Product Stewardship Market Size (2024 – 2030)

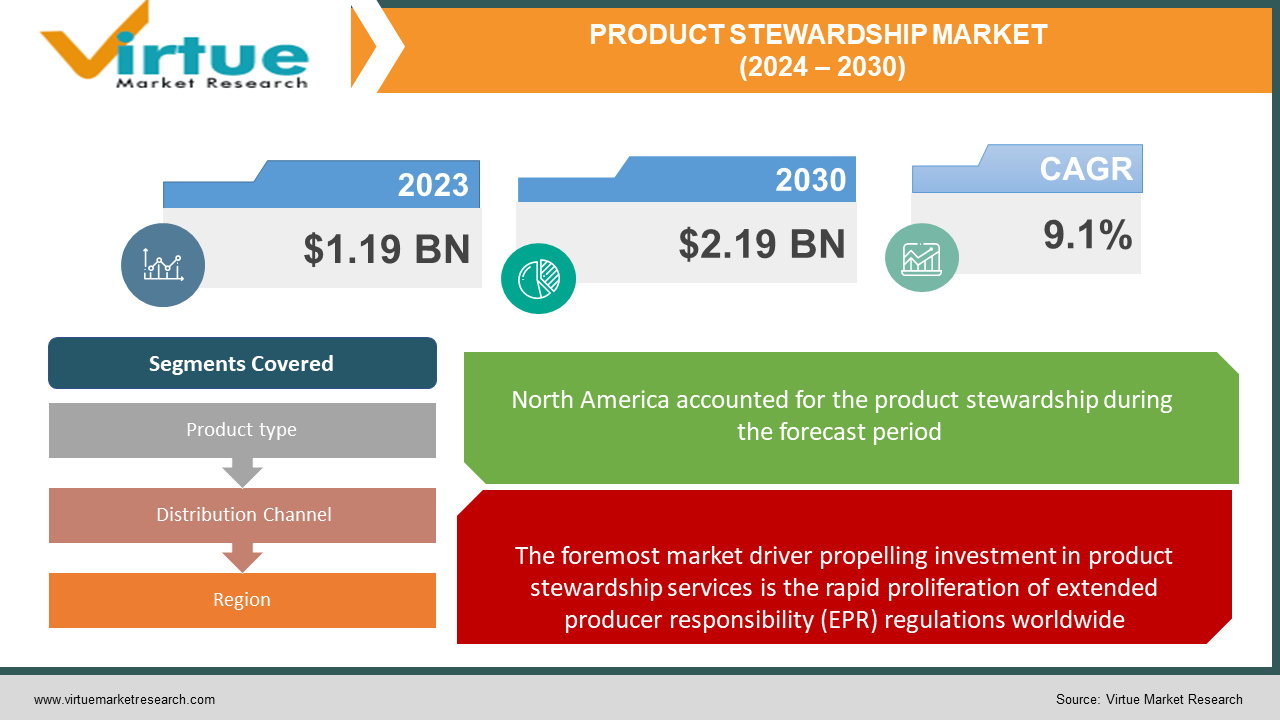

The Product Stewardship Market was valued at USD 1.19 Billion and is projected to reach a market size of USD 2.19 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.1%.

Product stewardship is a growing approach companies across industries are adopting to manage the environmental, health, and safety impacts of their products, especially at end-of-life. It reimagines the product lifecycle by bringing together all entities involved – manufacturers, retailers, consumers, recyclers, and regulators – to share responsibility for sustainable outcomes. Implementation of product stewardship is being driven by tightening regulations, corporate sustainability goals, and increasing consumer demand for greener products. The product stewardship model is centered on extended producer responsibility (EPR), which legally obligates manufacturers to finance and organize take-back and recycling of products after consumer use. This shifts financial and logistical burdens away from municipalities while incentivizing companies to design easier-to-recycle and reuse products. EPR regulations and frameworks now exist for packaging, electronics, batteries, automotive, pesticides, paint, mattresses, and other product categories across multiple countries and regions.

