Procurement Data Intelligence Market Size (2023 – 2030)

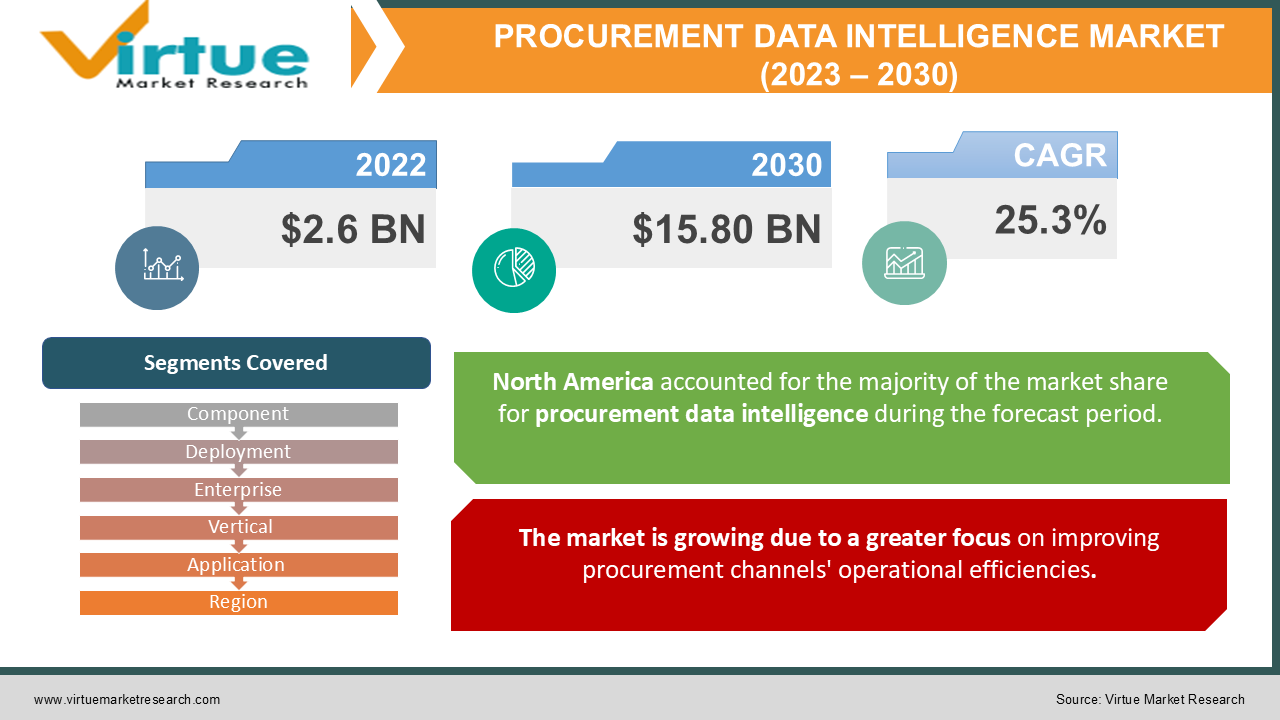

In 2022, the Global Procurement Data Intelligence Market was valued at $2.6 billion, and is projected to reach a market size of $15.80 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 25.3%. The use of procurement data intelligence technologies and services is projected to be driven by some factors, including increased expenditure on marketing and advertising by businesses, a changing landscape of consumer intelligence to drive the market, and the expansion of customer channels.

Market Overview

The practice of employing quantitative approaches to obtain actionable insights and outcomes from data is known as procurement data intelligence. It entails gathering and analysing data to enable fact-based decision-making. It usually reports on what has happened in the past and makes predictions based on historical data using predictive analytics. Purchasing of goods and services, vendor selection, sourcing, defining payment conditions, contract negotiations, and strategic vetting are all procedures that are important in creating an organization's business strategy. In organisations, these procedures create massive amounts of data. The use of analytics for these data entails a variety of quantitative methodologies that can assist firms to generate actionable insights and outcomes that can aid in strategic decision-making and competitive advantage. Procurement analytics solutions primarily use predictive analytics on historical data sets of firms to make forecasts for the future, which assists management people in making crucial procurement choices.

