Probiotic Seltzer Market Size (2025-2030)

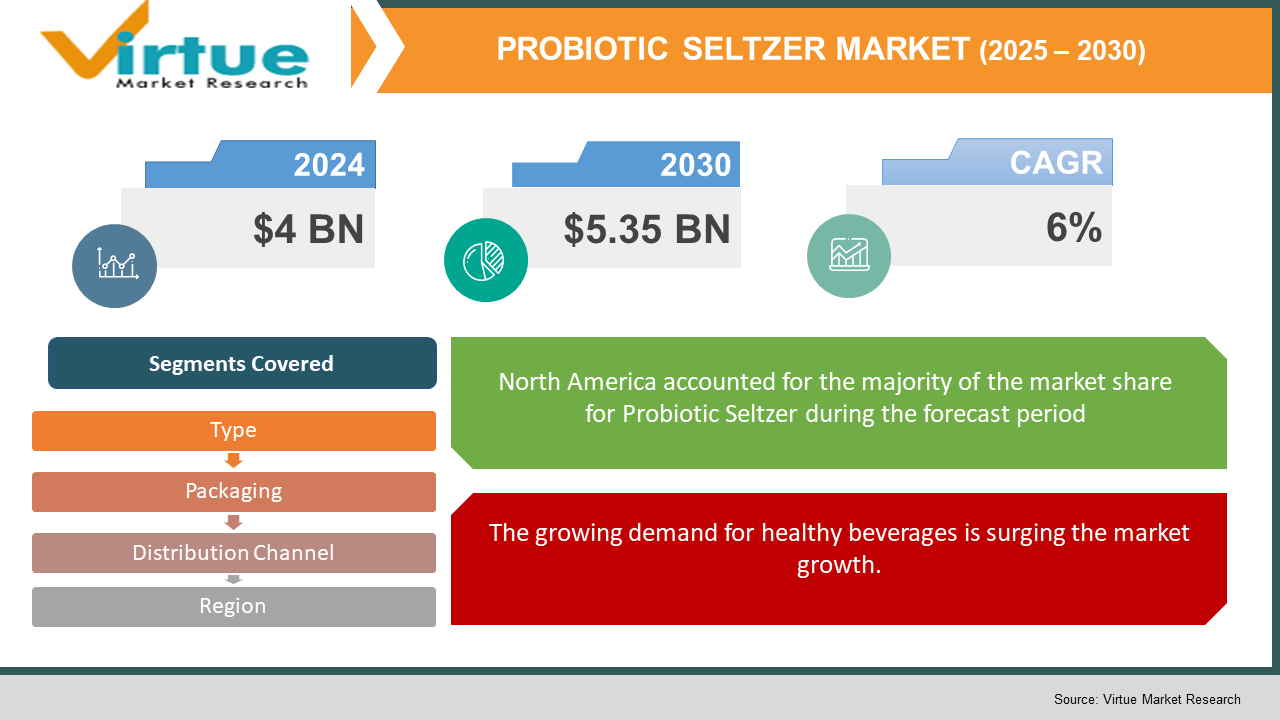

The Global Probiotic Seltzer Market was valued at USD 4 billion in 2024 and is projected to reach a market size of USD 5.35 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6%.

A rise in the demand for functional beverages worldwide to enhance digestive well-being is supporting the growth of the market year by year. Probiotic drinks aid in maintaining a healthy gut and stomach bacteria balance, along with various health benefits like digestive health, weight loss, and immune function. A probable daily intake of probiotics enhances bowel movement, food digestion, and nutrient absorption. As such, with increasing awareness of the product and recognition of its importance towards gut health, the demand for it has been growing enormously. Moreover, increasing health consciousness among people, particularly in the youth sector, has boosted the demand for the product on a global front. In addition, the easy availability of ready-to-drink products has facilitated consumption even while on the go, propelling the demand for the market. Some flavors, like citrus and others, are also becoming commercially popular among consumers. The increasing acceptance and popularity of new flavors among consumers are also expected to present opportunities to the players in this market. Also, these beverages promote mental well-being, as many studies have established that mood and mental well-being are connected to gut health. Therefore, the product assists with depression, anxiety, autism, and other mental diseases.

Key Market Insights:

- In 2023, probiotic sodas accounted for 54.76% of global revenues. The demand is driven by consumers seeking gut-friendly products that promote digestive health.

- Fruit-flavored probiotic and prebiotic sodas dominated the market in 2023, capturing 81.07% of global revenues. Their popularity stems from perceived health benefits and consumer preference for flavorful, functional beverages.

- In 2024, offline channels, including supermarkets and convenience stores, accounted for 56.26% of global revenues. These venues offer visibility and accessibility, driving impulse purchases.

Global Probiotic Seltzer Market Drivers:

The growing demand for healthy beverages is surging the market growth.

Fast-spreading diseases such as acidity, gastric problems, and constipation among individuals of all ages are projected to drive the growth of the Probiotic Seltzer market, globally. The beverages offer numerous health benefits such as weight loss, enhancing the digestive strength of the body, enhancing mental well-being, eliminating toxic substances, and enhancing immunity. These factors are expected to drive the growth of the market during the forecast period. Thus, the growing demand for healthy drinks among consumers because of the widespread occurrence of gastrointestinal diseases and disorders such as constipation is expected to propel the market for Probiotic Seltzers during the forecast period.

