Public Blockchain Technology at Healthcare Market Size (2024 – 2030)

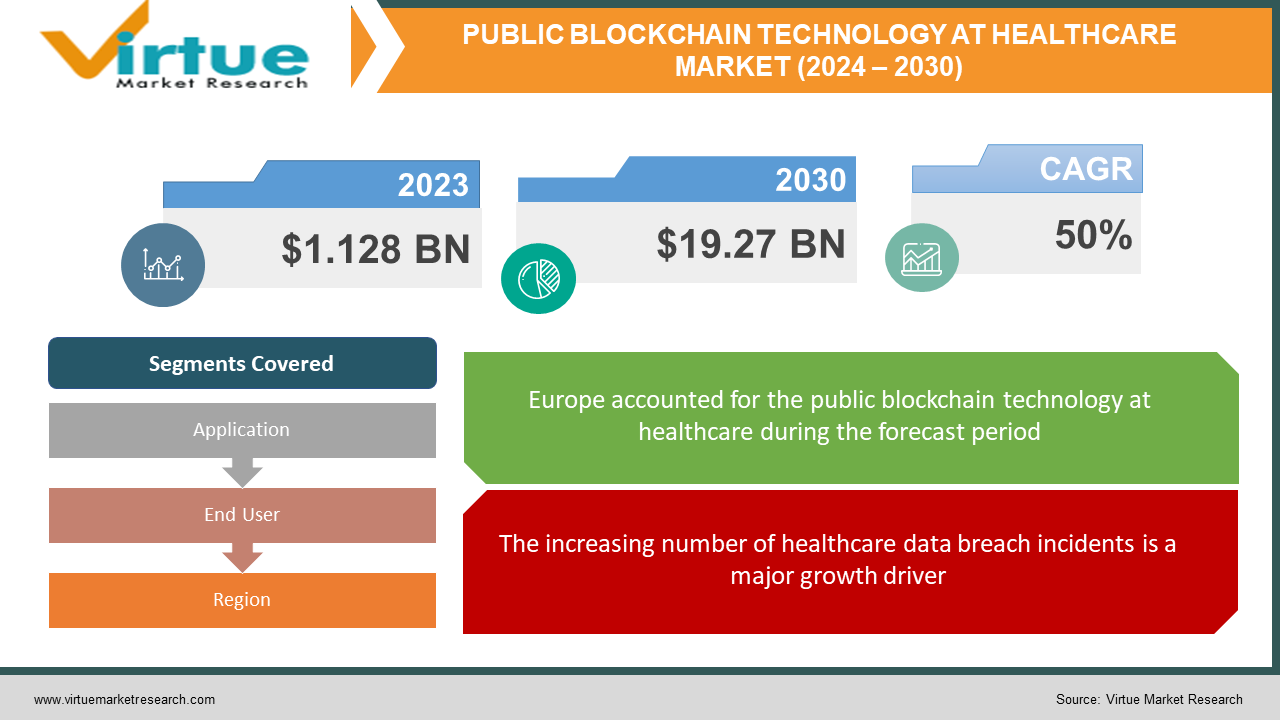

The global public blockchain technology in the healthcare market was valued at USD 1.128 billion in 2023 and is projected to reach a market size of USD 19.27 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 50%.

Public Blockchain Technology is a permissionless blockchain network that is transparent and allows anyone to join the network, validate the transaction, and contribute to the consensus process. It is decentralized, as data is distributed among the nodes and there is no central body controlling it. Data on the blockchain network is secure and immutable once it has been validated on the network. The public blockchain keeps the user’s identity hidden, with no obligation to use real names while being transparent, allowing everybody to see the ledger anytime.

Key Market Insights:

The total blockchain technology in the healthcare market was worth USD 3.61 billion in 2023. Public blockchain networks dominate with a 60% market share, while private blockchain networks have a 40% market share in the healthcare market.

In terms of region, Europe dominates the market with a 36% market share. Asia-Pacific and North America are also growing at a rapid pace.

In terms of application, the supply chain management segment dominates the market with a 26.2% market share in 2023.

In terms of end-users, the Pharmaceutical & Medical Device Manufacturers segment dominates with a market share of 41.4 in 2023.

Market Drivers:

The increasing number of healthcare data breach incidents is a major growth driver.

The healthcare industry is one of the major targets for cyberattacks. Globally, hospitals account for more than 30% of the data breaches. In 2023, more than 540 organizations reported healthcare data breaches to the United States Department of Health and Human Services (HHS), which impacted around 112 million individuals. According to The HIPAA Journal, there were around 26 data breaches of more than 1 million records and 4 data breaches of more than 8 million records. The rising number of cyberattacks and data breaches has increased the demand for the implementation of blockchain technology solutions to keep medical data secure and immutable.

Growing demand for enhanced data protection is facilitating the expansion.

