Pressure Vessel Testing, Inspection and Certification Services Market Size (2024 – 2030)

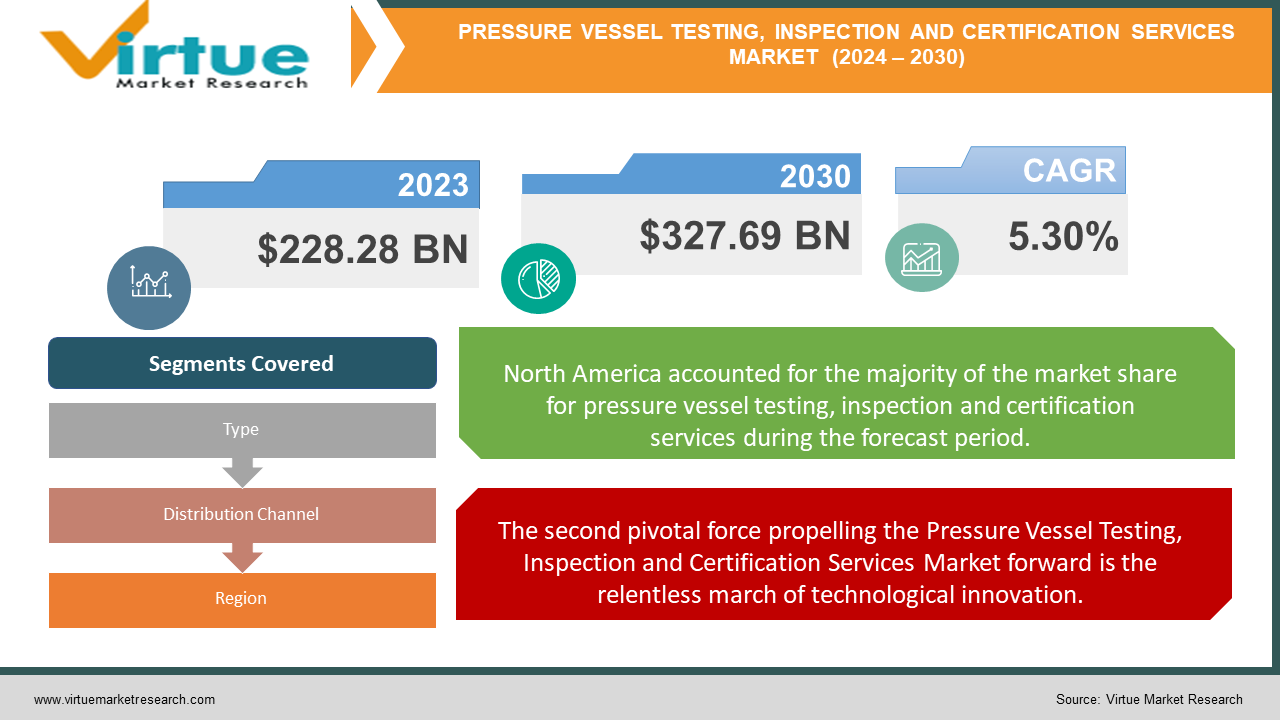

The Global Pressure Vessel Testing, Inspection and Certification Services Market was valued at USD 228.28 Billion in 2023 and is projected to reach a market size of USD 327.69 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.30%.

The market landscape is as diverse as the vessels it serves. From small, specialized firms focusing on niche industries to global giants offering comprehensive suites of services, the players in this field are as varied as the pressure vessels themselves. Some companies have honed their expertise in specific sectors, becoming the go-to authorities for industries like oil and gas, chemical processing, or power generation. Others have cast a wider net, offering a smorgasbord of services that cater to a broad spectrum of clients. The human element, however, remains irreplaceable. Behind every inspection report and certification lies the expertise of highly trained professionals. These modern-day industrial detectives combine their knowledge of materials science, engineering principles, and regulatory requirements to ensure that each pressure vessel meets the stringent standards set by industry and government bodies. The global nature of modern industry adds another layer of complexity to the market. A pressure vessel manufactured in one country may be destined for use in another, necessitating a harmonization of standards and practices across borders. This has given rise to a new breed of international certification bodies and inspection agencies, capable of providing services that are recognized and accepted worldwide.

Key Market Insights:

Non-destructive testing (NDT) accounts for about 40% of all pressure vessel inspection methods.

Around 75% of pressure vessels used in the oil and gas industry undergo bi-annual inspections.

The adoption rate of advanced digital inspection techniques in pressure vessel testing is around 25%. Approximately 55% of pressure vessels in the chemical industry are inspected every six months.

