Pulse Flour Market Size (2024-2030)

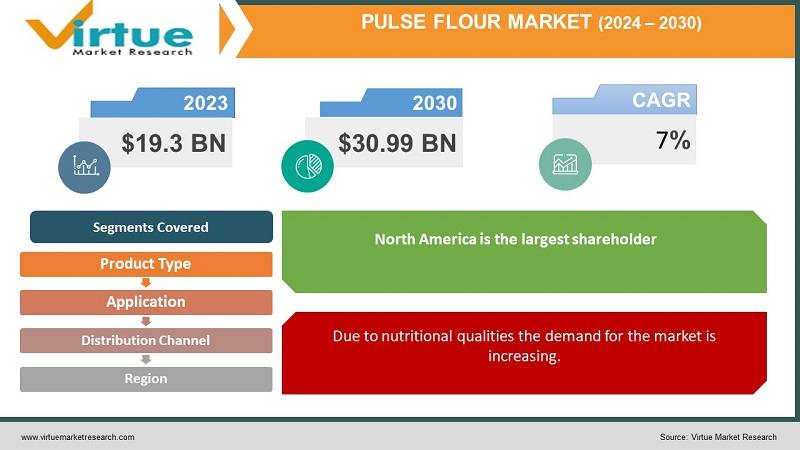

The Pulse Flour Market was valued at USD 19.3 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 30.99 billion by 2030, growing at a CAGR of 7%.

Pulse flour, derived from a milling process utilizing pulses as its primary raw material, finds application in various bakery items such as cookies, muffins, breads, and rolls. Its significance in bakery products lies in the enhancement of texture and prolongation of shelf life. In certain cases, it serves as a viable substitute for rice and wheat.

The anticipated rise in demand for pulse flour in the near future is attributable to its favorable properties, including low-fat content, high fiber content, and a low glycemic index. Consumer awareness of health and nutrition is expected to be a key driver of this increased demand throughout the forecast period. The global pulse flour market is also expected to benefit from the growing preference for nutritious foods such as barley flour, rye flour, and wheat.

The market is further poised for growth due to the escalating consumer demand for vegan and hygienic products. Beans, a significant component of pulse flour, offer various health benefits, ranging from reducing the risk of heart disease to aiding weight loss. Such health advantages associated with pulses are anticipated to propel market growth. Additionally, the versatile applications of wheat flour, including its use as fodder and animal feed, are contributing to its increased utilization in the market, signaling a revival in demand.

Key Market Insights:

The market is anticipated to experience a surge in demand for pulse flours throughout the forecast period, driven by factors such as the expanding vegetarian demographic and manufacturers' substantial investment in research and development to introduce innovative products. Government initiatives aimed at endorsing pulse consumption further contribute to the increased sales of pulse flours.

Growing awareness of the health benefits and the versatility of pulse flour significantly propels product demand in the market. The increasing consumer emphasis on nutrition and well-being is a key driver for market growth. Pulse flour, distinguished by its elevated dietary fiber content, serves as a substantial source of proteins, carbohydrates, vitamins, and minerals.

Pulse Flour Market Drivers:

Due to nutritional qualities the demand for the market is increasing.

The escalating demand for pulse flour is observed across diverse sectors, including the food and animal feed industries, owing to its gluten-free functional attributes. The heightened interest in pulse flour is predominantly attributable to its superior nutritional profile in comparison to other grain flours.

Government schemes and initiatives to promote pulse harvesting is leading to the industry's growth.

Government initiatives aimed at promoting pulse harvesting contribute significantly to the industry's growth, driven by the increasing cultivation of pulses. The market is undergoing substantial expansion, propelled by the introduction of innovative pulse flour-based products in Europe and North America in recent years. Additionally, the surge in demand for pulse flour is witnessed in other regions as well majorly due to the factors mentioned above.

Pulse Flour Market Restraints and Challenges:

Demand for other crops like wheat, maize is comparatively higher than pulse, which hinder the market

Despite a consistent global production increase, the output of pulses remains considerably lower compared to other crops such as wheat, rice, maize, and soya. The consumption of pulses has maintained a moderate level in both developing and developed nations. In contrast, there has been a substantial rise in the consumption of meat and dairy products, a trend anticipated to persist in the coming years.

