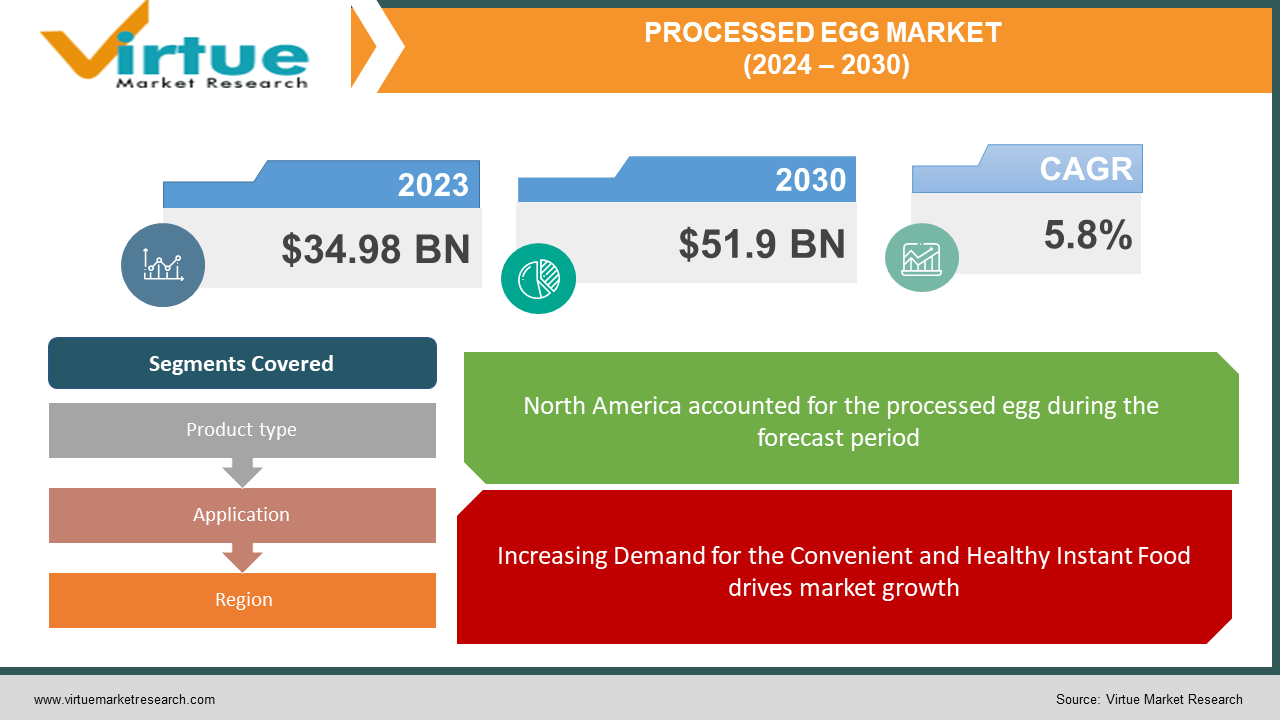

Processed Egg Market Size (2024 – 2030)

The Processed Egg Market was valued at USD 34.98 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 51.9 billion by 2030, growing at a CAGR of 5.8%.

Key Market Insights:

Processed eggs undergo a production process that involves the removal of eggshells and the separation of the resulting liquid product into egg yolk and egg white, rendering them suitable for diverse applications. Key steps in the manufacturing of processed eggs encompass eggshell removal, filtration, mixing & blending, stabilization, pasteurization, drying/freezing, and packaging. These processed eggs find utility as an ingredient across a spectrum of applications including baked goods, confectionery, sauces, dressings, spreads, and personal care items like shampoo and soap. Their nutritional value, bioactivity, and functional attributes enhance their applicability. However, the availability of alternative products like yogurt, non-fat dried milk, and vegetable oils may limit the utilization of processed eggs. Nevertheless, the exceptional nutritional and functional qualities of processed eggs present significant growth prospects for their integration into the food and beverage sector.

Processed Egg Market Drivers:

Increasing Demand for the Convenient and Healthy Instant Food drives market growth.

The market is primarily propelled by elevated spending on food and beverages, the introduction of products boasting extended shelf life, a surge in impulse purchasing, and escalating demand for convenient foods that can be swiftly prepared, driven by time constraints. These dynamics have fostered a necessity for household stockpiling of long-lasting food items, consequently bolstering frozen food sales. For example, as per the egg market news report issued by the USDA last year, there is a heightened demand for freeze-dried whole eggs, largely influenced by seasonal requirements and routine commitments.