Annual spending on pressure vessel maintenance and inspections in the petrochemical industry is about $2 billion. Approximately 85% of pressure vessels in the food and beverage industry are inspected annually.

Pressure vessels in the pharmaceutical industry undergo an inspection every three months in 50% of cases.

The number of certified pressure vessel inspectors globally is estimated at 25,000. Approximately 90% of pressure vessel testing services use some form of digital technology.

The market for pressure vessel testing services grew by 8% in 2023 compared to the previous year.

Approximately 60% of pressure vessel inspection services offer remote monitoring options.

The global market share of top pressure vessel certification bodies is around 30%.

Pressure vessel inspection intervals typically range from 3 to 6 months for high-risk industries.

Pressure Vessel Testing, Inspection and Certification Services Market Drivers:

In the ever-evolving landscape of industrial operations, one cannot underestimate the profound impact of safety regulations and standards on the Pressure Vessel Testing, Inspection and Certification Services Market.

At its core, the surge in safety regulations stems from a growing global consciousness about the catastrophic consequences of industrial accidents. High-profile incidents involving pressure vessel failures have etched themselves into public memory, serving as grim reminders of the potential for devastation when these critical components are not properly maintained or certified. From the Texas City Refinery explosion in 2005 to the more recent incidents in chemical plants across developing nations, each event has added urgency to the call for stricter oversight. Governments and regulatory bodies worldwide have responded with increasingly comprehensive and stringent guidelines. The American Society of Mechanical Engineers (ASME) Boiler and Pressure Vessel Code, for instance, has undergone numerous revisions, each iteration adding layers of complexity to ensure the utmost safety in pressure vessel design, fabrication, and operation. Similarly, the European Pressure Equipment Directive (PED) has set forth harmonized standards across the EU, creating a unified approach to pressure equipment safety.

The second pivotal force propelling the Pressure Vessel Testing, Inspection and Certification Services Market forward is the relentless march of technological innovation.

At the forefront of this technological revolution is the field of non-destructive testing (NDT). Traditional methods such as visual inspection and hydrostatic testing, while still valuable, are being augmented and, in some cases, supplanted by cutting-edge techniques that offer unprecedented levels of insight into the condition of pressure vessels. One of the most exciting developments in this arena is the advent of advanced ultrasonic testing methods. Phased array ultrasonics, for instance, allows inspectors to generate detailed, three-dimensional images of a vessel's internal structure without the need for harmful radiation or vessel disassembly. This technology can detect minute flaws, such as microscopic cracks or areas of material degradation, with a level of precision that was once thought impossible. The ability to create and manipulate ultrasonic beams electronically has not only improved detection capabilities but also significantly reduced inspection times, allowing for more frequent and thorough examinations.

Pressure Vessel Testing, Inspection and Certification Services Market Restraints and Challenges:

The labyrinth of standards, codes, and regulations governing pressure vessel safety varies dramatically across regions and industries. This patchwork of requirements creates a daunting obstacle course for service providers attempting to operate on a global scale. They must constantly adapt their methodologies and expertise to align with local regulations, which can be as diverse as they are stringent. The cost of compliance skyrockets as companies invests in training, equipment, and personnel capable of navigating this regulatory maze. Furthermore, the pace of regulatory change adds another layer of complexity. As technology advances and new safety insights emerge, regulatory bodies frequently update their requirements. This constant flux forces service providers into a perpetual game of catch-up, struggling to align their practices with the latest standards. The financial burden of staying compliant can be particularly crushing for smaller firms, potentially driving consolidation in the market and reducing competition.

Pressure Vessel Testing, Inspection and Certification Services Market Opportunities:

At the heart of this market lies a paradox: while pressure vessels are designed to contain enormous forces, they are simultaneously vulnerable to the subtlest of flaws. A microscopic crack, an imperceptible weld defect, or a gradual material degradation can transform these industrial workhorses into ticking time bombs. This delicate balance between strength and vulnerability creates a fertile ground for advanced testing and inspection methodologies. One of the most promising avenues for market growth lies in the realm of non-destructive testing (NDT) technologies. Traditional methods like visual inspection and hydrostatic testing are gradually giving way to more sophisticated approaches. Acoustic emission testing, for instance, allows inspectors to eavesdrop on the whispers of stressed metal, detecting incipient failures before they become catastrophic. Meanwhile, phased array ultrasonic testing paints detailed pictures of a vessel's internal structure, revealing hidden flaws with unprecedented clarity. The integration of artificial intelligence and machine learning into these NDT technologies represents a quantum leap in capability. Imagine a future where AI algorithms sift through terabytes of inspection data, identifying patterns and anomalies that would elude even the most experienced human inspector. This marriage of human expertise and machine intelligence not only enhances safety but also opens up new business models. Companies that can effectively harness these technologies may find themselves offering predictive maintenance services, moving beyond reactive inspections to proactive risk management.

