Propyl Benzene Market Size (2023 – 2030)

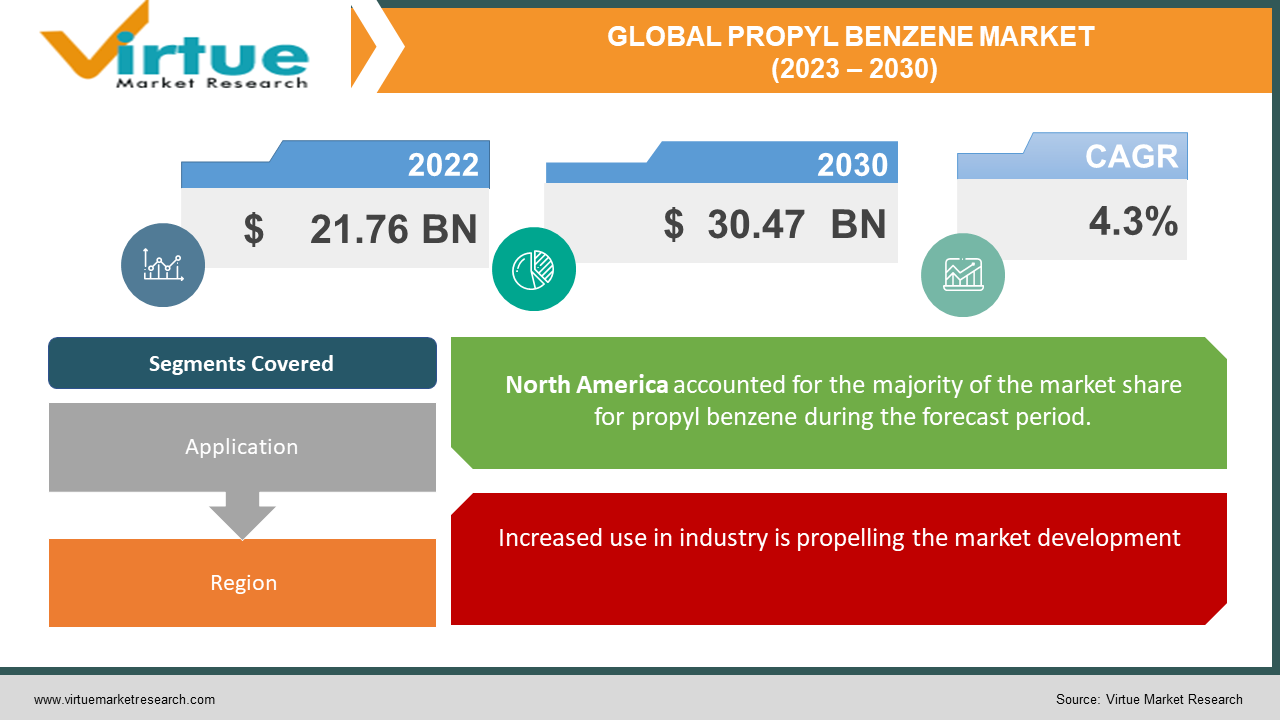

In 2022, the global Propyl Benzene Market was valued at $21.76 billion, and is projected to reach a market size of $30.47 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 4.3%. The use of Propyl benzene in the automotive industry to make tyres is the major driver of the market growth.

INDUSTRY OVERVIEW

Colourless and very combustible, benzene has the chemical formula C6H6 and a strong, gasoline-like odour. It is produced as a by-product of oil refining and is also present in cigarette smoke, gasoline, and crude oil. Despite being widely employed for several industrial applications, its poisonous nature restricts its non-industrial usage. Benzene has been classified as a carcinogen, or a material that may cause cancer, and ongoing exposure to it might have negative consequences on one's health. Benzene was once often used to decaffeinate coffee and clean metals, but less harmful compounds are now quickly taking its place.

