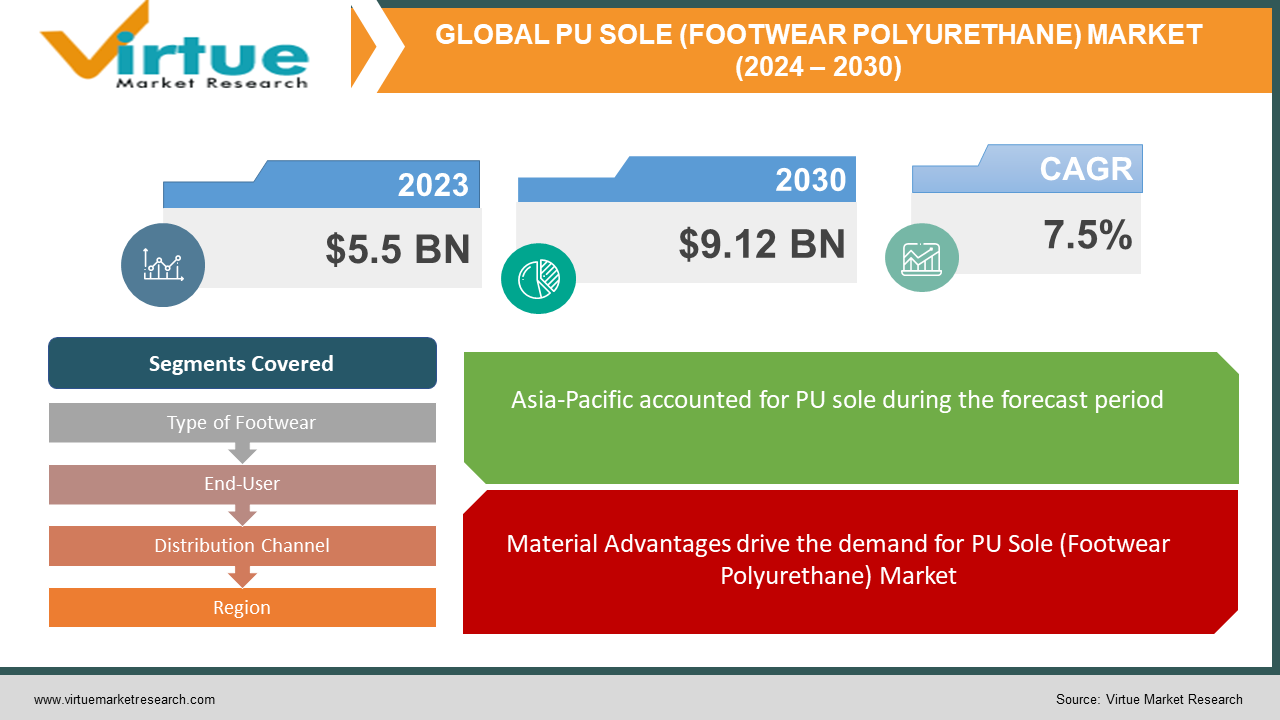

Global PU Sole (Footwear Polyurethane) Market Size (2024 – 2030)

The Global PU Sole (Footwear Polyurethane) Market was valued at USD 5.5 billion and is projected to reach a market size of USD 9.12 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.5%.

The PU (Polyurethane) sole market plays an important role in the footwear industry and encompasses the production, distribution, and sale of shoe soles made from polyurethane material. Polyurethane is a versatile polymer. It is known for its durability, flexibility, and comfort. This makes it a popular choice for footwear manufacturing. The PU Sole (Footwear Polyurethane) Market is expected to grow significantly in the coming years due to fashion trends, consumer preferences, and lifestyle choices. The major well-established key players in the PU Sole (Footwear Polyurethane) Market are BASF SE, Huntsman Corporation, Covestro AG, Dow Inc., and Wanhua Chemical Group Co., Ltd.

