Proprietary Pharma Chemicals Market Size (2023 – 2030)

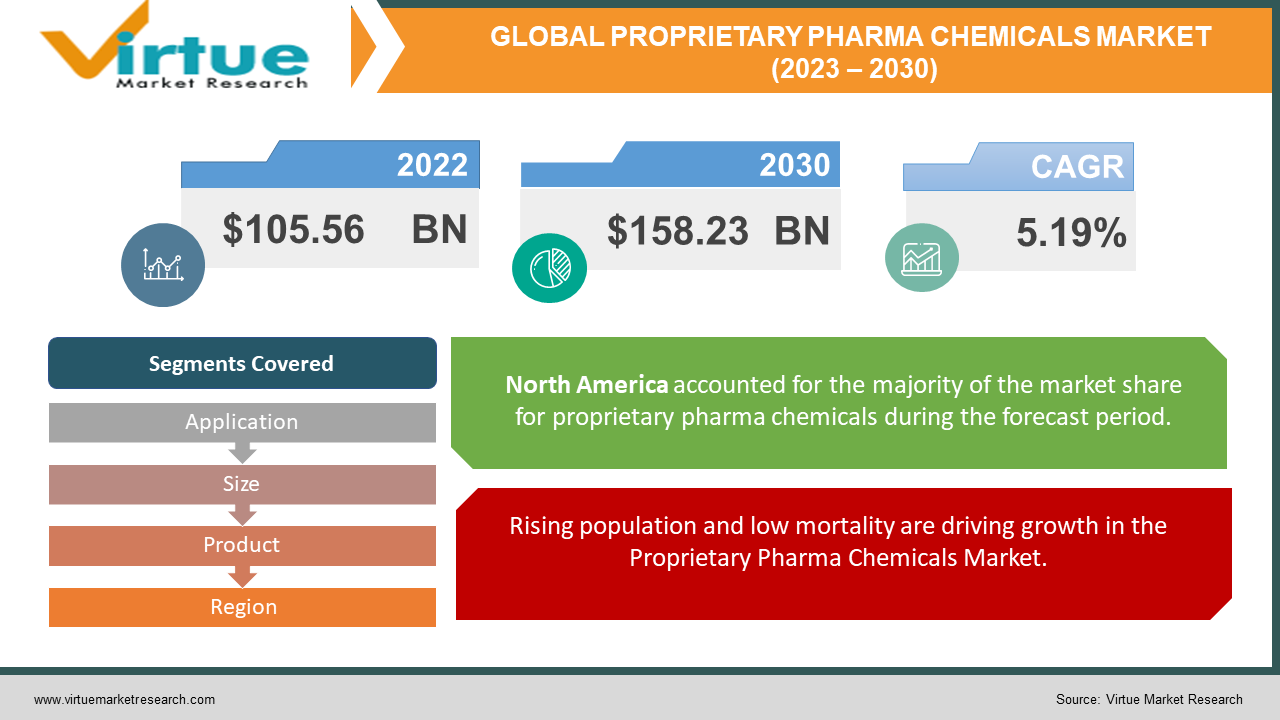

The Global Proprietary Pharma Chemicals Market was estimated to be worth USD 105.56 Billion in 2022 and is anticipated to reach a value of USD 158.23 Billion by 2030, growing at a fast CAGR of 5.19 % during the outlook period 2023-2030.

Pharmaceutical chemicals are substances that are employed in pharmaceutical products. Fine chemicals are also commonly found in pharmaceutical compounds. Unlike the usual compounds used in pharmaceutical products, these are pure substances. The treatment of cancers of the liver, blood, lung, and brain can greatly benefit from the use of fine chemicals. Companies have created divisions that are focused on producing specialty medications made for certain uses, like solidification and haemato-oncology. Good chemicals are fine chemicals that are employed in the production of pharmaceutical products. Two significant sectors that use fine chemicals are agrochemicals and medicines. The pharmaceutical industry offers a wide variety of active pharmaceutical ingredients, including chemical medicines, hormonal APIs, and APIs for hormones. OTC, generic, super generic, and similar drugs can all be found on the pharmaceutical market.

Global Proprietary Pharma Chemicals Market Drivers:

Rising population and low mortality are driving growth in the Proprietary Pharma Chemicals Market.

Pharmaceutical compounds are combined with simple chemicals to generate complex molecules, which have a variety of applications in the food, pharmaceutical, and agricultural industries. The healthcare sector has an opportunity for successful growth due to a rising population and low mortality. An increase in the global need for better healthcare systems is predicted to drive the market. Because of an aging population, there is a greater need for healthcare facilities. The components of these substances are used to make medicines. The market will also grow due to the increased manufacture of cutting-edge drugs. A rise in population in developing economies and the resulting desire for better healthcare facilities is also likely to be to blame for the surge in product demand on the global market.

