Precooked Corn Flour Market Size (2024-2030)

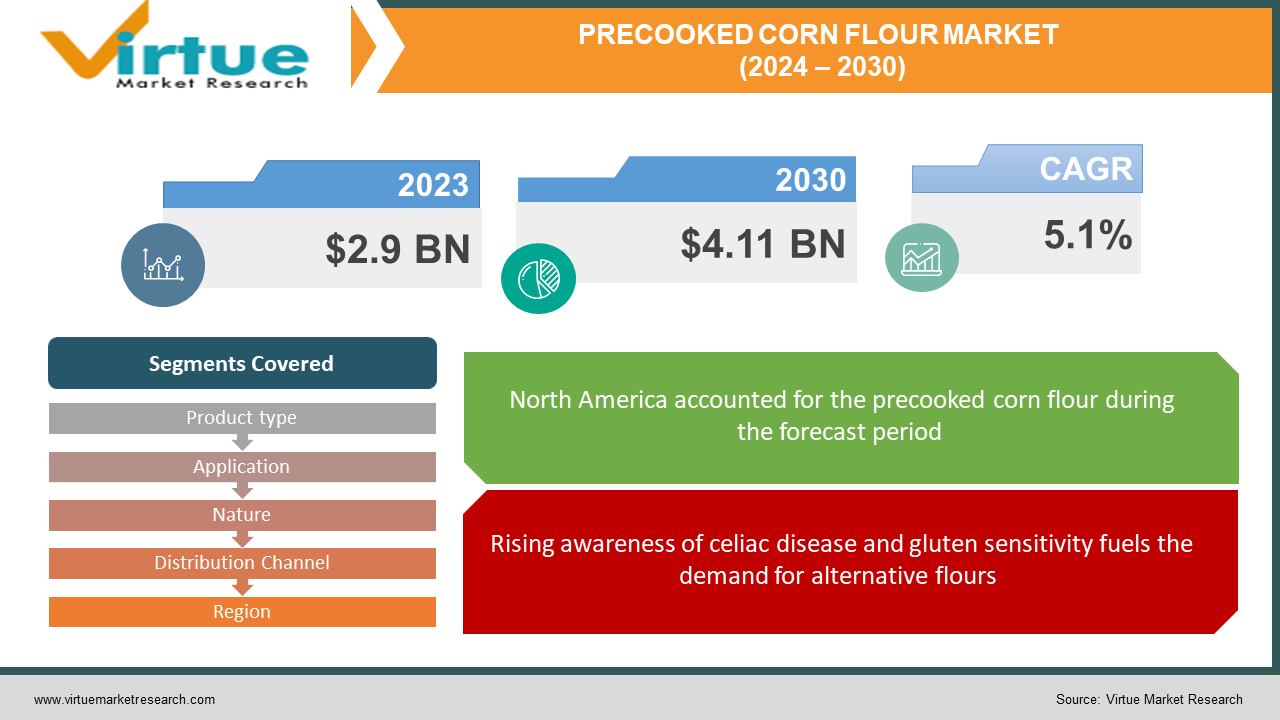

The Precooked Corn Flour Market was valued at USD 2.9 billion in 2023 and is projected to reach a market size of USD 4.11 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5.1%.

The precooked corn flour market is cooking up a storm, driven by the rising popularity of gluten-free options and convenient food choices. Consumers increasingly seek alternatives like precooked corn flour due to growing awareness of celiac disease and gluten sensitivity. Busy lifestyles also contribute to the demand for quick and easy-to-prepare solutions, where precooked corn flour shines. Beyond convenience, it's perceived as a source of fiber and vitamins, adding to its appeal.

Key Market Insights:

Precooked corn flour is experiencing a surge in popularity, driven by several key trends. Consumers increasingly seek gluten-free alternatives, and precooked corn flour offers a convenient and delicious solution. Busy lifestyles also crave quick and easy options, which this product readily delivers. Additionally, its perceived health benefits as a source of fiber and vitamins add to its appeal.

The market itself is quite diverse, offering different types (white, yellow, blue), applications (bakery, snacks, sauces, even baby food), and sources (conventional, organic). You can find it readily available in supermarkets, online, and even convenience stores. While global players like Cargill and Archer Daniels Midland hold significant market share, regional players are making their mark, contributing to a dynamic landscape.