The expansion of the product portfolio by the major key players is fuelling the market growth.

The expansion in the current probiotic drink products and new product launches in the form of new flavors and soda probiotic drink products with innovative packaging are expected to grow the probiotic seltzer market in the coming years. Leading key market player firms in the Probiotic market have begun focusing on new product offerings to cater to the growing need for high-nutrition probiotic drinks with better consumer taste options. These reasons are expected to propel the Probiotic Seltzer industry in the years to come.

Global Probiotic Seltzer Market Restraints and Challenges:

The high cost of probiotic drinks is hindering market growth in developing nations.

The probiotic seltzer market in emerging countries is also highly challenged by its high price, which makes it less affordable for price-conscious consumers. Although the demand for beverages focused on gut health is increasing, the premium nature of probiotic seltzers due to highly expensive production processes, specialty ingredients, and refrigeration requirements restricts its adoption. Moreover, insufficient awareness, reduced disposable incomes, and access to low-cost alternatives also hinder market penetration. To surpass these obstacles, brands need to emphasize cheap production, in-market marketing practices, and cost-effective packaging methods to position probiotic seltzers more affordably toward a wider clientele.

Global Probiotic Seltzer Market Opportunities:

The world probiotic seltzer market offers huge growth prospects fueled by growing consumer awareness of gut health, expanding demand for functional drinks, and changing preferences for natural, low-sugar beverages. As e-commerce and direct-to-consumer channels expand, brands can reach more consumers, including health-aware millennials and Gen Z consumers. Furthermore, innovation in flavors, combinations of ingredients, and eco-friendly packaging can differentiate products in a crowded marketplace. Increased demand for plant-based and dairy-free probiotics also provides opportunities for more extensive adoption. Players who prioritize affordable prices, tactical marketing, and pushing into new markets can benefit from the rising global demand for probiotic seltzers.

PROBIOTIC SELTZER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, Packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Yakult Honsha Co. Ltd., Danone S.A., Nestle SA, Chobani LLC, NextFoods, Harmless Harvest, and GCMMF |

Global Probiotic Seltzer Market Segmentation:

Probiotic Seltzer Market Segmentation: By Type

- Dairy-based

- Plant-based

Dairy-based products have the highest market revenue share of over 55.5%. In most cases, probiotic beverages are associated with fermented dairy beverages or yogurt-based beverages since they are highly compatible with dairy beverages. Drinkable yogurt is one of the favorite drinks in the United States, and the growing niche for carbonated drinkable yogurt in the functional food market industry is progressing toward the commercialization of new products to meet the consumer's tastes and demands. Therefore, the new manufacturing technologies can potentially carry out the commercialization of carbonated symbiotic dairy-based drinks. Based on a February 2021 report by Food & Drink International, Tesco PLC, an overseas supermarket, experienced 400% demand growth in Kefir in the United Kingdom. Top manufacturers such as Yakult Honsha Co., Ltd., Danone S.A., and GCMMF (Amul) produce a large variety of milk-based products. In recent years, the demand for plant-based probiotic beverages, such as fruit and vegetable juices, has picked up considerably. With the rise in lactose-intolerant individuals and heightened sensitivity towards animal cruelty in food and beverage companies, the plant-based segment has been driven by it. In April 2021, Neuro, a drink manufacturer, introduced a probiotic kombucha tea called Probucha which is a lemon- and ginger-flavored fizzy beverage cultured with Bacillus subtilis bacteria.

Probiotic Seltzer Market Segmentation: By Packaging

- Bottles

- Tetra packs

- Cans

The international probiotic seltzer market is also divided based on packaging into bottles, tetra packs, and cans, depending on the respective consumer tastes and distribution requirements. Bottles, either glass or PET plastic, are favored for their premiumness, recyclability, and greenness, a favorite among sustainable brands and health-conscious consumers. Tetra packs provide a lightweight, convenient, and affordable solution, well suited to on-the-go use with extended shelf life thanks to their protective layers. Cans are becoming increasingly popular for their convenience, recyclability, and carbonation preservation, making them a top choice for young consumers and on-the-go lifestyles. The packaging type of each plays an important role in driving the market by catering to different consumer requirements, environmental issues, and retail strategies.

Probiotic Seltzer Market Segmentation: By Distribution Channel

- Offline

- Online

The offline channel segment dominates the market and has a share of over 85.0% of the total revenue globally. The major offline distribution sales channels include supermarkets, hypermarkets, and convenience stores. The higher shelf space available in supermarkets, convenience stores, grocery stores, health food stores, and pharmacies has supported the sales of these drinks across the globe. The growing number of online retailers providing discount coupons, competitive pricing, hassle-free payment options, and easy delivery is supporting segment expansion. Moreover, the expansion can be traced to the younger generation's enhanced experience and dependence on the Internet and e-commerce. In addition, the strong penetration of the internet and smartphones among the middle-class population globally is expected to drive sales through online channels during the forecast period.

