Pregnancy and Mother Care Technology Market Size (2023 – 2030)

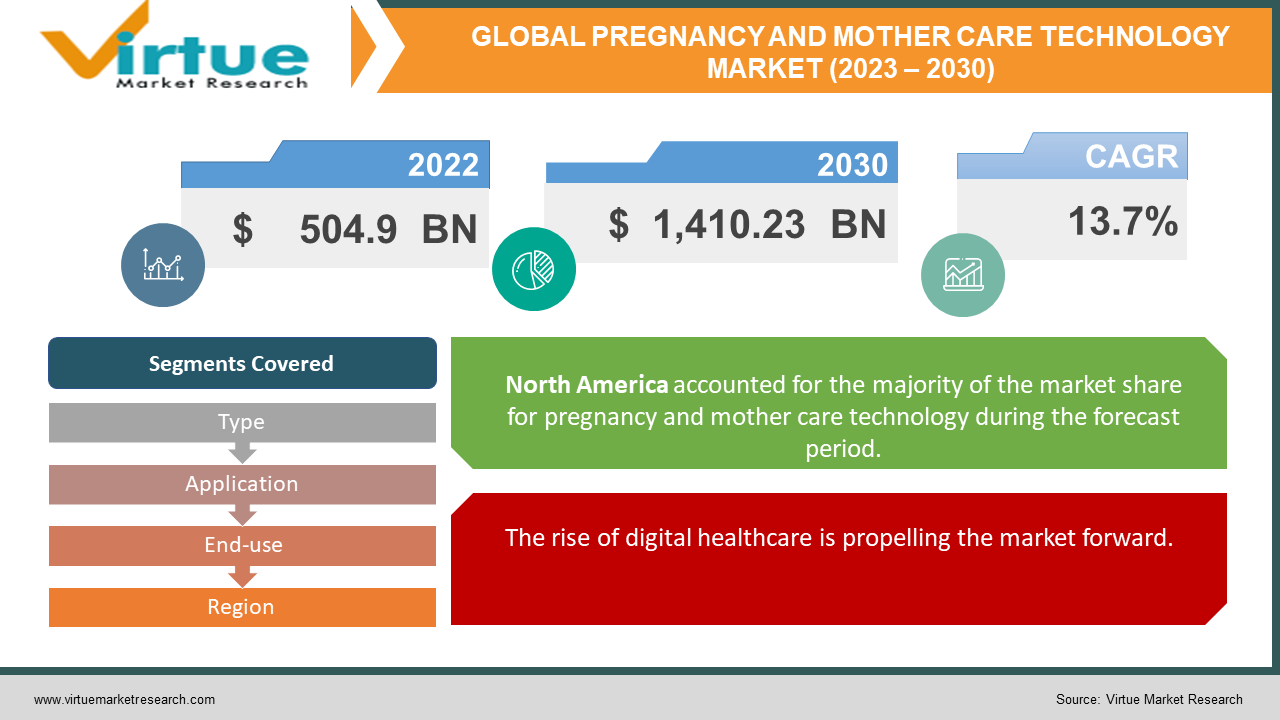

According to our research report, the global Pregnancy and Mother Care Technology market size was at USD 504.9 billion in 2022 and is expected to reach USD 1,410.23 billion by 2030. The global market is expected to witness a growth rate of 13.7% CAGR during the forecasted period from 2023 to 2030. Many variables influence the pregnancy and mother care technology market, including increased birth rates, affordability, and changing lifestyles.

Market Overview

Market size for pregnancy and mother care technology

Many variables influence the Pregnancy and Mother Care Technology market, including increased birth rates, affordability, and changing lifestyles. The expansion of the Pregnancy and Mother Care Technology market has been fuelled by the growing newborn population in emerging nations such as China and India, as well as a growing focus on e-commerce. Extensive urbanization in various locations has also increased the proportion of nuclear families in which both parents work, resulting in higher per capita expenditure on infant and mother care. Pacifiers and breast pumps (items for newborns and mothers, respectively) are among the various baby care products available. Regular use of pacifiers, on the other hand, may result in infection. The Pregnancy and Mother Care Technology are expected to benefit from increased awareness of baby care and mother care products in emerging nations, as well as the use of technology in products such as cribs, strollers, and toys.

