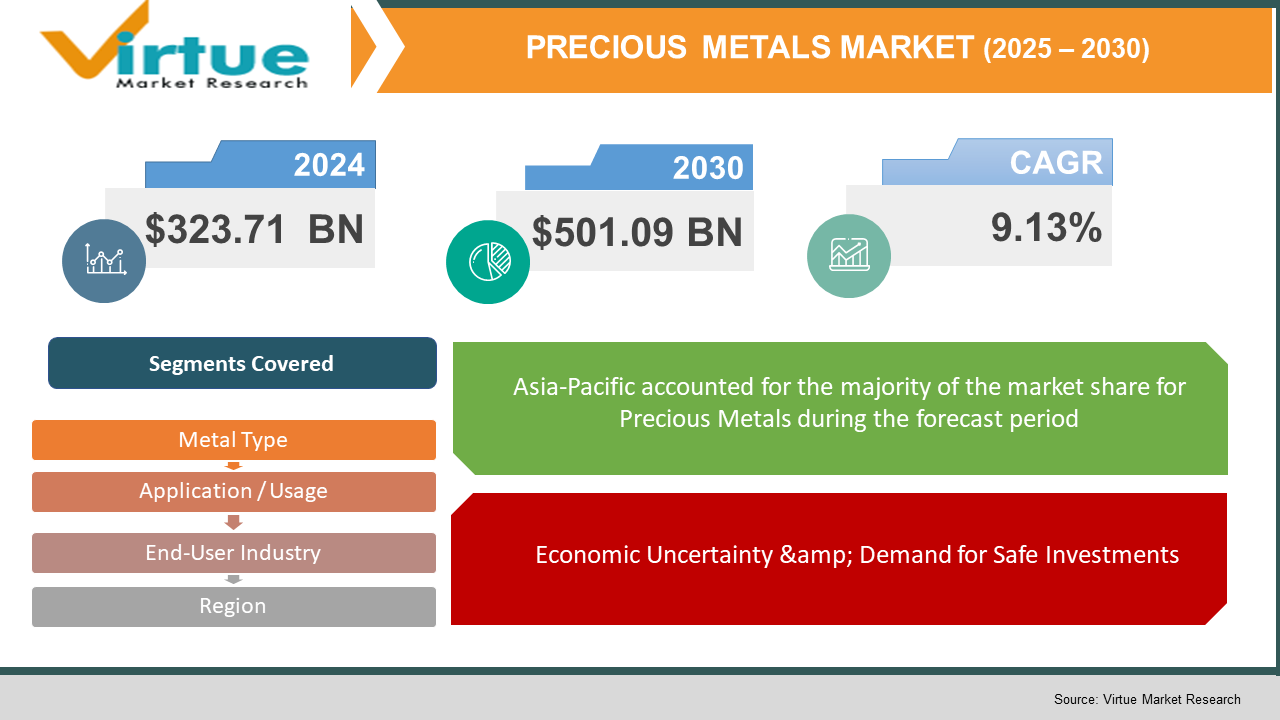

Precious Metals Market Size (2025-2030)

The Precious Metals Market was valued at $323.71 billion and is projected to reach a market size of $501.09 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.13%

Rising incomes and changing lifestyles have increased the global interest in precious metals, especially gold and silver, due to their importance in Southeast Asian wedding customs and growing appeal as investments. With more people worldwide able to spend money, these metals are key in both jewelry and investment. When the pandemic hit early 2020, it disrupted mining and manufacturing, which led to a decline in electronic production and a drop in industrial demand for silver by about 5 percent that year. But this was partly balanced out by a spike in investment: silver miners attracted a lot of interest, and gold ETFs saw record inflows—global demand for gold jumped 40 percent in 2020 compared to the previous year. This strong performance during tough times shows that precious metals are still seen as safe investments, helping to protect against inflation, currency issues, and market ups and downs. Gold remains a reliable investment, while silver and platinum-group metals still play roles in both industry and jewelry. New technology and financial products like ETFs and digital platforms make investing easier and more transparent. While prices can change rapidly and there are economic risks to consider, keeping an eye on global economic trends and regulations is key. These metals are not just scarce; they’re also versatile, offering qualities like conductivity and resistance to corrosion. This combination keeps them valuable across jewelry, investments, electronics, and various industries, ensuring they will remain relevant in the future.

Key Market Insights:

In 2022, the demand for industrial silver went up by 5%. This growth was mainly due to its crucial use in solar panels, electric vehicle parts, and electronics, showing how green technology is changing the market.

