Global Procurement Risk and Compliance Technology Market Size (2023-2030)

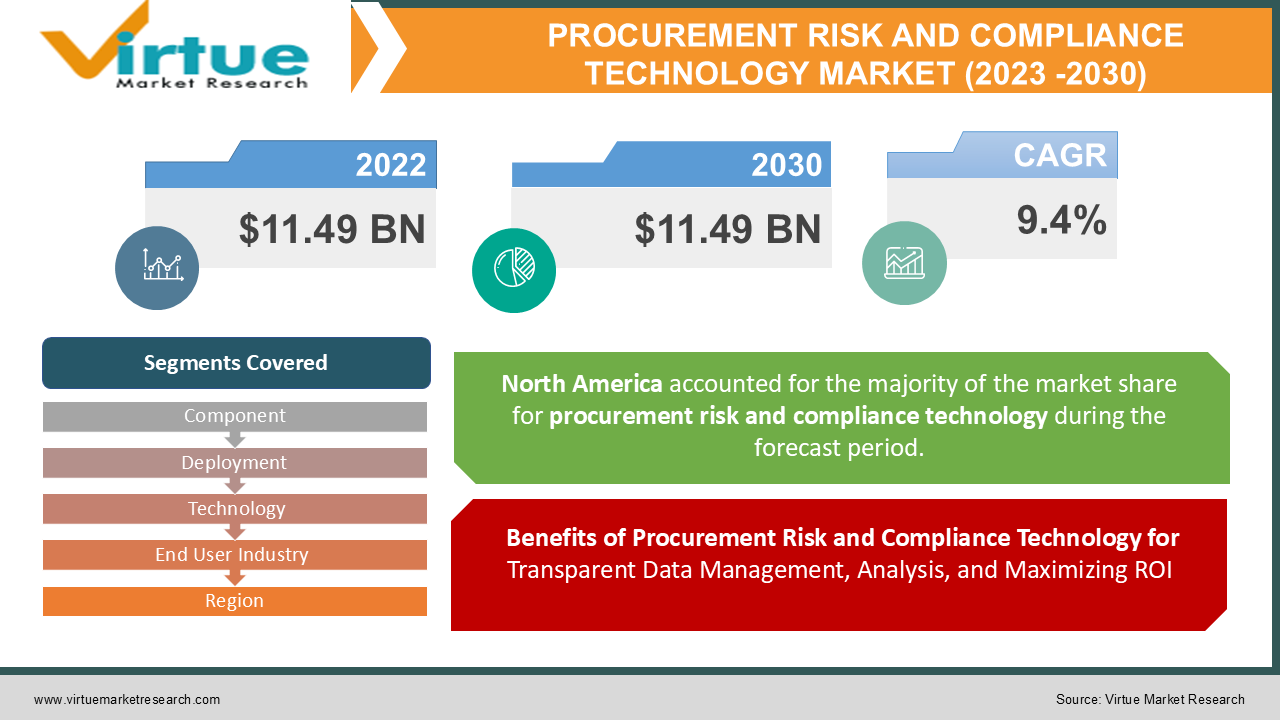

The Global Procurement Risk and Compliance Technology Market was valued at USD 11.49 billion and is projected to reach a market size of USD 11.49 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 9.4%.

Industry Overview:

E-procurement is the electronic implementation of the procurement cycle that includes steps from identifying requisitions, spending analysis, and setting up contracts with suppliers to the actual purchasing of products and supplier evaluation. It becomes essential to consider risks attached at every stage while procuring goods and services for any business. The risks of poor procurement are diverse and include non-compliance, poor vendor choice, chaotic vendor management, inaccurate need analysis, delays in procurement, error-prone manual internal processing, and talent shortages. Delays and mistakes in the procurement process can lead to wasted hours in chasing documentation or remedying errors. supply chain risk management solutions need to be adopted owing to the sheer volume of potential procurement risk factors. Procurement compliance includes formulating, following, and enforcing processes for company spend management. It ensures that all spending flows through a company-approved policy. Companies should employ effective forecasting methods to manage risks from the beginning. It is essential to establish a firm technological ground to streamline risk assessment processes and risk management solutions. With procurement risk and compliance technology, it becomes easier to monitor and effectively manage the procurement process in identifying bottlenecks as they occur. Technology reduces risks in procurement processes along with minimizing time spent on menial tasks, eliminating errors, and automating.

