hours.

Integration Potential:

- Streams and other existing infrastructures, such as water distribution systems and snowmaking facilities, present potential for integrating pumped-storage solutions.

Micro-Pumped Hydro:

- In micro-pumped hydro energy storage systems, a storm-water basin can function as an economical water reservoir.

Pumped Hydroelectric Storage Market Drivers:

The growth of the market is driven by the need for grid stability protection and the integration of renewable energy sources.

Over the past decade, global renewable energy capacity and generation have steadily increased. To ensure energy availability during periods of high demand, it is crucial to store and release this energy, as variable renewable energy (VRE) sources, such as solar and wind, produce power inconsistently and at varying rates. Moreover, a reliable baseload power capacity is required to maintain grid stability during times of low VRE generation, preventing potential power quality issues. This is vital for the effective integration of intermittent renewable energy sources. Consequently, energy storage systems (ESS) are becoming increasingly vital for renewable energy projects. The rapid growth of the renewable energy sector is expected to be one of the primary drivers of the global pumped hydro storage market expansion during the forecast period.

Pumped Hydroelectric Storage Market Restraints and Challenges:

The market growth is hindered by increasing competition from opposing interests.

The growth of alternative energy storage technologies is expected to significantly impact the global pumped hydro storage (PHS) market negatively during the forecast period. This is because PHS, while a mature and widely commercialized technology, has limited potential for further price reductions. The primary competitor to PHS is lithium-ion battery technology, which has become much more cost-effective over the past decade. In 2020, the average price of a lithium-ion battery per kilowatt-hour was USD 137, representing a 12.17% decrease from the previous year.

Battery manufacturers, especially in the Asia-Pacific region and China, benefit from lower labor costs, allowing them to offer batteries at prices well below the global average. Major battery producers such as Tesla, Sony, and various national governments are heavily investing in the research and development of lithium-ion batteries. These efforts aim to enhance the efficiency of battery cells and increase battery utilization rates.

Pumped Hydroelectric Storage Market Opportunities:

Technologies with the lowest lifecycle costs present significant opportunities in the market.

Pumped hydro storage (PHS) projects offer the lowest lifecycle cost per unit of energy generated. As the first large-scale energy storage technology (EST) developed, PHS has evolved significantly over time. The cost of this technology has reduced drastically over the past century, and it has been fully commercialized. A key factor contributing to the low lifecycle costs of PHS projects is their exceptionally long lifespan, averaging nearly 80 years. Consequently, when considering the entire lifespan and storage capacity (in the GWh range), PHS's overall cost is substantially lower than that of its closest competitor, lithium-ion battery systems.

Additionally, the lifespan of PHS projects can be further extended by upgrading and refurbishing existing assets. For instance, the Engeweiher pumped storage facility in Switzerland, which is the oldest operational pumped storage system globally, was built in 1907 and was refurbished in the early 1990s. It is expected to remain operational at least until 2052. Despite the high capital costs, PHS projects offer long operational lifespans and relatively low capital costs per unit of energy. This is due to PHS being a well-established technology with large capacities, extended discharge durations, and the highest ratings among energy storage technologies.

PUMPED HYDROELECTRIC STORAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Electric Company, Mitsubishi Heavy Industries Ltd, Siemens AG, Andritz AG, Ansaldo Energia SPA,Voith GmbH and Co. KGaA, Electricite de France SA (EDF), Duke Energy Corporation,Iberdrola SA., Enel SPAa |

Pumped Hydroelectric Storage Market Segmentation: By Type

-

Open-Loop

-

Closed-Loop

Pumped hydro storage (PHS) facilities in open-loop systems store water in an upper reservoir that lacks natural inflows. In contrast, pump-back plants combine pumped storage with traditional hydroelectric power generation, using a natural river as the water source for the upper reservoir instead of a man-made one. Conventional hydroelectric plants do not use pumped storage; however, they can mimic the function of pumped storage by delaying power output until demand rises, thanks to their large storage capacities. Open-loop pumped hydro storage is favored in many regions due to its proximity to natural water sources, such as rivers and streams. The project is likely to be implemented within the anticipated timeline due to the high cost of developing alternative systems and the availability of abundant water sources.

In the United States, as of 2022, nearly all existing pumped hydro storage projects use open-loop systems, drawing water from a free-flowing water source for either the upper or lower reservoir. For example, the 1.2 GW Helms pumped storage project by Pacific Gas and Electric (PG&E) operates between the Wishon and Courtright reservoirs, formed by damming Helms Creek.

Closed-loop pumped hydro storage systems use artificially constructed reservoirs, with neither the upper or lower reservoir receiving natural water inputs. To store a large amount of energy, significant height differences or substantial water flows between reservoirs are required, which occurs naturally in some locations but must be engineered in others. Closed-loop systems are favored for their high flexibility, reliability, and power output. Compared to open-loop systems, closed-loop pumped hydro storage has a lower environmental impact because it does not connect to existing river systems. Additionally, closed-loop systems can be located far from rivers, making them adaptable to areas where grid support is needed. Given the higher likelihood of obtaining operating licenses and the fact that they do not interfere with existing river systems, closed-loop pumped hydro storage systems are expected to see substantial growth in the coming years.

