Prepared Food Equipment Market Size (2024 – 2030)

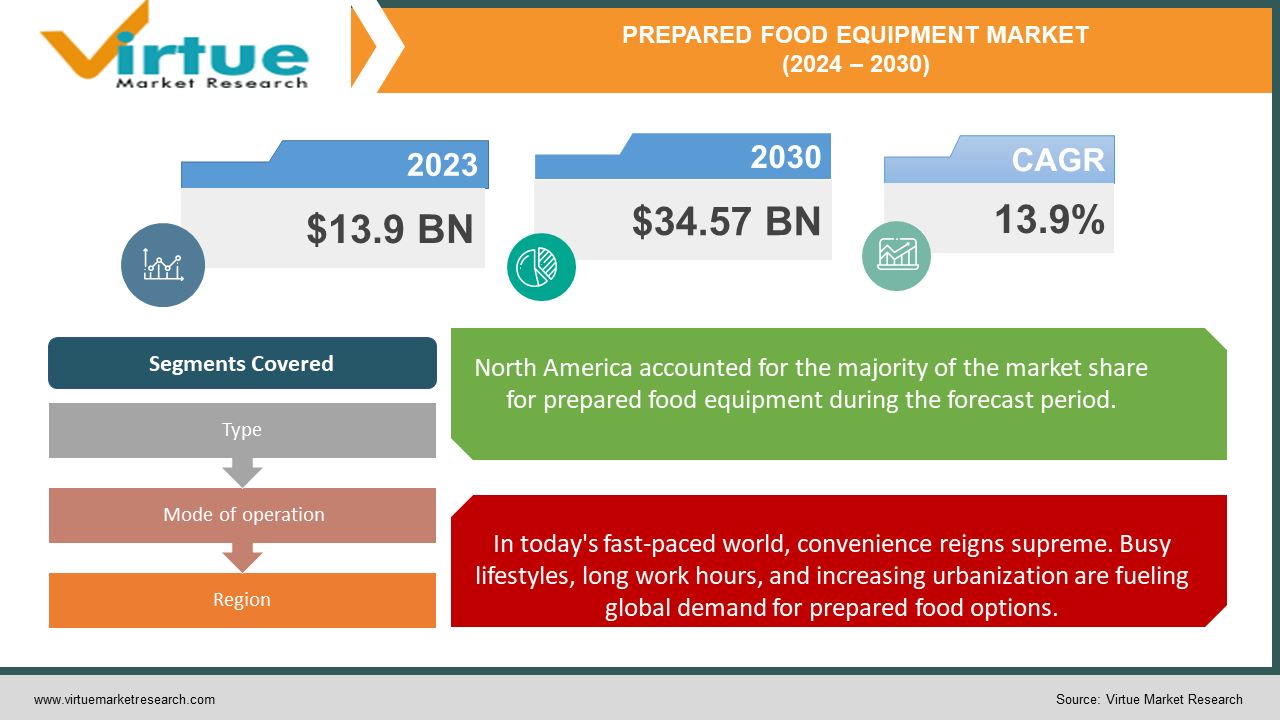

The Global Prepared Food Equipment Market is valued at USD 13.9 Billion in 2023 and is projected to reach a market size of USD 34.57 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.9%.

The prepared food sector produces a wide variety of tasty and convenient meals, and it is a dynamic and ever-changing field. The world of today is addicted to ease. Rapidly increasing urbanization and busy lives cause a spike in the demand for easily accessible prepared meals. Equipment for preparing food makes it easier to produce these quick and easy choices. As a result of consumers' growing attraction to unique and varied flavors, producers are investing in machinery that enables them to test and adjust prepared food recipes. Technology that guarantees continuous quality and longer shelf life for prepared food goods is required in light of the growing popularity of online grocery shopping and meal kit delivery services. The rise of personalized food experiences is driving demand for equipment that enables portion control, customized ingredients, and smaller batch production. Advanced technologies like ultraviolet (UV) sterilization and high-pressure processing (HPP) are expected to gain traction, further enhancing food safety in prepared food production.

Key Market Insights:

68% of global consumers report a preference for convenient and ready-to-eat meals due to busy lifestyles. This translates to a surge in demand for equipment that facilitates efficient prepared food production.

42% of consumers globally are willing to pay a premium for innovative and unique flavor profiles in prepared meals. This necessitates equipment that allows for recipe experimentation and customization within the prepared food industry.

The Ready-to-Eat (RTE) and Heat-and-Eat (H&E) prepared food segment is expected to reach a market size of USD 500 billion by 2027. This growth necessitates specialized equipment for portion control, packaging, and rapid preparation of these convenient options.

