PropTech Market Size (2025-2030)

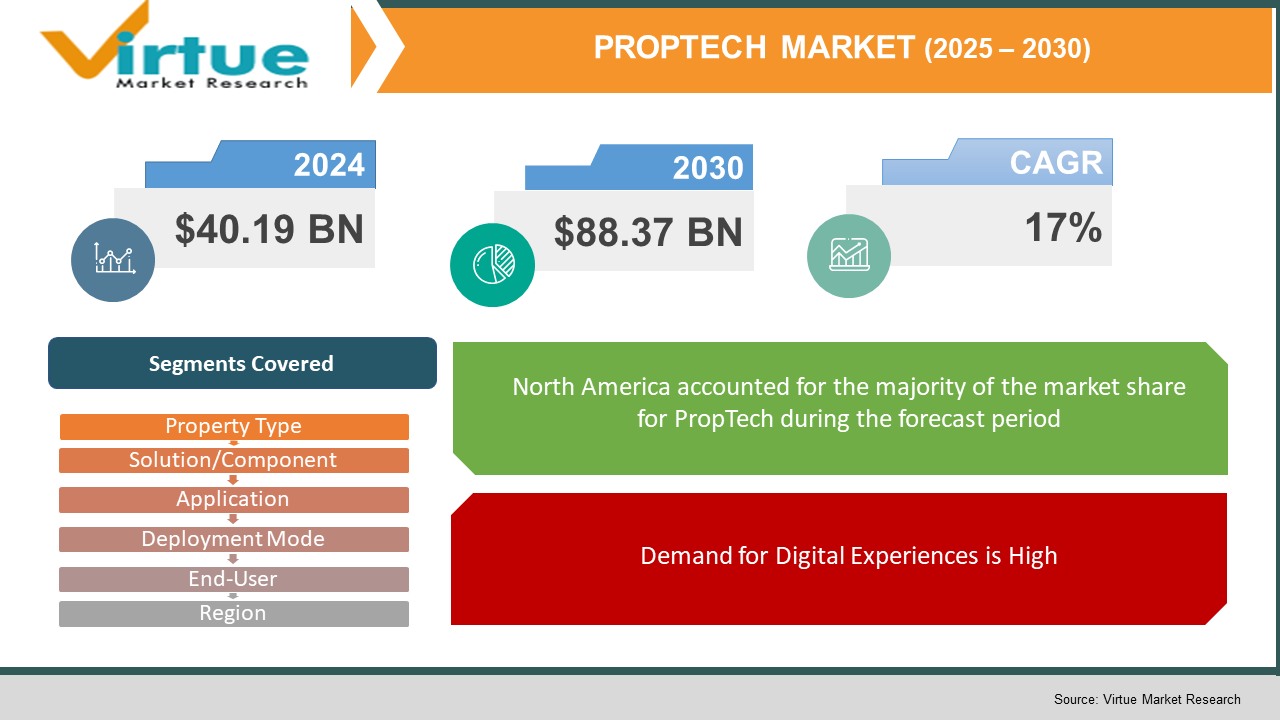

The PropTech Market was valued at $40.19 billion and is projected to reach a market size of $88.37 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 17%.

PropTech, short for property technology, is all about blending real estate with digital tools and ideas. It includes software, data analysis, and online services that make buying, selling, and managing properties easier. Thanks to tech like artificial intelligence, machine learning, big data, IoT, and cloud computing, the way we handle properties is changing fast. These tools help with things like smart buildings, online transactions, virtual tours, and automated services. As companies move their property info online, tools like property management software (PMS) and Software-as-a-Service (SaaS) are becoming key parts of how they operate. They help track maintenance, process payments smoothly, allow for data-driven choices, and improve communication with tenants. The COVID-19 pandemic pushed many to pick up digital tools, leading to a higher demand for homes and tech that supports remote work. Cloud-based solutions have changed how software is used, especially for property managers of multifamily buildings, giving them real-time access to services. PropTech also helps businesses target their marketing better and personalize customer experiences using AI insights, which leads to happier clients and smoother operations. Both established real estate firms and new startups are putting money into these technologies, which is shaking things up in the industry. By moving away from manual processes, PropTech is changing how we buy, sell, rent, and manage properties, making everything more transparent and efficient. As cities grow and technology keeps advancing, it’s clear that tech is central to how real estate is evolving and focusing more on customer needs.