Due to an increase in surgical procedures, growth is anticipated in the Proprietary Pharma Chemicals Market.

Medically speaking, diabetic individuals consume pricey pharmaceutical chemical-based items as part of their diet. And finally, pharmaceutical substances are useful in the fight against cancer. Even problems involving the cardiovascular and nervous systems drive demand for pharmaceutical chemicals because it is anticipated that these conditions would hasten the production of medicines. By addressing nerve imbalance and restoring neurological functions, pharmaceutical chemicals-based treatments can aid with neurological problems. The pharmaceutical chemical industry is anticipated to grow in the next years due to an increase in surgical procedures.

Generics and biopharmaceuticals demand is growing quickly which is driving growth in the Proprietary Pharma Chemicals Market.

As a result of rising medical spending, the introduction of novel medicines, and the rising prevalence of chronic illnesses, it is projected that the global pharmaceutical sector will expand gradually in the coming years. In recent years, a sizable number of effective medications have also lost their patents, and more will do so in the future. This will open the market to low-cost generic substitutes, presumably increasing the supply of drugs. During the projection period, it is anticipated that this phenomenon would raise the demand for medicinal chemicals.

Global Proprietary Pharma Chemicals Market Challenges:

High expenditures related to research and development capabilities are one of the major issues that the fine chemicals industry faces. Pharmaceuticals, food and beverage, cosmetics, and cleaning goods are just a few of the industries that use fine chemicals. These chemicals need substantial research expenditures to develop and manufacture, which can be challenging for businesses to justify given the hazy returns. Growing knowledge of the potential drawbacks of employing specific chemicals is another issue that the fine chemicals sector is currently dealing with. For instance, the overuse of certain delicate chemicals can result in skin allergies. Due to this, there is an increasing need for natural and organic compounds to replace synthetic ones.

Global Proprietary Pharma Chemicals Market Opportunities:

Businesses are constantly emphasizing innovation and technical improvements. These businesses are eager to enter regional markets to boost the pharmaceutical industry. It is anticipated that novel business tactics would be tested to gain market share.

Huge financial investments, clinical trials, and regulatory authority approvals may have some influence on the market. However, it is anticipated that applications based on therapy will boost the product's demand globally. As a result, the pharmaceutical chemical industry is anticipated to grow significantly in the approaching years.

COVID-19 Impact on Global Proprietary Pharma Chemicals Market:

The process of releasing a novel drug was challenging even before the coronavirus pandemic. Nearly 40% of international drug launches between 2009 and 2017 fell short of revenue projections. A successful launch must overcome various obstacles, such as heightened competition, increasing pricing pressure, growing access problems, and mounting provider and patient expectations. An already dangerous healthcare environment has become more difficult as a result of the outbreak and its economic effects. Innovative medicine launches provide pharmaceutical companies with a fantastic opportunity to test out new strategies and gauge their effectiveness before rolling them out to a larger market. Repeating successful launch strategies from the past is no longer a realistic option given the pandemic's uncertainties and the fundamental changes in physicians' attitudes and behaviors.

PROPRIETARY PHARMA CHEMICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.19 % |

|

By Application, Size, Product, and Region |

|

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lonza, Porton Fine Chemical, Dishman Lanxes, Johnson Matthey, Vertellus Holdings, Jubilant Life Sciences, Hika, Abbott, Kenko Corporation |

Global Proprietary Pharma Chemicals Market Segmentation: By Application

-

Cardiovascular

-

Neurology

-

Oncology

-

Infectious diseases

-

Metabolic system

-

Diabetes

-

Respiratory disease

-

Gastrointestinal diseases

-

Musculoskeletal diseases

-

Others

In 2022, the market's largest application segment was cardiovascular. The compounds are used in the production of medications and treatments used to treat disorders of the heart and blood vessels. Over the course of the projected period, this application category is anticipated to see significant market penetration and strong growth.

One of the most prevalent diseases in the world today is diabetes. Individuals with diabetes are frequently forced to follow a certain diet as a treatment for this. This diet frequently calls for expensive goods and medications. These variables will cause the diabetes segment to increase rapidly over the course of the projected period.

Global Proprietary Pharma Chemicals Market Segmentation: By Size

-

Small molecules

-

Big molecules

Big molecules accounted for the largest market share in 2022, and this pattern is anticipated to hold throughout the projected period. Dipeptides, which are utilized to treat cases of cardiovascular disorders, are one application for these compounds. The use of large molecules in immunization is another factor increasing market demand. Compared to tiny molecules, a lot bigger molecule goods have recently reached the market. Small compounds have been created by businesses for use as additives, pharmaceutical intermediates, drug metabolites, and drug intermediates.