The meat & seafood segment is anticipated to reach a market value of USD 4.2 billion by 2028, reflecting the demand for specialized equipment for marinating, grilling, and portion control in prepared food production.

The bakery & dessert segment is expected to grow at a steady rate of 5.8% CAGR by 2027, driven by the continued popularity of convenient sweet treats.

The top five players in the prepared food equipment market collectively hold an estimated market share of 30%, showcasing a moderately consolidated landscape with opportunities for niche players.

The use of automation and robotics in prepared food equipment is expected to reach a market value of USD 5.2 billion by 2025, indicating a significant shift towards efficiency and reduced labor costs.

45% of prepared food manufacturers are planning to invest in smart manufacturing solutions by 2027, leveraging the power of IoT (Internet of Things) for real-time monitoring and process optimization.

Prepared Food Equipment Market Drivers:

In today's fast-paced world, convenience reigns supreme. Busy lifestyles, long work hours, and increasing urbanization are fueling global demand for prepared food options.

Prepared food equipment manufacturers are composing a symphony of efficiency. Advanced processing equipment like high-speed cookers, industrial ovens, and automated mixing systems allow for large-scale production of prepared meals in a shorter timeframe. This translates to increased output for manufacturers and readily available options for consumers. Consumers are increasingly health-conscious and mindful of portion sizes. Prepared food equipment plays a crucial role in this movement. Filling machines, portion control systems, and single-serve packaging equipment enable manufacturers to offer prepared meals in pre-determined, controlled portions. This caters to the growing desire for convenience without compromising on dietary goals. Packaging plays a vital role in the prepared food industry. Prepared food equipment manufacturers are innovating with sophisticated packaging solutions that extend shelf life, ensure food safety, and enhance convenience. This includes equipment for creating resealable pouches, tamper-evident closures, and microwave-safe containers.

Consumers today are no longer satisfied with bland, generic prepared meals. They crave exciting flavor profiles, unique ingredients, and options that cater to dietary restrictions.

Prepared food equipment manufacturers are creating a platform for culinary exploration. Advanced mixing systems, innovative cooking technologies, and temperature control equipment allow for the creation of diverse flavor profiles and textures in prepared meals. This empowers manufacturers to experiment with new recipes, cater to regional preferences, and stay ahead of evolving culinary trends. The concept of "one-size-fits-all" is fading away in the prepared food industry. Consumers are increasingly seeking prepared meals that cater to their specific dietary needs and preferences. Equipment manufacturers are responding with innovative solutions like portion control systems that can be adjusted for different dietary requirements and ingredient dispensers that can handle a wider variety of ingredients, including gluten-free and vegan options.

Prepared Food Equipment Market Restraints and Challenges:

While convenience is a key driver, cost remains a crucial factor for many consumers, particularly in emerging economies. Prepared food manufacturers are constantly under pressure to balance the cost of employing advanced equipment with maintaining competitive pricing for their products. High-end, technologically advanced equipment can translate to higher production costs, which can ultimately be passed on to consumers. This can limit the accessibility of prepared food options for budget-conscious individuals and families. Striking a balance between affordability and innovation can be a delicate act. Investing in cutting-edge equipment allows manufacturers to explore new recipe possibilities, improve efficiency, and cater to evolving consumer preferences. However, the high initial investment cost associated with advanced equipment can be a deterrent for smaller manufacturers or those operating in cost-sensitive markets. This can create a situation where innovation is stifled due to affordability concerns. A significant portion of consumers still associate prepared meals with a lack of freshness and quality compared to home-cooked options. This perception can be fueled by negative media portrayals or personal experiences with bland or unappealing prepared meals. Overcoming this perception is crucial for the prepared food equipment market to reach its full potential. Food waste is a significant global issue. Prepared food equipment manufacturers play a role in minimizing this issue by developing equipment that optimizes portion control, minimizes processing scraps, and facilitates efficient use of ingredients. Additionally, equipment that utilizes biodegradable or recyclable packaging materials is essential for a more sustainable future.

