Protective Packaging Market Size (2025 – 2030)

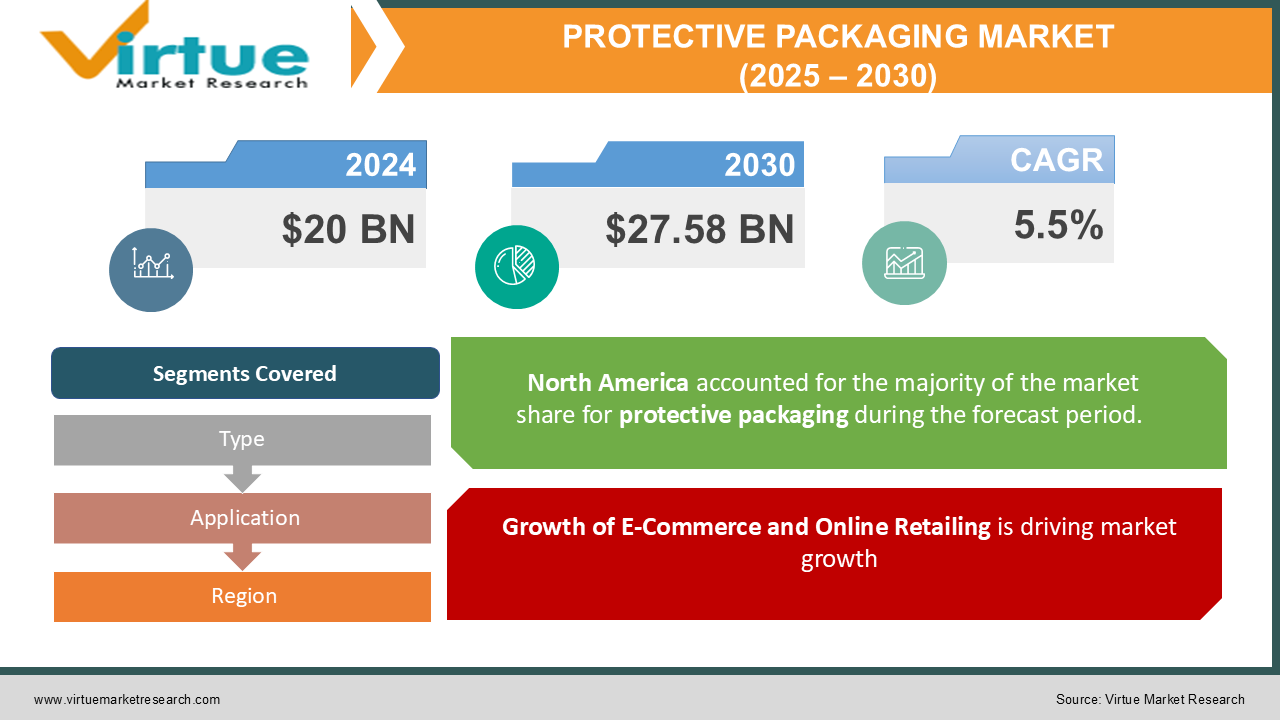

The Global Protective Packaging Market was valued at USD 20 billion in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2030. By 2030, the market is projected to reach USD 27.58 billion.

Protective packaging refers to materials and solutions designed to safeguard products during storage, transportation, and handling. These solutions include flexible, rigid, and foam packaging, which are extensively used across industries such as e-commerce, electronics, food and beverages, and healthcare. The increasing demand for durable, lightweight, and eco-friendly packaging options, coupled with the rapid growth of the e-commerce sector, drives the market's expansion globally.

Key Market Insights:

-

The e-commerce sector accounted for approximately 35% of the global protective packaging market revenue in 2024, driven by the rise in online shopping and the need for product safety during transit.

-

Flexible protective packaging, such as bubble wraps and air pillows, dominates the product type segment with a 40% market share due to its lightweight and cost-effective nature.

-

The food and beverage industry is a key end-user segment, contributing 25% to the market in 2024, driven by stringent regulations on food safety and packaging.

-

North America leads the protective packaging market, accounting for 30% of global revenue in 2024, owing to advanced logistics systems and high consumer demand.

-

The adoption of biodegradable and recyclable materials in protective packaging solutions increased by 15% in 2024, reflecting the industry's shift towards sustainability.

-

Rigid protective packaging, such as molded pulp and corrugated boxes, is growing at a CAGR of 6.2%, fueled by its application in shipping fragile and bulky products.