The rising frequency of chronic and infectious diseases among women may increase demand for improved diagnosis and treatment options, supporting market growth. Businesses are increasingly concentrating their efforts on developing innovative and complex engineering solutions to improve women's safety and well-being. Improvements in wellness products for women, such as tampons, breast pumps, and pelvic floor fitness devices, among others, would also help the business flourish.

COVID-19 Impact on Pregnancy and Mother Care Technology market

Although COVID-19 death rates in children and women of reproductive age appear to be low, these groups may be disproportionately affected due to inefficient routine health services, particularly in low- and middle-income countries like India. Fear of getting a virus in a healthcare facility, a lack of trust in the health system, and ignorance about the source of disease all contribute to breeding grounds that could halt progress in maternal and child health indices. If public health efforts are not tailored to country-specific conditions, they may do more harm than the lethal impacts of a pandemic. Understanding the effects of pandemic-prevention strategies on maternal and child health, as well as ensuring that key health services are maintained while the epidemic is contained, is a serious problem. Despite the risk of COVID-19 transmission, national programs should continue to provide core maternal and child services judged necessary to preserve lives.

MARKET DRIVERS

The rise of digital healthcare is propelling the market forward.

The increased market demand for embryo screening, egg freezing, fertility, and other services has resulted from breakthrough fem tech solutions. In addition, the development of wearable gadgets to track and monitor patient well-being will boost usage in the future years. During the anticipated period, the availability of such technologically advanced devices will boost market growth.

The market is growing due to increased demand for maternity care applications.

Femtech is used in reproductive health, pregnancy and nursing care, pelvic and uterine health, general healthcare and wellness, and other areas. The market segment for pregnancy and nursing care accounted for the majority of the market. The market will benefit from the rising demand for improved equipment and consumables used during pregnancy and nursing care. The introduction of such modern nursing care gadgets will be favorable to market growth.

MARKET RESTRAINTS

The market is being hampered by societal taboos around women's health issues.

Although expanding AI advancements and collaborations with public healthcare agencies are key industry propellers, demography, urban-rural segregation, and variable population socioeconomic position might be viewed as significant market limitations. Furthermore, the stigma associated with women's health, particularly that associated with sexual health, birth control, menstruation, and fertility, may impede the expansion of the Pregnancy and Mother Care Technology sector.

In some emerging regions, a lack of awareness of femtech products and applications is impeding market growth.

Growing worries about some chemicals, as well as a lower birth rate, would likely function as market limitations for the expansion of prenatal care goods in the forecasted term. The lack of understanding and availability of pregnancy goods in low-income nations will be the market's biggest and most pressing obstacle.

PREGNANCY AND MOTHER CARE TECHNOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

13.7% |

|

Segments Covered |

By Type, Application, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Athena Feminine Technologies, Sustain Natural, Sera Prognostics, HeraMED, on Health, Totohealth, Minerva, Nuvo, Elvie, and BioWink |

Pregnancy and Mother Care Technology - by type

-

Devices

-

Software

-

Services

This Pregnancy and Mother Care Technology market segment includes the following devices, software, and services. The software segment is likely to show the highest growth rate in the market by type. The rising prevalence of chronic and infectious disorders among women will increase the demand for better diagnosis and treatment options, pushing segmental growth. Furthermore, businesses are constantly working to develop novel and technologically advanced techniques to improve women's health and wellness. Improvements in women's health items like tampons, breast pumps, and pelvic floor exercise devices, among other things, will help the industry grow.

Pregnancy and Mother Care Technology - by application

-

Reproductive Health

-

Pregnancy & Nursing Care

-

Pelvic & Uterine Healthcare

In the next years, the Pregnancy & Nursing Care application category will dominate the market. In 2020, it had a considerable share of 40.2 percent. In 2021, the pregnancy and nursing care market dominated the sector, owing to the rising demand for novel products and consumables used during pregnancy and breastfeeding, as well as consumer trends. The fastest-growing segment, general healthcare, and wellness are predicted to develop at a rate of 16.0 percent. Increasing women's awareness of the disease early detection has the potential to increase demand for better diagnostic and screening technologies, assuring rapid and accurate diagnosis. Delays in receiving medical treatments or other illness remedies will have a detrimental influence on patient safety, resulting in serious health problems or deaths. As a result, the usage of femtech solutions for successful outcomes is increasing.