Key Market Insights:

Polyurethane offers several advantages over traditional materials like rubber and PVC. Some of them are lightweight construction, cushioning properties, and resistance to abrasion and chemicals. Fashion trends, material advantages, technological innovation, environmental concerns, and global economic factors are propelling the PU Sole (Footwear Polyurethane) Market. There is increasing awareness of environmental issues. This has led to a growing demand for sustainable and eco-friendly footwear materials. The restraints to the PU Sole (Footwear Polyurethane) Market include environmental concerns, cost and price volatility, regulatory compliance, competition and market saturation, and supply chain disruptions. Ongoing advancements in technology have impacted the PU sole market by improving production efficiency, reducing costs, and enhancing product performance. Asia-Pacific occupies the highest share of the PU Sole (Footwear Polyurethane) Market. Middle East and Africa is the fastest-growing segment during the forecast period.

PU Sole (Footwear Polyurethane) Market Drivers:

Material Advantages drive the demand for PU Sole (Footwear Polyurethane) Market

Polyurethane has several advantageous properties. This includes durability, flexibility, and comfort. PU soles are lightweight. They provide a comfortable and easy-wearing experience for consumers. The material's cushioning properties make it suitable for various types of footwear. This enhances overall comfort during prolonged use. PU soles are resistant to abrasion and chemicals. This contributes to the longevity of the footwear. These material benefits make PU a preferred choice for both manufacturers and consumers. This drives demand in the market.

Fashion Trends are propelling the PU Sole (Footwear Polyurethane) Market

The footwear industry is influenced by ever-changing fashion trends and consumer preferences. Designers and manufacturers incorporate PU soles into their products to align with current fashion aesthetics. PU's versatility allows for innovative and stylish shoe designs. This meets the demands of fashion-conscious consumers. Consumer preferences are evolving. The adaptability of PU soles enables the industry to respond quickly to emerging trends. This maintains market relevance. The dynamic nature of fashion trends ensures a continuous market demand for footwear with PU soles. Manufacturers strive to offer on-trend and aesthetically pleasing products.

PU Sole (Footwear Polyurethane) Market Restraints and Challenges

The major challenges faced by the PU Sole (Footwear Polyurethane) Market are the Environmental Concerns. Polyurethane is derived from petrochemicals. This concerns environmental impact. The manufacturing process of PU soles involves the use of potentially harmful chemicals and generates waste. This contributes to pollution and environmental degradation. Another challenge is the fluctuations in the prices of raw materials, such as crude oil and chemical components. This can affect the production costs of PU soles. The other restraints to the PU Sole (Footwear Polyurethane) Market include regulatory compliance, competition and market saturation, and supply chain disruptions.

PU Sole (Footwear Polyurethane) Market Opportunities:

The PU Sole (Footwear Polyurethane) Market has various opportunities in the market. Opportunities lie in embracing eco-friendly manufacturing processes and materials to meet the growing demand for sustainable footwear solutions. Another opportunity in the PU Sole (Footwear Polyurethane) Market includes investing in research and development to enhance product performance, durability, and customization options. Offering unique designs, features, and branding strategies cater to diverse consumer preferences. Forming strategic alliances with suppliers, retailers, and technology providers to streamline operations. This explores new business opportunities.

GLOBAL PU SOLE (FOOTWEAR POLYURETHANE) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Type of Footwear, End-User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Huntsman Corporation, Covestro AG, Dow Inc., Wanhua Chemical Group Co., Ltd., Lanxess AG, Mitsui Chemicals, Inc., Lubrizol Corporation, Evonik Industries AG, Recticel NV |

PU Sole (Footwear Polyurethane) Market Segmentation: By Type of Footwear:

-

Athletic Footwear

-

Casual Footwear

-

Formal Footwear

-

Boots

-

Sandals

-

Others

In 2023, based on market segmentation by Type of Footwear, Athletic footwear occupies the highest share of the PU Sole (Footwear Polyurethane) Market. This is mainly due to the widespread popularity of sports and fitness activities globally. Sneakers and trainers are in high demand among consumers for both sports and casual wear purposes. The durability, flexibility, and cushioning properties of PU soles make them well-suited for athletic footwear.

However, Casual footwear is the fastest-growing segment during the forecast period. This is due to changing consumer lifestyles and preferences. Casual shoes are worn for everyday activities, work, and leisure. This drives demand for comfortable and versatile footwear options. PU soles offer the desired combination of comfort, style, and durability. This makes them a preferred choice for casual footwear.

