GLOBAL PROTEASE MARKET (2024 - 2030)

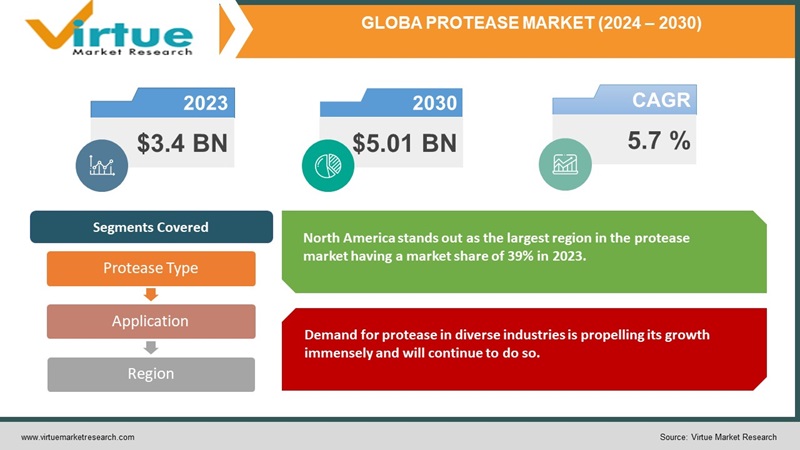

The Global Protease Market was valued at USD 3.4 Billion in 2023 and is projected to reach a market size of USD 5.01 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.7%

The proteases market, a vital segment within the enzyme industry, has seen consistent growth due to its diverse applications in various sectors like pharmaceuticals, food & beverages, detergents, and biotechnology. Proteases, enzymes that catalyze the breakdown of proteins into amino acids, are in high demand for their crucial role in industrial processes, particularly in detergent formulations for stain removal and in the food industry for improving texture and flavor. The market's expansion is fueled by advancements in enzyme engineering, increasing R&D activities, and the rising demand for bio-based products, driving companies to innovate and develop novel proteases with enhanced properties, stability, and specificity. The pharmaceutical sector's need for proteases in drug development and therapeutic applications continues to contribute significantly to the market's growth.

Key Market Insights:

Proteases, a diverse group of enzymes with roles as proteinases, peptidases, and amidases, find extensive applications across various industries, notably in food, detergents, and pharmaceuticals. They represent a significant portion of industrial enzymes, constituting about 60% of the enzyme market and contributing to 40% of global enzyme sales.

The Asia-Pacific region emerges as a powerhouse in the protease market due to the rapid growth of processed food markets in countries like India, China, and South Korea. India boasts one of the world's largest food processing industries, presenting immense growth prospects for proteases. In China, urbanization and increased disposable incomes drive demand for diverse, high-value food products, expanding the need for protease enzymes. South Korea's evolving processed food industry, with a preference for frozen and high-fat content meat products, positions it as a market ripe for protease enzyme applications, especially in food additives. Overall, these countries in the Asia-Pacific region exhibit substantial potential for the widespread use of proteases across multiple sectors.

Protease Market Drivers:

Demand for protease in diverse industries is propelling its growth immensely and will continue to do so.

Proteases find extensive use across a wide range of industries, including pharmaceuticals, food & beverages, detergents, and biotechnology. The increasing application of proteases in these sectors is a major driver. For instance, in the food industry, proteases are used for meat tenderization, dairy processing, and flavor enhancement. In detergents, they play a crucial role in stain removal. Additionally, the pharmaceutical industry relies on proteases for drug development, particularly in designing targeted therapies and in manufacturing biopharmaceuticals. The versatility and efficacy of proteases across these sectors contribute significantly to the market's growth.

Technological Advancements and Innovation in the protease market are increasing its growth.

Ongoing research and development in enzyme engineering and biotechnology have led to the creation of advanced proteases with improved properties. Companies are investing heavily in developing novel proteases that exhibit enhanced stability, specificity, and functionality. The pursuit of enzymes with optimized characteristics for specific applications is a key driver. These innovations not only broaden the scope of protease applications but also cater to the increasing demand for eco-friendly and bio-based solutions in various industries. As a result, the continuous advancements in protease technology drive market expansion by offering more efficient and tailored enzymatic solutions to diverse industrial needs.