Looking ahead, the precooked corn flour market is expected to continue its upward trajectory. Health-conscious consumers, the convenience factor, and expanding applications across various food categories are key drivers. Rising disposable incomes and the gluten-free trend gaining momentum in emerging markets could further fuel this growth. To stay ahead, players should focus on innovative products, catering to specific consumer needs, and embracing sustainable practices in this increasingly competitive market.

The Precooked Corn Flour Market Drivers:

Rising awareness of celiac disease and gluten sensitivity fuels the demand for alternative flours:

As awareness of celiac disease and gluten sensitivity grows, individuals seek out alternatives like precooked corn flour. This flour provides a readily available and versatile substitute for wheat flour, catering to both diagnosed and health-conscious consumers.

Precooked corn flour's ease of use and quick preparation times cater perfectly to busy lifestyles, making it a convenient kitchen companion:

In today's fast-paced world, busy lifestyles drive the demand for convenient and easy-to-prepare food options. Precooked corn flour shines in this aspect, as it eliminates the need for soaking and grinding raw corn, saving time and effort.

With a growing focus on healthy living, consumers seek nutritious choices:

Consumers increasingly prioritize healthy ingredients, and precooked corn flour benefits from its perceived health halo. It's often viewed as a good source of fiber and vitamins, adding to its appeal among health-conscious individuals.

Its exploration in diverse applications like pasta, batters, coatings, and even plant-based meats:

This market isn't just limited to baking! Precooked corn flour is found in various food categories, including bakery goods, snacks, sauces, and even infant formula. This versatility makes it attractive to manufacturers and caters to different consumer preferences.

The boom in online grocery shopping provides a convenient platform for consumers to access precooked corn flour, especially in regions with limited physical store options:

The increasing availability of precooked corn flour across various channels like supermarkets, hypermarkets, convenience stores, and online retailers makes it easily accessible to consumers, further boosting its popularity.

As disposable incomes increase, particularly in emerging markets, consumers have greater freedom to explore new food options:

Emerging markets experience rising disposable incomes, leading to increased spending on packaged and convenience foods. This trend creates a significant opportunity for precooked corn flour as a readily available and affordable ingredient.

The Precooked Corn Flour Market Restraints and Challenges:

Precooked corn flour is riding a wave of popularity, driven by gluten-free trends, convenience demands, and perceived health benefits. However, this market isn't without its hurdles.

Price fluctuations in raw corn can impact affordability, while limited consumer awareness and competition from other gluten-free alternatives require strategic marketing and product differentiation. Additionally, technological limitations may lead to flavor or texture differences compared to raw flour, demanding further innovation. Stringent regulations and sustainability concerns pose challenges that manufacturers need to navigate meticulously. Finally, specific storage and handling requirements, potential quality inconsistencies, and logistical hurdles for distributors add layers of complexity.

Despite these challenges, the positive drivers remain strong. By acknowledging these restraints and proactively addressing them, manufacturers and stakeholders can unlock the full potential of precooked corn flour in the ever-evolving food landscape.

The Precooked Corn Flour Market Opportunities:

The precooked corn flour market isn't just growing, it's brimming with opportunities! Innovation takes center stage, with possibilities to develop flours boasting better flavor, texture, and nutrition to attract new customers. Expanding beyond baking and snacks into pasta, batters, coatings, and even plant-based meats unlocks exciting new markets. Catering to specific dietary needs like keto, paleo, or high-protein preferences taps into lucrative niches. Sustainability is key, to attracting eco-conscious consumers with responsibly sourced corn and eco-friendly processing. Reaching a wider audience online requires investing in a strong online presence and engaging content. Collaboration is crucial, partnering with ingredient suppliers, distributors, retailers, and even health organizations for wider reach and enhanced credibility. Finally, educating consumers through campaigns, recipe development, and nutritional information dispels myths and showcases precooked corn flour's true versatility.

