Propulsion Systems Market Size (2024-2030)

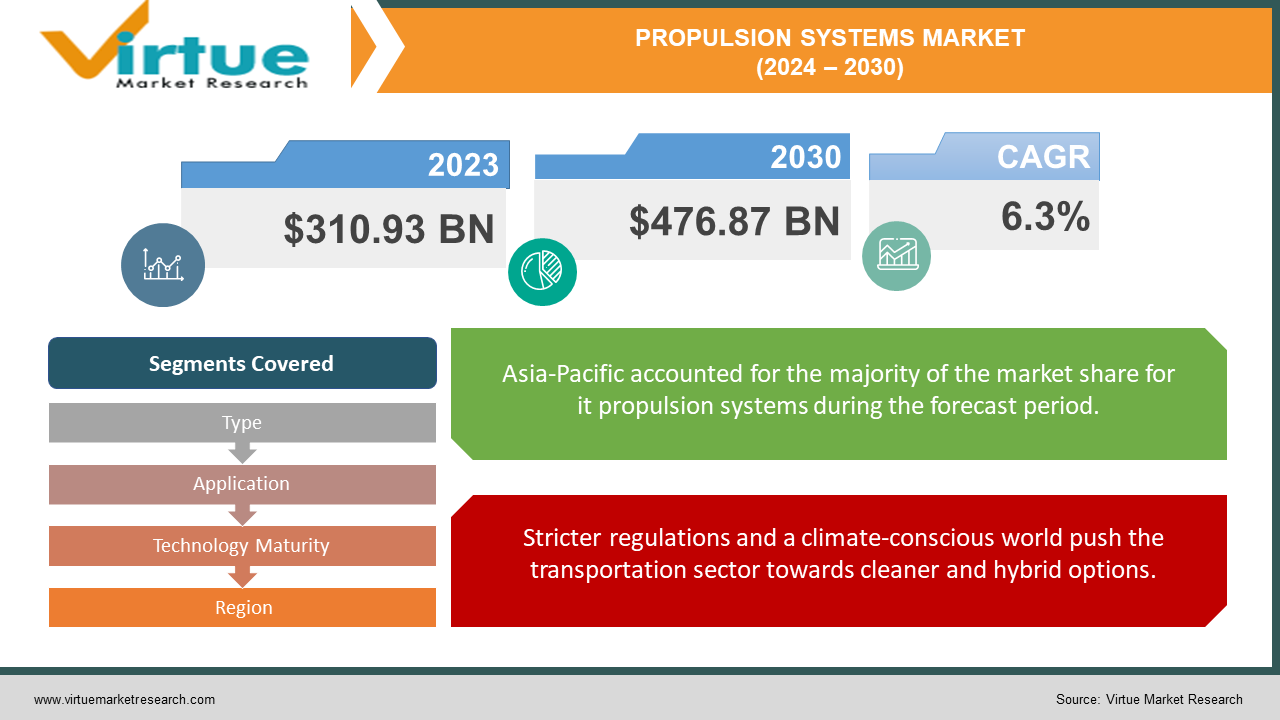

The Propulsion Systems Market was valued at USD 310.93 billion in 2023 and is projected to reach a market size of USD 476.87 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.3%.

The propulsion system market is a crucial industry that keeps things moving, from airplanes soaring through the sky to cars on the road and ships navigating the seas. It's driven by a rise in transportation needs, with more people and goods traveling than ever before.

Key Market Insights:

The propulsion system market is undergoing a period of significant transformation. Environmental concerns are driving a major shift towards electrification. This is particularly evident in the land transportation sector, where stricter regulations and a growing consumer preference for eco-friendly options are accelerating the development and adoption of electric and hybrid propulsion systems.

The growth trajectory of the propulsion system market varies depending on the region. While North America currently holds the leading position, the Asia Pacific region is poised for the fastest growth. This can be attributed to several factors, including a burgeoning middle class with rising disposable incomes, rapid urbanization leading to increased transportation needs, and significant investments in infrastructure development across the region.

Propulsion Systems Market Drivers:

Stricter regulations and a climate-conscious world push the transportation sector towards cleaner and hybrid options.

Stringent environmental regulations and a growing global focus on reducing greenhouse gas emissions and combating climate change are acting as major catalysts for the transportation sector. This translates to a significant rise in electric and hybrid propulsion systems, particularly in land transportation (cars). Market analysts predict a substantial market share capture by electric vehicles in the coming years, driven by consumer preference for eco-friendly options and government incentives promoting their adoption.

Increased space exploration fuels a surge for powerful rocket engines and innovative spacecraft propulsion technologies.

Increased investments in space programs by both government agencies and private companies are creating a strong demand for advanced rocket engines and innovative spacecraft propulsion technologies. This insatiable hunger for space exploration opens doors for new players to enter the market and propels advancements in propulsion technology at an unprecedented pace, fostering a more dynamic and competitive market landscape.

Battery improvements, lighter materials, and AI integration pave the way for the next generation of efficient and powerful propulsion systems.

