Probiotic Food Fortification Agents Market Size (2024-2030)

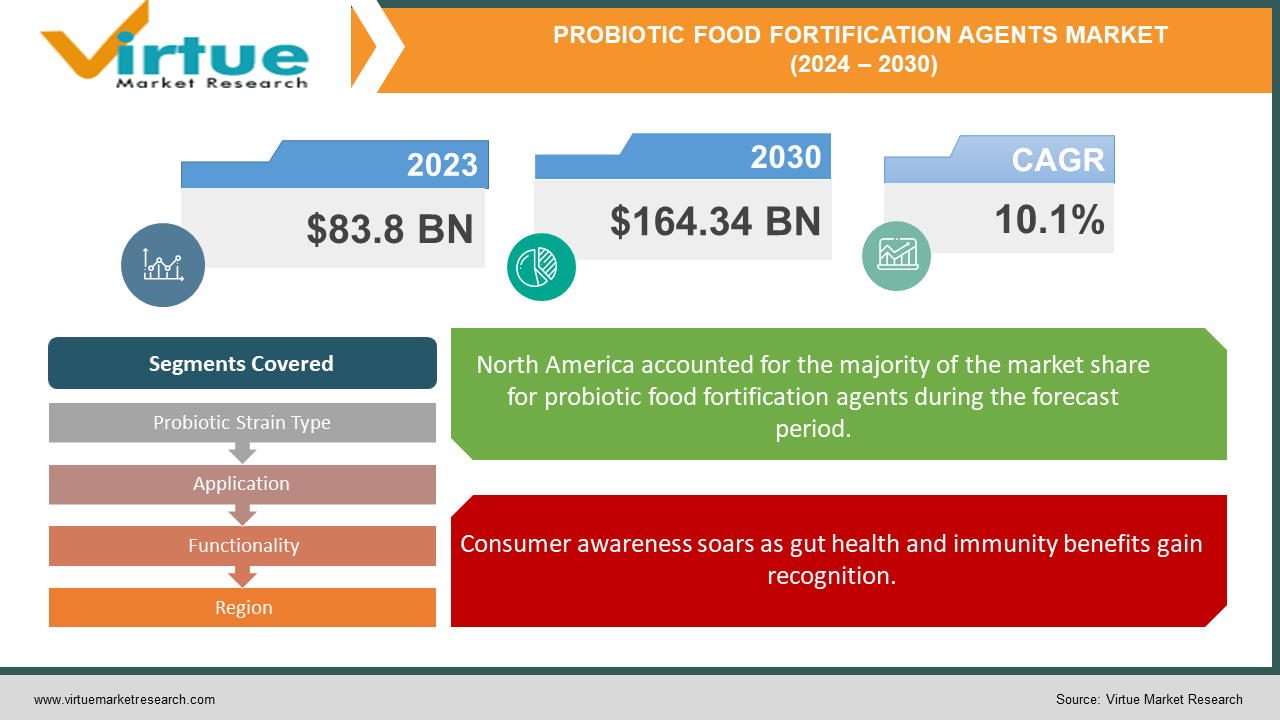

The Probiotic Food Fortification Agents Market was valued at USD 83.8 billion in 2023 and is projected to reach a market size of USD 164.34 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10.1%.

The probiotic food fortification agents market is a burgeoning niche within the food industry. Fueled by growing consumer awareness of the health benefits of probiotics, this market is capitalizing on the demand for convenient and healthy food options. The rise of functional foods and beverages, along with government initiatives in some regions promoting probiotic fortification, is further propelling this market forward. However, challenges remain.

Key Market Insights:

The probiotic food fortification agents market is experiencing a surge, fueled by a confluence of consumer trends and scientific advancements. Consumers are increasingly aware of the health benefits of probiotics, particularly for gut health and immunity. This awareness, coupled with busy lifestyles, is driving demand for convenient ways to incorporate probiotics into diets. Probiotic-fortified foods and beverages offer a simple solution, aligning perfectly with the popularity of functional foods and beverages boasting additional health perks. This trend is reflected in the broader food fortifying agents market, which is expected to see a Compound Annual Growth Rate (CAGR) of 10.1%. In some regions, government initiatives further bolster the market by promoting the fortification of food with probiotics to improve public health.