Prepared Food Equipment Market Opportunities:

The meteoric rise of online grocery shopping is creating a new wave of opportunity for the prepared food equipment market. Consumers are increasingly opting for the convenience of ordering groceries and prepared meals online. This necessitates equipment that caters to pre-portioned, packaged meals with extended shelf life, ideal for delivery. The growing popularity of single-serve prepared meals presents a significant opportunity. Equipment manufacturers can create solutions for efficient production and packaging of single-serve options, catering to busy individuals and smaller households. Smart packaging solutions that integrate with online grocery platforms and delivery services hold immense potential. This could include packaging with built-in freshness indicators or temperature monitoring capabilities, ensuring food safety and quality throughout the online delivery process. Consumers are increasingly seeking prepared meals that cater to their specific dietary needs and preferences. This opens doors for equipment that facilitates customization during the production process. This could involve portion control systems that can be adjusted for different calorie requirements or ingredient dispensers that can handle a wider variety of ingredients, including gluten-free and vegan options. The globalized world is craving diverse flavors and ethnic cuisines. Equipment manufacturers can cater to this by developing solutions for processing and packaging a wider variety of ingredients and ethnic dishes, allowing prepared food producers to tap into this growing market segment.

PREPARED FOOD EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.9% |

|

Segments Covered |

By Type, Mode of operation, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GEA Group, Alfa Laval , JBT Corporation, SPX FLOW , Tetra Laval , Marel , Bühler Group , Heat and Control , tna solutions , Everest Engineering |

Prepared Food Equipment Market Segmentation: By Type

-

Pre-processing Equipment

-

Processing Equipment

-

Packaging Equipment

-

Other Equipment

Processing equipment reigns supreme in the prepared food equipment market, holding an estimated share of 35-40%. This segment plays a pivotal role in transforming raw ingredients into delectable, prepared meals. This sub-segment includes a vast array of equipment for various cooking methods. Industrial ovens for baking, roasting, and drying; fryers for creating crispy and flavourful products; and kettles for boiling, simmering, and steaming are just a few examples. Efficient mixing is crucial for many prepared food products. This sub-segment offers a variety of mixers, from high-shear mixers for creating smooth emulsions to planetary mixers for combining dough ingredients. Homogenizing ingredients is essential for many prepared meals. Blenders of various sizes and capabilities are used to create sauces, dips, soups, and other products with a smooth texture.

Packaging equipment is projected to be the fastest-growing segment in the prepared food equipment market, with an estimated share of 25-30% and a strong upward trajectory. Consumers today are increasingly health-conscious and demand transparency in their food. Packaging equipment manufacturers are responding with solutions that offer resealable pouches, tamper-evident closures, and clear labeling with detailed ingredient information. The surge in online grocery shopping necessitates innovative packaging solutions. Packaging equipment that facilitates pre-portioned, single-serve options with an extended shelf life is crucial for catering to online grocery delivery models. Environmental responsibility is a growing concern for both consumers and manufacturers. The packaging equipment segment is responding with solutions that utilize biodegradable or recyclable materials, reducing the environmental impact of prepared food production.

Prepared Food Equipment Market Segmentation: By Mode of operation

-

Automatic Equipment

-

Semi-Automatic Equipment

-

Manual Equipment

Automatic equipment reigns supreme in the prepared food equipment market, holding an estimated share of 40-45%. This segment caters to the ever-growing demand for efficiency and consistency in prepared food production. Automatic equipment excels in high-volume production environments. By automating repetitive tasks like mixing, filling, and packaging, manufacturers can achieve significant increases in output, meeting the growing demand for prepared meals. Automatic equipment ensures consistent product quality. Programmable settings and automated processes minimize human error and ensure each prepared meal meets predefined specifications. The dominance of automatic equipment is further amplified by technological advancements. Integration with robotics and artificial intelligence is enabling even more sophisticated automation solutions, further streamlining production, and optimizing resource utilization.

Semi-automatic equipment is projected to be the fastest-growing segment, with an estimated share of 30-35% and a strong upward trajectory. This segment offers a compelling balance between automation and human oversight, catering to a wider range of production needs. Semi-automatic equipment allows for greater flexibility and customization in production compared to fully automated systems. This caters to manufacturers producing smaller batches or offering niche-prepared food options. Semi-automatic equipment is typically less expensive than fully automated solutions, making it a more accessible option for smaller manufacturers or those with limited budgets. Semi-automatic equipment can often be integrated with existing production lines, facilitating a gradual transition towards automation without requiring a complete overhaul of the system.

Prepared Food Equipment Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The prepared food equipment market is dominated by North America, which includes both the United States and Canada. The prominence of this area can be ascribed to a number of things, such as a robust food service sector, a focus on time- and convenience-saving solutions, and a high level of consumer expenditure on eating out. The demand for prepared food equipment is largely driven by the United States in particular. The nation's booming restaurant business, together with the growing appeal of fast-casual eating and meal delivery services, has increased demand for effective and cutting-edge equipment.