Key Market Insights:

Artificial intelligence (AI) and machine learning (ML) are becoming key parts of PropTech platforms. Over 65% of property tech startups are using these tools to make client experiences better, speed up property valuations, and provide useful insights. This is helping people make better decisions and run their operations more smoothly in property sales, leasing, and management.

With the need for scalability and working from anywhere, more than 58% of real estate companies in North America are choosing cloud-based platforms and Software-as-a-Service (SaaS)

models. These systems allow for easy online payments, smooth communication with tenants, and maintenance tracking, especially for firms managing apartment buildings.

When we look at the residential real estate market, it makes up about 50% of total PropTech use. Since COVID, there has been a noticeable increase in interest in smart property management software, online listings, and virtual tours, thanks to changes in how buyers prefer to interact.

In early 2024, investment funds like SPYRE PROPTECH VENTURE put in $48.3 million to support over 30 early and growth-stage PropTech companies. This shows that investors are feeling more confident about the potential for these companies to shake up traditional real estate.

Almost 70% of real estate businesses are now working with tech providers to bring digital tools into every part of the property lifecycle. These partnerships are making leasing quicker, improving tracking for sustainability, creating smarter building operations, and leading to more flexible asset management across different types of properties.

PropTech Market Key Drivers:

Tech in Real Estate (AI, IoT, Big Data, Cloud).

With the growth of artificial intelligence, smart devices, big data, and cloud services, PropTech platforms can now offer things like predictive maintenance, automated property valuations, smart building controls, and instant services for tenants. Both big companies and startups are using these tools to improve transparency, speed up operations, and make better choices based on data.

Demand for Digital Experiences is High.

Nowadays, buyers, renters, and property managers want smooth digital experiences. This includes virtual tours, online transactions, AI chatbots, and dashboards that show transparency, along with mobile property searches. PropTech is stepping up to meet this need, making it easy for people to connect anytime, anywhere, which boosts engagement and satisfaction.

Focus on Sustainability and Energy Efficiency.

As environmental issues become more urgent, PropTech solutions are crucial for green building efforts. With energy monitoring using smart devices, AI managing HVAC and lighting, smart meter analytics, and blockchain-backed sustainable supply chains, these innovations help cut down on carbon emissions, meet new regulations, and save on energy costs. This is especially important for regulators, investors, and tenants who care about eco-friendly spaces.

PropTech Market Restraints and Challenges:

Key Issues Slowing Down PropTech Adoption in Real Estate.

Even though PropTech has a lot to offer in terms of efficiency, there are several issues that are keeping it from taking off. One big problem is integrating new systems with old ones. Each building has different setups for things like HVAC, security, and automation, which can make this process tricky and expensive. It often needs a lot of changes, which can disrupt how things normally run. Then there’s worry about security and privacy. Since these platforms deal with sensitive data about tenants and finances, making sure everything is secure and complies with regulations can be a heavy burden. Also, the initial cost for new technology—like IoT, VR, or AI—can be high. Smaller firms might hesitate to adopt these technologies, especially since it might take a while to see any return on their investment. Cultural resistance is another challenge. Many property owners and managers stick to traditional, manual processes because they don't want to deal with the unknown risks of going digital. Lastly, different rules and old legal systems make things more complicated. The varying regulations around data, IoT, and digital transactions can slow down progress and create more compliance headaches.

PropTech Market Opportunities:

Growth Opportunities in the PropTech Market.

PropTech is really opening up a lot of chances right now. With AI, big data, and IoT coming together, we’re seeing improvements in smart building maintenance and cost savings. Blockchain is making things like fractional property ownership and easier transactions a reality. Co-living and co-renting are becoming popular as more people look for affordable housing, and platforms are popping up to connect tenants and support shared living. Sustainability is also a big deal, with a lot of focus on green building practices. Things like energy management systems, green materials, and supportive regulations are pulling in investments and catching tenant interest. Plus, we’re seeing more traditional real estate businesses teaming up with PropTech startups, which helps create all-in-one platforms for managing properties from construction to leasing. As the industry goes digital, we’re looking at better transparency and efficiency, setting PropTech up for some big changes in the real estate market.