One of the major drivers of market expansion is a rise in the use of insulating materials in construction activities. Additionally, the demand for consumer goods like furniture wax and thinners has increased globally as a result of expanding urbanisation and rising disposable incomes. Additionally, benzene is a crucial solvent in several businesses, industrial, and scientific pursuits. Alkyl benzene, for instance, is frequently used to make surfactants for the production of detergents. A fundamental raw ingredient for the creation of nylon, which is used to make textiles, is cyclohexane, another benzene derivative. Another significant growth-promoting element is the expanding paints and coatings industry (PCI), which uses benzene derivatives in the production of paints and lacquers.

Benzene that has had one of its hydrogens substituted by a propyl group is called N-propyl benzene. The liquid is denser than water and is colourless or light yellow. Typically, water cannot dissolve it. If swallowed or breathed, it is poisonous by nature. 86°F is the boiling point, and it is quite flammable. Making N-propylbenzene can be done in a variety of ways. These include fractional distilling petroleum reformate, alkylation of N-propyl chloride with benzene by adding aluminium chloride, the reaction of diethyl sulphate with benzyl magnesium chloride, and the reaction of diethyl sulphate with benzyl magnesium chloride. Both the analytical laboratory approach and the OSHA chemical sampling are used to make n-propyl benzene.

COVID-19 IMPACT ON THE PROPYL BENZENE MARKET

The COVID-19 outbreak and the ensuing recession in the economy were harmful to the petrochemical sector. In terms of market share for petrochemical production, China dominates. The limits put in place to stop the virus from spreading had a substantial impact on the country's industrial facilities, causing a reduced capacity or perhaps a complete closure. China was the epicentre of the outbreak. Industries that rely on Chinese imports were impacted by the supply chain disruption caused by the drop in Chinese manufacturing. During the early phases of the pandemic, lockdowns, mobility restrictions, and economic uncertainties seriously disrupted the supply chain and delayed major industrial projects. The pandemic's limitations, together with trade disputes between the United States and China, significantly weakened the market, resulting in demand changes, production interruptions, and logistical delays for manufacturing enterprises.

Crude oil prices crashed early in the epidemic, which was bad for oil-producing nations like North America and the Middle East. However, it provided South Korea, India, and China—countries that import oil—with the chance to develop strategic crude oil reserves for their petrochemical industries. As major economies across the world have started to recover from the shock created by COVID-19, demand has started to increase from application industries such as health care, packaging, and electronics, and is likely to continue over the projection period. Since then, China has greatly boosted its capacity for producing benzene derivatives like styrene, which is projected to have a significant impact on market dynamics throughout the projection period.

MARKET DRIVERS:

Increased use in industry is propelling the market development

Numerous products, including dyes, detergents, and agrochemicals, use propyl benzene. It works as a solvent in industry and an important ingredient in manufacturing. By changing a functional group in benzene, it is possible to manufacture several other chemicals, including xylene, ethylbenzene, nitrobenzene, and others. The Indian Ministry estimates that India exported $29,3 billion worth of chemicals in 2021. In terms of global chemical output, India comes in sixth. Thus, the expansion of propyl benzene's industrial uses is boosting the market's overall development.

Market expansion will be fueled by rising demand for styrene polymers from various end-use industries

Propyl Benzene is a colourless liquid. It is utilised in the manufacturing of methyl styrene, textile dyeing and printing, and as a solvent for cellulose acetate. Styrene is used in many different sectors, including construction, automotive, packaging, and electronics, when it has been polymerized or co-polymerized. The majority of the world's styrene production goes towards making polystyrene, a polymerized form of styrene that is available in solid, foam, and film forms. The packaging industry makes extensive use of polystyrene because of its superior durability, light weight, flexibility, and moisture resistance. Developing economies like India and China have experienced rapid e-commerce growth during the past ten years. Due to the increasing purchasing power and improved accessibility provided by e-commerce firms like Alibaba, Amazon, and Flipkart, this growth is most likely to continue. India boasts one of the world's fastest-growing e-commerce sectors. By 2030, India's online retail demand is anticipated to represent 37% of the nation's organised retail market, according to the National Investment Promotion and Facilitation Agency. More people are probably going to purchase online as a result of increased internet and smartphone use as well as creative marketing tactics. During the projection period, the packaging industry is likely to increase at the same time as the e-commerce sector, fueling market expansion.