However, the market faces some challenges. While research is ongoing to solidify the health claims associated with probiotics, developing cost-effective and stable probiotic strains specifically suited for food fortification remains a hurdle. These strains need to withstand the rigors of food processing and storage to ensure viability when consumed.

The Probiotic Food Fortification Agents Market Drivers:

Consumer awareness soars as gut health and immunity benefits gain recognition.

Consumers are becoming increasingly knowledgeable about the functional benefits of probiotics, particularly their role in supporting a healthy gut microbiome. This microbiome, often referred to as housing around 70% of the body's immune system, plays a crucial role in digestion, nutrient absorption, and overall immune function. This heightened awareness is driving a significant demand for convenient ways to incorporate probiotics into their diets.

Busy lifestyles crave convenience, and fortified products offer an easy way to add probiotics.

Modern lifestyles are often characterized by hectic schedules and limited time. Consumers are constantly seeking convenient solutions to maintain their health and well-being. Probiotic-fortified foods and beverages offer a simple and effective way to integrate these beneficial bacteria into daily routines. This convenience factor perfectly aligns with the desire for on-the-go wellness solutions, making probiotic fortification a highly attractive option for busy consumers.

Functional food frenzy creates a perfect marriage with probiotic fortification for holistic wellness.

The popularity of functional foods and beverages that boast additional health benefits creates a perfect synergy with probiotic fortification. These products cater to a growing segment of health-conscious consumers who are seeking a more holistic approach to well-being. Probiotic fortification aligns with this trend by offering an additional layer of health functionality to these products, making them even more appealing to consumers seeking a comprehensive approach to health.

Government backing strengthens the market by promoting fortification for public health.

In some regions, governments are actively promoting the fortification of food with probiotics to improve public health. This government support adds another layer of impetus to the growth of the probiotic food fortification agent market. By endorsing and potentially mandating probiotic fortification in certain food categories, governments are actively contributing to a rise in the demand and utilization of these beneficial bacteria.

The Probiotic Food Fortification Agents Market Restraints and Challenges:

While the probiotic food fortification agents market is flourishing, there are hurdles to overcome. One key challenge lies in solidifying the science behind probiotics. While the general benefits for gut health and immunity are increasingly recognized, further research is needed to pinpoint the specific health claims associated with different probiotic strains. Additionally, identifying the most effective strains for targeted health benefits and ensuring their viability throughout food processing and storage remains a challenge.

Cost also plays a role. Developing cost-effective and shelf-stable probiotic strains specifically designed for food fortification is crucial for wider market adoption. These strains need to withstand the rigors of processing, such as heat and pressure, and maintain viability throughout a product's shelf life to ensure they deliver the intended benefits to consumers.

Regulatory hurdles also exist. Requirements for probiotic fortification can vary by region, creating complexities for manufacturers who want to reach a global market. Furthermore, some consumers may have concerns about the safety or effectiveness of fortified foods. Building trust through ongoing education and clear labeling efforts will be crucial to addressing these concerns and ensuring continued market growth.

The Probiotic Food Fortification Agents Market Opportunities:

The probiotic food fortification agents market presents a treasure trove of opportunities for innovative companies. Research into novel probiotic strains with targeted health benefits and improved stability throughout processing is a key area. Additionally, developing delivery systems that ensure the optimal viability of probiotics within fortified products holds immense potential. Expanding fortification beyond traditional categories like yogurts and cereals into bakery items, snacks, plant-based alternatives, and even non-dairy beverages offers a vast market to tap into. The future could see personalized probiotic fortification based on individual needs, with targeted blends designed for specific age groups, gut health concerns, or even athletic performance. Technological advancements in areas like microencapsulation and bioprinting can further enhance the viability and functionality of probiotics in fortified foods. Finally, strategic partnerships between ingredient suppliers, food manufacturers, and research institutions, along with mergers and acquisitions within the market, can accelerate innovation, consolidate expertise, and lead to the emergence of stronger players in this exciting market space. By capitalizing on these opportunities, companies can unlock the full potential of the probiotic food fortification agents’ market and cater to the ever-growing consumer demand for convenient and health-promoting food options.