Continuous advancements in various fields are shaping the future of propulsion systems and influencing market trends. Improvements in battery technology promise longer range and faster charging times for electric vehicles, making them a more viable alternative to traditional gasoline-powered cars. Advancements in material science pave the way for lighter and stronger components in propulsion systems, leading to increased efficiency and performance. The integration of artificial intelligence (AI) in engine management systems has the potential to further optimize performance and efficiency by constantly learning and adapting to real-time conditions. These advancements combined are transforming the propulsion system market, fostering a shift towards cleaner, more efficient, and powerful technologies.

Propulsion Systems Market Restraints and Challenges:

Despite the promising growth trajectory, the propulsion system market faces hurdles that need to be addressed. A major challenge lies in overcoming the limitations of current electric vehicle technology. While electric vehicles offer a cleaner alternative, issues like "range anxiety" - the fear of running out of power before reaching a charging station - and lengthy charging times compared to gasoline vehicles can deter consumers. Additionally, building a robust network of charging stations across vast regions requires significant investment and infrastructure development.

Safety is another key concern. New propulsion technologies, particularly those involving alternative fuels or high-power capabilities, may face stricter regulations due to potential safety risks. This can add complexity and delays to the commercialization process, hindering the swift adoption of these new technologies. Furthermore, the global market grapples with potential disruptions in the supply chain for critical materials and components needed for propulsion systems. Geopolitical situations and resource limitations, especially for elements like lithium crucial for electric vehicle batteries, can create uncertainties and hinder production. Addressing these challenges through advancements in battery technology, infrastructure development, robust safety regulations, and a diversified supply chain will be crucial for the propulsion system market to achieve its full potential.

Propulsion Systems Market Opportunities:

The propulsion system market isn't solely focused on the electrification of traditional vehicles. The burgeoning Urban Air Mobility (UAM) sector, with its electric Vertical Take-off and Landing (VTOL) vehicles, presents a unique opportunity for propulsion systems specifically designed for quiet, clean, and efficient urban transportation. Imagine a world where electric air taxis silently whisk you across congested cityscapes - this future relies on the development of innovative and reliable propulsion systems tailored to the unique demands of eVTOL aircraft.

Furthermore, advancements in battery technology, particularly the development of solid-state batteries, hold immense promise for conquering the challenges of range anxiety and charging times that currently hinder electric vehicle adoption. Imagine electric cars capable of traveling long distances on a single charge and refueling in a matter of minutes, not hours. These advancements will significantly boost the electric propulsion system market, paving the way for a wider embrace of electric vehicles and a cleaner transportation landscape.

The ongoing space exploration boom adds another layer of excitement to the market. This insatiable hunger for venturing further into the cosmos creates a demand for powerful and innovative propulsion systems that can propel spacecraft faster and farther than ever before. Companies are exploring cutting-edge technologies like nuclear thermal propulsion and plasma drives, pushing the boundaries of what's possible. These advancements will not only revolutionize space travel but also inspire further innovation within the propulsion system market.

PROPULSION SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Type, Application, Technology Maturity, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Electric (GE), Rolls-Royce, Honeywell International, Aerojet Rocketdyne, Safran, United Technologies Corporation (UTC), BAE Systems, Pratt & Whitney, Siemens, Mitsubishi Heavy Industries |

Propulsion Systems Market Segmentation: By Type

-

Internal Combustion Engines

-

Electric Motors

-

Hybrid Powertrains

-

Rocket Engines

-

Other Propulsion Systems

Segmenting the propulsion system market by type reveals two key trends. Internally combusted engines (ICE) currently reign supreme, powering most land vehicles. However, the electric motor segment is experiencing the fastest growth due to the rising demand for electric and hybrid vehicles, driven by environmental concerns and government incentives. This shift towards electrification is poised to reshape the landscape of the propulsion system market in the years to come.

Propulsion Systems Market Segmentation: By Application

-

Air Transportation

-

Land Transportation

-

Marine Transportation

-

Spacecraft

The land transportation sector currently reigns supreme in the propulsion system market by application. This dominance is due to the vast number of cars, trucks, and other vehicles on the road that rely on internal combustion engines or are transitioning to electric motors. However, the Asia Pacific region is experiencing the fastest growth. This can be attributed to factors like rising disposable incomes, leading to more vehicle ownership, and significant investments in infrastructure development that will require new transportation solutions.

Propulsion Systems Market Segmentation: By Technology Maturity

-

Mature Technologies

-

Emerging Technologies

-

Future Technologies

By technology maturity, the propulsion system market is dominated by mature technologies like internal combustion engines that power most vehicles on the road today. However, the fastest-growing segment is emerging technologies, including electric motors and hybrid powertrains. Driven by environmental concerns and government incentives, electric and hybrid vehicles are rapidly gaining traction, and the propulsion systems that power them are experiencing significant growth.

Propulsion Systems Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America has historically held the dominant position in the propulsion system market, boasting established automotive and aerospace giants. With a strong focus on technological innovation, North America is a leader in developing advanced propulsion systems, particularly for aircraft and spacecraft. However, stringent environmental regulations are pushing the market towards cleaner options, with electric vehicle adoption steadily increasing.