Investors showed a lot of interest in silver, with physical holdings in ETFs hitting over 800 million ounces, which is a 22% increase compared to the previous year. This demand helped balance out some tightness in supply.

Gold also saw a rise, with ETF holdings surpassing 100 million ounces. This was mostly thanks to very low real interest rates and strong government spending after COVID, indicating that

many investors are turning to precious metals for protection.

By 2024, industrial silver demand reached a record high of 700 million ounces, up 7% from the year before. This marked the fourth consecutive year where supply fell short of demand, emphasizing the ongoing imbalance in the silver market.

Overall, global silver demand grew by about 38% from 2020 to 2022, reaching 1.242 billion ounces. For industrial purposes, usage was up by 5%, and the demand for jewelry surged by a staggering 80% in 2022.

Precious Metals Market Key Drivers:

Economic Uncertainty & Demand for Safe Investments.

These days, people are feeling the pinch with rising prices, changing interest rates, and all sorts of global drama going on. Because of this chaotic financial landscape, many folks are turning to precious metals like gold and silver as a way to protect their money. For instance, gold has recently gained popularity, even surpassing the euro as the second biggest global asset that people are holding onto amid all this geopolitical turmoil.

Industrial & Green Technology Uses.

When we look at modern industries, silver, platinum, and palladium are becoming more and more important. These metals are crucial in sectors like electronics, the automotive industry (think things like catalytic converters), and renewable energy solutions. From 2021 to 2024, demand for silver in the industry took off, hitting record levels because of its essential role in things like solar panels, electric vehicles, and semiconductors. These metals are playing a key part in the push for cleaner energy and advanced technology.

Central Bank Buying & What It Means for Money Policy.

Central banks around the world have been buying gold like there's no tomorrow, which shows they're confident that its value will stick around for the long haul. When the bank policies involve cutting rates or bringing in quantitative easing, it makes holding onto metals more appealing, especially when the dollar isn’t doing so hot. This means that more and more people are looking to invest in metals because it tends to be a safer bet when the economic outlook is shaky.

Precious Metals Market Restraints and Challenges:

Challenges Facing Growth in the Global Precious Metals Market.

The precious metals market is running into several tough problems. Price swings are unpredictable, supply can get disrupted, and regulations are getting stricter, all making it hard for businesses and investors to commit. Right now, a lot of issues are holding back in this market. For one, prices can jump or drop by over 20% from year to year. This kind of volatility makes it risky for companies and investors looking for stable returns, which leads to less long-term planning. On top of that, mining isn’t as straightforward due to lower ore grades, rising costs for labor and equipment, and delays in getting regulatory approvals. Geopolitical issues can also limit production, causing potential shortages that impact other industries. Then there are tough environmental rules aimed at reducing pollution and illegal mining. While these are important, they also raise costs and slow down production, especially where regulations are changing. There’s also stiff competition from investments and materials like cryptocurrencies or synthetic substitutes that can be cheaper or offer better returns than traditional metals. Lastly, there are risks tied to non-physical investment options like ETFs that can shake investor confidence due to fears of market manipulation and liquidation.

Precious Metals Market Opportunities:

How Tech and Green Changes Are Creating New Chances in the Precious Metals Market Over the Coming Years.

The precious metals market is at an important turning point, thanks to rising demand from tech innovations and renewable energy. Industrial silver use is set to hit a record high of over 700 million ounces in 2025, leading to a steady supply gap and keeping prices strong. Silver is becoming more important in solar panels and electric vehicles, with production expected to consume around 105 million ounces in 2023, and EV demand could exceed 90 million ounces a year by 2025. Plus, silver’s great electrical conductivity makes it key in new areas like 5G, AI, and advanced medical devices. As the use of global data centers increases by about 33% each year until 2030, so will the demand for electronics. On the flip side, platinum is becoming more popular beyond just jewelry and catalytic converters. It has risen about 41% this year, driven by increased use of hydrogen fuel cells, limited supply from South Africa, and a growing need for high-quality options in jewelry and green technology. Interest from investors in silver and platinum is on the rise, with over 300 tonnes of silver and 70,000 ounces of platinum added to ETFs in early 2025. This is happening amidst worries about a weak U.S. dollar and economic uncertainty. As tech advancements meet climate policies and investment strategies, the precious metals market looks set for steady growth, supported by ongoing supply issues, real-world applications, and increasing investor interest.