PRECOOKED CORN FLOUR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Product type, Application, Nature, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Empresas Polar, Maizena S.A., Roquette Frères, Südzucker AG, Cargill, Archer Daniels Midland, Ingredion Incorporated, Minsa S.A.,. Lifeline Foods, Cool Chile Company |

Precooked Corn Flour Market Segmentation: By Product Type

-

White corn flour

-

Yellow corn flour

-

Blue corn flour

In the precooked corn flour market by type, white corn flour reigns supreme, holding the largest share due to its neutral flavor and wide applicability in various cuisines and dishes. However, the fastest-growing segment is blue corn flour.

Precooked Corn Flour Market Segmentation: By Application

-

Household

-

Commercial

-

Industrial

Based on application, the commercial segment currently reigns supreme in the precooked corn flour market, dominating with its extensive use in food processing for various products like bakery goods, packaged meals, and even infant formula. However, the fastest growth is anticipated in the industrial segment.

Precooked Corn Flour Market Segmentation: By Nature

-

Conventional

-

Organic

Within the "By Nature" segment of the precooked corn flour market, conventional precooked corn flour currently reigns supreme, holding the dominant market share due to its wider availability, lower cost, and established presence catering to mass consumption. However, the organic segment is experiencing the fastest growth.

Precooked Corn Flour Market Segmentation: By Distribution Channel

-

Supermarkets/hypermarkets

-

Convenience stores

-

Online retail

-

B2B

The most dominant segment in the precooked corn flour market by distribution channel is currently B2B, catering to the commercial needs of food manufacturers and industrial users. This segment leverages the bulk demand and cost-effectiveness of direct sales. However, the fastest-growing segment is anticipated to be online retail.

Precooked Corn Flour Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America: This seasoned player in the market holds the crown for the largest market share. Driven by a long-standing awareness of gluten-free options, a penchant for convenience, and a well-established retail network, North America sees a strong demand for precooked corn flour. Big names like Cargill, Archer Daniels Midland, and Bob's Red Mill dominate the scene.

Asia-Pacific: Step aside, North America, because the fastest growth is happening in the East! This dynamic region, fuelled by rising disposable incomes, increasing awareness of gluten sensitivity, and a rapidly urbanizing population, is experiencing a surge in demand for precooked corn flour. The key to success here lies in offering value-added products with unique ethnic Flavors and leveraging the growing popularity of online retail. Players like Minsa S.A., Cargill, and Ingredion Incorporated are making their mark.

Europe: Europeans aren't just about croissants and pasta anymore. This significant market thrives on health consciousness, a preference for organic options, and a diverse range of applications for precooked corn flour. Innovation in functionality, sustainability, and catering to specific dietary needs are crucial for success here. Roquette Frères, Südzucker AG, and Unilever PLC are key players to watch.

South America: This emerging market is simmering with potential. A growing middle class and a rising appetite for convenience foods are creating fertile ground for precooked corn flour. However, limited infrastructure and logistical hurdles need to be addressed for this market to fully bloom. Empresas Polar, Maizena S.A., and ADM are keeping a close eye on this evolving landscape.

Middle East and Africa: Although currently a smaller player, this region holds promising opportunities. As urbanization and the adoption of Western food trends accelerate, awareness and adoption of precooked corn flour are expected to rise. While local and regional players like Olam International and Louis Dreyfus Company are present, overcoming limited purchasing power and awareness remains a challenge.

COVID-19 Impact Analysis on the Precooked Corn Flour Market:

The precooked corn flour market wasn't spared from the turbulent waves of COVID-19. Initial disruptions saw a dip in demand due to hampered supply chains, shifting consumer priorities, and economic constraints. Lockdowns shuttered restaurants and hotels, impacting commercial demand, while initial panic buying followed by stockpiling of essentials might have temporarily sidelined non-necessities like precooked corn flour. Reduced disposable incomes, particularly in emerging markets, could further limit spending on discretionary items.

However, amidst the challenges, opportunities bloomed. The home-baking renaissance triggered by lockdowns fueled demand for baking flours, including gluten-free options and convenient choices like precooked corn flour. The e-commerce boom offered a lifeline, providing a safe and readily accessible way for consumers to purchase the product during physical store restrictions. Additionally, a heightened focus on health and immunity during the pandemic might have piqued interest in precooked corn flour's perceived benefits as a source of fiber and vitamins.