The procurement risk and compliance market are witnessing new developments and an increase in partnerships which results in the adoption of procurement software. According to Frevvo, the new generation of the procurement system is anticipated to be user-driven instead of office-controlled Nearly 70% of companies invest in such technology as more buyers prefer to interact with businesses via self-service portals.

COVID-19 impact on Procurement Risk and Compliance Technology Market

The COVID-19 outbreak has severely affected the logistics and supply chain of major companies with goods exceeding their expiration date and a rise in the costs of transportation which resulted in losses for the company. Warehouses became overcrowded owing to the lockdown imposed by the government. The shift to a digital model of procurement can lead to tracking goods received notes (GRN) and invoice reference numbers (IRN) which can ensure productivity during the lockdown period. Automation of the procurement payment process can boost the sales of procurement risk and compliance software solutions over the forecast period. E-procurement technology can help organizations in contacting suppliers of their choice and communicate in real-time for their sourcing needs. The use of IoT data and device check-ins can map and verify through all stages of a shipment’s chain of custody. Software companies are currently increasing their focus on in-demand technologies and re-exploring innovative ways to serve their clients owing to the challenges across multiple industries created by the covid crisis. Procurement technology can assist companies in identifying goods with the highest liabilities and dealing with preventive measures. The technology is likely to see greater adoption rates even after the pandemic as buyers need to strengthen their supply chains and reduce risks.

MARKET DRIVERS:

Driving Market Growth: Benefits of Procurement Risk and Compliance Technology for Transparent Data Management, Analysis, and Maximizing ROI

With a connected, centralized document repository and accessibility for key stakeholders at all levels, management and staff can collect, analyze, and transform data to create top-notch audit trails, accurate financial reports, and forecasts. The compliance function, working with the legal team, can also use the software to create templates for contracts and other documents designed with legal and financial compliance in mind. This saves time and work hours combined with the speed and simplicity provided by automated approvals and payments. AI-assisted automation and centralized documentation in addition to vendor evaluation, provide complete visibility to areas exposed to undue risk through a supplier’s noncompliance. A procurement software solution provides an effective tool for evaluating procurement functions and can certainly improve compliance across the board for the organization and supply chain which is contributing to the market growth.

Automation empowers Spending, Supplier, and Contract Compliance along with cost-cutting and Creating Value with Compliance which is fuelling the market growth

A dedicated software solution helps to build internal controls for every step of the procurement process, from purchase orders to payments, and allows clear, easily accessible tracking for authorizations. With the supply chain connected to the document library, it becomes easier to offer approved team members user-friendly catalogs for purchases from only preferred suppliers that meet legal, financial, and internal requirements. Accountability and access are both improved, along with procurement’s ability to connect with other departments in support of broader value-building, cost-saving initiatives. The procurement risk and compliance technology and tools simplify and streamline the process, and ensure the procurement department complies with its standards and practices.

Technological advances are making evolution to the supply chain industry which is boosting the market growth

Advances in ICT are making the evolution of the supply chain more possible. Emerging technologies such as IoT, cloud computing, blockchain, AI, 5G, and robotics are all crucial to enabling the digital supply network of the future. Transparency and accountability play a key role in a functional supply chain. The integration of Artificial Intelligence (AI) with the software is likely to provide extensive developmental opportunities in the procurement risk and compliance technology market over the forecast period. Technological advancements are poised to increase revenue creation for market participants. Technology can provide value to organizations, offering real-time visibility on suppliers and associated risks.

MARKET RESTRAINTS:

Failure to adopt technology or in realizing its full potential and lack of awareness about supply chain management solutions can restrain the growth of the market

Managing procurement processes manually can appear simple at first, but it can become a roadblock to success as the processes become more complex. As per a recent report from mobile and IoT management solutions provider, SOTI, 41% of British transport and logistics companies, and 49% of global T&L companies, identified that their businesses utilize legacy technology. Over one-third (37%) of all transport and logistics companies globally with outdated technology, admitted that they have been unable to upscale operations adequately during the pandemic owing to their legacy technology. One of the procurement challenges is to realize the potential of technology as a helpful hand in creating value for the company. To achieve future goals, it is critical to foster innovation and adopt digital procurement solutions that can decrease costs. The lack of skilled personnel is also an impediment to market growth. Awareness regarding supply chain management solutions and their benefits is low despite various supportive initiatives. Unlocking the full potential of SCM tools will require increased training on SCM principles, including improved information and communication within internal departments, information systems, and enhanced executive support.