Probiotic Seltzer Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The world probiotic seltzer market is dominated by North America due to strong consumer awareness, high demand for functional drinks, and an established health and wellness sector. Europe is a close second, with increasing interest in gut health, natural ingredients, and eco-friendly packaging, especially in Germany, the UK, and France. The Asia-Pacific region is a rising leader, driven by growth in disposable incomes, urbanization, and greater demand for healthier beverage alternatives. South America is also experiencing sustained growth, helped by growing retail distribution and expanding health-aware consumers. The Middle East & Africa are increasingly embracing probiotic seltzers, and demand is expanding in urbanized markets where understanding of functional beverages and gastrointestinal well-being is growing.

COVID-19 Impact Analysis on the Global Probiotic Seltzer Market:

During the COVID-19 pandemic, the health benefits of probiotic beverages have played a key role in propelling the market's growth. It was a boon for the market. The market was propelled by a shift towards preventive exercises in health management due to the increased healthcare expenses and the growing disease burden following COVID-19. Since the pandemic severely affected the health and general well-being of individuals worldwide, the production and demand for Probiotics rose quickly. Since people have been suffering from gastric diseases at very high rates and experiencing severe symptoms of coronavirus, individuals are willing to accept healthy lifestyles and incorporate healthy drinks such as probiotics. It possesses several health benefits like enhancing intestinal health, reducing acidity, aiding in maintaining a healthy body weight, and enhancing the immunity of the individual. Hence, to make their body immune to coronavirus invasion, many individuals choose Probiotic Drinks. And with several major players launching new products and flavors with the advantage of probiotics, it has further contributed to the market growth.

Latest Trends/ Developments:

The world probiotic seltzer market is changing, with several important trends influencing its development. Brands are placing more emphasis on clean-label formulations, employing natural ingredients, organic probiotics, and no artificial sweeteners to attract health-aware consumers. The growth of plant-based and non-dairy probiotics is propelling innovation, serving lactose-intolerant and vegan consumers. Functional ingredient infusions, like adaptogens, prebiotics, and collagen, are becoming increasingly popular with added benefits beyond gut health. Environmentally friendly packaging, like recyclable cans and biodegradable bottles, is becoming a top priority as environmental awareness increases. Furthermore, the growth of e-commerce and direct-to-consumer sales is enabling brands to reach more people, driving growth in the market.

Key Players:

- Yakult Honsha Co. Ltd.

- Danone S.A.

- Nestle SA

- Chobani LLC

- NextFoods

- Harmless Harvest

- Bio-K Plus International Inc.

- GCMMF

- PepsiCo

Chapter 1. Probiotic Seltzer Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Probiotic Seltzer Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Probiotic Seltzer Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Probiotic Seltzer Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Probiotic Seltzer Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Probiotic Seltzer Market – By Type

6.1 Introduction/Key Findings

6.2 Dairy-based

6.3 Plant-based

6.4 Y-O-Y Growth trend Analysis By Type :

6.5 Absolute $ Opportunity Analysis By Type :, 2025-2030

Chapter 7. Probiotic Seltzer Market – By Packaging

7.1 Introduction/Key Findings

7.2 Bottles

7.3 Tetra packs

7.4 Cans

7.5 Y-O-Y Growth trend Analysis By Packaging

7.6 Absolute $ Opportunity Analysis By Packaging , 2025-2030

Chapter 8. Probiotic Seltzer Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Interior Coatings

8.3 Offline

8.4 Online

8.5 Y-O-Y Growth trend Analysis Distribution Channel

8.6 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 9. Probiotic Seltzer Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Packaging

9.1.3. By Distribution Channel

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Packaging

9.2.3. By Distribution Channel

9.2.4. By Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Packaging

9.3.3. By Distribution Channel

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By DISTRIBUTION CHANNEL

9.4.3. By Packaging

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By DISTRIBUTION CHANNEL

9.5.3. By Packaging

9.5.4. By Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Probiotic Seltzer Market – Company Profiles – (Overview, Packaging Automation Portfolio, Financials, Strategies & Developments)

10.1 Yakult Honsha Co. Ltd.

10.2 Danone S.A.

10.3 Nestle SA

10.4 Chobani LLC

10.5 NextFoods

10.6 Harmless Harvest

10.7 Bio-K Plus International Inc.

10.8 GCMMF

10.9 PepsiCo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Probiotic Seltzer Market was valued at USD 4 billion in 2024 and is projected to reach a market size of USD 5.35 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6%.

The global probiotic seltzer market is driven by rising consumer awareness of gut health and increasing demand for functional, low-sugar beverages. Additionally, innovations in natural ingredients, sustainable packaging, and e-commerce expansion are further accelerating market growth

Based on the Service Provider, the Global Probiotic Seltzer Market is segmented into material manufacturers, Raw Material Suppliers, Distributors & Wholesalers, and End-to-End Solution Providers

North America is the most dominant region for the Global Probiotic Seltzer Market.

Yakult Honsha Co. Ltd., Danone S.A., Nestle SA, Chobani LLC, NextFoods, Harmless Harvest, and GCMMF are the key players in the Global Probiotic Seltzer Market.