The burgeoning urban populace and hectic lifestyles have led to an augmented craving for convenience foods. Many consumers are inclined to invest in convenience foods due to a lack of time or culinary expertise for home-cooked meals. Consequently, there has been a surge in the demand for convenience food retail. Processed eggs streamline the culinary process by obviating the need to crack shells and manually separate egg components.

The rise of the bakery industry drives market growth

The bakery industry is witnessing robust expansion on a global scale, propelled primarily by the dynamic evolution of consumer preferences regarding taste, flavors, and freshness in products. This evolution in consumer tastes significantly contributes to the sector's growth, as the food industry demonstrates the highest levels of product innovation. In mature markets, growth is chiefly stimulated by shifting lifestyles and an increasing desire for comfort foods. Such markets experience growth due to heightened consumer awareness about health and a simultaneous rise in the consumption of indulgent foods.

Europe and North America emerge as major hubs for the bakery industry, yielding substantial revenues. However, the Asia-Pacific region is poised to emerge as the fastest-growing market in terms of revenue generation. Consequently, with the escalating consumption of bakery products and the overall expansion of the bakery industry, the processed eggs market is anticipated to witness significant growth during the review period.

Processed Egg Market Restraints and Challenges:

There is a rapidly increasing trend among consumers towards adopting healthier lifestyles, driven by concerns over the prevalence of obesity, diabetes, and cardiovascular diseases associated with unhealthy habits. Healthy eating habits are often associated with plant-based diets, which emphasize the consumption of whole, plant-based foods while discouraging the intake of meats, dairy products, eggs, and refined or processed foods. The growing emphasis on animal welfare, human health, and environmental sustainability has fueled the mainstream adoption of veganism. Vegan diets are recognized for their various health benefits, including enhanced heart health, improved management of diabetes, and lower obesity rates.

Countries such as Israel, Sweden, Japan, Poland, the US, Germany, and the UK have emerged as centers of veganism, boasting significant concentrations of adherents to this lifestyle. The widespread use of social media and the emergence of influential vegan celebrities have played pivotal roles in driving the popularity of the vegan movement. Consequently, the increasing adoption of vegetarian and vegan diets poses a challenge to the growth of the processed eggs market.

Processed Egg Market Opportunities:

Individuals may develop wheat allergies from products containing wheat, wherein the body produces antibodies in response to wheat proteins. Exposure to these proteins can trigger allergic reactions in individuals with wheat allergies. Wheat contains four classes of proteins—globulin, albumin, gliadin, and gluten—and allergy can develop to any of these proteins. In celiac disease, a specific protein in wheat called gluten triggers an abnormal immune system response.

Wheat allergies can manifest in various difficulties for individuals, including chest pain or tightness, severe difficulty breathing, nasal congestion, and trouble swallowing, among others. The myriad challenges posed by wheat protein allergies, coupled with increasing consumer awareness about wheat allergies, present significant growth opportunities for processed eggs.

PROCESSED EGG MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Glon Group, Actini Group, SKM Egg Products Export, Avril SCA, Igreca S.A, Rose Acre Farms, Ballas Egg Products Corporation, Bouwhuis Enthoven BV, Sanovo Technology Group, Rembrandt Enterprises Inc. |

Processed Egg Market Segmentation - By Product Type

-

Liquid Egg

-

Frozen Egg

-

Dried Egg

-

Other Product Types

The dried egg products segment holds a significant portion of the global revenue share, attributed to its extended shelf life and heightened stability compared to other egg products. These products are widely utilized as substitutes for fresh eggs in various bakery items such as cookies, cakes, ice creams, sauces, and doughnuts, owing to their superior emulsifying properties. Moreover, there is a plethora of opportunities for egg powder production facilities across multiple industries, including hospitals, military establishments, and restaurants, anticipated in the forthcoming years.

On the other hand, liquid egg products are poised for substantial growth at a compound annual growth rate (CAGR) during the projected period. These products have garnered substantial popularity, particularly in the food service sector, owing to their composition primarily comprising egg whites separated from yolk combinations. Additionally, the ease of transportation of liquid egg products and their adoption in various ready-to-eat meals and confectionery items are driving growth in this segment market.

Processed Egg Market Segmentation - By Application

-

food & beverages

-

Bakery

-

Dairy Products

-

Confectionery

-

Ready-to-eat Food

-

Nutritional Supplements

-

Other Applications

The food & beverages segment has secured the largest market share, further segmented into bakery & confectionery, sauces, dressings & spreads, sweet & savory snacks, and other subcategories. Processed eggs are extensively utilized across various applications within the food & beverages sector. The growing consumer preference for protein-rich food items is a key driver of segment growth. Moreover, the increasing demand for functional beverages, driven by heightened health consciousness among consumers, has prompted key industry players to introduce products featuring various health-enhancing ingredients. This trend has contributed to a surge in sales of processed eggs within the beverage industry.