Pregnancy and Mother Care Technology - by end-use

-

Direct-to-Consumer

-

Hospitals

-

Fertility Clinics

-

Surgical Centres

-

Diagnostic Centres

Uterine fibroids, gynecological infections, urine incontinence, and other gynecological problems affect the majority of women. Because of the availability of specialist technologies and experienced healthcare workers, they prefer successful diagnosis at clinical facilities. The growing demand for accurate and quick diagnosis is projected to propel this market forward.

New and innovative fertility tracking apps and pregnancy monitoring solutions for home care situations, as well as other technology specifically customized to meet women's requirements, are expected to have a big impact on segmental growth. Also expected to be a driving force in the market are improvements in feminine hygiene items and the rising use of tampons and menstrual cups instead of sanitary napkins.

Pregnancy and Mother Care Technology - by region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

Because of the rising prevalence of women's disorders in the region, the Pregnancy and Mother Care Technology industry in North America is predicted to develop at a rate of 15.8 percent throughout the study period. Women's contributions to the development and health education are likely to increase competition for technically creative solutions. Furthermore, a focus on women's well-being and safety in legislation would aid the growth of the femtech business in North America in the coming years.

The Pregnancy and Mother Care Technology market in the Asia Pacific is expected to grow at the fastest rate of 16.1%. A large pool of patients vulnerable to many infectious and chronic diseases in populous countries like India and China would act as the main engine of global company expansion. Furthermore, the industry's focus on providing dependable, higher-quality, and user-friendly tools and solutions for improving women's lives will assist the sector's geographic expansion. Changes in China's healthcare system and improvements in femtech should be beneficial to the business. Furthermore, China intends to promote female political leaders to ensure female empowerment while also providing opportunities for a new generation of entrepreneurs to advance in the field.

Pregnancy and Mother Care Technology by company

The Pregnancy and Mother Care Technology market is fairly consolidated, with a limited number of small and medium-sized producers accounting for the majority of the global market share. The Pregnancy and Mother Care Technology market's manufacturers are separated throughout the value chain. The market's leading companies have significant production facilities and are also involved in numerous research and development activities.

-

Athena Feminine Technologies

-

Sustain Natural

-

Sera Prognostics

-

HeraMED

-

on Health

-

Totohealth

-

Minerva

-

Nuvo

-

Elvie

-

BioWink

NOTABLE HAPPENINGS IN THE Pregnancy and Mother Care Technology IN THE RECENT PASTS.

PRODUCT LAUNCH:

-

In October 2021, Salignostics, a medical firm based in Jerusalem, aimed to release the world's first and only saliva-based fast pregnancy test kit. The non-invasive method of pregnancy detection provides precise findings in minutes.

-

In March 2021, The world's first biodegradable and flushable pregnancy test was launched by Lia, a women-founded firm providing eco-friendly reproductive health and wellness products.

-

In October 2020, Inne, a Berlin-based business, revealed that it had received USD 8 million in Series A funding for its hormone-monitoring subscription platform for natural conception and fertility tracking. Blossom Capital led the Series A fundraising round.

Chapter 1.Pregnancy and Mother Care Technology Market– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Pregnancy and Mother Care Technology Market– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Pregnancy and Mother Care Technology Market– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Pregnancy and Mother Care Technology Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5.DIGITAL CARE CONNECTIVITY MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Pregnancy and Mother Care Technology Market– By Type

6.1. Devices

6.2. Software

6.3. Services

Chapter 7.Pregnancy and Mother Care Technology Market– By End-Use

7.1.Direct-to-Consumer

7.2. Hospitals

7.3. Fertility Clinics

7.4. Surgical Centres

7.5. Diagnostic Centres

Chapter 8.Pregnancy and Mother Care Technology Market– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.Pregnancy and Mother Care Technology Market– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9. 1. Athena Feminine Technologies

9.2. Sustain Natural

9.3. Sera Prognostics

9.4. HeraMED

9.5. on Health

9.6. Totohealth

9.7. Minerva

9.8. Nuvo

9.9. Elvie

9.10. BioWink

Download Sample

Choose License Type

2500

4250

5250

6900