Preclinical CRO Market Size (2024 – 2030)

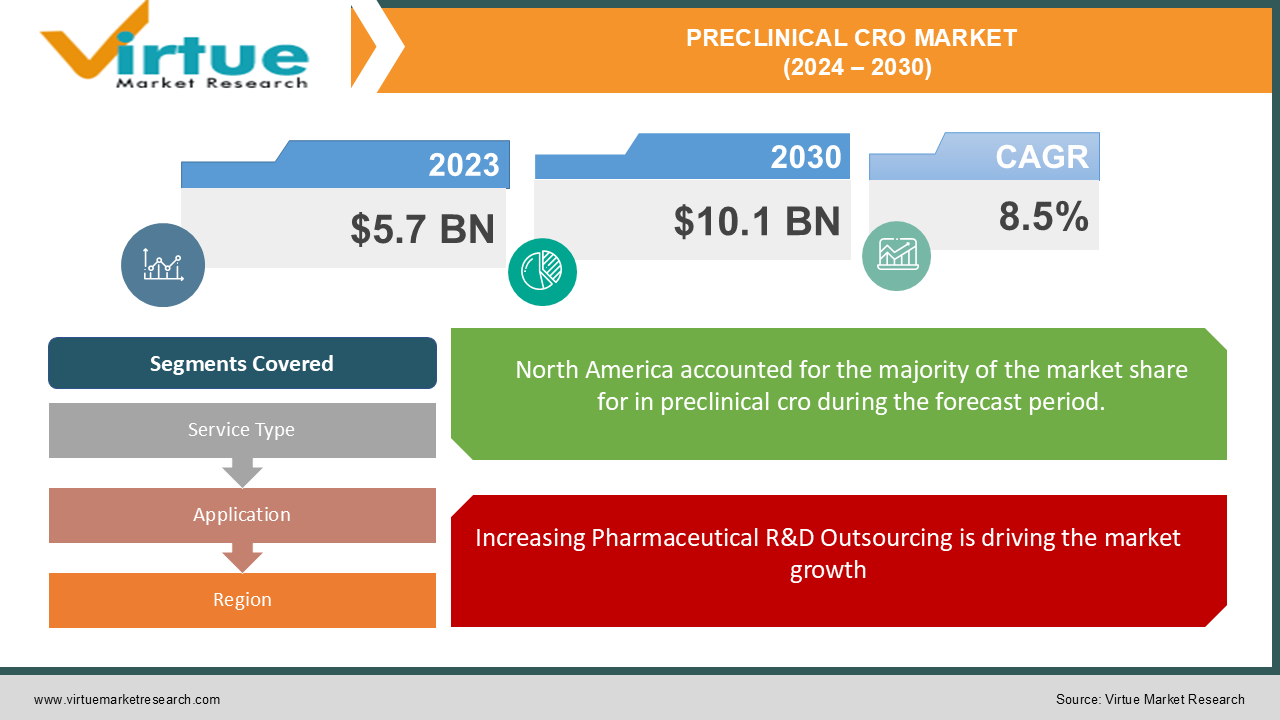

The Global Preclinical CRO Market was valued at USD 5.7 billion in 2023 and is projected to grow at a CAGR of 8.5% from 2024 to 2030. The market is expected to reach USD 10.1 billion by 2030.

The preclinical Contract Research Organization (CRO) market includes organizations that provide outsourced research services to pharmaceutical, biotechnology, and medical device companies in the preclinical stage of drug development. Preclinical CROs play a critical role in advancing drug candidates from discovery to clinical trials, offering services such as toxicology testing, pharmacokinetics, bioanalysis, and other preclinical studies. The rising demand for efficient drug discovery processes, growing biopharmaceutical industry, and increasing outsourcing of research and development (R&D) activities are driving the growth of this market.

Key Market Insights:

Toxicology testing holds the largest share of the preclinical CRO market, contributing approximately 40% of the total revenue in 2023 due to its crucial role in determining the safety of new drug candidates before clinical trials.

The bioanalysis and DMPK (Drug Metabolism and Pharmacokinetics) studies segment is expected to grow at a rapid pace, driven by the increasing complexity of drug molecules and the need for precise pharmacokinetic data to inform drug development decisions.