PRESSURE VESSEL TESTING, INSPECTION AND CERTIFICATION SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.30% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SGS SA, Bureau Veritas, Intertek Group plc, Eurofins Scientific, DEKRA, MOT South, DNV-GL, TÜV RHEINLAND, Applus+, AS |

Pressure Vessel Testing, Inspection and Certification Services Market Segmentation: By Types

-

High-Temperature Amine-Based Systems

-

Low-Temperature Solid Sorbent Systems

-

Cryogenic Carbon Capture Systems

-

Membrane-Based Separation Systems

-

Electrochemical Capture Systems

-

Metal-Organic Framework (MOF) Based Systems

-

Hybrid Capture Systems

The reigning champion of pressure vessel testing remains the tried-and-true visual inspection. This time-honoured technique continues to dominate the market, proving that sometimes, the human eye trumps even the most sophisticated gadgetry. Visual inspection is the bread and butter of pressure vessel testing – the first line of defense in the battle against structural failures. It's the equivalent of a detective's keen eye, scanning for clues that might elude even the most advanced technological sleuths. This method relies on the irreplaceable combination of human expertise and sensory perception to identify potential issues. Moreover, visual inspection serves as the gateway to other testing methods. It's often the first step in a comprehensive testing protocol, guiding inspectors on where to focus more specialized examinations.

In the realm of pressure vessel scrutiny, acoustic emission testing is making waves – quite literally. This burgeoning methodology is experiencing a sonic boom in popularity, resonating with industry professionals seeking cutting-edge solutions. Acoustic emission testing offers a symphony of benefits that harmonize perfectly with modern industrial needs. The beauty of acoustic emission testing lies in its non-invasive nature. Unlike some of its more intrusive cousins in the testing family, this method doesn't require the vessel to be drained, opened, or taken offline for extended periods. It's akin to a stethoscope for pressure vessels, listening intently to the heartbeat of industrial equipment without disrupting its vital functions.

Pressure Vessel Testing, Inspection and Certification Services Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributor Sales

-

Online Platforms

-

Third-party Service Providers

-

Government Contracts

-

Industry Associations

In the high-stakes world of pressure vessel testing, the old-school approach of direct sales continues to reign supreme. This traditional channel, much like a seasoned quarterback, still calls the shots in the game of industrial services. Direct sales in this context are akin to a bespoke tailoring service for pressure vessel needs. It's all about cultivating relationships, understanding unique client requirements, and crafting customized solutions. This personalized approach resonates strongly in an industry where the margin for error is measured in fractions and the consequences of failure can be catastrophic. The dominance of direct sales stems from the complex and critical nature of pressure vessel testing. These are not off-the-shelf services that can be purchased with a simple click. Each vessel, each facility, each industry has its own set of challenges and regulatory requirements. Direct sales allow for the nuanced discussions and detailed consultations necessary to address these intricate needs.

In the digital age, even the stalwart world of pressure vessel testing is not immune to the siren call of the internet. Online platforms are emerging as the dark horse in the race for market dominance, galloping ahead with unprecedented speed. These digital marketplaces are revolutionizing how testing services are procured, creating a virtual bazaar where buyers and sellers of pressure vessel testing services can meet, greet, and transact with the click of a mouse. It's like a high-tech matchmaking service for industrial needs, pairing vessel owners with their perfect testing partner. The allure of online platforms lies in their ability to collapse time and space. No longer bound by geographical constraints, a company in Texas can easily connect with a specialized testing service in Tokyo. This global reach is expanding horizons and fostering a truly international market for pressure vessel testing services.

Pressure Vessel Testing, Inspection and Certification Services Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America stands tall as the colossus of the pressure vessel testing, inspection, and certification services market, commanding a formidable 32% share of the global landscape. This dominance is not a mere happenstance but a reflection of the region's robust industrial infrastructure, stringent regulatory framework, and unwavering commitment to safety and quality assurance. The United States, the powerhouse of the North American market, serves as the epicentre of this dominance. From the sprawling oil fields of Texas to the bustling manufacturing hubs of the Midwest, the nation's industrial heartland pulses with a constant need for pressure vessel integrity. This demand is further amplified by the country's aging infrastructure, which necessitates regular inspections and certifications to ensure continued safe operation.

