Prepaid Card Market Size (2024 – 2030)

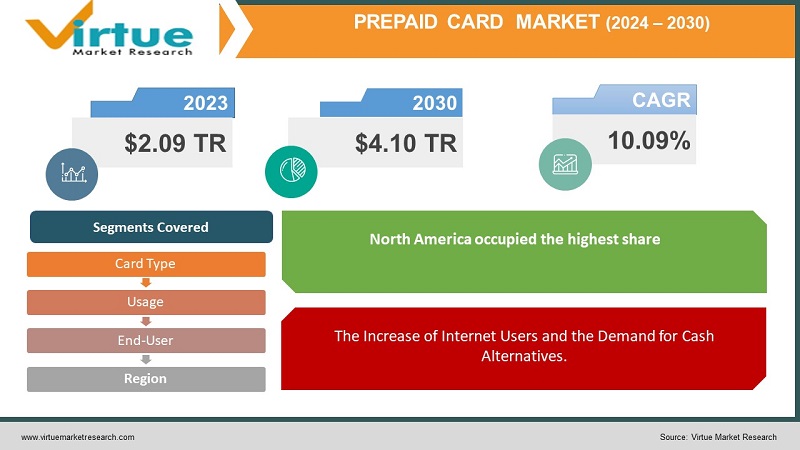

The Global Prepaid Card Market is valued at USD 2.09 trillion in 2023 and is projected to reach a market size of USD 4.10 trillion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.09%.

Prepaid cards serve as tools that empower individuals to carry out transactions without relying on a bank account or credit card. These cards allow users to preload an amount of money ensuring they can spend what they have loaded onto the card. There are types of cards available such, as open-loop cards that can be used at any establishment accepting card payments and closed-loop cards that are restricted to specific merchants or retailers. These cards offer consumers an adaptable payment option granting them security and control, over their expenses. Prepaid cards offer an alternative, to bank cards allowing users to spend the amount they have saved. They function similarly to debit cards. Can be used for a range of purposes like making purchases paying bills online buying gas, shopping, and handling payments. These prepaid cards are known as General Purpose Reloadable (GPR) cards. Are issued to individuals who may not meet the requirements for a bank account or find it difficult to afford the fees. These payment solutions have become increasingly popular. Provide an approach, to managing finances.

Key Market Insights:

According to a report, by the Federal Deposit Insurance Corporation (FDIC) in 2018 6.5% of households in the United States did not have a bank account, which means that around 8.4 million Americans were still managing their finances without one. Many people in this group opt for cards as they provide an affordable alternative, to traditional banking services effectively meeting their financial transaction needs.

In Latin America and the Caribbean the use of cards, from Mexico saw a rise of 37% in 2017. This surge in popularity also resulted in a 58% increase, in the number of transactions.

American Express and Walmart unveiled the "Bluebird card" on September 1, 2018. This prepaid card can be easily connected to an app.

Given that the majority (90%) of post offices, in India are situated in areas the Department of Posts in the country has plans to introduce prepaid cards as a means to enhance awareness and accessibility, among rural customers.

According to the Reserve Bank of India, there were a total of 4.12 billion debit card transactions in 2021.

According to Aite Group, a company specializing in insurance services it was reported that in the year 2020, almost half of all Americans fell victim to theft. The losses resulting from these cases of identity theft amounted to $502.5 billion, in 2019. Furthermore, there was an increase of 42% in incidents during 2020 reaching a total cost of $721.3 billion, in 2021.

Prepaid Card Market Drivers:

The Increase of Internet Users and the Demand for Cash Alternatives.

As per studies financial advisors have observed an increase in clients' interest in cashless transactions. This is driven by their desire for low-risk investments that offer returns compared to cash-based accounts. Prepaid cards have emerged as an alternative for individuals because they limit spending to the available card balance. These cards can be conveniently loaded through platforms, including bank account transfers, direct deposits, or cash both online and, in person.

Corporations are also focusing on alternatives, to currency to manage their day-to-day operations. Card issuers offer payment methods. For instance, VA Tech Ventures has introduced "Happay," a spending card that allows managers to remotely manage it through a mobile or web interface. With this card, employers can set limits add funds, monitor expenses, and approve transactions in time. All of these factors are expected to drive the growth of the card market. The booming e-commerce industry has led customers to rely on money rather than carrying physical cash in their wallets.

Based on information gathered from institutions it appears that the younger generation is playing a role, in the global shift away from credit cards when making purchases. An interesting example can be seen in the Dubais payments sector, where many customers are opting to replace their credit cards with a payment method known as a "debit card". These prepaid cards serve as alternatives to credit and debit cards and are particularly useful for individuals, without bank accounts. As a result, it is expected that prepaid cards will continue to dominate the electronic payment industry.