Additionally, businesses offer a range of services like synthesis development and help build up commercial production procedures for the manufacture of small molecules. Customers that require small molecules in small quantities are another market segment catered to by industry players. The approval of new molecular entities is dominated by the small molecules segment. Over the forecast period, these trends are anticipated to increase market demand. Another factor promoting market expansion is the rise of contract manufacturing organizations (CMOs) with integrated processes for producing small molecule intermediates, cutting-edge formulations, and concept-to-commercial manufacturing.

Global Proprietary Pharma Chemicals Market Segmentation: By Product

-

Basic building blocks

-

Advanced intermediates

-

Active ingredients

In 2022, the sector for active substances became the largest. To provide consumers with effective service, businesses maintain global active pharmaceutical ingredients (API) manufacturing facilities. Customers require high levels of purity, quality, strength, and identity, so the molecules are produced with strict quality controls.

A virtual molecule fragment with a reactive functional group makes up the fundamental building blocks. Acids, acid chlorides, esters, brominated derivatives, ketones, nitrile derivatives, and heterocyclic compounds are a few examples of building blocks. These are employed in the production of several medications used to treat illnesses like cardiovascular, musculoskeletal, and neurological conditions. Building block manufacturers are putting more of an emphasis on quality enhancement. Building block manufacturers' strategies and their products' broad applicability are anticipated to fuel segment expansion. To balance the effects of both the regulatory restrictions and the economic pressure, businesses are outsourcing their needs for intermediate production. The businesses that produce advanced intermediates collaborate with both major and small pharmaceutical firms to source high-quality pharmaceutical intermediates at cheaper prices.

Global Proprietary Pharma Chemicals Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

North America is emerging as the top consumer. The rigorous laws and restrictions that apply to both production and consumption define the North American region. Before the medication is released, the appropriate regulatory organizations must validate the claims made by the drug producers regarding the effectiveness of their medicine. People in the area have a high preference for preventive healthcare, which is another characteristic of the area. A significant regional characteristic is also a widespread awareness of drug use. Over the next eight years, the region with the highest growth rate is predicted to be Asia Pacific. The region's market expansion is being fuelled by the region's high population growth, rising disposable income, and rising standard of life in nations like China and India. Over the course of the projected period, rising government healthcare spending in the region is also anticipated to boost market demand.

Global Proprietary Pharma Chemicals Market Key Players:

-

Lonza

-

Porton Fine Chemicals

-

Dishman

-

Lanxess

-

Johnson Matthey

-

Vertellus Holdings

-

Jubilant Life Sciences

-

Hikal

-

Abbott

-

Kenko Corporation

Chapter 1. PROPRIETARY PHARMA CHEMICALS MARKET - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PROPRIETARY PHARMA CHEMICALS MARKET - Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. PROPRIETARY PHARMA CHEMICALS MARKET - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. PROPRIETARY PHARMA CHEMICALS MARKET - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. PROPRIETARY PHARMA CHEMICALS MARKET - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PROPRIETARY PHARMA CHEMICALS MARKET - By Application

6.1 Cardiovascular

6.2 Neurology

6.3 Oncology

6.4 Infectious diseases

6.5 Metabolic system

6.6 Diabetes

6.7 Respiratory disease

6.8 Gastrointestinal diseases

6.9 Musculoskeletal diseases

6.10 Others

Chapter 7. PROPRIETARY PHARMA CHEMICALS MARKET - By Size

7.1 Small molecules

7.2 Big molecules

Chapter 8. PROPRIETARY PHARMA CHEMICALS MARKET - By Product

8.1 Basic building blocks

8.2 Advanced intermediates

8.3 Active ingredients

Chapter 9. PROPRIETARY PHARMA CHEMICALS MARKET – By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. PROPRIETARY PHARMA CHEMICALS MARKET – Key Players

10.1 Lonza

10.2 Porton Fine Chemicals

10.3 Dishman

10.4 Lanxess

10.5 Johnson Matthey

10.6 Vertellus Holdings

10.7 Jubilant Life Sciences Hikal

10.8 Abbott

10.9 Kenko Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Proprietary Pharma Chemicals Market was estimated to be worth USD 105.56 Billion in 2022 and is anticipated to reach a value of USD 158.23 Billion by 2030, growing at a fast CAGR of 5.19 % during the outlook period 2023-2030.

The Segments under the Global Proprietary Pharma Chemicals Market by Product are Basic building blocks, advanced intermediates, and Active ingredients.

Some of the top industry players in the Proprietary Pharma Chemicals Market are Lonza, Porton Fine Chemicals, Dishman, Lanxess, Johnson Matthey Etc.

The Global Proprietary Pharma Chemicals market is segmented based on Application, Size, Product, and region.

North America region held the highest share in the Global Proprietary Pharma Chemicals market.