Growing security and privacy concerns among enterprises and data leakage can negatively affect the market growth

The enterprises adopting cloud-based procurement risk and compliance technology may face security and privacy issues. The risk that sensitive information can fall into the wrong hands through malicious acts or simple oversight can lead to possible regulatory issues and other risks. Technology comes with its dangers as systems can be hacked resulting in the loss of vital information. The growing concern of cyber risk can be a challenge as cybercriminals increasingly see supply chains with their countless upstream and downstream vendors as a back-door hack into high-value corporate targets. Organizations need to have good-quality data and supplier information, to fully understand the potential risks they face. The security issues relating to the data access by unauthorized users are likely to threaten the enterprise data security and competitive business position which increases the privacy concern among the enterprises and can restrain the growth of the market.

PROCUREMENT RISK AND COMPLIANCE TECHNOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.4 % |

|

Segments Covered |

By Component, Deployment, Technology, End User Industry and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PricewaterhouseCoopers, Deloitte Touche Tohmatsu, Ernst & Young Global, SAP SE, Proactis Holdings Plc, Ginesys (Ginni Systems Limited), Epicor Software Corporation, Coupa Software Inc., GT Nexus (Infor Inc.), Epicor Software Corporation, Zycus Inc., Ivalua Inc., Microsoft Corporation, Oracle Corporation, Basware AS, Mercateo AG, GEP Corporation, and Jaggaer Inc. |

This research report on the global Procurement Risk and Compliance Technology Market has been segmented and sub-segmented based on component, deployment, technology, end-user industry, and region.

Procurement Risk and Compliance Technology Market – By Component

- Spend Analysis

- Strategic Sourcing

- Spend Management

- Process Management

- Category Management

- Contract Management

- Transaction Management

- Others

Based on the Component, the Procurement Risk and Compliance technology Market is segmented into Spend Analysis, Strategic Sourcing, Spend Management, Process Management, Category Management, Contract Management, Transaction Management, and Others. The Spend Analysis segment is anticipated to witness growing demand and display a CAGR of 10.6% during the forecast period. This is attributed to the ability to pinpoint purchase patterns and opportunities for cost savings. Compliance with the latest laws and organization of spending data enables companies to make informed decisions. The Strategic Sourcing segment accounted for a major market share of over 33% in 2021. The growing number of challenges, such as the COVID-19 pandemic, international political unrest, and natural disasters that make a long-lasting impact on businesses, enable organizations to adopt better sourcing strategies. Strategic sourcing helps companies meet efficiency and performance goals with a deep-level analysis of supplier performance, supply markets, and internal processes. Thus, strategic sourcing enables the effective execution of organizations’ sourcing strategies, thereby saving money.

The Transaction Management segment is anticipated to register considerable growth during the forecast period as effective transaction management is an essential component that helps end-users increase business profitability while engaging suppliers in long-term business relationships. The growing focus of organizations on optimizing price & terms, delivery, invoicing applications, and purchase order in the overall transaction process is likely to drive the segment growth in coming years. Moreover, the rise in automation and the growing need for market vendors to help understand enterprises’ complex dynamics of a commercial transaction environment are further providing numerous growth opportunities to the market.

Procurement Risk and Compliance Technology Market – By Deployment

- Cloud-based

- On-premises

Based on Deployment, the Procurement Risk and Compliance technology Market is segmented into Cloud-based and On-premises. The increasing adoption of cloud-based technologies is presenting a lucrative opportunity for market expansion. In terms of procurement, the usage of cloud-based technology allows efficient handling of the process of requisitioning, procuring, sourcing, and handling payments for services, among others. Procurement via cloud deployment offers an effective and organized system to keep business costs under control, enforce company policy, and appraise supplier risk. Cloud technology has enabled procurement software providers to adapt their products to web-based applications. The on-premise segment is anticipated to hold a significant market share during the forecast period owing to the preference for on-premise installation of the software by organizations. Organizations can train their personnel for using software for the purchase and pricing of goods for acquiring large quantities at nominal rates.

