Psyllium Products Market Size (2024 – 2030)

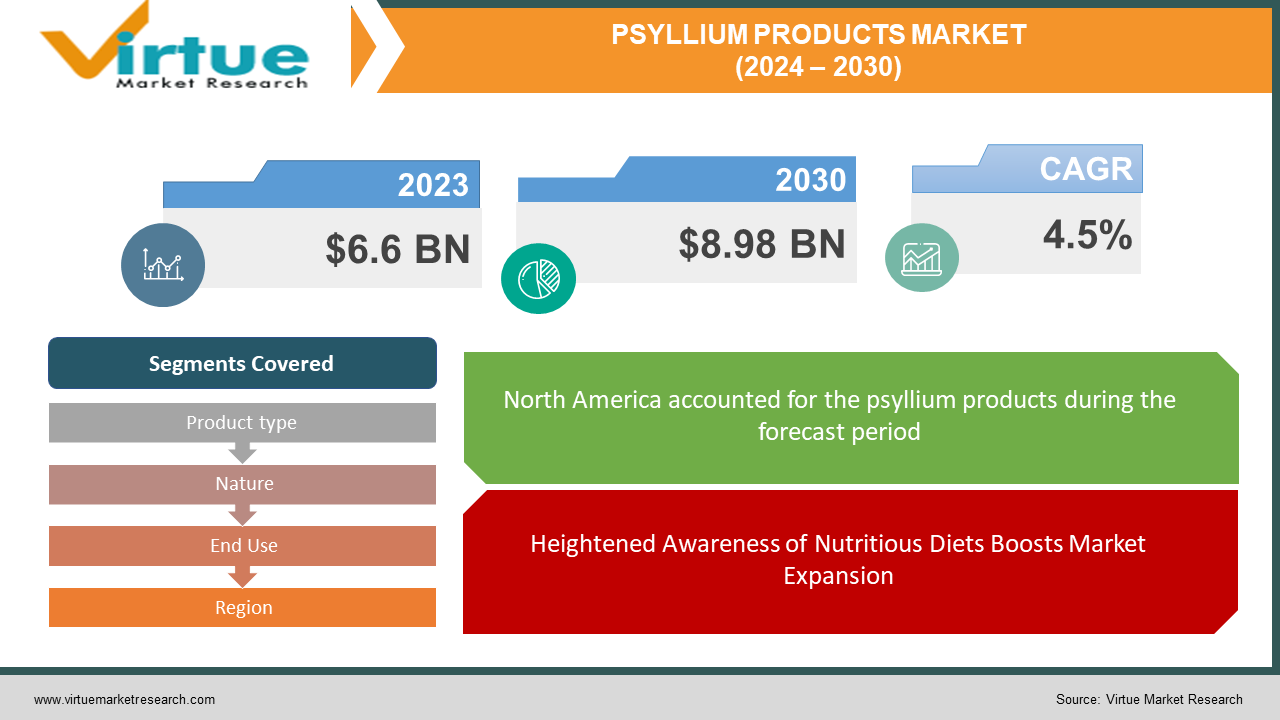

The Global Psyllium Products Market is expected to grow from USD 6.6 billion in 2023 to reach a valuation of USD 8.98 billion by 2030 at a compound annual growth rate (CAGR) of 4.5% between 2024-2030.

Psyllium has garnered considerable interest from the public, scientific circles, and certain consumer industries, mainly due to the health benefits associated with psyllium husk and mucilage for medicinal and nutritional purposes. Recognized for its role as a dietary fiber and a bulk-forming laxative, psyllium's gel-forming characteristics also act as stimulants for growth. This has stimulated a surge in market growth opportunities for a range of psyllium-based products. The increasing consciousness about health and wellness, along with a preference for nutritious foods, is expected to drive significant growth in the market for psyllium seed products. The husk of the seed plays a crucial role in managing and preventing gastrointestinal and bowel disorders. In developing countries, sedentary lifestyles and a rising demand for laxative medications are leading to a higher demand for psyllium husk. Additionally, the growing elderly population facing digestive issues contributes to the rising demand for husks in regions with an aging demographic. Psyllium husk shows promise as a polymer in gastroretentive floating drug delivery systems, especially when combined with synthetic polymers. These factors are anticipated to propel the psyllium market's growth throughout the forecast period.

