Premium Gin Market Size (2024 – 2030)

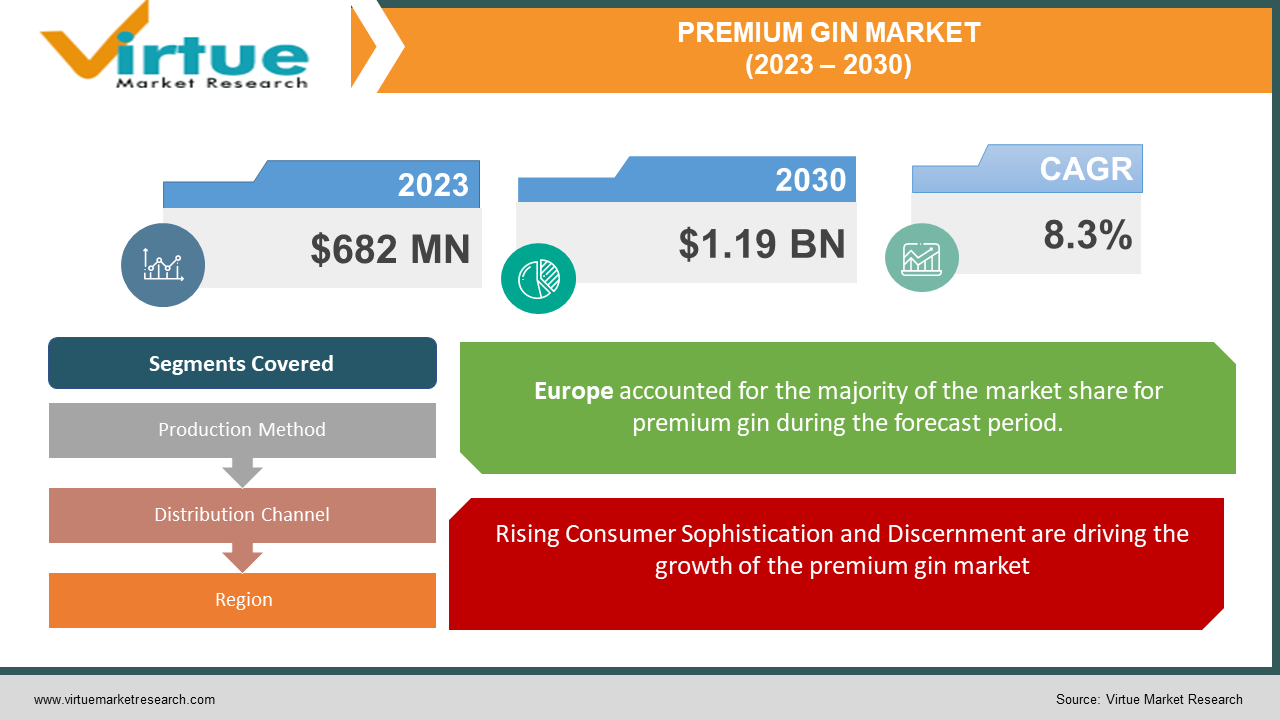

The Global Premium Gin Market was valued at USD 682 Million in 2023 and is projected to reach a market size of USD 1.19 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.3%.

The premium gin market has witnessed remarkable growth in recent years, driven by a global shift towards craft and artisanal spirits. Consumers increasingly seek unique and high-quality gin experiences, leading to a surge in the demand for premium offerings. Craft distilleries and established brands alike are innovating with botanical blends, sophisticated packaging, and small-batch production methods to distinguish their products. The premium gin market is characterized by a discerning consumer base appreciative of diverse flavor profiles, premium ingredients, and a commitment to quality, reflecting an overall trend in the beverage industry towards elevated and distinctive drinking experiences.

Key Market Insights:

Research conducted by the University of Derby in the United Kingdom has unveiled that over the past two years, more than 55% of female gin enthusiasts increased their gin consumption, highlighting a growing trend in 2020.

Furthermore, gin is highly esteemed for its natural and earthy appeal, especially as it is extensively utilized by on-trade counters to craft premium cocktails. According to the Beverage Information Group, consumers in the United States alone indulged in nearly 1,510,000 9-litre cases of Seagram's Gin in 2021.

The United Kingdom holds the esteemed position of being the world's largest exporter of gin, boasting an impressive count of over 315 distilleries. The Gin market is projected to reach a volume of 60 million liters by 2027, with an anticipated average volume per person amounting to 0.18 liters in 2023.

Premium Gin Market Drivers:

Rising Consumer Sophistication and Discernment are driving the growth of the premium gin market.

One significant driver is the increasing sophistication of consumers who are seeking unique and premium experiences in their beverage choices. As consumers become more knowledgeable about spirits and cocktails, there is a growing demand for high-quality, handcrafted gins that offer distinct flavor profiles and premium ingredients. The premium gin market benefits from this trend as consumers are willing to explore and pay a premium for spirits that provide a more refined and unique drinking experience.