The procurement sector is gaining new insights through the use of robust data analytics, which may be used in negotiations, vendor segmentation, performance management, and annual purchasing plan. The procurement department has a large amount of data, including transaction history, expenditure details, and other information. With the support of intelligent argumentation, the use of analytics in procurement data can lead to improved business decisions.

Covid-19 Impact on Procurement data intelligence market

The extraordinary severity of the health issue has reverberations across a variety of industries, including hospitality, healthcare, consumer electronics, banking and finance, and technology. This crisis has caused firms to not only face new obstacles but also to change their business strategies. However, the procurement industry is expanding, since procurement may help businesses mitigate the economic effects of the pandemic and assist other businesses in growing and executing their operations, boosting the adoption of procurement analytics. Furthermore, businesses have begun to focus on and engage with their network of suppliers, internal customers, and external partners. As a result, firms are required to increase their focus on procurement activities. As a result of the increased attention on procurement operations, it is projected that businesses will be more focused on their procurement strategy, creating attractive prospects for the procurement data intelligence market.

MARKET DRIVERS

The market is growing due to a greater focus on improving procurement channels' operational efficiencies.

The procurement analytics market is driven by the growing requirement to predict losses and risks, enhance productivity, reduce operational costs, and achieve consistent business growth. Procurement analytics provides data-driven knowledge that helps companies lower total procurement costs and enhance service levels. With the increased use of analytics tools, procurement processes such as planning, design, production, delivery, and service have improved. As a result, business growth has been hindered, resulting in a rise in demand for procurement analytics solutions. With capabilities such as plan compliance analytics, spend analysis, inventory optimization, vendor management, contract management, route and network optimization methods, and price optimization, the solutions help businesses to make well-informed decisions.

The introduction of machine learning and artificial intelligence (AI) into the procurement process is accelerating industry growth.

Organizations' ability to gather information, analyse it, and make informed decisions has improved thanks to machine learning and artificial intelligence. These technologies are making their way into procurement platforms and technology to help firms improve their capabilities and offerings. AI technologies are being used by businesses to speed up purchase decisions. The AI system examines and recommends modifications to Governance, Risk Management, and Compliance (GRC). As a result, it aids in the monitoring and collection of data of sufficient quality to meet regulatory requirements. By analysing data acquired from different sources, providers have been able to better comprehend customers' perceptions and organisation expenditure habits thanks to the advent and rising deployment of ML and AI. By studying customers' purchase behaviours, businesses have moved their attention to providing a unified customer experience across channels and providing real-time offers. AI technologies assist businesses and suppliers by detecting supply chain disruptions, detecting fraud, and recognising and flagging supplier compliance issues, allowing for smarter procurement.

MARKET RESTRAINTS

Enterprises are becoming increasingly concerned about data security which is hampering the market growth

Enterprises that use procurement analytics tools confront concerns about security and privacy. They hold sensitive information that must be safeguarded to avoid data breaches and theft, which could harm an organization's brand and revenue. The fact that analytical providers have access to such confidential data has raised concerns among organisations that their data could be leaked over the internet and accessed by unauthorised users; for example, the Transportation Management System (TMS) requires a multi-tenant architecture, in which a single version of the software runs on a server shared by multiple customers. Subscribers to an enterprise may be able to see data from competitors in this scenario. These data security risks involving unauthorised users would jeopardise the enterprise's data security and competitive business position. As a result, worries about security and privacy are growing among businesses. As a result, the procurement data intelligence market's growth may be limited throughout the projection period.

The market's expansion is being hampered by a lack of analytical skills.

Enterprises have been using procurement analytics solutions to improve their procurement portfolio since the introduction of analytical capabilities into organisational procurement platforms. Employees are usually in charge of using platforms to get insights from data. To acquire precise insights, rapidly rising big data across industrial verticals must be correctly modelled, merged, wrangled, and then analysed. Data scientists need specific skills to recognise and uncover trends that help marketers make informed decisions, from data ingestion to data reporting. However, one of the key issues that diverse businesses confront is a lack of knowledge in recognising the relevance of procurement analytics.