Protease Market Restraints and Challenges:

Stability and Specificity insurance is necessary for the protease market, failure could lead to significant challenges.

Enhancing the stability and specificity of proteases remains a critical challenge. These enzymes often face issues related to maintaining their activity under varying conditions such as pH, temperature, and the presence of inhibitors. Ensuring stability becomes crucial, especially in industrial applications where proteases are subjected to harsh conditions. Additionally, achieving high specificity to target particular substrates while avoiding unintended degradation of other compounds is challenging but crucial for many applications like pharmaceuticals and food processing. Efforts in enzyme engineering and protein modification are ongoing to address these challenges, but achieving both stability and specificity simultaneously remains a complex task.

Cost and Scale of Production involved in protease production is also a hindrance for the market.

The cost-effectiveness and scalability of producing proteases pose another challenge. Industrial-scale production of high-quality enzymes at a reasonable cost is vital for their widespread use across industries. The manufacturing process, often involving fermentation or microbial expression systems, requires optimization to increase yield and reduce production costs. Additionally, the use of renewable and sustainable sources for enzyme production is an ongoing focus to align with the demand for environmentally friendly solutions. Balancing the cost of production while maintaining high quality and meeting market demands remains a persistent challenge in the proteases market.

Protease Market Opportunities:

Opportunities within the protease market are vast and diverse, presenting promising avenues for growth and innovation. The increasing demand for eco-friendly and sustainable solutions across industries like pharmaceuticals, biotechnology, food & and beverages, and detergents fuels the opportunity for proteases. Leveraging enzyme engineering and biotechnological advancements offers a chance to develop novel proteases with enhanced properties, stability, and specificity, catering to specific industrial needs. The rising interest in personalized medicine and the continuous exploration of proteases' therapeutic potential open doors for their utilization in drug development, diagnostics, and targeted therapies. With a growing emphasis on green chemistry and the shift towards bio-based products, proteases stand at the forefront as key catalysts for innovation, offering immense opportunities for market expansion and application diversification.

GLOBAL PROTEASE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.7 % |

|

Segments Covered |

By Protease Type, Source, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Advanced Enzyme Technologies, Amano Enzyme, Inc., Associated British Foods Plc BASF SE, Biocatalysts Ltd., Dyadic International, Inc., E.I. Du Pont De Nemours and Company, Koninklijke DSM N.V., Novozymes A/S, Specialty Enzymes & Probiotics |

Protease Market Segmentation:

Protease Market Segmentation: By Protease Type:

- Serine proteases

- Cysteine proteases

- Aspartic proteases

- Metalloproteases

- Others

The largest segment by type of protease in the protease market is the serine proteases category which has a market share of 56% in 2023. Serine proteases hold a dominant position due to their versatility, wide range of applications, and prevalence across various industries. They exhibit remarkable specificity and catalytic efficiency, making them extensively utilized in pharmaceuticals for drug development, in the food industry for food processing and flavor enhancement, and in detergent formulations for their superior stain-removing capabilities. Serine protease's diverse functionalities and their ability to function effectively in different pH and temperature conditions contribute significantly to their widespread adoption. The serine proteases segment is the fastest-growing. This is primarily due to the versatility and widespread applications of serine proteases across various industries such as pharmaceuticals, biotechnology, and detergents. Serine proteases exhibit a high specificity for peptide cleavage and can be engineered to target specific substrates, making them crucial in drug development, where they are employed in treatments and drug formulations. The increasing demand for bio-based and eco-friendly products has led to the utilization of serine proteases in detergent formulations for their exceptional stain removal properties. The advancements in enzyme engineering have further enhanced the stability, specificity, and catalytic efficiency of serine proteases, driving their accelerated growth and adoption across multiple industrial sectors.