Key Market Insights:

Product stewardship is rapidly gaining traction as businesses and governments work harder to lessen the negative environmental effects of consumer goods, particularly as they approach the end of life. Several strong forces are driving this shift, including more focus on circular economic models, stricter rules about extended producer responsibility, corporate sustainability objectives, and growing consumer apprehension over excessive waste. Realizing that shared accountability throughout the whole product lifetime and supply chain is necessary for successful waste management is a basic realization that is propelling the expansion of product stewardship. While towns used to handle the majority of end-of-life disposal, product stewardship makes it easier for manufacturers, merchants, consumers, recyclers, and regulators to work together. This distributes accountability for long-term results to all parties involved in producing and marketing used goods. From a legislative standpoint, extended producer responsibility (EPR)—legal duties requiring manufacturers to plan and fund product take-back and recycling—is the focal point of product stewardship. Reuse and recycling are becoming more and more ingrained in product design and business models of organizations because of EPR rules about packaging, electronics, batteries, cars, pesticides, and other waste-intensive categories. As more and more regions enact EPR legislation, compliance costs for stewardship services are expected to climb sharply.

Product Stewardship Market Drivers:

The foremost market driver propelling investment in product stewardship services is the rapid proliferation of extended producer responsibility (EPR) regulations worldwide.

Extended producer responsibility legislation is the foremost factor catalyzing growth in the product stewardship industry. EPR policies and frameworks legally obligate manufacturers to take financial and/or operational responsibility for collecting and recycling post-consumer products instead of the obligation falling predominantly to municipalities. Robust EPR schemes now operate across Europe, North America, East Asia, and Australia and are expanding to other regions. Landmark policies in the EU, like the Waste Electrical and Electronic Equipment (WEEE) Directive and the Packaging and Packaging Waste Directive, have induced companies to establish European-wide stewardship organizations that coordinate recycling programs on behalf of industry. These policies are driving steady year-over-year increases in EPR program funding and waste tonnages recovered. Similar legislation has passed at a state level across the United States and Canada. A patchwork of policies targeting e-waste, packaging, paint, and mattresses compel consumer brands to contract state-specific stewardship groups based on sale locales. For multinationals, this means managing a network of several EPR partners with varying registration, reporting, and funding requirements that increase administrative complexity. Harmonization remains a challenge.

The rising preference for nutritious and eco-friendly food options is coupled with the challenge of food security, fostering the growth of the Organic Farro Produce market.

Complementing the push from extended producer responsibility regulations, brands across industries are also proactively pursuing product stewardship initiatives to meet ambitious corporate sustainability targets. Taking responsibility for end-of-life collection and material recovery aligns with company commitments around carbon neutrality, circular production, resource conservation, waste minimization, and ethical sourcing. Leading multinationals in technology, fashion, food & beverage, automotive, and other sectors are setting bold goals to reduce emissions, water use, and virgin material requirements by orders of magnitude over the next decade. For example, Apple aims to become 100% carbon neutral across its vast supply chain by 2030. Other tech giants like Dell, HP, and Samsung have pledged to use increasing amounts of recycled plastics and rare earth metals in devices. These commitments create inherent pressure for brands to consider the post-consumer fate of goods produced today - especially for resource-intensive categories like electronics and plastics. If disposed of improperly instead of recycled, these future waste streams would undermine corporate emissions reductions and circularity targets. This reality is driving companies to get ahead of the problem by integrating product stewardship and take-back programs into product design and business models. Making devices easier to disassemble and materials easier to recover for the next generation of goods closes the loop. It also provides efficiency opportunities to reuse manufacturing byproducts. Many brands find participation in voluntary stewardship initiatives boosts credibility around meeting sustainability goals. For example, the Sustainable Apparel Coalition’s Circular Materials Guidelines help clothing companies source recycled fibers and assess durability to minimize waste. Even without hard targets, these frameworks stimulate progress.

Product Stewardship Market Restraints and Challenges:

While momentum behind product stewardship and extended producer responsibility (EPR) frameworks continues accelerating, substantial infrastructure barriers exist - especially in developing nations - that constrain material recovery and recycling rates.