Procurement Risk and Compliance Technology Market – By Technology

- Artificial Intelligence

- Predictive Analytics

- Prescriptive Analytics

- Embedded Intelligence

- Enterprise Commerce Platforms

Based on Technology, the Procurement Risk and Compliance technology Market is segmented into Artificial Intelligence, Predictive Analytics, Prescriptive Analytics, Embedded Intelligence, and Enterprise Commerce Platforms. Artificial intelligence is increasingly being embedded in procurement platforms as it offers actionable and predictive insight, allowing procurement to mitigate disruption and make data-driven decisions. Predictive analytics identifies likely late deliveries even before an order is placed based on previous events. Prescriptive analytics assists teams in proactively mitigating the risk of late deliveries by leveraging a variety of supply sources. Embedded intelligence learns from human buying patterns, and automates end-to-end, human-free procurement. Enterprise commerce platforms present buyers and suppliers together on the same network and align buyer needs and supplier capabilities to integrate with outside solutions, creating a single data ecosystem.

Procurement Risk and Compliance Technology Market – By End User Industry

- Retail

- Manufacturing

- Transportation & Logistics

- Healthcare

- BFSI

- Others

Based on End-User Industry, the Procurement Risk and Compliance technology Market is segmented into Retail, Manufacturing, Transportation & Logistics, Healthcare, BFSI, and Others. The retail segment is anticipated to register a significant market share during the forecast period owing to rising demand for centralized procurement processes and efficient management of the inventory. The growing competition, diminishing brand loyalty, and falling margins, have made retailers adopt new ways to remain profitable and competitive. Retail enterprises are increasingly turning to their procurement teams to, mitigate supply risks, create more value, and reduce costs which have enabled the increased adoption of procurement software in the retail industry. The utilization of the procurement risk and compliance technology for automating tasks and procuring the best rates from the vendor can increase the market demand in the segment.

The Manufacturing segment leads the global market in 2021 and registered the largest share of more than 24.5% of the global revenue. The manufacturing sector is focusing on improving supply chain dynamics concerning direct inputs and raw materials with shorter lead times.

Procurement Risk and Compliance Technology Market - By Region

- North America

- Europe

- Asia-Pacific

- The Middle East, Latin America, and Africa

Geographically, the North American Procurement Risk and Compliance Technology Market dominates the global market and is anticipated to expand significantly during the forecast period owing to the rising demand for centralized procurement processes and the consolidation of companies incorporated in the region. The United States is rigorously looking to strengthen its manufacturing industry, by enhancing its productivity and improving activities across the supply chain, within the industrial sector. The e-retailers are rigorously trying to enhance the customer experience by incorporating same-day delivery, which can be achieved through effective supply chain management.

The European Procurement Risk and Compliance Technology Market account for the second-largest market share globally in 2021. This is attributed to growing retail and higher adoption of online channels. Germany is the highest shareholder in the procurement risk and compliance technology market in Europe. The UK is anticipated to register the highest CAGR in this region over the forecast period.

The Procurement Risk and Compliance Technology Market in the Asia Pacific is anticipated to register the highest CAGR during the forecast period. This growth is attributed to the growing adoption of new technologies, and huge investments in infrastructure by the government and private enterprises. The increased shift of enterprises toward agile supply chains with end-to-end visibility by the adoption of the latest technologies is one of the major drivers of the procurement risk and compliance technology market growth in the region.

The Procurement Risk and Compliance Technology Market in Latin America, the Middle East, and Africa is anticipated to grow moderately over the forecast period. The UAE is active in adopting the latest technologies and implementing them in various industries.

Major Key Players in the Market

Companies like

- PricewaterhouseCoopers

- Deloitte Touche Tohmatsu

- Ernst & Young Global

- SAP SE

- Proactis Holdings Plc

- Ginesys (Ginni Systems Limited)

- Epicor Software Corporation

- Coupa Software Inc.,

- GT Nexus (Infor Inc.)

- Epicor Software Corporation

- Zycus Inc.

- Ivalua Inc.

- Microsoft Corporation

- Oracle Corporation

- Basware AS

- Mercateo AG

- GEP Corporation and Jaggaer Inc.