Pulse Flour Market Opportunities:

The foreseeable future is expected to witness a surge in demand for pulse flour, attributed to its advantageous properties such as low-fat, high fiber content, and low glycemic levels. The product, offering substantial health benefits in comparison to wheat or rice flour, is increasingly incorporated into various blends and mixes of food products characterized by high nutritional and protein content.

The global pulse flour market is experiencing a positive impact from the growing demand for gluten-free food items. Manufacturers are making substantial investments in research and development programs to enhance product quality. This initiative is also fostering the creation of innovative pulse flour variants suitable for diverse food applications.

Diligent efforts are underway among manufacturers to devise techniques that preserve the optimal nutritional quality of pulse flours when used in food products. In the pulse flours market, manufacturers are actively adopting new technologies to expand commercial capacity for value-added pulse ingredients without compromising quality.

These advancements have opened up new possibilities across various food categories, including instant noodles, spaghetti, extruded snacks, and morning cereals. The integration of such technologies enables the industry to explore and capitalize on innovative opportunities.

PULSE FLOUR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Product Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ADM, Ingredion, AGT Food & Ingredients, Blue Ribbon, ParakhAgroIndustrie, The Scoular Company, CanMar Grain Products, Best Cooking Pulses, Bean Growers Australia, Diefenbaker Spice & Pulse |

Pulse Flour Market Segmentation:

Pulse Flour By Product Type

- Chickpea

- Lentils

- Pea

- Beans

- Other Product Types

The predominant segment in the market is chickpea holding approximately 34% share of the total market, with chickpea flour gaining rapid recognition as a valuable feedstock in animal nutrition. Distinguished by elevated levels of protein and energy, chickpea flour contributes significantly to the commercial aspects of animal rearing for milk, egg, and meat production. Its positive impact on livestock health has further strengthened the inclination of dairy farmers towards chickpea flour.

Lentil stands out as a viable alternative to modified starches, offering enhanced nutritional capabilities. The market for wheat flour is expected to benefit from increased vegetarianism and the research and development initiatives of innovative companies during the forecast period. Government programs promoting pulse consumption have heightened the demand for soybean meal, thereby propelling the growth of the soybean meal market.

Pulse Flour By Application

- Bakery and Confectionery

- Extruded products

- Beverages

- Animal Feed

- Dairy Products

- Other Applications

Chickpea flour is swiftly gaining recognition as a valuable feedstock in animal nutrition, owing to its high levels of protein and energy. This, in turn, contributes to the commercial aspects of raising animals for milk, egg, and meat production. The positive impact on livestock health has led to a growing preference among dairy farmers for chickpea flour.

Bakeries are expected to grow in the forecasted period. People are preferring healthy yet tasty food. Baked items are preferred more as they don’t have oil in the food item. With pulse flour used in bakeries it will benefit the market more.

Pulse Flour By Distribution Channel

- Food Chain Services

- Modern Trade

- Convenience Store

- Departmental Store

- Online Store

- Other Distribution Channel

Food Chain services is the dominating segment in the market. Convenience stores can provide pulse flour easily. They even have different types of flour. There is no difficulty finding convenience stores or departmental stores. It is available in every part of the country.

Pulse Flour Market Segmentation- by region

- North America

- Latin America

- Europe

- Asia Pacific

- The Middle East & Africa (MEA)

A substantial portion of the revenue is anticipated to come from the North American market. The significant government support in this sector is facilitating in-depth studies by numerous emerging businesses, presenting promising opportunities for investors. The robust government backing is expected to pave the way for modern approaches to the production and storage of pulse flours.

In the Asia Pacific region, rice flour takes precedence in the market. Market expansion in this region is propelled by health concerns and a rising demand for gluten-free products, particularly in emerging markets like India. Consumers in these markets are increasingly incorporating flours such as peas, lentils, beans, and chickpeas into their daily meals. The market is thriving in response to the growing demand for health-oriented food products in Asia Pacific, driven by increased expenditure on healthcare, heightened productivity, globalization, evolving lifestyles, and rising personal income.