MARKET RESTRAINTS:

Fluctuating crude oil prices are likely to negatively influence the market development of Propyl benzene

The dependence of the market for propyl benzene and its derivatives on crude oil for its production is one of the primary issues it faces. Since the cost of propyl benzene and its derivatives is directly impacted by price variations, the market for these products is severely constrained by the current economic situation's rising crude oil costs and general price volatility. According to BP's Statistical Review of World Energy, crude oil prices have become more volatile recently. For example, the price of crude oil dropped from $98.95 in 2014 to $52.39 in 2015 and then rose from $43.73 in 2016 to $71.31 in 2018.

The hazardous nature of Propyl benzene is hampering the market growth

The toxic nature of propyl benzene presents a further significant obstacle to this sector. Due to its low flashpoint and strong flammability, propyl benzene is explosive. In the event of contact or inhalation, it also has poisonous, mutagenic, and carcinogenic effects on people. Therefore, the market growth for propyl benzene and its derivatives is being impacted by these variables.

PROPYL BENZENE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, CHINA PETROCHEMICAL CORPORATION , ROYAL DUTCH SHELL PLC., CHINA NATIONAL PETROLEUM CORPORATION, DOW, SABIC, EXXON MOBIL CORPORATION, INEOS GROUP LTD. CHEVRON PHILLIPS CHEMICAL COMPANY LLC., MITSUBISHI CHEMICAL CORPORATION LYONDELLBASELL INDUSTRIES HOLDINGS B.V., MARUZEN PETROCHEMICAL CO., LTD. RELIANCE INDUSTRIES LIMITED |

This research report on the Propyl Benzene Market has been segmented and sub-segmented based on Application and By Region.

PROPYL BENZENE MARKET – BY APPLICATION

-

Industrial Chemical

-

Automobile Industry

-

Oil and Gas

-

Rubber and Plastics

-

Pharmaceutical

-

Others

Based on application, the propyl benzene market is segmented into Industrial Chemical, Automobile Industry, Oil and Gas, Rubber and Plastics, Pharmaceutical and Others. Among these, the automotive industry held the major proportion of the market share. Propyl Benzene is employed in the manufacturing of styrene which is an important ingredient used in the automotive industry. Styrene-butadiene rubber (SBR), a styrene copolymer used to make tyres, has been utilised extensively in the automobile industry. The automobile sector is projected to grow significantly throughout the projection period, especially in developing nations like China and India. The tyre has no substitute and will remain in use while the automobile industry switches from gasoline or diesel-powered to electric cars. India only has 22 automobiles per 1,000 inhabitants, which is much less than China, the United Kingdom, and the United States, according to the Niti Aayog. In addition, research by the International Energy Agency (IEA) projects that by 2040, there would be 175 automobiles per 1,000 people, a 775 per cent increase. This market will be driven by the tyre industry, which will grow along with the vehicle industry in various parts of the world.

PROPYL BENZENE MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Propyl Benzene Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. When it comes to domestic consumption and export of benzene and its derivatives, such as propyl benzene, a significant market share belongs to the Asia Pacific. The International Council of Chemical Associations estimates that in 2020, the chemical sector in Asia and the Pacific contributed around USD 2.3 trillion to the world GDP or about 45% of the total. It is projected that over the projection period, the local chemical sector would grow even more. The synthesis of benzene and its derivatives is a common practice in several application sectors, including rubber and plastics, adhesives, paints, medicines, and petrochemicals. These Application sectors are projected to increase to fulfil growing consumer demand, particularly in emerging nations like India and China, which is propelling industry expansion.

