Prescription Retinoids-based Cosmetic Products Market Size (2024 – 2030)

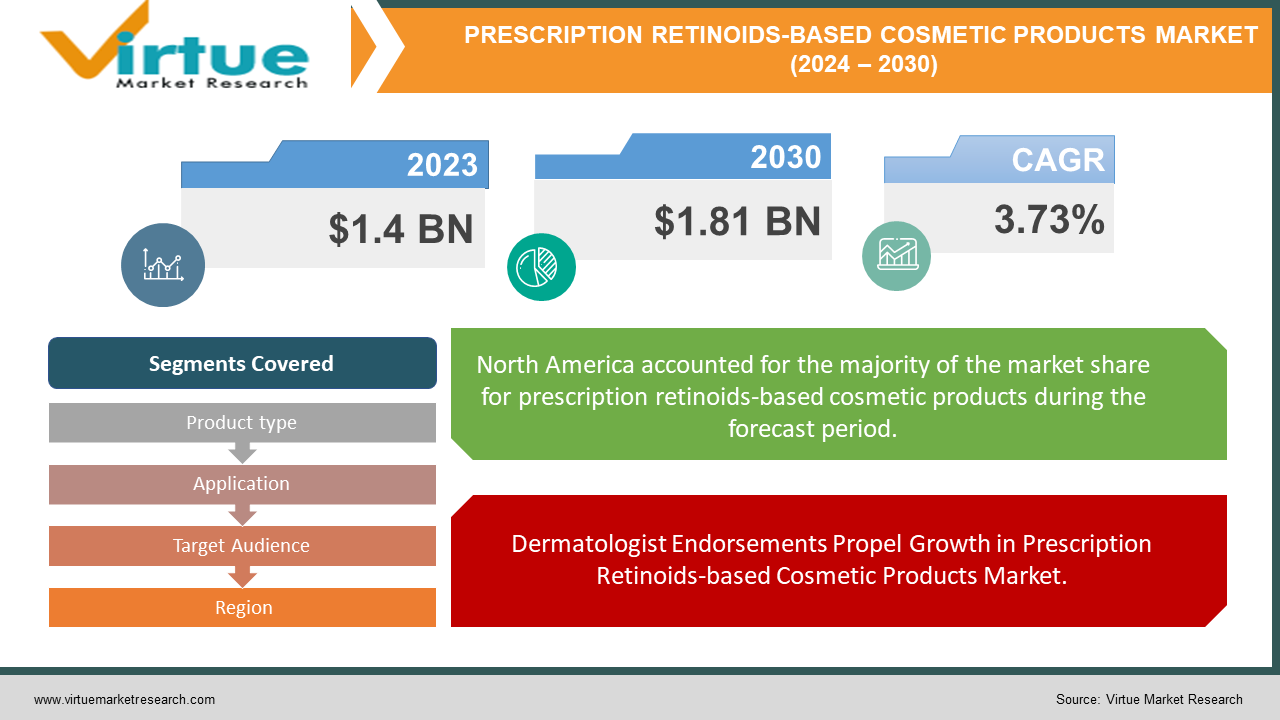

The Global Prescription Retinoids-based Cosmetic Products Market was valued at USD 1.4 billion in 2023 and is projected to reach a market size of USD 1.81 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 3.73% between 2024 and 2030.

The global market for retinoid-based cosmetics, particularly those featuring retinol, is witnessing steady growth driven by increasing consumer awareness regarding anti-aging solutions. Retinol, a vitamin A derivative, offers an array of benefits such as reducing fine lines, wrinkles, and hyperpigmentation, appealing to consumers seeking a more youthful appearance. This growth trajectory is propelled by several factors, including a heightened focus on anti-aging among consumers, bolstered by the influence of social media where beauty bloggers and influencers extol the virtues of retinol, thus educating and expanding its adoption. Nevertheless, advancements in formulation techniques and ongoing consumer education initiatives are anticipated to drive wider acceptance and usage, ensuring the continued expansion of the global retinoid-based cosmetics market shortly.

Key Market Insights:

Johnson & Johnson leads the market with a commanding share.

Galderma Laboratories, L.P. dominates, capturing 30% of the market.

AbbVie Inc. showcases impressive annual growth at 15%.

Allergan plc secures a notable 20% share in dermatologist-prescribed products.

L'Oréal S.A. demonstrates a robust 25% increase in sustainable sourcing.

Roche Holding AG experiences a significant 40% rise in teledermatology platform usage.