PROCUREMENT DATA INTELLIGENCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

25.3% |

|

Segments Covered |

By Component, Deployment, Enterprise, Vertical, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SAP (Germany), Oracle (US), SAS Institute (US), Coupa Software (US), Genpact (US), Rosslyn Data Technologies (UK), Microsoft (US), IBM (US), Cisco (US), GEP (US), Corcentric (US), and Zycus |

This research report based on the Procurement data intelligence market is segmented and sub-segmented by component, deployment, enterprise, vertical, application and region.

Procurement data intelligence market by component

- Solution

- Services

The global market is divided into solutions and services based on their components. Enterprises use solutions from market players such as Board International's Board 11, SAP Analytics Cloud & SAP BusinessObjects Lumira, Yellowfin B1, Tableau (Server, Desktop, Online, Prep), and QlikSerise & QlikView, among others, to derive actionable insights from real-time and historical business performance tracking. In addition, the integration of artificial intelligence-driven analytics solutions with the business intelligence platform is expected to increase demand for enhanced visualisation. Similarly, Bi Augmented Analytics based on augmented reality would ensure that these technologies are transformed in the long run.

Procurement data intelligence market by deployment

- Cloud

- On-premise

The market is segmented into cloud and on-premise deployments. In 2020, on-premise deployment will have the most market share, but cloud deployment is predicted to increase at the fastest rate during the projection period. Enterprises with on-premises deployments can benefit from cloud adoption. The applications are designed to increase the utilisation of storage, networking, and tools while also providing analytical capabilities. Cloud deployments allow the company to administer its apps without having to worry about the Bl infrastructure. This element aids the organisation in increasing productivity, reducing operational costs, and optimising implementation schedules. As a result, cloud deployment is likely to rise at a rapid pace.

Procurement data intelligence market by enterprise

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

The market is divided into small and mid-size businesses and major businesses based on their size. Large businesses are likely to account for the majority of the market, owing to significant expenditure and the availability of IT infrastructure, among other factors.

Due to the increased deployment of software for smooth operating, SMEs are predicted to grow at the fastest rate. Through commercials and targeted marketing activities, it plays an essential role in enhancing client happiness. Aside from that, resource optimization and constant productivity evaluation are two factors that fuel the demand for innovative tools among SMEs.

Procurement data intelligence market by Vertical

- BFSI

- Retail and eCommerce

- Telecom and IT

- Manufacturing

- Healthcare and Life Science

- Energy and Utilities

- Government and Defence

The telecom and IT industry are fiercely competitive, and companies are constantly striving to improve their services to attract new clients and maintain existing ones. The demand for procurement analytics solutions has grown as the telecom business has become more complex and the number of service providers has increased. The rapid adoption of smartphones and other connected mobile devices has increased the amount of data passing over telecom networks. The data must be processed, stored, and information extracted by the operators. By minimising network consumption, improving customer experience, and increasing scalability, procurement analytics may help them optimise profitability.

Procurement data intelligence market by application

- Supply chain analytics

- Risk Analytics

- Spend Analytics

- Demand Forecasting

- Contract Management

- Vendor Management

- Category Management

During the projection period, the Supply Chain Analytics sector will account for a greater market share. The use of various analytics technologies to improve supply chain operational efficiency and effectiveness with data-driven insight is known as supply chain analytics. Manufacturing, retail and consumer products, energy and utilities, and healthcare are all expected to use supply chain analytics tools to make educated decisions about procurement, supplier performance, inventory management, demand planning and forecasting, and supply chain optimization. Supplier performance analytics, spend and procurement analytics, inventory analytics, demand analysis and forecasting, and transportation and logistics analytics are just a few of the supply chain analytics solutions offered by industry companies.

Procurement data intelligence market by region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

North America, Europe, APAC, Latin America, and MEA are the five primary regions that make up the procurement data intelligence industry. During the projection period, APAC is expected to grow at a healthy rate. The region will be booming, as it is seeing a lot of new entrepreneur setups, who will be aiming to gain new clients and earn customer trust by implementing new sophisticated analytics paradigms to obtain a competitive advantage over the incumbent companies. In the procurement data intelligence industry, China, Japan, and India have all shown significant development potential.