PU Sole (Footwear Polyurethane) Market Segmentation: By End-User:

-

Men

-

Women

-

Children

In 2023, based on market segmentation by End-User Gender, the Men segment occupies the highest share of the PU Sole (Footwear Polyurethane) Market. This is mainly due to factors such as workwear requirements, sports participation, and fashion trends. Men's footwear encompasses a wide range of styles, from formal shoes to casual sneakers. The versatility and durability of PU soles make them popular among men for different occasions.

However, the Women are the fastest-growing segment during the forecast period. This is mainly due to the changing fashion trends, increasing purchasing power, and rising participation in sports and outdoor activities. Women's footwear styles range from formal heels to casual flats and athletic shoes. There is a growing demand for comfortable yet stylish footwear among women, which aligns well with the properties offered by PU soles.

PU Sole (Footwear Polyurethane) Market Segmentation: By Distribution Channel:

-

-

Online Retail

-

Offline Retail

-

Specialty Stores

-

Departmental Stores

-

Hypermarkets/Supermarkets

-

Others

-

-

In 2023, based on market segmentation by Distribution Channel, the Offline Retail including the Specialty Stores segment occupies the highest share of the PU Sole (Footwear Polyurethane) Market. Specialty stores provide a wide variety of footwear options to consumers, including specialized products with PU soles. Customers can physically examine and try on shoes. This enhances their shopping experience. Specialty stores offer personalized service and expertise, catering to specific consumer needs and preferences.

However, online retail is the fastest-growing segment during the forecast period. This growth is driven by the increasing popularity of e-commerce platforms and changing consumer shopping habits. Online retail provides convenience, accessibility, and a vast selection of products, including footwear with PU soles. Consumers can browse and purchase shoes from the comfort of their homes, compare prices and styles, and benefit from doorstep home delivery services.

PU Sole (Footwear Polyurethane) Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, Asia-Pacific occupies the highest share of the PU Sole (Footwear Polyurethane) Market. This growth is due to the vast population, increasing disposable income, and a robust footwear manufacturing sector. Countries like China, India, Japan, and Australia, have significant market share due to increasing domestic consumption and exports. The presence of major manufacturing hubs for footwear production, coupled with a well-established supply chain network further contributes to the growth of the market.

However, Middle East and Africa is the fastest-growing segment during the forecast period. This is mainly due to rising urbanization, changing consumer lifestyles, government initiatives, and a growing awareness of fashion trends. The demand for comfortable and durable footwear is increasing. This further drives the adoption of PU soles. The Middle East region is known for its high demand for premium and luxury footwear products. This often features PU soles for their comfort and durability.

COVID-19 Impact Analysis on the Global PU Sole (Footwear Polyurethane) Market:

The COVID-19 pandemic had a significant impact on the PU Sole (Footwear Polyurethane) Market. There were lockdowns, other safety restrictions, factory closures, transportation restrictions, and logistical challenges. This disrupted global supply chains, affecting the availability of raw materials and components necessary for PU sole production. This hindered the flow of goods, leading to delays in production and distribution. With reduced purchasing power and limited opportunities for social gatherings and events, demand for new shoes, particularly fashion and casual footwear featuring PU soles, decreased. E-commerce platforms witnessed a surge in traffic and sales. Consumers increasingly turned to online shopping channels to fulfill their footwear needs. Thus, the pandemic accelerated certain trends in the PU Sole (Footwear Polyurethane) Market.

Latest Trends/ Developments:

One of the developments, in the PU Sole (Footwear Polyurethane) Market is the customization features such as color, design, and fit, allowing consumers to create footwear tailored to their preferences. Design innovation continues to be a key trend in the footwear industry. Manufacturers introduce new and creative designs to capture consumer interest. There's a growing focus on sustainability within the footwear industry, leading to increased demand for eco-friendly materials. PU sole manufacturers are exploring sustainable formulations, including bio-based polyurethane derived from renewable sources such as plant-based feedstocks or recycled materials.

Key Players:

-

BASF SE

-

Huntsman Corporation

-

Covestro AG

-

Dow Inc.

-

Wanhua Chemical Group Co., Ltd.

-

Lanxess AG

-

Mitsui Chemicals, Inc.