Protease Market Segmentation: By Source:

- Animal

- Plant

- Microbial

The largest segment by source in the protease market is microbial having a significant market share of 61% in 2023. Microbial proteases offer higher yield and easier scalability in production compared to animal or plant-derived proteases. They are also more cost-effective and have a shorter production cycle, making them commercially attractive. Microbial proteases can be genetically modified or engineered to enhance their properties, such as stability and specificity, meeting diverse industrial needs. Advancements in biotechnology and fermentation techniques have facilitated efficient extraction and purification of microbial proteases, further boosting their dominance in the market as versatile and high-performance enzymes across various industries. The microbial source segment is also showing the most rapid growth in the projected period expected to grow at a rate of 9.8%. Microbial-derived proteases, sourced from microorganisms like bacteria and fungi, are witnessing significant expansion due to numerous advantages, including higher yields, cost-effectiveness in production, easier genetic modification for desired properties, and scalability in industrial settings. Their ability to be produced through fermentation processes on a large scale and the advancements in biotechnology have led to improved strains and optimized production techniques. The growing demand for eco-friendly and sustainable solutions in various industries further drives the preference for microbial-derived proteases, contributing to their status as the fastest-growing segment in the market.

Protease Market Segmentation: By Application:

- Pharmaceuticals

- Food & beverages

- Detergents

- Biotechnology

- Animal feed

- Others

The largest segment by application in the protease market is the detergents industry having a prominent market share of 43% in 2023. Proteases play a pivotal role in detergent formulations due to their exceptional ability to break down and remove protein-based stains like blood, grass, and food residues. Their enzymatic action targets these tough stains, improving the efficiency of detergents in removing them from fabrics. The demand for proteases in detergents is consistently high due to consumers' increasing emphasis on effective cleaning solutions and the constant need for more environmentally friendly and efficient cleaning agents. Advancements in enzyme engineering have led to the development of proteases that exhibit improved stability and performance in various wash conditions, further solidifying their dominance in the detergent industry as indispensable components for superior stain removal. The fastest-growing segment by application within the protease market is likely the pharmaceutical sector, due to the increasing focus on personalized medicine and biopharmaceuticals, where proteases play a pivotal role in drug development, formulation, and therapeutic applications. Proteases are crucial in the production of biologics, including monoclonal antibodies and vaccines, where they aid in protein purification, cleavage, and modification. Ongoing research explores proteases potential for targeted therapies, diagnostics, and as therapeutic agents themselves, driving a surge in demand within the pharmaceutical industry.

Protease Market Segmentation: Regional Analysis:

- North America

- Asia- Pacific

- Europe

- South America

- Middle East and Africa

North America stands out as the largest region in the protease market having a market share of 39% in 2023. This dominance can be attributed to several factors, including a robust presence of key industry players, extensive R&D activities, and a well-established pharmaceutical sector that extensively utilizes proteases in drug development, and a matured food and beverage industry relying on enzymes for various applications. North America's heightened focus on sustainable and bio-based solutions aligns with the increasing demand for proteases across multiple industries, contributing significantly to the region's substantial market share in the global protease market. The Asia Pacific region stands out as the fastest-growing region in the protease market. This growth is propelled by several factors, including the region's burgeoning population, increasing urbanization, and rising disposable incomes. The robust expansion of industries such as food & beverages, pharmaceuticals, and detergents in countries like China, India, and Southeast Asian nations fuels the demand for proteases. The shift towards eco-friendly and sustainable products aligns with the market's offerings, as enzyme-based solutions gain traction due to their environmentally conscious appeal.

COVID-19 Impact Analysis on the Global Protease Market:

The global protease market witnessed a multifaceted impact due to COVID-19. While certain sectors like pharmaceuticals saw an upsurge in demand for proteases due to their role in drug development and research for potential treatments, other industries such as food and beverages faced temporary slowdowns. Disruptions in supply chains, manufacturing, and distribution networks affected the overall market dynamics, causing fluctuations in demand and production capacities. The emphasis on hygiene and cleanliness during the pandemic bolstered the demand for detergents containing proteases, albeit with some fluctuations in purchasing patterns. Despite initial challenges, the focus on healthcare and sanitation solutions provided an impetus for research and innovation in the protease market, highlighting its resilience and adaptability to evolving global needs.