During the projected period, North America is expected to dominate the market in terms of revenue. The rapid development and acceptance of innovative technologies, as well as significant firms like Microsoft Corporation, Oracle Corporation, Tableau Software, LLC, and others, are projected to drive regional growth.

The UK government is dedicated to developing good infrastructure to support big data analysis. The government has funded around USD 222.6 million in capital funding in energy-efficient computing and data centres, according to the UX, trade and investment report. This indicator demonstrates that the region has strong government support and significant investment, both of which will aid market expansion. Organizations like the British Healthcare Business Intelligence Association promote knowledge of healthcare in the United Kingdom.

Procurement data intelligence market by company

To expand their market offers, procurement data intelligence suppliers have used a variety of organic and inorganic growth tactics, such as new product launches, product upgrades, partnerships and agreements, corporate expansions, and mergers and acquisitions.

- SAP (Germany),

- SAS Institute (US)

- Coupa Software (US),

- Genpact (US)

- Microsoft (US)

- IBM (US)

- Cisco (US)

- GEP (US)

- Corcentric (US),

- Zycus

NOTABLE HAPPENINGS IN THE PROCUREMENT DATA INTELLIGENCE MARKET IN THE RECENT PAST:

PRODUCT LAUNCH

- In May 2021, IBM released Watson AIOps, an AI-based tool that automates how businesses self-detect, diagnose, and respond to IT abnormalities in real-time. It could work in any hybrid cloud setting.

- In July 2020, GEP announced its next-generation accounts payable (AP) automation platform to satisfy market demand for a cloud-native solution that optimises and accelerates AP operations using artificial intelligence and machine learning.

- In June 2020, SAP will deploy the Corona Warn App for the German government. SAP and Deutsche Telekom, as well as other partners, collaborated on the app's development. It was created in an open-source manner, with the source code available to the public on the GitHub development site.

Chapter 1.PROCUREMENT DATA INTELLIGENCE MARKET -– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.PROCUREMENT DATA INTELLIGENCE MARKET -– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.PROCUREMENT DATA INTELLIGENCE MARKET -– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.PROCUREMENT DATA INTELLIGENCE MARKET - - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. PROCUREMENT DATA INTELLIGENCE MARKET -- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.PROCUREMENT DATA INTELLIGENCE MARKET -– By Component

6.1. Solution

6.2. Services

Chapter 7.PROCUREMENT DATA INTELLIGENCE MARKET -– By Deployment

7.1. Cloud

7.2. On-premise

Chapter 8.PROCUREMENT DATA INTELLIGENCE MARKET -– By Enterprise

8.1. Large Enterprises

8.2. Small and Medium-Sized Enterprises (SMEs)

Chapter 9.PROCUREMENT DATA INTELLIGENCE MARKET -– By Vertical

9.1. Retail and eCommerce

9.2. Telecom and IT

9.3. Manufacturing

9.4. Healthcare and Life Science

9.5. Energy and Utilities

9.6. Government and Defence

Chapter 10.PROCUREMENT DATA INTELLIGENCE MARKET -– By Application

10.1. Supply chain analytics

10.2. Risk Analytics

10.3. Spend Analytics

10.4. Demand Forecasting

10.5. Contract Management

10.6. Vendor Management

10.7. Category Management

Chapter 11.PROCUREMENT DATA INTELLIGENCE MARKET -– By Region

11.1. North America

11.2. Europe

11.3. The Asia Pacific

11.4. Latin America

11.5. The Middle East

11.6. Africa

Chapter 12..PROCUREMENT DATA INTELLIGENCE MARKET -– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

12.1. SAP (Germany),

12.2. SAS Institute (US)

12.3. Coupa Software (US),

12.4. Genpact (US)

12.5. Microsoft (US)

12.6. IBM (US)

12.7. Cisco (US)

12.8. GEP (US)

12.9. Corcentric (US),

12.10. Zycus

Download Sample

Choose License Type

2500

4250

5250

6900