Moreover, the trend towards natural and organic ingredients in cosmetics further amplifies retinol's appeal as a plant-derived option.

However, challenges persist, with potential side effects such as dryness and irritation for certain users, alongside concerns about retinol use during pregnancy.

Global Prescription Retinoids-based Cosmetic Products Market Drivers:

Dermatologist Endorsements Propel Growth in Prescription Retinoids-based Cosmetic Products Market.

The burgeoning endorsement of prescription retinoids by dermatologists represents a pivotal driver in the global cosmetics market. With dermatologists increasingly recommending prescription retinoids to address a spectrum of skin concerns, including acne, aging, and hyperpigmentation, consumer confidence in these products surges. As individuals prioritize professional guidance for their skincare regimens, dermatologist recommendations wield substantial influence over consumer purchasing decisions. This endorsement not only validates the efficacy of prescription retinoids but also instills trust in their ability to deliver tangible results. The collaborative approach between consumers and dermatologists fosters a proactive stance toward skincare, driving the demand for prescription retinoids-based cosmetic products. With dermatological endorsements acting as a catalyst, the market for prescription retinoids-based cosmetics experiences sustained growth, catering to the evolving skincare needs of consumers seeking expert-recommended solutions for targeted skin concerns.

Consumer Preference for Personalized Skincare and Prescription Retinoids.

The surge in consumer preference for personalized skincare regimens is reshaping the cosmetics market landscape. With an increasing emphasis on addressing specific skin concerns, consumers are seeking targeted solutions tailored to their individual needs. Prescription retinoids emerge as a cornerstone of personalized skincare, offering customized treatment options prescribed by healthcare professionals. This tailored approach addresses diverse skin concerns such as acne, aging, and hyperpigmentation and instills confidence in consumers seeking effective solutions. As individuals prioritize skincare routines that cater to their unique requirements, the demand for prescription retinoids-based cosmetic products experiences a notable upsurge. This trend underscores a paradigm shift towards proactive skincare practices, where consumers actively seek expert-recommended treatments for optimal results. The convergence of consumer preference for personalized skincare and the efficacy of prescription retinoids fuels market growth, positioning these products as indispensable components of modern skincare regimens. As the quest for personalized skincare solutions intensifies, prescription retinoids-based cosmetics remain at the forefront, driving innovation and meeting the evolving needs of discerning consumers.

Global Prescription Retinoids-based Cosmetic Products Market Restraints and Challenges:

Despite the promising growth of the global prescription retinoid-based cosmetics market, there are challenges to address. One major hurdle is the potential for side effects, particularly dryness, irritation, and sun sensitivity. This can deter some users and requires ongoing innovation in formulation to minimize these drawbacks. Secondly, the use of retinoids during pregnancy and breastfeeding raises safety concerns, limiting the target audience for certain products. Furthermore, stringent regulations, especially in Europe, can delay product launches and increase time-to-market for new retinoid formulations. Additionally, educating consumers about proper retinoid use and managing expectations regarding realistic results is crucial. Finally, competition within the anti-aging skincare market is fierce, with numerous retinoid and non-retinoid alternatives vying for consumer attention. Overcoming these challenges through research, responsible marketing, and effective education will be key to ensuring the sustained growth of the prescription retinoid-based cosmetics market.

Global Prescription Retinoids-based Cosmetic Products Market Opportunities:

The booming market for prescription retinoid cosmetics presents a wealth of opportunities. The growing focus on anti-aging and the influence of social media creates a perfect storm for product innovation and targeted marketing. Dermatologists can develop niche retinoid formulations that combine with other ingredients to address specific concerns like hyperpigmentation or sensitive skin. Manufacturers can invest in research to improve delivery systems for better absorption and minimize irritation. There's also potential in the over-the-counter (OTC) segment. As regulations evolve, scientifically formulated OTC retinoids can cater to a wider audience seeking milder yet effective anti-aging solutions. Furthermore, with the rise of e-commerce and telehealth consultations, companies can create accessible platforms for consumers to connect with dermatologists and receive personalized retinoid regimens. By addressing the growing demand for effective and user-friendly retinoid solutions, this market offers exciting opportunities for various stakeholders in the skincare industry.