Craft and Artisanal Movement is propelling the premium gin market.

The surge in the craft and artisanal movement within the spirits industry has significantly propelled the premium gin market. Consumers are drawn to the authenticity, attention to detail, and craftsmanship associated with small-batch gin production. Craft distilleries are often at the forefront of innovation, experimenting with botanical blends, unique distillation techniques, and locally sourced ingredients. This emphasis on craftsmanship and a sense of exclusivity aligns with consumer preferences for premium products, driving the growth of the premium gin market globally.

Premium Gin Market Restraints and Challenges:

Saturated Market and Competition in the premium gin market pose challenges for businesses.

One significant challenge in the premium gin market is the increasing saturation and intense competition. The market's popularity has attracted numerous new entrants, leading to a crowded landscape where distinguishing one's brand becomes challenging. Established brands must continually innovate to maintain their market share, while newer players face the uphill task of breaking through the clutter and establishing their unique value proposition. This heightened competition puts pressure on pricing strategies, marketing efforts, and the need for constant product differentiation to capture and retain consumer attention in an oversaturated market.

Regulatory and Compliance Hurdles is a major hurdle in the premium gin market.

Another challenge faced by the premium gin market is navigating the complex landscape of regulations and compliance, both domestically and internationally. The production and sale of alcoholic beverages are subject to stringent regulations, and compliance with varying legal requirements can pose challenges for distillers operating in different regions. From labeling and advertising restrictions to varying taxation policies, the regulatory environment adds complexity to the production, distribution, and marketing processes. Navigating these regulatory hurdles demands a significant investment of time and resources, and non-compliance could lead to legal consequences, hampering the growth and expansion of premium gin brands.

Premium Gin Market Opportunities:

The premium gin market presents exciting opportunities for growth and innovation as consumer preferences continue to evolve. With a rising demand for unique and sophisticated spirits, premium gin brands have the chance to explore innovative botanical blends, craft distillation techniques, and distinct flavor profiles to captivate a discerning consumer base. Opportunities also lie in strategic collaborations, such as partnerships with mixologists or exclusive limited-edition releases, which can enhance brand exclusivity. As the trend towards premiumization persists, there is room for premium gin brands to engage consumers through immersive brand experiences, storytelling, and sustainable practices, creating a strong and loyal customer base in this dynamic market.

PREMIUM GIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.3% |

|

Segments Covered |

By Production Method, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bacardi Limited, Blackforest Distilleries, Sipsmith Distilleries, Davide Campari-Milano N.V., Diageo Plc, William Grant & Sons Ltd., Warwick Valley Winery, Anheuser-Busch Companies |

Premium Gin Market Segmentation: By Production Method

-

Copper Pot Still Distilled Gins

-

Vacuum Distilled Gins

-

Column Still Distilled Gins

-

Cold Compound Gins

-

Rotary Evaporator Distilled Gins

-

Steam-Infused Gins

-

Hybrid Distillation Gins

-

Hemp or Cannabis-Infused Gins

The largest segment among these is Copper Pot Still Distilled Gins having a market share of 58%. This traditional distillation method is widely embraced in the production of premium gins due to its ability to create a robust and complex flavor profile. Copper pot stills allow for a slower and more thorough extraction of botanical essences, resulting in a gin with a rich and full-bodied character. Many renowned and established gin brands favor this method, contributing to its prevalence and popularity within the premium gin market. The fastest-growing segment among these is Rotary Evaporator Distilled Gins. This method's popularity is surging due to its ability to capture delicate and intricate flavors from botanicals, resulting in a gin with a distinctive profile. Consumers, particularly those seeking unique and premium taste experiences, are drawn to the innovative approach of rotary evaporator distillation, which sets these gins apart in a competitive market. The method's capacity to create complex and sophisticated flavor profiles aligns with the evolving preferences, driving the rapid growth of this segment in the premium gin market.

Premium Gin Market Segmentation: By Distribution Channel

-

Retail Distribution

-

On-Trade

-

Online Retail

-

Specialty Liquor Stores

-

Others

The largest segment by distribution channel is Retail distribution having a market share of 62%. Retail outlets, including supermarkets and liquor stores, have a broad consumer reach and accessibility, contributing to their dominance in the market. Consumers often prefer the convenience of purchasing premium gin during routine shopping trips, making retail distribution the go-to channel for a significant portion of the target audience. The diverse range of premium gins available in retail stores caters to varying consumer preferences. The fastest-growing segment among these is Online Retail growing at a rate of 22%. This segment has experienced rapid growth due to the increasing trend of online shopping and the convenience it offers to consumers. The shift in consumer behavior, especially post-COVID-19, has accelerated the demand for premium gins through online platforms. The accessibility, wide product variety, and the ability to reach a global audience make online retail the fastest growing in the premium gin market.