Key Market Insights:

Psyllium husk, obtained during the seed processing cycle, is primarily known for its mucilage – a clear, colorless gelling agent capable of forming a gel in water. Commercially, psyllium is available in various forms including seeds, husk, husk powder, organic variants, capsules, and granules. Its application is widespread in the food industry, pharmaceuticals, nutraceuticals, cosmetics, personal care items, and as an additive in animal and poultry feed. According to the FAO, India is the leading producer and exporter of psyllium seeds. Psyllium serves as a dietary fiber and bulk laxative, offering therapeutic and preventive benefits for certain health conditions. Research on psyllium has highlighted its beneficial properties both as a medicinal product and a potential industrial ingredient. The demand for natural ingredients and bioceutical foods has stimulated psyllium product production. Factors fueling the market growth of psyllium products include ongoing research and development, the demand for nutraceutical and therapeutic products, organic farming, the role of traditional medicine products, increased harvesting and trading of the psyllium plant, health benefits of psyllium products, industrial applications of psyllium seeds, rising health awareness and healthy diet trends, an increase in digestive disorders due to sedentary lifestyles, psyllium's role in animal feed, and advancements in technology.

Global Psyllium Products Market Drivers:

Heightened Awareness of Nutritious Diets Boosts Market Expansion

The prevalence of constipation and other health issues, particularly in urban areas, has risen due to rapid lifestyle shifts and poor dietary habits. Consequently, these factors bode well for the growth of the psyllium product market. A shift in consumer eating habits, coupled with a growing focus on diet and health, has led to increased demand for healthier food options. The inclination towards nutritious diets has intensified in recent years, fueling research and leading to the identification of superfoods like psyllium.

Various methods, including mechanical, enzymatic, chemical, and physical techniques, have been employed to enhance or modify the physicochemical and functional properties of psyllium. This innovation has led to the development of improved polysaccharide-based hydrogels, maintaining the health benefits of the original polysaccharides. Due to a broadening recognition of its importance, the demand for psyllium in both the food & beverage and healthcare industries has seen a substantial rise.

Utilization of Psyllium Products in Cosmetics and Personal Care Spurs Market Growth

The seed coats of medicinal and industrial plants, along with their commercial products, serve multiple purposes. Psyllium, often referred to as the seed coat, plays a vital role in managing and preventing gastrointestinal and intestinal ailments. The growing adoption of psyllium in recent years has shed light on its industrial applications for both food and therapeutic uses.

The health benefits of psyllium husk and powder, particularly in home remedies for regulating cholesterol, are gaining prominence. With the global increase in cardiovascular diseases, the demand for psyllium products has surged. These factors collectively contribute to the upward trajectory of the psyllium market in the forthcoming years.

Global Psyllium Products Market Restraints and Challenges:

Obstacles in Market Growth Due to Limited Consumer Knowledge of Psyllium Husk Benefits

Herbal supplements, widely used for health maintenance and treatment of various conditions, are gaining traction. The growing focus on preventive healthcare and increased health and wellness expenditures, particularly in emerging economies, are propelling the use of herbal nutritional supplements, thereby influencing market growth. Furthermore, these herbal supplements are recognized for their role in digestive regulation, cholesterol management, and stress reduction. The rising preference for natural products has enhanced the penetration of herbal nutraceuticals, which in turn, is fostering the growth of the psyllium market.

The ongoing trend towards healthcare in societies with an aging population has escalated the demand for herbal nutritional supplements. Psyllium husk powder, consumed as an herbal dietary supplement, is popular for treating constipation and aiding bowel movements. Additionally, the escalating demand for laxatives has prompted manufacturers to expand their product range in this segment, leading to an increased presence of alternative products in the market, which could hinder market growth during the forecast period.

The Challenge Posed by a Variety of Alternatives to Psyllium Products

Despite their benefits, psyllium husk supplements can have undesirable side effects. Gradually increasing the dosage can mitigate discomfort, but fiber supplements may still interfere with drug absorption and reduce blood sugar levels. Natural and cheaper synthetic alternatives are available, presenting a challenge. The market is witnessing a growing number of alternatives, which may significantly impede annual market growth in the years ahead.

The challenges faced by psyllium products in the market stem from both natural substitutes like cornstarch, xanthan gum, arrowroot powder, and flaxseed, and synthetic alternatives, which are capturing a considerable market share. This has compelled manufacturers to innovate and introduce more varied products in this segment, leading to an increased presence of substitutes in the market.