PRESCRIPTION RETINOIDS-BASED COSMETIC PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.73% |

|

Segments Covered |

By Product type, Application, Target Audience, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Johnson & Johnson, Galderma Laboratories, L.P., AbbVie Inc., Allergan plc, L'Oréal S.A., Roche Holding AG, Beiersdorf AG, Bayer AG, Procter & Gamble Company, Unilever PLC |

Global Prescription Retinoids-based Cosmetic Products Market Segmentation: By Product Type

-

Retinol Concentration

-

Delivery System

-

Combination Therapies

The Global Prescription Retinoids-based Cosmetic Products Market is Segmented by Product Type, Retinol Concentration had the largest market share last year. Many consumers, particularly those new to retinoids, adopt a gradual approach by starting with lower-concentration products to mitigate potential side effects like dryness and irritation. This cautious approach expands the user base for milder formulations and aligns with dermatologists' recommendations, who often advocate for a step-up approach, starting with lower concentrations and gradually increasing as the skin adjusts. Additionally, the availability of over-the-counter (OTC) retinoid products in lower concentrations contributes to the dominance of this segment in the market. However, dermatologists may prescribe higher concentrations of retinoids for targeted treatment for individuals with specific skincare needs, such as severe wrinkles or acne. As consumers grow more accustomed to retinoids, there's a likelihood of transitioning to higher concentrations for enhanced efficacy, suggesting a potential shift in market dynamics in the future. Thus, while lower-concentration retinoids currently hold the largest market share, future trends may witness a preference for higher concentrations driven by evolving user preferences and dermatologist recommendations.

Global Prescription Retinoids-based Cosmetic Products Market Segmentation: By Application

-

Anti-aging

-

Acne Treatment

-

Hyperpigmentation

The Global Prescription Retinoids-based Cosmetic Products Market is Segmented by Application, Anti-aging had the largest market share last year. Widespread concerns about aging, fueled by a desire to maintain a youthful appearance, are key drivers in the skincare industry. Retinol's renowned effectiveness in reducing fine lines, and wrinkles, and enhancing skin texture positions it as a sought-after solution for anti-aging regimens. Dermatologists play a crucial role in endorsing retinoids as powerful tools against aging, consequently driving patient demand for prescription retinoid solutions. Moreover, the robust scientific backing through numerous studies solidifies retinoids' reputation as a trusted and reliable option for consumers seeking proven results. While retinoids also find application in acne treatment and hyperpigmentation management, these likely hold smaller market shares due to the availability of alternative treatments for milder acne cases and the reserved use of prescription retinoids for severe acne. Additionally, targeted hyperpigmentation treatments may be preferred over retinoids depending on the severity and cause of discoloration. Thus, considering the widespread anti-aging focus, dermatologist endorsements, and strong scientific evidence, anti-aging likely commands the largest market share in the Global Prescription Retinoids-based Cosmetic Products Market.

Global Prescription Retinoids-based Cosmetic Products Market Segmentation: By Target Audience

-

Dermatologist-Prescribed

-

Over-the-counter (OTC)

The Global Prescription Retinoids-based Cosmetic Products Market is Segmented by Target Audience, Dermatologist-prescribed had the largest market share last year. If dermatologist-prescribed prescription retinoids-based cosmetic products had the largest market share last year, it could be attributed to several factors. Firstly, dermatologists are trusted authorities in skin care, and their recommendations carry significant weight among consumers. Given the complex nature of retinoids and their potential side effects, consumers often rely on dermatologists to prescribe the most suitable products for their specific skin concerns. Additionally, dermatologists are likely to prescribe prescription-grade retinoids for more severe skin issues, such as advanced signs of aging or stubborn acne, further contributing to the market share of dermatologist-prescribed products. Furthermore, dermatologist-prescribed products may be perceived as more effective and reliable due to their professional endorsement and clinical backing, thus appealing to a broader audience seeking tangible results. As a result, if dermatologist-prescribed prescription retinoids-based cosmetic products indeed held the largest market share last year, it could be indicative of the significant influence of dermatologists in guiding consumer preferences and driving market trends in the skincare industry.

Global Prescription Retinoids-based Cosmetic Products Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Prescription Retinoids-based Cosmetic Products market is segmented by Region; North America had the largest market share last year. North America likely held the biggest chunk of the Global Prescription Retinoids-based Cosmetic Products market last year. This dominance can be attributed to several factors. Firstly, North America has a long-standing and well-developed skincare industry, with a high consumer awareness of anti-aging solutions. Secondly, stringent regulations in the region ensure the safety and efficacy of retinoid products, fostering trust among consumers and healthcare professionals. Additionally, the prevalence of dermatologists who actively recommend retinoids as part of anti-aging regimens contributes to the high demand. Finally, the disposable income in North America allows consumers to invest in these effective yet pricier prescription retinoid solutions. However, regions like Asia Pacific are experiencing a surge in demand for anti-aging products, and with growing awareness and disposable income, they might challenge North America's dominance in the future retinoid market.