PROBIOTIC FOOD FORTIFICATION AGENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.1% |

|

Segments Covered |

By Probiotic Strain Type, Application, Functionality, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill Incorporated, Chr. Hansen Holding A/S, Nestle S.A., Archer Daniels Midland Company, BASF SE, DuPont, Ingredion Incorporated, Tate & Lyle PLC, DSM Nutritional Products |

Probiotic Food Fortification Agents Market Segmentation: By Probiotic Strain Type

-

Lactobacillus

-

Bifidobacterium

-

Bacillus

-

Other Strains

Within the probiotic strain type segment, Lactobacillus and Bifidobacterium currently dominate the market due to their established health benefits in gut health and digestion. However, the fastest-growing segment is likely to be specific, targeted strains. As research continues to explore the potential of probiotics for various health concerns, consumers are increasingly seeking personalized solutions. This trend, coupled with growing awareness, is fuelling the demand for novel strains with specific functionalities.

Probiotic Food Fortification Agents Market Segmentation: By Application

-

Dairy Products

-

Beverages

-

Cereals and Cereal Bars

-

Bakery Products

-

Dietary Supplements

-

Other Applications

Within the application sector, dairy products like yogurt and kefir currently dominate the probiotic food fortification agents market due to their established association with gut health. However, the fastest-growing segment is anticipated to be non-dairy beverages and plant-based alternatives. This surge is fuelled by rising consumer interest in plant-based diets and the growing popularity of functional beverages offering gut health benefits beyond traditional dairy options.

Probiotic Food Fortification Agents Market Segmentation: By Functionality

-

Gut Health and Digestion

-

Immunity Support

-

Specific Health Conditions

Within the functionality segment, gut health and digestion remain the most dominant areas due to established consumer awareness and a long history of probiotic use for these purposes. However, immunity support is experiencing the fastest growth as consumers become increasingly interested in preventative health measures and strengthening their natural defenses. This trend is fuelling research into probiotic strains specifically linked to immune system function.

Probiotic Food Fortification Agents Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America market is a leader in probiotic awareness, with consumers well-versed in the potential health benefits these bacteria offer. The well-developed infrastructure allows for efficient production and distribution, while established regulations ensure the safety and quality of probiotic-fortified products. Furthermore, a strong focus on research and development positions North American companies at the forefront of innovation in probiotic strains and delivery methods.

Asia Pacific region is witnessing the most explosive growth in the probiotic food fortification agent market. Several factors contribute to this surge. Rising disposable income, particularly in countries like China and India, allows consumers to invest in their health and explore premium functional food options. Furthermore, rapid urbanization often leads to lifestyle changes that can negatively impact gut health. As awareness of gut health and the potential benefits of probiotics increases, consumers in this region are increasingly seeking convenient and effective ways to incorporate probiotics into their diets. This confluence of factors creates a highly promising market for probiotic food fortification agents in the Asia Pacific region.

COVID-19 Impact Analysis on the Probiotic Food Fortification Agents Market:

The COVID-19 pandemic's impact on the probiotic food fortification agents’ market has been a mixed bag. On the positive side, the global focus on health and immunity during the pandemic fuelled consumer interest in preventative measures, directly benefiting the market as probiotics are increasingly recognized for their potential immune-supporting properties. Additionally, the rise in demand for convenient health solutions during lockdowns and social distancing measures boosted the market as probiotic-fortified products offer a simple way to incorporate these beneficial bacteria into diets. Furthermore, the e-commerce boom provided wider access to these products, particularly in regions with limited physical stores.

However, the pandemic also presented challenges. Global supply chain disruptions caused by lockdowns and travel restrictions impacted the availability of some raw materials used in probiotic production, leading to potential shortages or price fluctuations. The economic downturn might have also influenced consumer behavior, with some prioritizing affordability over premium probiotic-fortified options. Additionally, shifting consumer habits during lockdowns, such as increased home cooking and reduced consumption of on-the-go fortified products, may have temporarily impacted demand for certain categories.