Due to the developing petrochemical industry, North America is predicted to see a considerable growth rate. The production of benzene and its derivative, a widely used feedstock in the petrochemical sector for the creation of a variety of chemicals, principally involves the catalytic reforming and steam cracking of crude oil. The upstream petroleum industry in the area has grown dramatically over the past ten years as a result of technical advancements, particularly the hydraulic fracturing method for extracting shale oil. Investors are focusing their efforts on value addition and the development of new petrochemical complexes since the region's oil and gas output has outpaced domestic fuel demand. Growing petrochemical industry demand and the availability of excess crude oil are intended to support market expansion.

Due to strict rules controlling the use of benzene and its derivatives in consumer products, Europe is forecasted to grow gradually. Styrene and phenol are more popular due to rising demand from the plastics, pharmaceutical, and automobile sectors. The regional market is developed, and it is projected that demand for benzene and its derivatives would remain constant. However, the expansion of the regional market is anticipated to be constrained by the rigorous regulations imposed by the European Chemicals Agency (ECHA) and other regulatory agencies.

PROPYL BENZENE MARKET - BY COMPANIES

Some of the major players operating in the Propyl Benzene Market include:

- BASF SE

- CHINA PETROCHEMICAL CORPORATION

- ROYAL DUTCH SHELL PLC.

- CHINA NATIONAL PETROLEUM CORPORATION

- DOW

- SABIC

- EXXON MOBIL CORPORATION

- INEOS GROUP LTD.

- CHEVRON PHILLIPS CHEMICAL COMPANY LLC.

- MITSUBISHI CHEMICAL CORPORATION

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- MARUZEN PETROCHEMICAL CO., LTD.

- RELIANCE INDUSTRIES LIMITED

NOTABLE HAPPENING IN THE PROPYL BENZENE MARKET

- EXPANSION- Hengyi Petrochemical intended to build a benzene facility in February 2021 as part of its refining and petrochemical development project on Pulau Muara Besar of Brunei. This would raise the yearly capacity from 500 kilotons to 800 kilotons. Through this action, the corporation hopes to grow its petrochemical division. This plant will also be used for manufacturing other benzene derivatives as well.

- EXPANSION- Iran's benzene supply is now self-sufficient as of April 2021. In March 2020, the Bu Ali Sina Petrochemical Plant achieved full production capacity.

- COLLABORATION- Honeywell declared in February 2021 that it will give Hengyi Industries licences and solution designs for the usage of cutting-edge reforming and aromatics technology. The Totray technology will be used by the Hengyi industries, nearly doubling benzene production.

Chapter 1. Propyl Benzene Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Propyl Benzene Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Propyl Benzene Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Propyl Benzene Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Propyl Benzene Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Propyl Benzene Market – By Application

6.1. Industrial Chemical

6.2. Automobile Industry

6.3. Oil and Gas

6.4. Rubber and Plastics

6.5. Pharmaceutical

6.6. Others

Chapter 7. Propyl Benzene Market- By Region

7.1. North America

7.2. Europe

7.3. Asia-Pacific

7.4. Latin America

7.5. The Middle East

7.6. Africa

Chapter 8. Propyl Benzene Market – key players

8.1 BASF SE

8.2 CHINA PETROCHEMICAL CORPORATION

8.3 ROYAL DUTCH SHELL PLC.

8.4 CHINA NATIONAL PETROLEUM CORPORATION

8.5 DOW

8.6 SABIC

8.7 EXXON MOBIL CORPORATION

8.8 INEOS GROUP LTD.

8.9 CHEVRON PHILLIPS CHEMICAL COMPANY LLC.

8.10 MITSUBISHI CHEMICAL CORPORATION

8.11 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

8.12 MARUZEN PETROCHEMICAL CO., LTD.

8.13 RELIANCE INDUSTRIES LIMITED

Download Sample

Choose License Type

2500

4250

5250

6900