North America was the largest regional market in 2023, accounting for over 45% of the global market, largely due to the presence of major pharmaceutical companies and advanced R&D infrastructure in the region.

The oncology segment dominated the application landscape, driven by the rising prevalence of cancer worldwide and the focus on developing novel cancer therapies.

Increasing outsourcing trends in pharmaceutical R&D are contributing to market expansion, as companies aim to reduce costs and accelerate drug development timelines by partnering with specialized CROs.

Global Preclinical CRO Market Drivers:

Increasing Pharmaceutical R&D Outsourcing is driving the market growth

The pharmaceutical industry is increasingly outsourcing its R&D activities to contract research organizations (CROs) to optimize costs, focus on core competencies, and accelerate the drug development process. Outsourcing to preclinical CROs allows pharmaceutical companies to access specialized expertise and advanced technologies without the need for heavy internal investment in infrastructure and personnel. CROs offer a range of services, from early drug discovery and toxicology testing to bioanalysis and pharmacokinetics, making them an integral part of the drug development pipeline. As drug candidates advance through preclinical testing, the need for thorough evaluation in terms of safety, efficacy, and pharmacokinetics becomes paramount, which CROs are well-equipped to provide. The trend toward outsourcing is further fueled by the rising complexity of drug development, especially with the advent of biologics, cell therapies, and gene therapies. These novel therapies require more specialized preclinical testing services, driving pharmaceutical and biotech companies to collaborate with CROs that possess the necessary expertise and capabilities.

Growing Demand for Novel Drug Therapies is driving the market growth

The rising prevalence of chronic diseases, such as cancer, cardiovascular disorders, and neurodegenerative diseases, is creating an urgent need for new and innovative therapies. This demand is particularly evident in the field of oncology, where significant resources are being allocated toward the discovery and development of targeted therapies, immunotherapies, and personalized medicine. Preclinical CROs play a vital role in the early stages of this development process by providing services such as toxicology testing, pharmacokinetics studies, and efficacy testing using animal models. The increasing focus on precision medicine, which requires detailed preclinical analysis of drug candidates to ensure they are effective for specific patient populations, further underscores the importance of preclinical CROs in the drug development process. Moreover, the pharmaceutical industry is witnessing a surge in investment in biopharmaceuticals, including monoclonal antibodies, RNA-based therapies, and cell therapies, all of which require extensive preclinical testing to evaluate their safety and efficacy before they can proceed to human trials.

Regulatory Requirements and Stringent Safety Standards is driving the market growth

Regulatory agencies, such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other global health authorities, have established stringent guidelines for preclinical testing of new drug candidates. These regulations ensure that drugs undergo rigorous safety and efficacy evaluations before they are approved for human trials. Preclinical CROs provide the expertise and infrastructure needed to comply with these regulations, offering services that meet the highest standards of quality and safety. For example, toxicology testing is essential to assess the potential adverse effects of a drug candidate, while pharmacokinetics studies help determine the absorption, distribution, metabolism, and excretion of the drug in living organisms. CROs must also adhere to Good Laboratory Practice (GLP) guidelines, which outline the standards for conducting non-clinical safety studies. As regulatory requirements become more complex, particularly for novel therapies like gene editing and regenerative medicine, pharmaceutical companies are increasingly turning to CROs to navigate the regulatory landscape and ensure compliance with global standards. This trend is expected to continue driving growth in the preclinical CRO market, as biopharmaceutical companies seek to streamline the approval process and bring innovative therapies to market more efficiently.

Global Preclinical CRO Market Challenges and Restraints:

High Cost and Complexity of Preclinical Studies is restricting the market growth

One of the significant challenges facing the preclinical CRO market is the high cost and complexity associated with conducting preclinical studies, particularly for novel drug candidates. Preclinical studies require extensive resources, including specialized equipment, animal models, and highly trained personnel. Additionally, the regulatory environment surrounding preclinical research is becoming increasingly stringent, particularly with regard to safety assessments and ethical considerations in animal testing. These factors contribute to the overall cost of preclinical research, making it a financial burden for smaller biopharmaceutical companies and start-ups. The high cost of outsourcing preclinical studies to CROs may deter some companies, especially those with limited budgets, from fully utilizing these services. Moreover, the complexity of preclinical research, particularly in fields like oncology, immunology, and neuroscience, requires CROs to possess advanced scientific expertise and technical capabilities. The challenge for CROs is to maintain the quality and reliability of their services while managing the costs associated with conducting complex preclinical studies. To overcome these challenges, CROs are investing in advanced technologies and automation to improve efficiency and reduce costs, but the high cost of preclinical research remains a significant barrier for market growth.