-

Rising raw material prices pose challenges, with costs for paperboard and plastic increasing by an average of 10% in 2024, affecting manufacturers' profit margins.

Global Protective Packaging Market Drivers:

Growth of E-Commerce and Online Retailing is driving market growth:

The explosive growth of e-commerce platforms such as Amazon, Alibaba, and Shopify has been a primary driver for the protective packaging market. With the convenience of online shopping, consumers demand secure delivery of products, leading to increased use of protective packaging. For instance, the global e-commerce sector grew by 20% in 2024, driving demand for cushioning materials, corrugated boxes, and air-filled packaging. The need for damage-free delivery and improved customer experience further emphasizes the importance of robust protective packaging solutions.

Sustainability and Eco-Friendly Packaging Trends is driving market growth:

Rising environmental concerns and stringent regulations on plastic use have pushed companies to adopt sustainable protective packaging. Biodegradable materials, such as molded pulp, paper-based solutions, and compostable films, are gaining traction. For example, governments in Europe and North America have implemented laws to reduce plastic waste, encouraging businesses to switch to recyclable and reusable packaging options. This shift is not only meeting regulatory requirements but also aligning with consumer preferences for eco-conscious products, boosting the demand for sustainable packaging.

Expansion of the Electronics Industry is driving market growth:

The electronics industry, with its high-value and fragile products, relies heavily on protective packaging to prevent damage during transit. Products like smartphones, laptops, and consumer electronics require specialized packaging solutions such as foam inserts, anti-static wraps, and custom-molded designs. With the global electronics market growing at a CAGR of 8%, the demand for protective packaging is rising proportionally. Innovations in packaging materials that provide both cushioning and static protection are further propelling market growth.

Global Protective Packaging Market Challenges and Restraints:

Fluctuations in Raw Material Prices is restricting market growth:

The protective packaging industry faces challenges due to rising raw material costs. The prices of key materials such as corrugated paperboard, polyethylene, and polypropylene increased by 10-15% in 2024 due to supply chain disruptions and heightened demand. These cost fluctuations directly impact manufacturers' profit margins, particularly for small and medium enterprises (SMEs). While efforts to recycle materials and explore alternative sources are underway, the dependency on traditional raw materials remains a significant hurdle for the industry.

Environmental Regulations and Waste Management is restricting market growth:

Stringent regulations on plastic usage and waste management pose challenges for the protective packaging market. Countries across Europe and North America have introduced laws mandating the reduction of single-use plastics, forcing companies to adopt sustainable alternatives. However, transitioning to eco-friendly solutions involves high capital investment and development time. Additionally, the lack of recycling infrastructure in developing economies limits the adoption of sustainable packaging, creating regional disparities in the market's growth trajectory.

Market Opportunities:

The protective packaging market presents numerous opportunities, particularly with the increasing focus on sustainability and innovation. The rise in biodegradable and recyclable materials offers a chance for companies to align their products with global environmental goals. Investments in research and development for lightweight and durable materials can significantly reduce transportation costs, benefiting both manufacturers and end-users. Moreover, the growing penetration of e-commerce into rural and semi-urban areas opens new avenues for protective packaging solutions tailored to these markets. The adoption of advanced technologies, such as smart packaging with sensors to monitor temperature, humidity, and shock, provides an edge in high-value applications like healthcare and electronics. Additionally, partnerships between manufacturers and logistics providers to develop customized packaging solutions can create competitive advantages.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sealed Air Corporation, Smurfit Kappa Group, DS Smith Plc, Pregis Corporation, Storopack Hans Reichenecker GmbH, Sonoco Products Company, Pro-Pac Packaging Limited, Intertape Polymer Group |

Protective Packaging Market Segmentation: By Type

-

Flexible Protective Packaging

-

Rigid Protective Packaging

-

Foam Protective Packaging

In the type, flexible protective packaging dominates the market with a 40% share in 2024 due to its lightweight and versatile nature, catering to diverse applications in e-commerce and food delivery.

Protective Packaging Market Segmentation: By Application

-

E-Commerce

-

Food and Beverages

-

Healthcare

-

Electronics

-

Industrial Goods

In the application category, e-commerce leads with a 35% share, driven by the rapid expansion of online retail and the need for secure product delivery.

Protective Packaging Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the protective packaging market, holding 30% of the global share in 2024. This dominance is driven by the region's well-established logistics and retail sectors, coupled with increasing demand for eco-friendly packaging. The United States, in particular, has a robust e-commerce industry, with major players such as Amazon investing in advanced protective packaging solutions to enhance customer satisfaction. Additionally, government incentives for sustainable practices and innovations in packaging technologies support North America's market leadership.