Processed Egg Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America commands a substantial share of market revenue and is expected to maintain stability in terms of growth in the foreseeable future, primarily due to the presence of a diverse array of processed egg products and a culture of high product innovation within the region. Additionally, the prevalence of busy lifestyles and a growing demographic of consumers seeking convenient yet health-conscious meal options, coupled with the thriving bakery sector in the United States, are poised to significantly contribute to regional market expansion.

Meanwhile, Asia Pacific is emerging as the fastest-growing region in the market over the forecast period, driven by factors such as rapid population growth, urbanization, and increasing awareness regarding the nutritional benefits of processed eggs in the region. Furthermore, the rising number of athletes and sports enthusiasts hailing from countries such as China, Japan, and India, who require protein-rich products to maintain optimal fitness levels, is expected to propel the rapid adoption of processed eggs across the region.

COVID-19 Pandemic: Impact Analysis

The emergence of the COVID-19 pandemic has had a notable impact on the growth and demand of the processed eggs market. With numerous countries implementing lockdown measures and border closures to mitigate the spread of the virus, the global supply chain experienced significant disruptions, leading to challenges for manufacturing firms. However, amidst these challenges, the pandemic has spurred increased sales of processed eggs through eCommerce platforms. This shift towards online sales channels is expected to drive heightened demand for eggs and facilitate rapid market growth.

Latest Trends/ Developments:

-

In January 2023, Cal-Maine Foods, the leading producer and distributor of fresh shell eggs in the United States, unveiled a strategic partnership with Entegrity Energy Partners.

-

In July 2022, Sanovo Technology disclosed its strategic investment with Ovotrack in Ovotrack Holding. Ovotrack Holding is a prominent provider of traceability and inventory management solutions tailored for egg processing plants, grading centers, and hatcheries.

Key Players:

These are the top 10 players in the Processed Egg Market: -

-

Glon Group

-

Actini Group

-

SKM Egg Products Export

-

Avril SCA

-

Igreca S.A

-

Rose Acre Farms

-

Ballas Egg Products Corporation

-

Bouwhuis Enthoven BV

-

Sanovo Technology Group

-

Rembrandt Enterprises Inc.

Chapter 1. Processed Egg Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Processed Egg Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Processed Egg Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Processed Egg Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Processed Egg Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Processed Egg Market – By Product Type

6.1 Introduction/Key Findings

6.2 Liquid Egg

6.3 Frozen Egg

6.4 Dried Egg

6.5 Other Product Types

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Processed Egg Market – By Application

7.1 Introduction/Key Findings

7.2 food & beverages

7.3 Bakery

7.4 Dairy Products

7.5 Confectionery

7.6 Ready-to-eat Food

7.7 Nutritional Supplements

7.8 Other Applications

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Processed Egg Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Processed Egg Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Glon Group

9.2 Actini Group

9.3 SKM Egg Products Export

9.4 Avril SCA

9.5 Igreca S.A

9.6 Rose Acre Farms

9.7 Ballas Egg Products Corporation

9.8 Bouwhuis Enthoven BV

9.9 Sanovo Technology Group

9.10 Rembrandt Enterprises Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is primarily propelled by elevated spending on food and beverages, the introduction of products boasting extended shelf life, a surge in impulse purchasing, and escalating demand for convenient foods that can be swiftly prepared, driven by time constraints.

The top players operating in the Processed Egg Market are - Glon Group, Actini Group, SKM Egg Products Export, Avril SCA, Igreca S.A, Rose Acre Farms, Ballas Egg Products Corporation, Bouwhuis Enthoven BV, Sanovo Technology Group, Rembrandt Enterprises Inc.

The emergence of the COVID-19 pandemic has had a notable impact on the growth and demand of the processed eggs market.

Wheat allergies can manifest in various difficulties for individuals, including chest pain or tightness, severe difficulty breathing, nasal congestion, and trouble swallowing, among others. The myriad challenges posed by wheat protein allergies, coupled with increasing consumer awareness about wheat allergies, present significant growth opportunities for processed eggs

Asia Pacific is emerging as the fastest-growing region in the market over the forecast period, driven by factors such as rapid population growth, urbanization, and increasing awareness regarding the nutritional benefits of processed eggs in the region.