Ethical Concerns and Regulatory Scrutiny on Animal Testing is restricting the market growth

The use of animal models in preclinical research has long been a topic of ethical debate, with growing concerns over the welfare of animals used in testing. Regulatory agencies, animal rights organizations, and the general public are increasingly advocating for alternative methods to reduce the reliance on animal testing in drug development. In response, there is increasing regulatory scrutiny on the ethical conduct of preclinical studies, particularly those involving animals. While animal models remain a crucial component of preclinical research for evaluating the safety and efficacy of drug candidates, CROs are under pressure to adopt alternative testing methods, such as in vitro models, organ-on-a-chip technologies, and computer-based simulations. The challenge for the preclinical CRO industry is to balance the need for accurate and reliable preclinical data with ethical considerations and regulatory demands for reducing animal testing. Furthermore, the development and validation of alternative testing methods can be costly and time-consuming, adding to the challenges faced by CROs. As regulatory frameworks evolve to encourage the use of alternative methods, CROs will need to adapt their service offerings to remain compliant and meet the ethical expectations of their clients and regulatory bodies.

Market Opportunities:

The Global Preclinical CRO Market is poised for significant growth, driven by several key opportunities. One of the most promising opportunities is the increasing demand for specialized preclinical services tailored to specific therapeutic areas, such as oncology, immunology, and infectious diseases. As pharmaceutical and biotechnology companies focus on developing targeted therapies and personalized medicine, there is a growing need for CROs that can provide niche expertise in these fields. For example, preclinical CROs that offer advanced toxicology testing, pharmacokinetics studies, and efficacy evaluations using specific animal models for cancer research are in high demand. Another key opportunity lies in the adoption of advanced technologies in preclinical research. CROs are increasingly incorporating technologies such as high-throughput screening, in vivo imaging, and AI-driven data analysis to enhance the efficiency and accuracy of preclinical studies. These technologies enable CROs to provide more comprehensive data to their clients, helping to accelerate the drug development process. Furthermore, the rising trend of strategic partnerships and collaborations between CROs and pharmaceutical companies presents an opportunity for market expansion. By forming long-term partnerships, CROs can establish themselves as trusted research partners, providing ongoing support throughout the drug development lifecycle. Finally, the growing focus on regenerative medicine and gene therapies represents a significant opportunity for preclinical CROs, as these emerging fields require extensive preclinical testing to assess the safety and efficacy of novel therapies. CROs with expertise in these areas are well-positioned to capitalize on the growing investment in these innovative therapies.

PRECLINICAL CRO MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.5% |

|

Segments Covered |

By Service Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Charles River Laboratories, Labcorp Drug Development, Wuxi AppTec, Eurofins Scientific, Covance Inc., PPD, Inc., Medpace Holdings, ICON Plc, Envigo, PRA Health Sciences |

Preclinical CRO Market Segmentation: By Service Type

-

Toxicology Testing

-

Bioanalysis and DMPK Studies

-

Pharmacokinetics

-

Others

Toxicology testing is the dominant segment, accounting for approximately 40% of the total market in 2023, as it is critical in assessing the safety of drug candidates before clinical trials.

Preclinical CRO Market Segmentation: By Application

-

Oncology

-

Cardiovascular Disease

-

Neurology

-

Infectious Diseases

-

Others

Oncology is the dominant segment in terms of application, driven by the increasing focus on developing cancer therapies and the rising incidence of cancer worldwide.

Preclinical CRO Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the global preclinical CRO market, with a market share of approximately 45% in 2023, due to the presence of major pharmaceutical companies, advanced research infrastructure, and high levels of R&D investment.