Asia Pacific is experiencing the fastest growth in the propulsion system market. This surge is fueled by several factors: a burgeoning middle class with rising disposable incomes leading to a growing demand for personal vehicles, rapid urbanization creating a need for efficient transportation solutions, and significant investments in infrastructure development across the region. This presents a lucrative opportunity for manufacturers who can cater to the specific needs of this fast-growing market, with a potential focus on electric and hybrid options due to rising fuel costs and growing environmental concerns.

COVID-19 Impact Analysis on the Propulsion Systems Market:

The COVID-19 pandemic undeniably impacted the propulsion system market, with a ripple effect across various sectors. In the short term, the global economic slowdown caused a slump in demand for new vehicles, leading to a decrease in production and sales of propulsion systems. Lockdowns and travel restrictions further disrupted global supply chains, causing delays and price fluctuations for critical materials needed for manufacturing. Research and development efforts on new technologies were also hampered due to resource limitations and social distancing measures.

However, amidst the disruptions, the pandemic has also presented some long-term opportunities. The heightened focus on environmental issues could lead to a long-term shift towards cleaner propulsion options like electric and hybrid systems. Additionally, the e-commerce boom has amplified the demand for efficient delivery vehicles, potentially benefiting the electric propulsion system market in the commercial vehicle segment. Finally, the pandemic's acceleration of automation technologies in various industries could translate into increased demand for propulsion systems in autonomous vehicles and drones in the long run. While the COVID-19 pandemic undoubtedly caused challenges, the propulsion system market also has the potential to emerge stronger with a focus on clean technology and automation.

Latest Trends/ Developments:

The propulsion system market is abuzz with innovation focused on efficiency, sustainability, and pushing the boundaries of travel. One key development is the progress in solid-state battery technology. These batteries hold the potential to revolutionize electric vehicles by offering extended range, faster charging times, and improved safety compared to traditional lithium-ion batteries. This could significantly address range anxiety, a major hurdle for electric vehicle adoption.

Another trend gaining momentum is the rise of hydrogen fuel cell electric vehicles (FCEVs). FCEVs offer the advantage of rapid refueling times similar to gasoline vehicles, while producing only water vapor as a byproduct, making them a zero-emission option. Advancements in fuel cell technology and the development of hydrogen infrastructure are crucial for the wider adoption of FCEVs.

Key Players:

-

General Electric (GE)

-

Rolls-Royce

-

Honeywell International

-

Aerojet Rocketdyne

-

Safran

-

United Technologies Corporation (UTC)

-

BAE Systems

-

Pratt & Whitney

-

Siemens

-

Mitsubishi Heavy Industries

Chapter 1. Propulsion Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Propulsion Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Propulsion Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Propulsion Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Propulsion Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Propulsion Systems Market – By Type

6.1 Introduction/Key Findings

6.2 Internal Combustion Engines

6.3 Electric Motors

6.4 Hybrid Powertrains

6.5 Rocket Engines

6.6 Other Propulsion Systems

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Propulsion Systems Market – By Application

7.1 Introduction/Key Findings

7.2 Air Transportation

7.3 Land Transportation

7.4 Marine Transportation

7.5 Spacecraft

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Propulsion Systems Market – By Technology Maturity

8.1 Introduction/Key Findings

8.2 Mature Technologies

8.3 Emerging Technologies

8.4 Future Technologies

8.5 Y-O-Y Growth trend Analysis By Technology Maturity

8.6 Absolute $ Opportunity Analysis By Technology Maturity, 2024-2030

Chapter 9. Propulsion Systems Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By Technology Maturity

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Technology Maturity

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Technology Maturity

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Technology Maturity

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Technology Maturity

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Propulsion Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 General Electric (GE)

10.2 Rolls-Royce

10.3 Honeywell International

10.4 Aerojet Rocketdyne

10.5 Safran

10.6 United Technologies Corporation (UTC)

10.7 BAE Systems

10.8 Pratt & Whitney

10.9 Siemens

10.10 Mitsubishi Heavy Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Propulsion Systems Market was valued at USD 310.93 billion in 2023 and is projected to reach a market size of USD 476.87 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.3%.

Environmental Concerns and the Rise of Electrification, Space Exploration Boom and the Need for Advanced Propulsion, Regional Growth Variations and the Rise of the Asia Pacific Market, Technological Advancements Revolutionizing Propulsion Systems.

Internal Combustion Engines, Electric Motors, Hybrid Powertrains, Rocket Engines, Other Propulsion Systems.

North America holds the dominant position in the Propulsion Systems Market, boasting established automotive and aerospace giants. However, Asia Pacific is experiencing the fastest growth due to rising demand and infrastructure development.

General Electric (GE), Rolls-Royce, Honeywell International, Aerojet Rocketdyne, Safran, United Technologies Corporation (UTC), BAE Systems, Pratt & Whitney, Siemens, Mitsubishi Heavy Industries, Hyundai Mobis, Contemporary Amperex Technology Co. Limited (CATL), BYD Company.