Latest Trends/ Developments:

A significant trend in the protease market is the increasing focus on bio-based and sustainable solutions. There's a growing demand for enzymes like proteases derived from renewable sources, aligning with the global push for eco-friendly products across industries. This trend has pushed companies to invest in research and development, aiming to optimize enzyme production processes, utilizing sustainable feedstocks, and improving biotechnological methods to create more environmentally friendly proteases.

As for a notable development, one significant stride is the advancement in enzyme engineering and protein modification techniques. These developments have allowed scientists and researchers to tailor proteases for specific industrial applications by enhancing their stability, specificity, and functionality. Through techniques like directed evolution and protein engineering, researchers can design proteases with improved properties, making them more efficient, versatile, and adaptable to diverse industrial processes, ranging from pharmaceuticals to food and beyond. Such advancements have significantly expanded the potential applications and efficacy of proteases in various industries.

Key Players:

- Advanced Enzyme Technologies

- Amano Enzyme, Inc.

- Associated British Foods Plc

- BASF SE

- Biocatalysts Ltd.

- Dyadic International, Inc.

- E.I. Du Pont De Nemours and Company

- Koninklijke DSM N.V.

- Novozymes A/S

- Specialty Enzymes & Probiotics

In June 2021, Koninklijke DSM NV unveiled ProAct 360, a novel protease enzyme designed to offer increased flexibility to feed producers in their raw material choices. This innovation aims to diminish the industry's dependency on primary crops like soy, consequently reducing feed expenses. ProAct 360 substantially improves protein digestibility, leading to better nitrogen retention in metabolism and reduced nitrogen emissions into the environment. This enzyme launch aligns with DSM's commitment to broadening its product range and fostering sustainable advancements within the industry.

Chapter 1. GLOBAL PROTEASE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL PROTEASE MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL PROTEASE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL PROTEASE MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL PROTEASE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL PROTEASE MARKET – By Protease Type

6.1. Serine proteases

6.2. Cysteine proteases

6.3. Aspartic proteases

6.4. Metalloproteases

6.5. Others

Chapter 7. GLOBAL PROTEASE MARKET – By Source

7.1. Animal

7.2. Plant

7.3. Microbial

Chapter 8. GLOBAL PROTEASE MARKET – By Application

8.1. Pharmaceuticals

8.2. Food & beverages

8.3. Detergents

8.4. Biotechnology

8.5. Animal feed

8.6. Others

Chapter 9. GLOBAL PROTEASE MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Protease Type

9.1.3. By Source

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Protease Type

9.2.3. By Source

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Protease Type

9.3.3. By Source

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest South America

9.4.2. By Protease Type

9.4.3. By Source

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Protease Type

9.5.3. By Source

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL PROTEASE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Advanced Enzyme Technologies

10.2. Amano Enzyme, Inc.

10.3. Associated British Foods Plc

10.4. BASF SE

10.5. Biocatalysts Ltd.

10.6. Dyadic International, Inc.

10.7. E.I. Du Pont De Nemours and Company

10.8. Koninklijke DSM N.V.

10.9. Novozymes A/S

10.10. Specialty Enzymes & Probiotics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Protease Market was valued at USD 3.4 Billion in 2023 and is projected to reach a market size of USD 5.01 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.7%.

The demand for protease in diverse industries along with Technological Advancements and Innovation are drivers of the Protease market.

Based on the source, the Global Protease Market is segmented into Animal, Plant, and Microbial.

North America is the most dominant region for the Global Protease Market.

Advanced Enzyme Technologies, Amano Enzyme, Inc., Associated British Foods Plc, and BASF SE are a few of the key players operating in the Global Protease Market.