Are playing a pivotal role in the Global Procurement Risk and Compliance Technology Market.

The procurement risk and compliance technology market is moderately concentrated, owing to the presence of many large and small players in the market operating in the domestic as well as the international market. Players in the market are engaged in key strategies, such as product innovation, strategic partnerships and mergers, and acquisitions.

Notable happenings in the Global Procurement Risk and Compliance Technology Market in the recent past:

- Product Launch- In December 2021, SAP SE created CommBox AI omnichannel solution to change the way brands communicate with their customers by providing a robust platform that unifies all customer interactions in one smart inbox. CommBox integrated into SAP Sales Cloud, enabling it to become fully omnichannel & powered by AI capabilities.

- Partnership- In January 2020, GEP announced its partnership with Brunei Shell Petroleum Company Sdn Bhd (BSP) to manage complete source-to-pay over its subsidiary operations which may include a full range of functions including sourcing, contract, and supplier management, purchasing, spending analysis, savings tracking, and invoice handling.

- Partnership- In February 2020, Proactis announced a new partnership with Agilyx Group, a global change-ready technology specialist, to provide a range of spend management solutions to Agilyx customers. Through this partnership, Agilyx can identify a customer’s unmet need and decide to make a change to be fulfilled by Proactis technology, and allow that customer to leverage additional value from their current ERP solution.

- Partnership- In March 2020, GEP, a provider of procurement software and procurement services, announced its partnership with Cheniere Energy Inc. to offer its procurement software, GEP SMART.

- Product Launch- In April 2020, Epicor Software Corporation announced the launch of a new portal to its existing Epicor Commerce Connect solution, Epicor Commerce Connect Express. The product is designed to improve productivity in the business, offer quality online experiences, and stay connected to valued customers and suppliers.

- Product Launch- In June 2020, CobbleStone Software announced the release of Contract Insight Enterprise 17.6.0 which brings forth numerous new and improved feature offerings to enhance the leading contract management, vendor management, procurement, and sourcing platform. It enables users to initiate and manage documents for record creation on their time with control over their AI-based process, with Contract Insight's drag and drop record queue.

Chapter 1. Procurement Risk and Compliance Technology Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Procurement Risk and Compliance Technology Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Procurement Risk and Compliance Technology Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Procurement Risk and Compliance Technology Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Procurement Risk and Compliance Technology Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Procurement Risk and Compliance Technology Market – By Component

6.1. Spend Analysis

6.2. Strategic Sourcing

6.3. Spend Management

6.4. Process Management

6.5. Category Management

6.6. Contract Management

6.7. Transaction Management

6.8. Others

Chapter 7. Procurement Risk and Compliance Technology Market – By Deployment

7.1. Cloud-based

7.2. On-premises

Chapter 8. Procurement Risk and Compliance Technology Market – By Technology

8.1. Artificial Intelligence

8.2. Predictive Analytics

8.3. Prescriptive Analytics

8.4. Embedded Intelligence

8.5. Enterprise Commerce Platforms

Chapter 9. Procurement Risk and Compliance Technology Market – By End-User

9.1. Retail

9.2. Manufacturing

9.3. Transportation & Logistics

9.4. Healthcare

9.5. BFSI

9.6. Others

Chapter10. Procurement Risk and Compliance Technology Market- By Region

10.1. North America

10.2. Europe

10.3. Asia-Pacific

10.4. Latin America

10.5. The Middle East

10.6. Africa

Chapter 11. Procurement Risk and Compliance Technology Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. PricewaterhouseCoopers

11.2. Deloitte Touche Tohmatsu

11.3. Ernst & Young Global

11.4. SAP SE

11.5. Proactis Holdings Plc

11.6. Ginesys (Ginni Systems Limited)

11.7. Epicor Software Corporation

11.8. Coupa Software Inc.,

11.9. GT Nexus (Infor Inc.)

11.10. Epicor Software Corporation

11.11. Zycus Inc.

11.12. Ivalua Inc.

11.13. Microsoft Corporation

11.14. Oracle Corporation

11.15. Basware AS

11.16. Mercateo AG

11.17. GEP Corporation and Jaggaer Inc.

Download Sample

Choose License Type

2500

4250

5250

6900