PROPTECH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

17% |

|

Segments Covered |

By PROPERTY TYPE, APPLICATION, END USER, DEPLOYMENT MODE, SOLUTION, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Opendoor Technologies Inc., CoStar Group, Zillow Inc., RealPage Inc., Compass, Reonomy, Guesty Inc., HoloBuilder Inc., Qualia, Zumper Inc. |

PropTech Market Segmentation:

PropTech Market Segmentation: By Property Type

- Residential

- Commercial & Industrial

Residential PropTech is growing fast due to rising demand for smart homes, virtual tours, and easy digital transactions. Tech advancements like smart locks, cloud-based management, and VR showings are making it popular. Startups focusing on single-family and multi-family homes are gaining traction because of strong returns on low investments. Reports say this sector is expected to grow the most as platforms that make buying, renting, and managing homes easier appeal to tech-savvy users.

Even with this rapid growth in residential areas, the commercial and industrial sectors still dominate the market. They held the largest share in 2024, providing tools for managing assets, smart building controls, and leasing. Businesses and big investors are pushing this sector forward by investing in technologies that improve efficiency and save energy. Reports indicate that commercial PropTech led the market in 2024 and will keep growing due to its fit with automation and business needs.

PropTech Market Segmentation: By Solution/Component

- Software

- Services

- Asset Management

- Sales & Advertisement tools

- Security & Surveillance systems

PropTech software, especially tools for property and asset management, is growing quickly. Cloud-based property management platforms are booming, with AI-driven analytics leading the way thanks to automation and improved tenant experiences. Standalone tools with features like analytics, maintenance scheduling, and portfolio evaluation are being widely adopted by both startups and established firms, as they allow for easy integration and clear benefits.

Integrated PropTech platforms that combine property management, asset optimization, sales, marketing, and security hold the majority of the market share. In 2024, these all-in-one solutions became the most popular due to their operational benefits. Cloud-first security vendors, like Eagle Eye Networks, are also gaining traction, enhancing these comprehensive platforms. Large real estate companies prefer these full-suite solutions for better control, data sharing, and smooth coordination across different areas like leasing and maintenance.

PropTech Market Segmentation: By Application

- Virtual tours & online marketing

- Underwriting and mortgage processing

- Online leasing

- Construction progress & site management

- Property/facility management

- Asset and investment management

Virtual tours, online leasing, and underwriting are rapidly growing in PropTech. Virtual tours using AR/VR and 3D walkthroughs have become popular, especially with platforms like Zillow seeing increased use due to the pandemic. Tools for online leasing, like self-guided tours and AI chatbots, are also on the rise, making it easier for tenants to move in and reducing vacancy times. Automated underwriting and mortgage processing are gaining traction too, as startups digitize complicated workflows, attracting more investor funding.

Property management and asset management remain key in PropTech. Cloud-based property management systems account for over two-thirds of usage, helping with leasing, maintenance, payments, and tenant interactions across residential and commercial areas. Asset management remains vital, driven by data analytics and AI tools from companies like Reonomy and VTS. These help users make better portfolio decisions and track performance, essential for the industry.

PropTech Market Segmentation: By Deployment Mode

- Cloud-based platforms/applications

- On-premises solutions

Cloud-based PropTech solutions are taking off, making up around 70% of global deployments in 2024. They're growing fast because they're scalable, cost-effective, and allow for easy updates and centralized data access. Small and medium businesses, plus multifamily managers, love the mobile access and integration with payment systems and AI/IoT features that cloud platforms provide, making them ideal for businesses looking to grow.

That said, on-premises deployment is still strong, holding over 50% of the market share from 2021 to 2024. Larger businesses and regulated firms prefer these systems for better data security, control, and customization. They work well with specialized systems like HVAC and security in private networks, catering to strict compliance needs. So, while cloud systems are on the rise, on-premises solutions are still a solid choice.