-

Lubrizol Corporation

-

Evonik Industries AG

-

Recticel NV

Market News:

- In January 2024, SOLE™ unveiled the Jasper Chukka, a limited edition shoe that redefines footwear possibilities with natural materials. Featuring the innovative ReCORK™ Recycled Cork midsole, made from post-consumer recycled wine corks, the Jasper Chukka offers lightweight, flexible, and durable cushioning while being carbon-negative. The shoe also incorporates natural fibers like Merino wool and up-cycled bison for sustainable comfort and style.

- In March 2023, BASF SE, headquartered in Germany, unveiled Elastopan®, a pioneering polyurethane system engineered specifically for shoe soles. This innovation promises enhanced performance, reduced density, and a decreased carbon footprint.

- In January 2023, Covestro, a German-based company, announced a strategic partnership with Reebok, an American footwear giant, to jointly develop and market innovative footwear solutions centered around polyurethane materials.

- In November 2022, DuPont, a US-based multinational, completed the acquisition of Solegear Bioplastics Inc., a Canadian leader in bio-based and compostable polyurethane production, expanding its portfolio in sustainable footwear materials.

- In September 2022, Huntsman Corporation, based in the US, introduced Daltoped® AquaPUR, a novel water-blown polyurethane system tailored for shoe soles, boasting reduced energy consumption and emissions throughout the manufacturing process.

- In July 2022, Wanhua Chemical Group, headquartered in China, launched Wanthane® ECO, a series of bio-based polyurethane products designed for footwear, derived from renewable sources to minimize environmental impact.

Chapter 1. PU Sole (Footwear Polyurethane) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PU Sole (Footwear Polyurethane) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PU Sole (Footwear Polyurethane) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PU Sole (Footwear Polyurethane) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PU Sole (Footwear Polyurethane) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PU Sole (Footwear Polyurethane) Market – By Type of Footwear

6.1 Introduction/Key Findings

6.2 Athletic Footwear

6.3 Casual Footwear

6.4 Formal Footwear

6.5 Boots

6.6 Sandals

6.7 Others

6.8 Defence Vessels Y-O-Y Growth trend Analysis By Type of Footwear

6.9 Absolute $ Opportunity Analysis By Type of Footwear, 2024-2030

Chapter 7. PU Sole (Footwear Polyurethane) Market – By End-User

7.1 Introduction/Key Findings

7.2 Men

7.3 Women

7.4 Children

7.5 Y-O-Y Growth trend Analysis By End-User

7.6 Absolute $ Opportunity Analysis By End-User 2024-2030

Chapter 8. PU Sole (Footwear Polyurethane) Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Online Retail

8.3 Offline Retail

8.3.1 Specialty Stores

8.3.2 Departmental Stores

8.3.3 Hypermarkets/Supermarkets

8.3.4 Others

8.4 Y-O-Y Growth trend Analysis By Distribution Channel

8.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. PU Sole (Footwear Polyurethane) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Footwear

9.1.3 By End-User:

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Footwear

9.2.3 By End-User:

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Footwear

9.3.3 By End-User

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Footwear

9.4.3 By End-User:

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Footwear

9.5.3 By End-User

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. PU Sole (Footwear Polyurethane) Market – Company Profiles – (Overview, By Type of Footwear Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 Huntsman Corporation

10.3 Covestro AG

10.4 Dow Inc.

10.5 Wanhua Chemical Group Co., Ltd.

10.6 Lanxess AG

10.7 Mitsui Chemicals, Inc.

10.8 Lubrizol Corporation

10.9 Evonik Industries AG

10.10 Recticel NV

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global PU Sole (Footwear Polyurethane) Market was valued at USD 5.5 billion and is projected to reach a market size of USD 9.12 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.5%.

Fashion trends, material advantages, technological innovation, environmental concerns, and global economic factors are the market drivers of the Global PU Sole (Footwear Polyurethane) Market.

Athletic Footwear, Casual Footwear, Formal Footwear, Boots, Sandals, and Others are the segments under the Global PU Sole (Footwear Polyurethane) Market by Type of Footwear.

Asia Pacific is the most dominant region for the Global PU Sole (Footwear Polyurethane) Market.

BASF SE, Huntsman Corporation, Covestro AG, Dow Inc., and Wanhua Chemical Group Co., Ltd. are the key players in the Global PU Sole (Footwear Polyurethane) Market.