Global Psyllium Products Market Opportunities:

The Health Advantages of Psyllium

Psyllium offers a range of gastrointestinal health advantages to numerous consumers. It also supplies essential nutrition, including proteins, vitamins, minerals, and antioxidants, which enhance the body's immune response over time. Additionally, the growing preference for gluten-free products is steering consumers towards psyllium as an excellent substitute. Increasingly, consumers are concentrating on a nutritious diet to address issues such as fatigue and reduced concentration. In some instances, a gluten-free diet aids in improving focus and can also alleviate gastrointestinal problems. Psyllium's most recognized benefit is its laxative effect, which helps many individuals increase their dietary fiber intake and detoxify. This is particularly beneficial for those dealing with constipation or cardiovascular diseases.

Psyllium's Emergence in the Cosmetics and Skincare Market

The cosmetics market has not only expanded but also evolved significantly. Nowadays, consumers are showing a preference for skincare products that are cruelty-free and free from allergens, including gluten. With increased disposable income, there is a trend towards purchasing premium skincare products. Online trends and the influence of popular social media personalities have also encouraged a focus on self-grooming. The inclusion of psyllium-based products in skincare regimens contributes to enhanced skin health, offering vital vitamins and nutrients not just on the surface but also penetrating the deeper skin layers. Additionally, psyllium husk can have a calming effect on the skin, mitigating irritation related to rashes and acne. Consequently, psyllium finds diverse applications in the cosmetics and skincare product market.

PSYLLIUM PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Product type, Nature, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Jyot Overseas Pvt. Ltd., Satnam Psyllium Industries, Keyur Industries, Shubh Psyllium Industries, Atlas Industries, Gayatri Psyllium Industries, Abhyuday Industries, Psyllium Labs LLC, KV Agro Products, AEP Colloids |

Global Psyllium Products Market Segmentation: Product Type

-

Psyllium seeds

-

Psyllium Husk

-

Psyllium husk powder

-

Psyllium industrial powder

The Global Psyllium Products Market displays a diverse array of products, each tailored to specific needs and preferences. Notably, Psyllium Husk emerges as the leading segment due to its fibrous composition, widely utilized in health products and as a dietary supplement. Renowned for its efficacy in enhancing digestion and promoting heart health, Psyllium Husk stands out. Meanwhile, the Psyllium Seeds and Psyllium Husk Powder segments are gaining momentum, exhibiting the highest growth during the forecast period. Psyllium Seeds, in their raw form, are gaining popularity for their natural and unprocessed attributes. Simultaneously, Psyllium Husk Powder, known for its convenience in food preparation, is becoming the preferred choice for consumers seeking health benefits without compromising on ease of use.

Global Psyllium Products Market Segmentation: By Nature

-

Organic

-

Conventional

When examining the market based on nature, two discernible segments emerge: Organic and Conventional. Presently, the Conventional segment dominates the market, driven by the widespread availability and generally lower price points of conventional Psyllium products, making them accessible to a broader consumer base. However, there is a notable surge in the Organic segment, growing at an unprecedented pace. This surge is fueled by increasing consumer demand for natural and chemical-free products, reflecting growing health consciousness and environmental concerns. Organic Psyllium products, cultivated without synthetic pesticides or fertilizers, are establishing a niche in the market.

Global Psyllium Products Market Segmentation: By End Use

-

Food & beverages

-

Pharmaceuticals

-

Dietary supplements

-

Animal feed

-

Others

The applications of Psyllium Products extend across various end-use segments, including Food & Beverages, Pharmaceuticals, Dietary Supplements, Animal Feed, and Others. The Pharmaceutical sector commands the largest share, underscoring Psyllium's acknowledged benefits in medicinal and therapeutic applications. Its role in managing cholesterol levels and aiding digestion makes it a staple in numerous pharmaceutical products. In contrast, the Dietary Supplements segment is experiencing rapid expansion, driven by a growing inclination towards preventive healthcare and the increasing popularity of functional foods. Dietary supplements enriched with Psyllium cater to a market segment prioritizing health maintenance and wellness through natural supplements.

Global Psyllium Products Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The geographical analysis of the Global Psyllium Products Market reveals a varied landscape. North America claims the largest market share, attributed to its well-established health and wellness industry, high consumer awareness, and purchasing power. The presence of major market players further solidifies its dominance. However, in terms of growth, the Asia-Pacific and Europe regions are advancing rapidly. In Asia-Pacific, this growth is propelled by increasing health awareness, rising disposable incomes, and the traditional use of Psyllium in local cuisines. Meanwhile, Europe's growth is fueled by escalating demand for natural and organic supplements, coupled with stringent regulations promoting the use of sustainable and natural ingredients in food and health products. This shift reflects an increasing preference for healthier lifestyles and the growing influence of global health trends in these regions.