Prepaid Card Market Restraints and Challenges:

Fees, for cards like charges for not using the card or closing the account, vary depending on the product or service, within the prepaid industry. For customers, it can be quite difficult to choose or find a prepaid product, from the wide range of options in the market. The Consumer Financial Protection Bureau (CFPB) has introduced rules and guidelines to ensure consistency, in product features. However, it will take some time for these regulations to be fully implemented as they are still relatively new.

Prepaid Card Market Opportunities:

Various demographic groups, such, as those with incomes, less education, and younger age brackets have higher rates of being underbanked or unbanked. According to the Federal Deposit Insurance Corporation (FDIC) report in 2018 6.5% of households did not have a bank account meaning that around 8.4 million homes were operating without one in the economy. To fulfill their needs and transactions prepaid cards are often preferred by these groups due to their reliability, affordability, and suitability as an alternative to banking services. As an example in LAC (Latin America and the Caribbean) in 2017 there was a surge of 37% in card usage originating from Mexico alone. This increase led to a 58% rise in the number of transactions made using prepaid cards. Such spending patterns indicate that prepaid instruments have become a part of life for many individuals and communities who are open to exploring various options available for prepaid cards. Consequently, it is expected that the growing adoption of cards among the population will present promising opportunities, for market participants.

PREPAID CARD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.09% |

|

Segments Covered |

By Card Type, Usage, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mastercard, PayPal Holdings, Inc., Visa, Banco Bilbao Vizcaya Argentaria S.A, American Express Company, Revolut, JPMorgan Chase & Co., H&R Block Inc., Brink's Incorporated, Green Dot Corporation, Netspend |

Prepaid Card Market Segmentation: By Card Type

-

Closed Loop Card

-

Open Loop Card

In 2022, based on the card type, the Closed Loop Card segment accounted for the largest revenue share by almost 60% and has led the market. Open loop cards account for the remaining 40% of the market share. In contrast, to closed loop cards, which are limited to a merchant or retailer like a gift card for a store open loop cards can be used anywhere that accepts payment from networks such as Visa or Mastercard. Among card types, open-loop cards are experiencing a growth rate. It is projected that open-loop cards will see a growth rate (CAGR) of approximately 20% during the forecast period compared to around 15% for closed-loop cards.

The surge in popularity of loop cards can be attributed to factors including; The increasing adoption of digital payments, The growing preference for online shopping and e-commerce, The rising demand for open loop cards in government benefit programs and payroll disbursements, The increased utilization of loop cards, in travel and entertainment transactions.

Prepaid Card Market Segmentation: By Usage

-

General Purpose Reloadable Card

-

Gift Card

-

Government Benefits/Disbursement Card

-

Incentive/Payroll Card

-

Others

The section dedicated to purpose cards is expected to dominate the market with a growth rate of 14.3% annually. These prepaid cards, commonly known as purpose prepaid cards function as independent alternatives, to traditional bank accounts while offering customers the same convenience and security as credit and debit cards. By utilizing identification numbers (PINs) they provide enhanced protection against fraud and errors. The finance industry has transformed due to the rise of payments leading to increased popularity in managing cash through prepaid options like the general purpose reloadable card (GPR).

Following closely behind is the gift card segment, which holds a market share. Gift cards are prepaid stripe cards that come with an expiration date and cannot be reloaded. They are often given as presents since they can be used at merchant point-of-sale terminals. Furthermore, these gift cards can be personalized for occasions making them an appealing option available in bars and shops, with the inclusion of a personal message.

Prepaid Card Market Segmentation: By End-User

-

Retail Establishment

-

Corporate Institutions

-

Government

-

Financial Institutions

The Retail Establishment sector is expected to dominate, with a projected growth rate of 12.9%. The surge, in activities and the popularity of using the Internet for bill payments and shopping have led to an increase in the adoption of cards as a preferred payment method. The population's increased purchasing power in North America and Europe has contributed to the use of prepaid cards at retail stores. These cards offer enhanced risk management, heightened security, flexibility, access to funds, and lower processing costs making them increasingly popular, in environments.

The government sector is expected to have the portion. Governments, around the world are keen on leveraging the speed, convenience, and accessibility of transactions to maximize the benefits of payments and reduce reliance on paper checks for individual payments. They are actively working towards limiting the use of paper checks and exploring methods such as deposits, for various government transactions.

Prepaid Card Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, North America dominates the market because of the presence of companies, like Microsoft and Google. The integration of advancements and the increased investment in Research and Development by enterprises will drive market growth. The American region is known for hosting players in the prepaid card industry, including Visa, Mastercard, and American Express. The expansion of the card market, in this area can be attributed to the rising use of payments the surging popularity of online shopping, and the increasing need for prepaid cards, for government benefits and salary distribution purposes. Asia Pacific on the other hand is projected to experience the fastest growth in the forecast period due to the rising number of applications, in retail establishments, government support, and corporate institutions involvement.