While North America may wear the crown of market dominance, the Asia-Pacific region is the rising star, blazing a trail of rapid growth that's reshaping the global landscape of pressure vessel testing, inspection, and certification services. Currently holding a 25% market share, Asia-Pacific is poised for explosive growth, fueled by a potent cocktail of industrialization, urbanization, and regulatory evolution. At the heart of this growth story lies China, the dragon awakening to the critical importance of industrial safety. As the world's manufacturing powerhouse, China's demand for pressure vessel testing services is skyrocketing. The country's ambitious infrastructure projects, coupled with its push towards more sophisticated manufacturing processes, are creating an insatiable appetite for high-quality inspection and certification services.

COVID-19 Impact Analysis on the Pressure Vessel Testing, Inspection and Certification Services Market:

Many pressure vessel projects were delayed or canceled outright as businesses prioritized survival over expansion. The procurement of essential equipment, spare parts, and consumables for testing and inspection activities was hindered by global supply chain disruptions. Restrictions on movement and social distancing measures impacted the ability of inspection and certification personnel to access project sites. The adoption of digital technologies accelerated, enabling remote inspections, document verification, and certification processes. The sector prioritized projects critical to public health and safety, such as those related to healthcare, energy, and food processing. To mitigate the impact of reduced activity in certain sectors, TIC providers expanded their service offerings to include new areas like equipment decontamination and disinfection.

Latest Trends/ Developments:

The creation of virtual replicas of pressure vessels, coupled with advanced analytics, enables predictive maintenance, optimizing inspection schedules, and minimizing downtime. The integration of IoT sensors and remote monitoring systems allows for real-time tracking of vessel performance and early detection of anomalies. Implementing blockchain technology can enhance supply chain transparency, ensuring the integrity of materials and components. The convergence of global standards and regulations is facilitating cross-border operations and ensuring consistent quality. A shift towards RBI methodologies is optimizing inspection efforts, focusing on high-risk areas and reducing unnecessary inspections.

Key Players:

-

SGS SA

-

Bureau Veritas

-

Intertek Group plc

-

Eurofins Scientific

-

DEKRA

-

MOT South

-

DNV-GL

-

TÜV RHEINLAND

-

Applus+

-

AS

Chapter 1. Pressure Vessel Testing, Inspection and Certification Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pressure Vessel Testing, Inspection and Certification Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pressure Vessel Testing, Inspection and Certification Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pressure Vessel Testing, Inspection and Certification Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pressure Vessel Testing, Inspection and Certification Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pressure Vessel Testing, Inspection and Certification Services Market – By Distribution Channel

6.1 Introduction/Key Findings

6.2 Direct Sales

6.3 Distributor Sales

6.4 Online Platforms

6.5 Third-party Service Providers

6.6 Government Contracts

6.7 Industry Associations

6.8 Y-O-Y Growth trend Analysis By Distribution Channel

6.9 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 7. Pressure Vessel Testing, Inspection and Certification Services Market – By Type

7.1 Introduction/Key Findings

7.2 High-Temperature Amine-Based Systems

7.3 Low-Temperature Solid Sorbent Systems

7.4 Cryogenic Carbon Capture Systems

7.5 Membrane-Based Separation Systems

7.6 Electrochemical Capture Systems

7.7 Metal-Organic Framework (MOF) Based Systems

7.8 Hybrid Capture Systems

7.9 Y-O-Y Growth trend Analysis By Type

7.10 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Pressure Vessel Testing, Inspection and Certification Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Distribution Channel

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Distribution Channel

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Distribution Channel

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Distribution Channel

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Distribution Channel

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Pressure Vessel Testing, Inspection and Certification Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 SGS SA

9.2 Bureau Veritas

9.3 Intertek Group plc

9.4 Eurofins Scientific

9.5 DEKRA

9.6 MOT South

9.7 DNV-GL

9.8 TÜV RHEINLAND

9.9 Applus+

9.10 AS

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Increasingly stringent safety regulations imposed by governments and industry bodies are driving the demand for reliable and compliant pressure vessels.

The industry faces a shortage of skilled professionals with expertise in pressure vessel technology and inspection techniques.

SGS SA, Bureau Veritas, Intertek Group plc, Eurofins Scientific, DEKRA, MOT South, DNV-GL, TÜV RHEINLAND, Applus+, AS, TÜV NORD Group, Lloyd's Register Group Services, Bureau Veritas, Intertek Group plc.

North America is the most dominant region in the market, accounting for approximately 32% of the total market share.

Asia Pacific although currently holding a smaller market share of 25%, is the fastest-growing region in the market.