COVID-19 Impact Analysis on the Global Psyllium Products Market:

The COVID-19 pandemic has notably hindered economic growth in various countries, with significant industries experiencing a slowdown in trade. Psyllium products, known for their role as functional ingredients, are primarily utilized in several end-use industries. The pandemic has heightened the relevance of dietary supplements, a sector where psyllium products play a crucial role. The outbreak has led to an increased consumption of dietary supplements by individuals seeking to enhance their immunity and nutrition, resulting in an unforeseen surge in sales of these supplements. This trend has positively influenced the growth of the psyllium products market. Nevertheless, the pandemic also brought challenges, including disruptions in the supply chain and difficulties in procuring raw materials, which posed hurdles for psyllium product manufacturers.

Recent Trends and Developments in the Global Psyllium Products Market:

In September 2022, Nutravet introduced a high-fiber dietary supplement aimed at promoting long-term digestive health and proper anal gland function. These supplements are meticulously formulated to support gut health by utilizing natural ingredients that ensure optimal stool consistency and regular bowel movements.

In June 2022, ORGANIC INDIA USA unveiled new varieties of prebiotic and probiotic psyllium fiber in orange, cinnamon spice, and original flavors, designed to enhance overall digestive health. These innovative products aid in digestion and nutrient absorption, feature heat-stable probiotics for a healthy microbiome, and simplify the inclusion of probiotics in daily diets.

Key Players:

-

Jyot Overseas Pvt. Ltd.

-

Satnam Psyllium Industries

-

Keyur Industries

-

Shubh Psyllium Industries

-

Atlas Industries

-

Gayatri Psyllium Industries

-

Abhyuday Industries

-

Psyllium Labs LLC

-

KV Agro Products

-

AEP Colloids

Chapter 1. Psyllium Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Psyllium Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Psyllium Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Psyllium Products Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Psyllium Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Psyllium Products Market – By Product Type

6.1 Introduction/Key Findings

6.2 Psyllium seeds

6.3 Psyllium Husk

6.4 Psyllium husk powder

6.5 Psyllium industrial powder

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Psyllium Products Market – By Nature

7.1 Introduction/Key Findings

7.2 Organic

7.3 Conventional

7.4 Y-O-Y Growth trend Analysis By Nature

7.5 Absolute $ Opportunity Analysis By Nature, 2024-2030

Chapter 8. Psyllium Products Market – By End-User

8.1 Introduction/Key Findings

8.2 Food & beverages

8.3 Pharmaceuticals

8.4 Dietary supplements

8.5 Animal feed

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Psyllium Products Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Nature

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Nature

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Nature

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Nature

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Nature

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Psyllium Products Market – Company Profiles – (Overview, By Product Type Portfolio, Financials, Strategies & Developments)

10.1 Jyot Overseas Pvt. Ltd.

10.2 Satnam Psyllium Industries

10.3 Keyur Industries

10.4 Shubh Psyllium Industries

10.5 Atlas Industries

10.6 Gayatri Psyllium Industries

10.7 Abhyuday Industries

10.8 Psyllium Labs LLC

10.9 KV Agro Products

10.10 AEP Colloids

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Psyllium Products Market size is valued at USD 6.6 billion in 2023.

The worldwide Global Psyllium Products Market growth is estimated to be 4.5% from 2024 to 2030.

The Global Psyllium Products Market is segmented By Product Type (Psyllium seeds, Psyllium Husk, Psyllium husk powder, and Psyllium industrial powder), By Nature (Organic and Conventional), By End Use (Food & beverages, pharmaceuticals, dietary supplements, and animal feed, and others.

Growing awareness of psyllium's health advantages is expected to propel the expansion of the global market for psyllium products. Lucrative prospects are presented by the growing demand for natural dietary supplements and the attention being paid to digestive health. The market potential is further driven by advancements in product formulations and growing consumer preferences for organic options.

The COVID-19 pandemic gave the global market for psyllium products a big boost as customers looked for natural supplements that would strengthen their immune systems. Demand was fueled by a greater emphasis on gut health brought on by the pandemic's impact on public health, but supply chain interruptions presented difficulties that required quick reactions from industry participants.