While regulatory and brand investment momentum into product stewardship continues building, substantial infrastructure deficiencies pose barriers to maximizing material recovery and recycling rates globally. Without widespread, convenient collection points and cost-efficient sorting and reprocessing technologies, corporations lack viable pathways for retrieving and recycling goods post-consumer. In countries lacking organized waste management systems, high-value electronics, plastics, and metals end up discarded into landfills and the natural environment instead of reclaimed as manufacturing inputs. But even robust European stewardship frameworks suffer shortcomings like consumers disposing of regulated products into general waste bins ultimately bound for incinerators or landfills. Progress requires massive capital investments into the collection and sorting infrastructure like deposit return programs, municipal drop-off stations, at-home pickups, and advanced facilities powered by sensor, robotic, and artificial intelligence technologies. Government facilities alone cannot scale fast enough. The onus falls to corporations benefiting from material reuse to help fund infrastructure build-out. Yet funding remains inadequate within regions lacking centralized recycling coordination, especially in developing countries where formal systems are nascent. Companies face extreme difficulties tracing goods shipped abroad for resale let alone managing post-consumer fate with minimal visibility and regulation requiring take back. In nations like India, Mexico, or Indonesia, valuable plastics and electronics often end up openly dumped or burned rather than reclaimed as manufacturing inputs. The scale of waste generated already overwhelms public infrastructure even before factoring in significant consumption growth projections.

Product Stewardship Market Opportunities:

As regulations tighten and companies set ambitious sustainability targets, product stewardship presents a sizeable market opportunity for corporations able to turn obligation into a competitive advantage. Leaders solving the biggest infrastructure and transparency challenges stand to realize efficiency gains, reputational boosts, and first-mover positioning. Significant potential exists for brands proactively investing in collection infrastructure and sorting/recycling technologies to lower operating costs while securing reliable access to recycled materials needed to achieve circular production and zero waste goals. With rival companies competing for finite supplies of recycled plastics, metals, fibers, and minerals, integrating backward into recovery systems becomes a strategic priority. First movers also get to dictate the standards, capabilities, and costs in nascent regional recycling ecosystems, whether through financing processing facilities with specific design requirements or training subsets of the informal collecting workforce to supply target waste categories. These anchor partnerships form the foundation for scaling infrastructure. Additionally, brands that develop robust traceability using blockchain or chemical markers to authenticate material flows will gain the advantage verify the authenticity of supply chains and sustainability claims for regulators and consumers alike.

PRODUCT STEWARDSHIP MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.1% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sphera Solutions, Enablon, SAP, 3E Company, Intelex Technologies, ERM, Gensuite |

Product Stewardship Market Segmentation: By Product Type

-

Software

-

Services

Software holds approximately 40-50% of the market, these Solutions are designed to manage product stewardship information, compliance, and processes. Services hold approximately 50-60% of the market, these Solutions manage Consulting, implementation, auditing, and other support for product stewardship programs.

Services represent the slightly more dominant segment of the product stewardship market. This is because even with sophisticated software, companies need external expertise to guide them through program design, regulatory complexities, and best practices. The software segment is demonstrating accelerated growth, Software aids with tracking, reporting, and managing compliance in the ever-changing regulatory landscape, Efficient software tools help to collect, analyze, and visualize data from across the product lifecycle, facilitating better decision-making, these offerings enhance accessibility and scalability for both small and large enterprises.

Product Stewardship Market Segmentation: By Distribution Channel

-

Chemicals

-

Electronics

-

Consumer Goods

-

Retail

-

Pharmaceuticals

-

Others

Chemicals are historically one of the most dominant sectors due to the need to manage hazardous substances and meet strict regulations (REACH, TSCA, etc.). Companies need rigorous product stewardship to track hazardous materials throughout their lifecycle and to maintain full compliance. Electronics, with a rise in electronic devices, growing concern over e-waste disposal, and an emphasis on recycling valuable materials, the electronics industry relies heavily on effective product stewardship programs. It is likely one of the fastest-growing segments. Consumer Goods, this sector is seeing major shifts. Consumer pressure for ethically sourced, sustainable products is fueling the adoption of responsible product stewardship practices. While large, its current growth percentage may be slightly slower than in specialized sectors like electronics. Retail is not dominant as many retailers indirectly participate by requiring their suppliers to comply with their product stewardship standards. Its impact depends on the size of the retailer and its emphasis on sustainability in its sourcing operations. Pharmaceuticals are highly regulated to ensure drug safety and proper disposal. While impactful, this segment often has internal structures focused on compliance, thus the "external" product stewardship market share might be less pronounced. Industries like automotive, construction, and textiles each have a growing emphasis on product stewardship practices due to their distinct environmental footprints and specialized material disposal needs.