The demand for public blockchain in the healthcare market is growing due to the rising demand for data security solutions. The healthcare industry needs to ensure the security and immutability of data from patient’s health data, medical records, and pharmaceutical records to record several particular disease cases. Healthcare industry data needs to be accurate, untampered, unauthorized, and immutable, and blockchain solutions are an ideal choice for this. About 23% of data breaches are due to human fault.

Rising investment in digital transformation is accelerating the growth rate.

Public blockchain technology in healthcare is becoming popular in the healthcare industry due to its properties to keep data secure, immutable, and resistant to data loss due to being stored on a distributed network of nodes. With the development of technology, investments are made to shift to blockchain solutions from traditional digital or non-digital solutions to lower operating expenses and inefficiencies in the system. According to Statista, spending on blockchain solutions is expected to reach around USD 19 billion by 2024. Rising investments are one of the major drivers for the growth of blockchain technology in the healthcare industry.

Market Restraints and Challenges:

Lack of awareness about blockchain technology is a major challenge in the industry.

One of the key challenges faced by public blockchain technology in the healthcare market is a lack of awareness. People are unaware of the benefits, uses, and applications of blockchain in the healthcare industry. This is hindering the growth and implementation of public blockchain in the healthcare market. If people working in the healthcare sector are made aware of and propose beneficial blockchain solutions, it may help overcome this challenge.

A lack of regulation on medical data exchange can create losses.

The growth of public blockchain technology in the healthcare market is hindered due to the reluctance of healthcare providers and payers to use blockchain technology solutions for the healthcare system. Due to the lack of regulations on medical data exchange, the majority of healthcare providers are reluctant to implement blockchain, especially in emerging countries.

The reluctance of healthcare providers to disclose data is creating hurdles.

In the healthcare industry, the majority of healthcare providers are reluctant to disclose medical data to maintain a competitive edge by keeping the medical data to themselves. The healthcare industry is facing challenges in the adoption of transparent ledger blockchain technology due to the fierce profit war in the industry.

Market Opportunities:

Government initiatives towards blockchain technology adoption are providing many possibilities.

The rising interest of the healthcare industry in blockchain technology is one of the growth drivers in the market. The healthcare industry has started to emphasize the benefits of blockchain technology, like data security, data immutability, and data interoperability. Many startups are arising in the healthcare industry that offer solutions to medical record interoperability, prevention of counterfeit drugs in the pharmaceutical supply chain, data breach security solutions, etc. This increasing interest has captured the attention of government bodies across the globe, which are investing, researching, and promoting blockchain technology.

PUBLIC BLOCKCHAIN TECHNOLOGY AT HEALTHCARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

50% |

|

Segments Covered |

By Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BurstIQ, PATIENTORY Inc., Guardtime, Chronicled, Avaneer Health, IBM, Solve. care, Pokitdok, Blockpharma, Medicalchain |

Public Blockchain Technology in Healthcare Market Segmentation: By Application

-

Supply Chain Management

-

Clinical Data Exchange and Interoperability

-

Clinical Trials and eConsent

-

Claims Adjunction and Billing

-

Others

In the public blockchain technology in the healthcare market, supply chain management is the dominant segment with over 26.2% market share in 2023. The supply chain management segment is growing in the healthcare market due to security laws, strict adherence to drug quality standards, and an increasing number of counterfeit drugs in circulation. According to the WHO, around 10% of medical drugs and medical products in low- and middle-income countries are defective or fake. Throughout the projected period, the fastest growth is anticipated in the clinical trials and eConsent categories. Clinical trials that use technology to their advantage can organize and secure data more effectively. The use of blockchain technology facilitates safe internal connections for clinicians. The prohibition of information modifications or revisions via the blockchain is expected to drive business expansion in the upcoming years. Data integrity is guaranteed by the use of blockchain technology in medical records. Comparable ideas apply to clinical studies as well, as records play a significant role in legal matters.

Public Blockchain Technology in Healthcare Market Segmentation: By End User

-

Hospitals

-

Insurance Providers

-

Pharmaceutical and Medical Device Manufacturers

-

Others

In the public blockchain technology in the healthcare market, pharmaceutical and medical device manufacturers dominate with an overall market share of 41.4%. The demand for improved security and data interoperability has led to the adoption of blockchain technology by pharmaceutical and medical device manufacturers. Blockchain technology has also been used to improve operational efficiency in different sectors of the healthcare industry, such as research institutes, pharmaceutical drug manufacturers, government bodies, and hospitals. The hospital segment is the fastest-growing segment. Hospitals are now striving to store patient data to ensure the system operates smoothly. This not only facilitates the categorization of new and returning patients, but it also makes use of current information to enhance patient-doctor visits. Furthermore, the system will guard against data breaches and cyberattacks that might expose sensitive information like phone numbers, addresses, and payment details.