COVID-19 Impact Analysis on the Preclinical CRO Market:

The COVID-19 pandemic had a profound impact on the global preclinical CRO market, both positively and negatively. On one hand, the disruption of global supply chains and the temporary suspension of research activities in many regions during the early months of the pandemic led to delays in preclinical studies and drug development projects. Many CROs faced operational challenges, including reduced access to laboratory facilities and delays in animal testing due to lockdown measures and travel restrictions. However, the pandemic also highlighted the critical role of preclinical research in the development of life-saving therapies and vaccines. As the world urgently sought treatments and vaccines for COVID-19, there was a surge in demand for preclinical services to accelerate the development of antiviral drugs and vaccines. Preclinical CROs were instrumental in conducting safety and efficacy studies for COVID-19 vaccine candidates, contributing to the rapid development and approval of several vaccines. The pandemic also underscored the importance of outsourcing in the pharmaceutical industry, as companies turned to CROs to maintain progress on non-COVID-related drug development projects. In the post-pandemic era, the global preclinical CRO market is expected to continue its growth trajectory, with increased investment in R&D and a renewed focus on pandemic preparedness driving demand for preclinical services.

Latest Trends/Developments:

The Global Preclinical CRO Market is witnessing several important trends and developments that are shaping its future. One notable trend is the growing adoption of advanced technologies, such as AI and machine learning, in preclinical research. These technologies are being used to analyze large datasets, optimize study designs, and predict the outcomes of preclinical studies, helping CROs deliver faster and more accurate results. Additionally, there is an increasing focus on specialized preclinical services for novel drug modalities, including biologics, gene therapies, and cell therapies. As these therapies become more prominent in the pharmaceutical pipeline, CROs with expertise in these areas are in high demand. Another significant trend is the expansion of CRO services in emerging markets, particularly in Asia-Pacific. Countries like China and India are becoming key hubs for preclinical research due to their cost advantages and growing biopharmaceutical industries. CROs are expanding their operations in these regions to tap into the increasing demand for preclinical services. Furthermore, there is a growing emphasis on regulatory compliance and ethical considerations in preclinical research, with CROs investing in systems and processes to ensure adherence to global regulatory standards and ethical guidelines, particularly regarding animal testing. These trends are expected to continue driving growth and innovation in the global preclinical CRO market.

Key Players:

-

Charles River Laboratories

-

Labcorp Drug Development

-

Wuxi AppTec

-

Eurofins Scientific

-

Covance Inc.

-

PPD, Inc.

-

Medpace Holdings

-

ICON Plc

-

Envigo

-

PRA Health Sciences

Chapter 1. Preclinical CRO Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Preclinical CRO Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Preclinical CRO Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Preclinical CRO Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Preclinical CRO Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Preclinical CRO Market – By Service Type

6.1 Introduction/Key Findings

6.2 Toxicology Testing

6.3 Bioanalysis and DMPK Studies

6.4 Pharmacokinetics

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Service Type

6.7 Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. Preclinical CRO Market – By Application

7.1 Introduction/Key Findings

7.2 Oncology

7.3 Cardiovascular Disease

7.4 Neurology

7.5 Infectious Diseases

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Preclinical CRO Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Service Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Service Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Service Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Service Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Service Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Preclinical CRO Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Charles River Laboratories

9.2 Labcorp Drug Development

9.3 Wuxi AppTec

9.4 Eurofins Scientific

9.5 Covance Inc.

9.6 PPD, Inc.

9.7 Medpace Holdings

9.8 ICON Plc

9.9 Envigo

9.10 PRA Health Sciences

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Preclinical CRO Market was valued at USD 5.7 billion in 2023 and is projected to reach USD 10.1 billion by 2030, growing at a CAGR of 8.5% from 2024 to 2030.

Key drivers include increasing outsourcing of pharmaceutical R&D, growing demand for novel drug therapies, and stringent regulatory requirements for preclinical testing.

The market is segmented by service type (Toxicology Testing, Bioanalysis and DMPK Studies, Pharmacokinetics, Others) and by application (Oncology, Cardiovascular Disease, Neurology, Infectious Diseases, and Others).

North America is the dominant region, accounting for approximately 45% of the market share in 2023.

Leading players include Charles River Laboratories, Labcorp Drug Development, Wuxi AppTec, Eurofins Scientific, and Covance Inc.