Product Stewardship Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America accounts for around 35–40% of the market. In the product stewardship market, North America is regarded as the most important area. Strong environmental laws such as the Toxic Substances Control Act (TSCA) and ever-increasing material transparency requirements. Strong public demand for goods sourced ethically and sustainably. Companies in North America adopted product stewardship concepts quite early. Europe holds over 30% share presently given long-running EPR schemes covering packaging, WEEE, and other waste streams paired with extremely high sustainability targets set by EU regulators and manufacturers. About 20–25% of the market is accounted for by Asia-Pacific. The product stewardship market is expanding at the quickest rate in the Asia-Pacific area. Nations like China, India, and others are enforcing stricter environmental laws to conform to international norms. Product management is becoming more and more important due to the rapid rise of industry and manufacturing. Demand for safer and more ethical products is driven by the growing middle class and growing awareness of sustainability. Currently, Latin America the Middle East, and Africa account for lesser shares of global revenue, but as more nations implement stewardship laws and build infrastructure for collection and sorting, constant sub-10 percent growth is anticipated.

COVID-19 Impact Analysis on the Product Stewardship Market:

When the pandemic hit, stewardship groups and recyclers were forced to suspend many collection services, reduce processing facility operations, and delay infrastructure projects to comply with public health precautions. Disruptions were most severe under strict lockdowns in Europe and North America from March to June 2020. Program funding also temporarily declined given member fees are volume-based and corporations cut spending to weather demand uncertainty. However, the pandemic made visible several risks regarding the interdependence of critical waste management infrastructure and vulnerabilities from reliance on complex global supply chains for manufacturing inputs. Recyclers lacked PPE equipment early on while feedstock prices spiked. These realizations are now driving efforts to onshore sensitive recycling activity, enhance domestic reprocessing capabilities, and stockpile certain reclaimed commodities as strategic reserves to mitigate future disruptions. Governments also dedicated stimulus funds to upgrade municipal recycling infrastructure and skills training to strengthen resilience.

Latest Trends/ Developments:

The product stewardship landscape is evolving rapidly alongside tighter regulations, ambitious corporate sustainability targets, and technological advances improving economics for reuse and recycling. Key trends shaping the industry include rising investment in collection infrastructure and reprocessing facilities, increased adoption of circular design principles, and new digital technologies enabling supply chain transparency. Stakeholders are ramping up capital commitments to expand waste collection networks and upgrade sorting and recycling infrastructure in recognition of systemic gaps hindering progress toward circularity goals. This infrastructure buildout will enable emerging engagement models based on convenience to drive consumer participation. Trends like deposit return schemes for beverage containers, at-home retrieval options for e-waste, and free take-back programs embedded in retailers are gaining traction. Digitization and emerging technologies like blockchain, IoT sensors, machine vision, and robotics are also enhancing transparency in complex recovery supply chains. Tagging systems can trace apparel from fiber harvesting through secondhand sales. Chemical markers verify trusted sources for recycled metals and minerals. This verifiable data improves accountability, optimization, and incentive mechanisms.

Key Players:

-

Sphera Solutions

-

Enablon

-

SAP

-

3E Company

-

Intelex Technologies

-

ERM

-

Gensuite

Chapter 1. Product Stewardship Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Product Stewardship Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Product Stewardship Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Product Stewardship Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Product Stewardship Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Product Stewardship Market – By Product Type

6.1 Introduction/Key Findings

6.2 Software

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Product Stewardship Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Chemicals

7.3 Electronics

7.4 Consumer Goods

7.5 Retail

7.6 Pharmaceuticals

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Distribution Channel

7.9 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Product Stewardship Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Product Stewardship Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Sphera Solutions

9.2 Enablon

9.3 SAP

9.4 3E Company

9.5 Intelex Technologies

9.6 ERM

9.7 Gensuite

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Globally, governments are tightening environmental regulations around hazardous substances, responsible disposal, and waste management (e.g., REACH in Europe, and TSCA in the US). This is forcing manufacturers to track and report product content proactively.

Keeping up with constantly evolving regulations across different regions can be a massive undertaking, especially for smaller companies. This makes compliance both costly and time-consuming.

Sphera Solutions, Enablon, SAP, 3E Company, Intelex Technologies, ERM, Gensuite.

North America currently holds the largest market share, estimated at around 35%.

Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.