COVID-19 Pandemic: Impact Analysis

The worldwide spread of the COVID-19 virus has significantly influenced international trade, with varying impacts across different agricultural sectors. While the grains, pulses, and oilseeds sector have experienced a relatively smaller effect compared to other segments, companies within this industry are grappling with notable challenges. Despite the challenges, demand has largely endured, given the indispensable nature of food and feed supply to any society. Grains, pulses, and oilseeds continue to be essential ingredients in both human diets and animal feed

Latest Trends/ Developments:

In September 2022, Equii, formerly known as Cella Farms, a food technology start-up established in 2021, successfully secured $6 million in a seed funding round, spearheaded by Khosla Ventures. Leveraging its proprietary technique, the company has innovatively crafted high-protein grain flour. Notably, Equii's flour boasts 3 to 6 times more protein content than conventional flour.

Key Players:

These are 10 top players in the Pulse Flour Market: -

- ADM

- Ingredion

- AGT Food & Ingredients

- Blue Ribbon

- ParakhAgroIndustrie

- The Scoular Company

- CanMar Grain Products

- Best Cooking Pulses

- Bean Growers Australia

- Diefenbaker Spice & Pulse

Chapter 1. GLOBAL PULSE FLOUR MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL PULSE FLOUR MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL PULSE FLOUR MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL PULSE FLOUR MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL PULSE FLOUR MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL PULSE FLOUR MARKET– BY APPLICATION

6.1. Introduction/Key Findings

6.2. Bakery and Confectionery

6.3. Extruded products

6.4. Beverages

6.5. Animal Feed

6.6. Dairy Products

6.7. Other Applications

6.8. Y-O-Y Growth trend Analysis By Application

6.9. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. GLOBAL PULSE FLOUR MARKET– BY PRODUCT TYPE

7.1. Introduction/Key Findings

7.2. Chickpea

7.3. Lentils

7.4. Pea

7.5. Beans

7.6. Other Product Types

7.7. Y-O-Y Growth trend Analysis By PRODUCT TYPE

7.8. Absolute $ Opportunity Analysis By PRODUCT TYPE , 2024-2030

Chapter 8. GLOBAL PULSE FLOUR MARKET– BY Distribution Channel

8.1. Introduction/Key Findings

8.2. Food Chain Services

8.3. Modern Trade

8.4. Convenience Store

8.5. Departmental Store

8.6. Online Store

8.7. Other Distribution Channel

8.8. Y-O-Y Growth trend Analysis Distribution Channel

8.9. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. GLOBAL PULSE FLOUR MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By PRODUCT TYPE

9.1.3. By Application

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By PRODUCT TYPE

9.2.3. By Distribution Channel

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By PRODUCT TYPE

9.3.3. By Application

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By PRODUCT TYPE

9.4.3. By Application

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By PRODUCT TYPE

9.5.3. By Application

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL PULSE FLOUR MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 ADM

10.2. Ingredion

10.3. AGT Food & Ingredients

10.4. Blue Ribbon

10.5. ParakhAgroIndustrie

10.6. The Scoular Company

10.7. CanMar Grain Products

10.8. Best Cooking Pulses

10.9. Bean Growers Australia

10.10. Diefenbaker Spice & Pulse

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is anticipated to experience a surge in demand for pulse flours throughout the forecast period, driven by factors such as the expanding vegetarian demographic and manufacturers' substantial investment in R&D to introduce innovative products. Government initiatives aimed at endorsing pulse consumption further contribute to the increased sales of pulse flours.

The Top Players operating in the Pulse Flour Market -ADM, Ingredion, AGT Food & Ingredients, Blue Ribbon, ParakhAgroIndustrie, The Scoular Company, CanMar Grain Products, Best Cooking Pulses, Bean Growers Australia, Diefenbaker Spice & Pulse

The worldwide spread of the COVID-19 virus has significantly influenced international trade, with varying impacts across different agricultural sectors. While the grains, pulses, and oilseeds sector have experienced a relatively smaller effect compared to other segments, companies within this industry are grappling with notable challenges.

In the pulse flours market, manufacturers are actively adopting new technologies to expand commercial capacity for value-added pulse ingredients without compromising quality.

In the Asia Pacific region, rice flour takes precedence in the market. Market expansion in this region is propelled by health concerns and a rising demand for gluten-free products, particularly in emerging markets like India.