Pumped Hydroelectric Storage Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

Asia-Pacific stands as the largest revenue contributor to the market. This is attributed to the region’s ongoing transition away from fossil fuels, particularly in countries like China, Japan, South Korea, India, and the ASEAN region, which have invested heavily in renewable energy, hydropower, and pumped hydro storage projects. China has also committed to reaching a peak in coal consumption by 2025 and achieving carbon neutrality by 2060.

Europe is one of the most proactive regions in addressing climate change, with hydropower consistently being the dominant renewable energy source. As the region transitions to a cleaner energy mix, the roles of solar and wind power are also growing. A significant milestone in the European Union’s decarbonization efforts occurred in 2020 when, for the first time, all renewable energy sources combined generated more electricity than fossil fuels. Despite the

impact of the COVID-19 pandemic, which reduced electricity demand, global hydropower generation in 2020 surpassed 2019 levels by 4%, driven by stronger output in regions such as the Nordics and Iberia. As part of ensuring a more reliable and flexible energy supply, there were notable advancements in pumped storage hydropower in Europe.

COVID-19 Pandemic: Impact Analysis

The impact of the COVID-19 pandemic on the global pumped hydro storage (PHS) market was moderate, as it affected all sectors associated with power generation and distribution. The pandemic caused labor shortages and disrupted the supply of raw materials, which resulted in delayed construction timelines, project postponements, and cost overruns. Additionally, the economic downturn reduced investments in PHS projects, while shifting demand dynamics further affected their business operations, leading to potential reassessments of the projects' viability. Consequently, COVID-19 had a negative impact on the global PHS market.

Latest Trends/ Developments:

January 2023: The Greenko Group announced a USD 1.2 billion investment to develop a pumped storage project in the Neemuch district of Madhya Pradesh, India.

June 2022: The State Investment Promotion Board (SIPB) of Andhra Pradesh, India, granted approval for Adani Green Energy's for hydro-pumped storage projects, with a total capacity of 3,700 MW. The projects require an investment of USD 2 billion and will include a 1,200 MW facility in Karukutty, a 1,000 MW plant in Karrivalasa, a 1,000 MW project in Gandikota, and a 500 MW facility in Chitravathi.

Key Players:

These are top 10 players in the Pumped Hydroelectric Storage Market :-

-

General Electric Company

-

Mitsubishi Heavy Industries Ltd

-

Siemens AG

-

Andritz AG

-

Ansaldo Energia SPA

-

Voith GmbH and Co. KGaA

-

Electricite de France SA (EDF)

-

Duke Energy Corporation

-

Iberdrola SA.

-

Enel SPAa

Chapter 1. PUMPED HYDROELECTRIC STORAGE MARKET – Scope & Methodology

1.1 Market Segmentationa

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PUMPED HYDROELECTRIC STORAGE MARKET – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PUMPED HYDROELECTRIC STORAGE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PUMPED HYDROELECTRIC STORAGE MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PUMPED HYDROELECTRIC STORAGE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PUMPED HYDROELECTRIC STORAGE MARKET – By Type

6.1 Introduction/Key Findings

6.2 Open-Loop

6.3 Closed-Loop

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. PUMPED HYDROELECTRIC STORAGE MARKET , By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By Type

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By Type

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By Type

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By Type

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By Type

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. PUMPED HYDROELECTRIC STORAGE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 General Electric Company

8.2 Mitsubishi Heavy Industries Ltd

8.3 Siemens AG

8.4 Andritz AG

8.5 Ansaldo Energia SPA

8.6 Voith GmbH and Co. KGaA

8.7 Electricite de France SA (EDF)

8.8 Duke Energy Corporation

8.9 Iberdrola SA.

8.10 Enel SPA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Pumped-storage hydroelectricity enables the storage of energy from intermittent power sources, such as solar and wind, or surplus electricity from steady base-load sources like coal or nuclear, for use during periods of high demand.

The top players operating in the Pumped Hydroelectric Storage Market are - General Electric Company, Mitsubishi Heavy Industries Ltd, Siemens AG, Andritz AG and Ansaldo Energia SPA.

The impact of the COVID-19 pandemic on the global pumped hydro storage (PHS) market was moderate, as it affected all sectors associated with power generation and distribution.

The cost of this technology has reduced drastically over the past century, and it has been fully commercialized. A key factor contributing to the low lifecycle costs of PHS projects is their exceptionally long lifespan, averaging nearly 80 years. Consequently, when considering the entire lifespan and storage capacity (in the GWh range), PHS's overall cost is substantially lower than that of its closest competitor, lithium-ion battery systems.

Europe is the fastest-growing region in the Pumped Hydroelectric Storage Market.