COVID-19 Impact Analysis on the Global Prepaid Card Market:

The COVID-19 pandemic caused an increase, in the use of cards. With lockdowns and economic uncertainty, more people turned to contactless payments and online shopping. Prepaid cards became a choice for those, without bank accounts providing a safe and convenient alternative. As a result, the usage and acceptance of cards saw growth during the pandemic.

Latest Trends/ Developments:

A prepaid card is a way to make payments and it doesn't take much time or money to get one. Prepaid cards do not serve as an alternative, to cash. Also, provides consumers with added security and ease when making transactions. Over the decade India has experienced growth in the e-commerce industry thanks to the widespread use of smartphones and the internet. This growth has led to an increase in payments made with cards. Additionally, factors such as demonetization and government initiatives promoting a cashless economy have further fueled this growth. The presence of organized retailers in the market has also played a role in boosting the popularity of cards, in India.

The prepaid card market has changed due, to the emergence of fintech companies and digital transformation. Mobile wallets are now being seamlessly integrated with cards allowing customers to conveniently access and control their cards through smartphone applications. Additionally, prepaid card providers are offering personalized experiences by enabling customers to customize their debit cards with designs and features. Furthermore tailored offers, discounts, and rewards based on purchasing habits are becoming increasingly prevalent, in this industry. Moreover, there is a growing trend of merging visa prepaid cards, with cryptocurrencies and digital assets. Users now can load their cards with cryptocurrencies and use them for transactions. This development serves as a bridge between finance and the expanding world of digital currencies. As a result, the prepaid card market is experiencing growth driven by factors such, as transformation, fintech integration, contactless payment cryptocurrency, and digital assets. Visa recently announced an expansion of its card services in November 2022. As part of this, they have introduced pilot payment innovations such, as the Wys cards that come with animated card art and even support facial biometric payments. It seems like Visa is keeping up with the growing demand for gratification by testing a digital card issuing option for a group of cardholders, in Doha.

Key Players:

-

Mastercard

-

PayPal Holdings, Inc.

-

Visa

-

Banco Bilbao Vizcaya Argentaria S.A

-

American Express Company

-

Revolut

-

JPMorgan Chase & Co.

-

H&R Block Inc.

-

Brink's Incorporated

-

Green Dot Corporation

-

Netspend

In September 2021 Mastercard announced their agreement to acquire Aiia, a technology provider, in the field of open banking. Aiia offers an API that enables direct connections, to various banks. This acquisition aims to empower Mastercard customers by allowing them to create and introduce solutions that cater to the demands of daily life, work, and leisure activities.

In July 2021 Mastercard, Mumbai Metro, and Axis Bank introduced the "One Mumbai Metro Card." This card allows users to make transactions using a system. It offers convenience and ease of use for commuters, in the city.

Chapter 1. Prepaid Card Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Prepaid Card Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Prepaid Card Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Prepaid Card Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Prepaid Card Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Prepaid Card Market – By Card Type

6.1 Introduction/Key Findings

6.2 Closed Loop Card

6.3 Open Loop Card

6.4 Y-O-Y Growth trend Analysis By Card Type

6.5 Absolute $ Opportunity Analysis By Card Type, 2024-2030

Chapter 7. Prepaid Card Market – By Usage

7.1 Introduction/Key Findings

7.2 General Purpose Reloadable Card

7.3 Gift Card

7.4 Government Benefits/Disbursement Card

7.5 Incentive/Payroll Card

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Usage

7.8 Absolute $ Opportunity Analysis By Usage, 2024-2030

Chapter 8. Prepaid Card Market – By End-User

8.1 Introduction/Key Findings

8.2 Retail Establishment

8.3 Corporate Institutions

8.4 Government

8.5 Financial Institutions

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Prepaid Card Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Card Type

9.1.3 By Usage

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Card Type

9.2.3 By Usage

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Card Type

9.3.3 By Usage

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Card Type

9.4.3 By Usage

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Card Type

9.5.3 By Usage

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Prepaid Card Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Mastercard

10.2 PayPal Holdings, Inc.

10.3 Visa

10.4 Banco Bilbao Vizcaya Argentaria S.A

10.5 American Express Company

10.6 Revolut

10.7 JPMorgan Chase & Co.

10.8 H&R Block Inc.

10.9 Brink's Incorporated

10.10 Green Dot Corporation

10.11 Netspend

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Prepaid Card Market is valued at USD 2.09 trillion in 2023 and is projected to reach a market size of USD 4.10 trillion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.09%.

The Increase of Internet Users and the Demand for Cash Alternatives.

Based on Card Type, the Global Prepaid Card Market is segmented into Open Loop Card and Closed Loop Card.

North America is the most dominant region for the Global Prepaid Card Market.

Mastercard, PayPal Holdings, Inc., Visa, Banco Bilbao Vizcaya Argentaria S.A, American Express Company, and Revolut are the key players operating in the Global Prepaid Card Market.