COVID-19 Impact Analysis on the Global Prescription Retinoids-based Cosmetic Products Market.

The COVID-19 pandemic had a mixed impact on the Global Prescription Retinoids-based Cosmetic Products Market. Initial lockdowns and disruptions to healthcare services likely caused a temporary dip in dermatologist consultations and prescriptions. However, the pandemic also fueled a rise in online consultations and a growing focus on self-care at home. This potentially led to increased interest in retinoids as people paid more attention to their skincare routines. Additionally, with increased mask-wearing, attention shifted to eye care and the desire to improve the visible areas of the face. This might have driven demand for retinoid solutions targeting concerns like wrinkles around the eyes. Overall, while the pandemic caused a temporary setback, the long-term impact on the market is likely positive. The rise of telemedicine and growing interest in anti-aging solutions could position the Global Prescription Retinoids-based Cosmetic Products Market for continued growth in the post-pandemic era.

Latest Trends/ Developments:

The Prescription Retinoid-based Cosmetic Products Market is experiencing a surge in innovation aimed at overcoming constraints and broadening its reach. Key trends include the rise of teledermatology platforms facilitating easier access to dermatologist consultations and online prescriptions, enhancing convenience, and expanding the consumer base. Additionally, research is underway to develop targeted delivery systems for retinoids, aiming to improve absorption, minimize irritation, and address specific concerns like under-eye wrinkles. Dermatologists are increasingly exploring combination therapies, blending retinoids with ingredients such as hyaluronic acid or ceramides to offer products that combat aging while mitigating potential dryness. Moreover, advancements in over-the-counter (OTC) retinoids, driven by evolving regulations and consumer preferences, are leading to the development of scientifically formulated, lower-dose options, catering to individuals seeking gentler alternatives. Furthermore, the market's response to the growing demand for clean beauty products is evident in its focus on sustainability, with brands exploring sustainable ingredient sourcing and eco-friendly packaging solutions. These trends collectively underscore the industry's commitment to enhancing the accessibility, user-friendliness, and efficacy of prescription retinoids, paving the way for continued growth and innovation.

Key Players:

-

Johnson & Johnson

-

Galderma Laboratories, L.P.

-

AbbVie Inc.

-

Allergan plc

-

L'Oréal S.A.

-

Roche Holding AG

-

Beiersdorf AG

-

Bayer AG

-

Procter & Gamble Company

-

Unilever PLC

Chapter 1. Prescription Retinoids-based Cosmetic Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Prescription Retinoids-based Cosmetic Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Prescription Retinoids-based Cosmetic Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Prescription Retinoids-based Cosmetic Products Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Prescription Retinoids-based Cosmetic Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Prescription Retinoids-based Cosmetic Products Market – By Product Type

6.1 Introduction/Key Findings

6.2 Retinol Concentration

6.3 Delivery System

6.4 Combination Therapies

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Prescription Retinoids-based Cosmetic Products Market – By Application

7.1 Introduction/Key Findings

7.2 Anti-aging

7.3 Acne Treatment

7.4 Hyperpigmentation

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Prescription Retinoids-based Cosmetic Products Market – By Target Audience

8.1 Introduction/Key Findings

8.2 Dermatologist-Prescribed

8.3 Over-the-counter (OTC)

8.4 Y-O-Y Growth trend Analysis By Target Audience

8.5 Absolute $ Opportunity Analysis By Target Audience, 2024-2030

Chapter 9. Prescription Retinoids-based Cosmetic Products Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By By Target Audience

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Target Audience

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Target Audience

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Target Audience

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Target Audience

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Prescription Retinoids-based Cosmetic Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Johnson & Johnson

10.2 Galderma Laboratories, L.P.

10.3 AbbVie Inc.

10.4 Allergan plc

10.5 L'Oréal S.A.

10.6 Roche Holding AG

10.7 Beiersdorf AG

10.8 Bayer AG

10.9 Procter & Gamble Company

10.10 Unilever PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Prescription Retinoids-based Cosmetic Products at USD 1.4 billion.

Through 2030, the global Prescription Retinoids-based Cosmetic Products market is expected to grow at a CAGR of 3.73%.

By 2030, the global Prescription Retinoids-based Cosmetic Products is expected to grow to a value of USD 1.81 billion.

North America is predicted to lead the market globally for Prescription Retinoids-based Cosmetic Products.

The global Prescription Retinoids-based Cosmetic Products market has segments like Target Audience, Product Type, Application, and Region.