In this industry, the Asia-Pacific area is starting to grow at the quickest rate. There are a number of reasons for this quick expansion, including the region's rapidly urbanizing middle class, rising disposable incomes, and shifting eating habits. The food service sectors in countries like China, India, and Southeast Asia are expanding to meet the growing need for convenient dining options and prepared food equipment. As a result, these countries are seeing a spike in demand for this equipment. Quick-service restaurants, cafés, and casual dining venues are becoming more and more popular, which has increased the need for dependable, efficient equipment that can manage large quantities without sacrificing quality.

COVID-19 Impact Analysis on the Prepared Food Equipment Market:

Restaurant closures and social distancing measures led to a drastic decline in demand for prepared food. This, in turn, resulted in a slump in demand for equipment used by restaurants and food service providers, impacting manufacturers across all segments. Global lockdowns and travel restrictions disrupted the intricate supply chains for prepared food equipment. Shortages of raw materials and components hampered production, leading to delays and price hikes. Uncertainty surrounding the pandemic's duration caused many businesses to postpone or cancel equipment upgrades. This further dampened the market sentiment. With the rise of home cooking and online grocery shopping, manufacturers shifted their focus towards equipment catering to increased demand for packaged and single-serve prepared meals. This included equipment for portion control, extended shelf-life solutions, and packaging efficiency. The prepared food equipment market embraced the e-commerce boom. Manufacturers invested in online platforms and digital marketing strategies to reach customers directly and cater to the growing demand for contactless transactions. Hygiene and sanitation became paramount concerns. Manufacturers saw a surge in demand for equipment that facilitated easier cleaning, minimized human contact with food during processing, and ensured food safety throughout the production process.

Latest Trends/ Developments:

The market for prepared food equipment is being revolutionized by the Industrial Internet of Things or IoT. Sensor-equipped equipment has the ability to gather data in real-time on energy consumption, temperature, and performance. Predictive maintenance, industrial process optimization, and downtime reduction are all possible with this data. In order to handle repetitive operations like palletizing, packing, and product handling, sophisticated robotic systems are being integrated into food production lines. Cobots, or collaborative robots, are also becoming more and more popular. These complement human laborers by helping with jobs and enhancing productivity. Food waste is a significant global issue. New equipment is focusing on minimizing waste throughout the production process. This includes portion control systems that ensure precise ingredient measurement, technology for reusing food scraps, and improved packaging solutions to extend product shelf life. Developing standardized protocols for smart labeling systems would ensure seamless information sharing and transparency across the food supply chain. Collaboration on open-source equipment platforms could allow for faster development and customization of equipment to meet specific production needs.

Key Players:

-

GEA Group

-

Alfa Laval

-

JBT Corporation

-

SPX FLOW

-

Tetra Laval

-

Marel

-

Bühler Group

-

Heat and Control

-

tna solutions

-

Everest Engineering

Chapter 1. Prepared Food Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Prepared Food Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Prepared Food Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Prepared Food Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Prepared Food Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Prepared Food Equipment Market – By Type

6.1 Introduction/Key Findings

6.2 Pre-processing Equipment

6.3 Processing Equipment

6.4 Packaging Equipment

6.5 Other Equipment

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Prepared Food Equipment Market – By Mode of operation

7.1 Introduction/Key Findings

7.2 Automatic Equipment

7.3 Semi-Automatic Equipment

7.4 Manual Equipment

7.5 Y-O-Y Growth trend Analysis By Mode of operation

7.6 Absolute $ Opportunity Analysis By Mode of operation, 2024-2030

Chapter 8. Prepared Food Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Mode of operation

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Mode of operation

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Mode of operation

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Mode of operation

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Mode of operation

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Prepared Food Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 GEA Group

9.2 Alfa Laval

9.3 JBT Corporation

9.4 SPX FLOW

9.5 Tetra Laval

9.6 Marel

9.7 Bühler Group

9.8 Heat and Control

9.9 tna solutions

9.10 Everest Engineering

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In today's fast-paced world, consumers are increasingly seeking convenient and time-saving meal options. Prepared meals represent a readily available solution, driving demand for equipment that facilitates efficient and high-volume production.

Automated and advanced equipment often comes with a hefty price tag. This can be a barrier to entry for smaller producers or those with limited budgets. Manufacturers need to explore solutions like leasing options or financing models to make advanced equipment more accessible.

GEA Group, Alfa Laval, JBT Corporation, SPX FLOW, Marel, Bühler Group, Heat and Control, tna solutions, Everest Engineering.

North America has firmly established itself as the most dominant player in the market, commanding an impressive 40% market share.

The Asia-Pacific region is emerging as the fastest-growing region in this sector. This rapid growth can be attributed to several factors, including rapid urbanization, increasing disposable incomes, and changing dietary preferences among the region's burgeoning middle class.