PropTech Market Segmentation: By End-User

- Real estate agents and brokers

- Housing associations and residential operators

- Property/investment managers

- Lenders, insurers, developers

- Tenants and renters

Property managers and real estate agents are quickly adopting PropTech. With smart tools like AI pricing, automated lead management, and virtual tours, they're using technology to make their work easier and boost income. Cloud-based solutions are especially popular, as they allow for scaling and automating tasks like rent collection, scheduling maintenance, and tenant communication. As both commercial and residential projects grow globally, the need for efficient property management software keeps rising.

Housing associations and residential operators hold the biggest market share in PropTech, generating about a third to half of the revenue. They use tools for payment tracking, inspections, tenant onboarding, and community management. Their success comes from managing large residential portfolios effectively and enhancing tenant satisfaction. By using centralized platforms to automate tasks and ensure compliance, they're the main users in the PropTech industry.

PropTech Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

North America is the leading PropTech market, making up about 56% of the share. This is mainly due to its solid digital setup, lots of investments, and the rise of smart real estate solutions. Europe is in second place with around 20%, focusing on sustainability and urban tech. The Asia-Pacific region is growing the fastest, holding about 15% of the market, thanks to smart city projects and more IoT use. Latin America the Middle East & Africa have smaller shares at 5% and 4%, but they’re starting to see growth as digital real estate tools are getting a foothold in these emerging areas.

COVID-19 Impact Analysis on the PropTech Market:

The COVID-19 pandemic really pushed the real estate industry to embrace technology. About 60% of professionals in the field started using more tech tools like air-quality sensors, crowd management tools, and virtual property tours. Around 16% even set up brand-new systems to handle pandemic-related challenges. With lockdowns and social distancing, people needed remote solutions more than ever, leading to a rise in virtual tours, 3D property models, online leasing, and fully digital transactions, which helped keep things moving during tough times.

In commercial real estate, new tools like touchless entry, real-time occupancy tracking, AI thermal screening, and contactless maintenance have become crucial for keeping tenants safe and businesses running smoothly. The pandemic made everyone rethink what technology was necessary; what used to be optional suddenly felt like a must-have, prompting a serious look at tech systems and old setups.

Even though there were some initial worries from investors and a few project delays, technologies aimed at reducing face-to-face contact—like automated transactions and digital platforms—took off. Overall, the pandemic sped up the adoption of PropTech by several years, pushing the industry towards smarter buildings and digital systems that are likely to stick around long after COVID-19 is gone.

Trends/Developments:

In November 2024, a global digital imaging company launched a small, portable instant photo booth using ZINK technology. This booth is perfect for events and helps with tenant engagement in real estate projects by allowing people to print photos on-site, promote events, and create sticky-backed prints for marketing.

In January 2024, HID teamed up with Olea Kiosks to add AI facial recognition to self-service kiosks. This upgrade makes check-ins safer and contactless, useful in places like property lobbies, rentals, co-working spaces, and building access.

In September 2023, a Japanese property-tech firm bought over 3,500 smart kiosks located in busy areas. These kiosks will help with tenant check-ins, access management, and digital transactions in both residential and commercial settings.

In July 2022, a big print-tech company expanded its digital signage and interactive display services into real estate by partnering with resellers. This move supports onsite property marketing, wayfinding, and smart lobby communications linked to PropTech platforms.

Key Players:

- Opendoor Technologies Inc.

- CoStar Group

- Zillow Inc.

- RealPage Inc.

- Compass

- Reonomy

- Guesty Inc.

- HoloBuilder Inc.

- Qualia

- Zumper Inc.