COVID-19 Impact Analysis on the Protective Packaging Market:

The COVID-19 pandemic had a mixed impact on the protective packaging market. On one hand, sectors such as e-commerce and healthcare saw a significant increase in demand. With the surge in online shopping and the need to transport medical supplies, the demand for packaging solutions soared. E-commerce alone experienced a 25% increase in protective packaging usage in 2020 as more consumers shifted to online platforms during lockdowns. This shift highlighted the critical role of protective packaging in maintaining the integrity of products during transportation. However, other sectors, including industrial goods and retail, faced a decline in packaging demand due to reduced business activity and supply chain disruptions. The pandemic also led to challenges in the packaging industry, such as raw material shortages and labor constraints, which temporarily impacted production capacities. These factors created hurdles for manufacturers trying to meet the rising demand from certain sectors while addressing their own operational challenges. As the world moved towards recovery, there was a notable shift towards sustainability. The post-pandemic period has seen a rise in the adoption of eco-friendly, sustainable, and reusable packaging solutions. This shift aligns with changing consumer preferences for environmentally responsible products and stricter regulatory standards aimed at reducing packaging waste. Overall, the protective packaging market is adapting to these new demands, and the pandemic has played a key role in accelerating these long-term trends towards sustainability and efficiency.

Latest Trends/Developments:

The protective packaging market is experiencing several transformative trends aimed at improving sustainability and operational efficiency. One key trend is the shift toward biodegradable and compostable materials. Companies are increasingly adopting molded pulp and paper-based solutions as alternatives to traditional plastics, helping to reduce environmental impact and meet consumer demand for eco-friendly options. This move aligns with growing concerns about plastic waste and environmental preservation. Another notable trend is the rise of smart packaging technologies, such as shock indicators and temperature sensors. These innovations are particularly gaining traction in industries like healthcare and electronics, where ensuring product integrity during transportation is crucial. Smart packaging provides real-time monitoring, reducing the risk of damage and improving supply chain visibility. In addition to these technological advancements, automation is transforming packaging processes. The use of robotics and AI-driven systems is enhancing efficiency, reducing human error, and lowering operational costs. Automated packaging solutions are becoming essential for businesses looking to streamline production lines and meet increasing demand while maintaining cost-effectiveness. The integration of lightweight materials in protective packaging is also a significant trend. By reducing the weight of packaging, companies can lower transportation costs and decrease their carbon footprints, contributing to more sustainable supply chain practices. Finally, collaborative efforts among industry stakeholders are driving the development of circular economy models. These initiatives focus on reducing waste through recycling, reusing materials, and creating closed-loop systems, further reshaping the landscape of the protective packaging industry. Collectively, these trends are positioning the industry toward more sustainable, efficient, and cost-effective practices in the years to come.

Key Players:

-

Sealed Air Corporation

-

Smurfit Kappa Group

-

DS Smith Plc

-

Pregis Corporation

-

Storopack Hans Reichenecker GmbH

-

Sonoco Products Company

-

Pro-Pac Packaging Limited

-

Intertape Polymer Group

Chapter 1. Protective Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Protective Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Protective Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Protective Packaging Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Protective Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Protective Packaging Market – By Type

6.1 Introduction/Key Findings

6.2 Flexible Protective Packaging

6.3 Rigid Protective Packaging

6.4 Foam Protective Packaging

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Protective Packaging Market – By Application

7.1 Introduction/Key Findings

7.2 E-Commerce

7.3 Food and Beverages

7.4 Healthcare

7.5 Electronics

7.6 Industrial Goods

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Protective Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Protective Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 E-Commerce

9.2 Food and Beverages

9.3 Healthcare

9.4 Electronics

9.5 Industrial Goods

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Protective Packaging Market was valued at USD 20 billion in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2030. By 2030, the market is projected to reach USD 27.58 billion.

Key drivers include the growth of e-commerce, increasing demand for eco-friendly solutions, and the expansion of the electronics industry.

The market is segmented by type (flexible, rigid, foam) and application (e-commerce, food and beverages, healthcare, electronics, industrial goods).

North America is the dominant region, accounting for 30% of the market share in 2024, driven by a strong logistics network and eco-friendly packaging trends.

Leading players include Sealed Air Corporation, Smurfit Kappa Group, DS Smith Plc, Pregis Corporation, and Storopack Hans Reichenecker GmbH.