Latest Trends/ Developments:

The probiotic food fortification agents market is a hotbed of innovation, constantly buzzing with new trends and developments. One exciting area is precision fermentation, a technique used to create novel probiotic strains with targeted health benefits. This opens doors to a wider range of applications in food fortification. Additionally, advancements in microencapsulation are improving the stability of probiotics throughout processing and storage, allowing their incorporation into a broader spectrum of food products. Delivery systems are also undergoing exciting changes, with the development of methods to ensure optimal delivery and functionality of probiotics within the gut. These include enteric coatings that shield probiotics from stomach acid and targeted delivery systems that release them in specific areas of the intestine. Artificial intelligence is even entering the scene, aiding in the selection of probiotic strains for specific uses and the development of new fortified products by analyzing vast datasets and predicting potential health benefits. The trend towards personalized nutrition is extending to probiotics, with research exploring personalized blends tailored to individual needs based on gut health, age, and specific goals. As the plant-based food market flourishes, plant-based probiotic strains are gaining traction, offering a vegan-friendly alternative to traditional dairy-derived probiotics. Finally, companies are increasingly focusing on sustainable packaging solutions for probiotic-fortified products, aligning with growing consumer concerns about environmental impact. These trends paint a picture of a dynamic and innovative market poised for continued growth.

Key Players:

-

Cargill Incorporated

-

Chr. Hansen Holding A/S

-

Nestle S.A.

-

Archer Daniels Midland Company

-

BASF SE

-

DuPont

-

Ingredion Incorporated

-

Tate & Lyle PLC

-

DSM Nutritional Products

Chapter 1. Probiotic Food Fortification Agents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Probiotic Food Fortification Agents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Probiotic Food Fortification Agents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Probiotic Food Fortification Agents Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Probiotic Food Fortification Agents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Probiotic Food Fortification Agents Market – By Probiotic Strain Type

6.1 Introduction/Key Findings

6.2 Lactobacillus

6.3 Bifidobacterium

6.4 Bacillus

6.5 Other Strains

6.6 Y-O-Y Growth trend Analysis By Probiotic Strain Type

6.7 Absolute $ Opportunity Analysis By Probiotic Strain Type, 2024-2030

Chapter 7. Probiotic Food Fortification Agents Market – By Application

7.1 Introduction/Key Findings

7.2 Dairy Products

7.3 Beverages

7.4 Cereals and Cereal Bars

7.5 Bakery Products

7.6 Dietary Supplements

7.7 Other Applications

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Probiotic Food Fortification Agents Market – By Functionality

8.1 Introduction/Key Findings

8.2 Gut Health and Digestion

8.3 Immunity Support

8.4 Specific Health Conditions

8.5 Y-O-Y Growth trend Analysis By Functionality

8.6 Absolute $ Opportunity Analysis By Functionality, 2024-2030

Chapter 9. Probiotic Food Fortification Agents Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Probiotic Strain Type

9.1.3 By Application

9.1.4 By By Functionality

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Probiotic Strain Type

9.2.3 By Application

9.2.4 By Functionality

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Probiotic Strain Type

9.3.3 By Application

9.3.4 By Functionality

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Probiotic Strain Type

9.4.3 By Application

9.4.4 By Functionality

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Probiotic Strain Type

9.5.3 By Application

9.5.4 By Functionality

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Probiotic Food Fortification Agents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill Incorporated

10.2 Chr. Hansen Holding A/S

10.3 Nestle S.A.

10.4 Archer Daniels Midland Company

10.5 BASF SE

10.6 DuPont

10.7 Ingredion Incorporated

10.8 Tate & Lyle PLC

10.9 DSM Nutritional Products

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Probiotic Food Fortification Agents Market was valued at USD 83.8 billion in 2023 and is projected to reach a market size of USD 164.34 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10.1%.

Surging Consumer Awareness of Functional Benefits, Convenience Factor Caters to Busy Lifestyles, Functional Food Frenzy, and Government Backing Bolsters Market Growth.

Dairy Products, Beverages, Cereals and Cereal Bars, Bakery Products, Dietary Supplements, Other Applications.

North America holds the dominant position in the Probiotic Food Fortification Agents Market, boasting high consumer awareness and established regulations.

Cargill Incorporated, Chr. Hansen Holding A/S, Nestle S.A., Archer Daniels Midland Company, BASF SE, DuPont, Ingredion Incorporated, Tate & Lyle PLC, DSM Nutritional Products.