Public Blockchain Technology in Healthcare Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, the largest market share was in Europe, with about 36% of the market. The rising sophistication of healthcare infrastructure and the use of digital technology have paved the way for the growth of blockchain technology implementation in the healthcare market in Europe. Increasing government support to prevent data breaches from healthcare providers is also one of the reasons for the growth in the region. Countries like Germany and the United Kingdom are at the forefront. North America is witnessing growth due to factors like regulations for the security of patient data, the rising need to safeguard data from tampering, and rising healthcare fraud. The US healthcare industry's investments are also rising in emerging technologies like blockchain, driving growth in the public blockchain for the healthcare market. Asia-Pacific is witnessing the fastest growth due to a rise in its market share due to increasing research and investment, partnerships, and government initiatives. Countries like China, India, Japan, and South Korea are the notable ones. Many emerging companies over here are coming up with technological advancements and other innovations. This has led to an increased share.

COVID-19 Impact Analysis on the Global Public Blockchain Technology in the Healthcare Market:

COVID-19 has boosted the adoption and demand for blockchain solutions in the healthcare market. It had a favorable effect on the growth of blockchain technology in the healthcare market. Support for blockchain-based ventures in the healthcare industry also rose post-pandemic. Blockchain technology has been used to monitor and control the COVID-19 spread and manage vaccine certificates to ensure tamperproof records of individuals’ vaccination status. COVID-19 has accelerated the exploration and implementation of blockchain technology in the healthcare market.

Latest Trends/Developments:

The use of public blockchain is on the rise in the supply chain management segment. According to the WHO, it is estimated that more than 30% of medicines on the market in some countries in Africa, South America, and parts of Asia can be counterfeited. Many factors have contributed to this, including the supply chain, where a network of non-regulated wholesalers and distributors and non-legitimate internet pharmacies are included. To overcome the problem of counterfeit drugs, blockchain-based supply chain management solutions are used. Blockchain solutions facilitate communication between the entire supply chain, from manufacturers and wholesalers to retail pharmacies, to maintain drug records and collect faulty items. The investments are made to implement blockchain technology to maintain medical records and ensure the accuracy and immutability of the data.

Key Players:

-

BurstIQ

-

PATIENTORY Inc.

-

Guardtime

-

Chronicled

-

Avaneer Health

-

IBM

-

Solve. care

-

Pokitdok

-

Blockpharma

-

Medicalchain

-

In December 2023, BurstIQ and Lytics Health merged to combine blockchain-based data security with advanced AI healthcare analytics. Through this merger, Lytics Health's blockchain-based data security platform and BurstIQ's cutting-edge artificial intelligence healthcare analytics will be combined to provide a single, all-encompassing solution for healthcare data management that combines strong security measures and analytical capability.

-

In November 2023, GuardTime introduced the Keyless Trust Anchor Service for tamper-proof evidence of data integrity in the pharmaceutical supply chain.

-

In October 2023, iSolve acquired MedLedger to expand its blockchain platform for patient data privacy and clinical trial management.

-

In September 2023, PATIENTORY, Inc., and Health Gorilla partnered to integrate a patient engagement platform and interoperability network.

Chapter 1. Public Blockchain Technology in Healthcare Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Public Blockchain Technology in Healthcare Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Public Blockchain Technology in Healthcare Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Public Blockchain Technology in Healthcare Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Public Blockchain Technology in Healthcare Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Public Blockchain Technology in Healthcare Market – By Application

6.1 Introduction/Key Findings

6.2 Supply Chain Management

6.3 Clinical Data Exchange and Interoperability

6.4 Clinical Trials and eConsent

6.5 Claims Adjunction and Billing

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Public Blockchain Technology in Healthcare Market – By End User

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Insurance Providers

7.4 Pharmaceutical and Medical Device Manufacturers

7.5 Others

7.6 Y-O-Y Growth trend Analysis By End User

7.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Public Blockchain Technology in Healthcare Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Application

8.1.3 By End User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Application

8.2.3 By End User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Application

8.3.3 By End User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Application

8.4.3 By End User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Public Blockchain Technology in Healthcare Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BurstIQ

9.2 PATIENTORY Inc.

9.3 Guardtime

9.4 Chronicled

9.5 Avaneer Health

9.6 IBM

9.7 Solve. care

9.8 Pokitdok

9.9 Blockpharma

9.10 Medicalchain

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global public blockchain technology in the healthcare market was valued at USD 1.128 billion in 2023 and is projected to reach a market size of USD 19.27 billion by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 50%.

Key drivers include the rising demand for enhanced data protection solutions, the increasing number of data breaches, and rising investment in technology transformation.

Hospitals, insurance providers, and pharmaceutical and medical device manufacturers are the end users of the public blockchain technology in the healthcare market.

Europe held the largest market share of 36% estimated in the public blockchain technology in the healthcare market. This dominant position can be attributed to the region's growing healthcare infrastructure and digital technology adoption.

BurstIQ, PATIENTORY Inc., Guardtime, Chronicled, and Avaneer Health are some of the key players in the global public blockchain technology in the healthcare market.