Premium Gin Market Segmentation: Regional Analysis

-

North America

-

Asia- Pacific

-

Europe

-

South America

-

Middle East and Africa

The largest region in the premium gin market is Europe, holding a market share of 40%, driven by the United Kingdom's strong historical association with gin consumption. The UK, a key market for premium gins, has witnessed a surge in craft and artisanal distilleries, contributing to the region's dominance. The European market benefits from a mature and discerning consumer base with a rich appreciation for high-quality spirits. The presence of gin culture, coupled with a demand for premiumization and innovative flavor profiles, makes Europe the leading and most influential region in the global premium gin market. The fastest-growing region in the premium gin market is Asia-Pacific growing at a CAGR of 18%. This growth can be attributed to a rising consumer affinity for premium and craft spirits, coupled with a growing middle class with increased disposable income. The region's evolving cocktail culture, expanding urbanization, and increasing demand for unique and high-quality products contribute to the surge in demand for premium gins.

COVID-19 Impact Analysis on the Global Premium Gin Market:

The global premium gin market experienced both challenges and opportunities in the wake of the COVID-19 pandemic. Initially, the closure of bars, restaurants, and travel restrictions resulted in a decline in on-premise sales, impacting the premium gin market. However, as consumers shifted towards at-home consumption, there was a notable surge in off-premise sales through e-commerce channels. Premium gin brands that adapted quickly to changing consumer behaviors, emphasizing online presence, and offering unique at-home experiences, managed to mitigate some of the losses. The pandemic underscored the importance of premiumization, with consumers increasingly seeking high-quality and novel products for home enjoyment. As the world gradually recovers, the premium gin market is expected to rebound with a continued focus on innovation, online engagement, and catering to the evolving preferences of consumers.

Latest Trends/ Developments:

A prevailing trend in the premium gin market is the increasing emphasis on sustainability and ethical practices. Consumers are becoming more conscientious about the environmental and social impact of their purchases. Premium gin brands are responding by incorporating sustainable sourcing of botanicals, eco-friendly packaging, and adopting ethical production methods. This trend aligns with the growing demand for products that not only offer a premium experience but also reflect a commitment to environmental and social responsibility.

A notable development in the premium gin market is the continued rise of craft and artisanal gins. Consumers are drawn to unique, small-batch productions that offer distinct flavor profiles and a sense of craftsmanship. Craft distilleries are gaining prominence, challenging established brands and introducing innovative botanical blends, unconventional distillation methods, and storytelling that resonates with consumers seeking authenticity and a personalized drinking experience. This development signifies a shift towards a more diversified and dynamic premium gin market.

Key Players:

-

Bacardi Limited

-

Blackforest Distilleries

-

Sipsmith Distilleries

-

Davide Campari-Milano N.V.

-

Diageo Plc

-

William Grant & Sons Ltd.

-

Warwick Valley Winery

-

Anheuser-Busch Companies

In March 2022, Hendrick's Neptunia Gin was introduced by William Grant & Sons. Crafted by the master distiller Lesley Gracie, this gin incorporates a blend of Scottish coastal botanicals, maintaining the unmistakable Hendrick's signature.

Chapter 1. Premium Gin Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Premium Gin Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Premium Gin Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Premium Gin Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Premium Gin Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Premium Gin Market – By Production Method

6.1 Introduction/Key Findings

6.2 Copper Pot Still Distilled Gins

6.3 Vacuum Distilled Gins

6.4 Column Still Distilled Gins

6.5 Cold Compound Gins

6.6 Rotary Evaporator Distilled Gins

6.7 Steam-Infused Gins

6.8 Hybrid Distillation Gins

6.9 Hemp or Cannabis-Infused Gins

6.10 Y-O-Y Growth trend Analysis By Production Method

6.11 Absolute $ Opportunity Analysis By Production Method, 2024-2030

Chapter 7. Premium Gin Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Retail Distribution

7.3 On-Trade

7.4 Online Retail

7.5 Specialty Liquor Stores

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Premium Gin Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Production Method

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Production Method

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Production Method

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Production Method

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Production Method

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Premium Gin Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Bacardi Limited

9.2 Blackforest Distilleries

9.3 Sipsmith Distilleries

9.4 Davide Campari-Milano N.V.

9.5 Diageo Plc

9.6 William Grant & Sons Ltd.

9.7 Warwick Valley Winery

9.8 Anheuser-Busch Companies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Premium Gin Market was valued at USD 682 Million in 2023 and is projected to reach a market size of USD 1.19 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.3%.

Rising Consumer Sophistication and Discernment along with Craft and Artisanal Movement are drivers of the Premium Gin market.

Based on distribution channel, the Global Premium Gin Market is segmented into Retail Distribution, On-Trade, Online Retail, Specialty Liquor Stores, and Others.

Europe is the most dominant region for the Global Premium Gin Market.

William Grant & Sons Ltd., Warwick Valley Winery, and Anheuser- Busch Companies are a few of the key players operating in the Global Premium Gin Market.