Chapter 1 PROPTECH Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2 PROPTECH Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3 PROPTECH Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4 PROPTECH Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5 PROPTECH Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 PROPTECH Market – By Property Type

6.1 Introduction/Key Findings

6.2 Residential

6.3 Commercial & Industrial

6.4 Y-O-Y Growth trend Analysis By Property Type

6.5 Absolute $ Opportunity Analysis By Property Type, 2025-2030

Chapter 7 PROPTECH Market – By Solution/Component

7.1 Introduction/Key Findings

7.2 Software

7.3 Services

7.4 Asset Management

7.5 Sales & Advertisement tools

7.6 Security & Surveillance systems

7.7 Y-O-Y Growth trend Analysis By Solution/Component

7.8 Absolute $ Opportunity Analysis By Solution/Component , 2025-2030

Chapter 8 PROPTECH Market – By Application

8.1 Introduction/Key Findings

8.2 Virtual tours & online marketing

8.3 Underwriting and mortgage processing

8.4 Online leasing

8.5 Construction progress & site management

8.6 Property/facility management

8.7 Asset and investment management

8.8 Y-O-Y Growth trend Analysis Application

8.9 Absolute $ Opportunity Analysis Application, 2025-2030

Chapter 9 PROPTECH Market – By Deployment Mode

9.1 Introduction/Key Findings

9.2 Cloud-based platforms/applications

9.3 On-premises solutions

9.4 Y-O-Y Growth trend Analysis Deployment Mode

9.5 Absolute $ Opportunity Analysis Deployment Mode , 2025-2030

Chapter 10 PROPTECH Market – By End-User

10.1 Introduction/Key Findings

10.2 Real estate agents and brokers

10.3 Housing associations and residential operators

10.4 Property/investment managers

10.5 Lenders, insurers, developers

10.6 Tenants and renters

10.7 Y-O-Y Growth trend End-User

10.8 Absolute $ Opportunity End-User , 2025-2030

Chapter 11 PROPTECH Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Property Type

11.1.3. By Deployment Mode

11.1.4. By Application

11.1.5. Solution/Component

11.1.6. End‑User Type

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Property Type

11.2.3. By Deployment Mode

11.2.4. By Application

11.2.5. Solution/Component

11.2.6. End‑User Type

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.1. By Country

11.3.1.2. China

11.3.1.2. Japan

11.3.1.3. South Korea

11.3.1.4. India

11.3.1.5. Australia & New Zealand

11.3.1.6. Rest of Asia-Pacific

11.3.2. By Property Type

11.3.3. By Deployment Mode

11.3.4. By Application

11.3.5. Solution/Component

11.3.6. End‑User Type

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.1. By Country

11.4.1.1. Brazil

11.4.1.2. Argentina

11.4.1.3. Colombia

11.4.1.4. Chile

11.4.1.5. Rest of South America

11.4.2. By Property Type

11.4.3. By Deployment Mode

11.4.4. By Application

11.4.5. Solution/Component

11.4.6. End‑User Type

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.1. By Country

11.5.1.1. United Arab Emirates (UAE)

11.5.1.2. Saudi Arabia

11.5.1.3. Qatar

11.5.1.4. Israel

11.5.1.5. South Africa

11.5.1.6. Nigeria

11.5.1.7. Kenya

11.5.1.11. Egypt

11.5.1.11. Rest of MEA

11.5.2. By Property Type

11.5.3. By Deployment Mode

11.5.4. By Application

11.5.5. Solution/Component

11.5.6. End‑User Type

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12 PROPTECH Market – Company Profiles – (Overview, Property Type Portfolio, Financials, Strategies & Developments)

12.1 Opendoor Technologies Inc.

12.2 CoStar Group

12.3 Zillow Inc.

12.4 RealPage Inc.

12.5 Compass

12.6 Reonomy

12.7 Guesty Inc.

12.8 HoloBuilder Inc.

12.9 Qualia

12.10 Zumper Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth is mainly fueled by urbanization, the push for smarter buildings, and more people using digital tools in real estate.

Real estate developers, property managers, investors, and tenants are the main users, using technology to improve how they operate and enhance customer experiences.

AI helps with predicting trends, automating tasks, improving virtual tours, and giving smarter property suggestions

North America and Europe are seeing fast adoption, thanks to smart city projects and a lot of investment.

Some emerging trends include using blockchain for transactions, virtual property viewings, integrated smart tech, and the rise of SaaS platforms for managing properties.