Overall, the market endured an initial decline followed by a recovery, and experts predict a continuation of its growth trajectory. Long-term drivers like convenience, gluten-free trends, and health consciousness remain strong. The pandemic's influence on online shopping habits and home cooking preferences is likely to further benefit precooked corn flour in the long run. Nevertheless, regional variations and evolving consumer behavior necessitate further research to understand the full picture and accurately predict future market trends.

Latest Trends/ Developments:

The precooked corn flour market is bubbling with innovation! Forget basic baking, functional flours boasting boosted protein, better texture, and targeted nutrition are taking center stage. Think keto-friendly or high-protein options catering to specific dietary needs. And it's not just about bread anymore! Experimentation is exploring exciting uses in pasta, batters, coatings, and even plant-based meats, unlocking new avenues for growth. Sustainability is also in the spotlight, with eco-conscious consumers driving the demand for responsibly sourced and processed flour. Certifications like organic and Fairtrade are gaining traction as manufacturers partner with ethical farmers and implement sustainable practices. The digital revolution is also flourishing, with brands investing in strong online presence, engaging content, and targeted advertising to reach new customers. Collaboration is key, with partnerships between ingredient suppliers, distributors, retailers, and even health organizations leveraging each other's strengths and boosting brand credibility. Finally, educational campaigns and recipe development are dispelling myths and showcasing the true versatility of precooked corn flour. As a bonus trend, upcycled corn flour made from leftover processing streams is emerging as a sustainable and potentially cost-effective option.

Key Players:

-

Empresas Polar

-

Maizena S.A.

-

Roquette Frères

-

Südzucker AG

-

Cargill

-

Archer Daniels Midland

-

Ingredion Incorporated

-

Minsa S.A.

-

Lifeline Foods

-

Cool Chile Company

Chapter 1. Precooked Corn Flour Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Precooked Corn Flour Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Precooked Corn Flour Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Precooked Corn Flour Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Precooked Corn Flour Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Precooked Corn Flour Market – By Product Type

6.1 Introduction/Key Findings

6.2 White corn flour

6.3 Yellow corn flour

6.4 Blue corn flour

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Precooked Corn Flour Market – By Application

7.1 Introduction/Key Findings

7.2 Household

7.3 Commercial

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Precooked Corn Flour Market – By Nature

8.1 Introduction/Key Findings

8.2 Conventional

8.3 Organic

8.4 Y-O-Y Growth trend Analysis By Nature

8.5 Absolute $ Opportunity Analysis By Nature, 2024-2030

Chapter 9. Precooked Corn Flour Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Supermarkets/hypermarkets

9.3 Convenience stores

9.4 Online retail

9.5 B2B

9.6 Y-O-Y Growth trend Analysis By Distribution Channel

9.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. Precooked Corn Flour Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Application

10.1.3 By Nature

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Application

10.2.4 By Nature

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Application

10.3.4 By Nature

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Application

10.4.4 By Nature

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Application

10.5.4 By Nature

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Precooked Corn Flour Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Empresas Polar

11.2 Maizena S.A.

11.3 Roquette Frères

11.4 Südzucker AG

11.5 Cargill

11.6 Archer Daniels Midland

11.7 Ingredion Incorporated

11.8 Minsa S.A.

11.9 Lifeline Foods

11.10 Cool Chile Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Precooked Corn Flour Market was valued at USD 2.9 billion in 2023 and is projected to reach a market size of USD 4.11 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 5.1%.

Rising awareness of celiac disease and gluten sensitivity fuels the demand for alternative flours, Precooked corn flour's ease of use and quick preparation times cater perfectly to busy lifestyles, making it a convenient kitchen companion, With a growing focus on healthy living, consumers seek nutritious choices, Its exploration in diverse applications like pasta, batters, coatings, and even plant-based meats, The boom in online grocery shopping provides a convenient platform for consumers to access precooked corn flour, especially in regions with limited physical store options, As disposable incomes increase, particularly in emerging markets, consumers have greater freedom to explore new food options.

Supermarkets/hypermarkets, Convenience stores, Online retail, B2B

While North America currently holds the largest market share, Asia-Pacific boasts the fastest growth, fueled by rising disposable incomes and increasing awareness of gluten sensitivity.

Empresas Polar, Maizena S.A., Roquette Frères, Südzucker AG., Cargill, Archer Daniels Midland, Ingredion Incorporated, Minsa S.A., Lifeline Foods, Cool Chile Company.