PRECIOUS METALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.13% |

|

Segments Covered |

By metal Type, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Freeport‑McMoRan, Polyus Gold International, Newmont Corporation,Barrick Gold Corporation, Anglo American Platinum Limited, Kinross Gold Corporation, Gold Fields Limited, Fresnillo plc, Sibanye‑Stillwater Limited, Wheaton Precious Metals Corp |

Precious Metals Market Segmentation:

Precious Metals Market Segmentation: By Metal Type

- Gold

- Silver

- Platinum Group Metals (PGMs)

Silver is the fastest-growing precious metal right now, thanks to high demand in renewable energy, electronics, and the automotive industry. In 2025, it jumped about 27%, beating gold’s returns, and ETFs brought in 300 tonnes in just a month. Platinum and palladium have also seen gains, with platinum increasing by 15-41% lately due to more use in hydrogen fuel cells and tougher emissions rules. These metals show how the market is moving towards green technology and clean energy.

Gold, on the other hand, still leads the precious metals market, holding about 70-78% share. Its reputation as a safe-haven investment, its role in jewelry, and its use by central banks keep it at the top. Gold is now the second-largest reserve asset globally, overtaking the euro, and central banks buy over 1,000 tonnes a year, confirming its strong position. Its cultural importance and high liquidity further secure gold status in the market.

Precious Metals Market Segmentation: By Application / Usage

- Jewelry

- Investment

- Industrial

- Others

Industrial demand for silver, platinum, and palladium is growing fast in the precious metals market. Silver is being used more in solar panels, electric vehicle parts, electronics, and medical devices, leading to supply shortages for the fourth year in a row. Meanwhile, platinum is gaining traction in catalytic converters and green tech, with its price up over 40% this year due to increased industrial use. As businesses focus on reducing carbon footprints, demand in this area will keep rising.

When it comes to precious metals, jewelry still leads the way, with gold making up around 50-60% of new production. This trend is especially strong in India and China, where gold holds cultural significance in wealth and ceremonies. Silver and platinum are also popular, with platinum seeing a 50% rise in demand for jewelry in China in the first quarter. Growing consumer preferences and rising incomes mean jewelry is likely to remain the top choice in the market.

Precious Metals Market Segmentation: By End‑User Industry

- Electronics

- Medical / Dentistry

- Automotive

- Aerospace

- Oil & Gas

- Chemicals

- Others

Silver and other precious metals are in high demand in electronics due to their great conductivity. In 2023, silver demand reached a record 654 million ounces, a 20% increase, with electronics alone using 445 million ounces and photovoltaic usage up by 64%. As digital transformation and green tech grow, this sector is the biggest driver of precious metals.

Electronics is far ahead of other industries, taking about 67.3% of the precious metals market share in 2023. This is mainly because silver is used in printed circuit boards and connectors. Gold is also important for making sure electrical connections don’t corrode, especially in devices like cell phones. With the electronics industry consuming most of the precious metal supply, it’s likely to stay on top for a while.

Precious Metals Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The precious metals market varies a lot depending on region. The Asia-Pacific area is the biggest player, making up about 45% of the market. This is mainly because there's a high demand for jewelry and more industrial uses in countries like China and India. North America comes next with around 25%, with a lot of investment in gold and silver ETFs, plus a solid base in electronics and mining. Europe holds about 18%, thanks to steady industrial use and investment, particularly in the automotive and renewable energy sectors. Latin America makes up about 7% of the market, thanks to its rich natural resources and mining activities in places like Mexico and Peru. The Middle East and Africa together account for around 5%, driven by a cultural love for gold and important mining products like platinum and palladium. Overall, this shows a balanced global need for precious metals in both consumer and industrial areas.

COVID-19 Impact Analysis on the Precious Metals Market:

During the pandemic, the precious metals market changed a lot. Gold prices shot up to nearly $2,000 an ounce in mid-2020 as investors looked for safe places to put their money during the lockdown and market chaos. Silver had a mixed bag—industrial demand dipped about 5-9% due to factories stopping, fewer cars being made, and supply issues, but investment demand took off, with ETF investments increasing by over 300 million ounces and people buying more physical bars and coins by about 8-10%. Gold production dropped by 5-6%, putting pressure on supply even though recycling was on the rise. Platinum and other metals took a hit of more than 40% at first because of car factory shutdowns but bounced back a bit as mining slowed down. The government support, low interest rates, and weaker currencies boosted precious metals even more, showing how valuable they are both for industry and as a safe investment.

Trends/Developments:

In February 2025, Asahi Kasei, a big name in chemicals from Japan, teamed up with Furuya Metal to start a recycling project focused on getting precious metals from parts used in making caustic soda. This lot is looking to be more eco-friendly.

In May 2024, Americas Gold and Silver Corporation shared their Q1 results, saying they produced about 0.48 million ounces of silver. This shows they're keeping steady even as market conditions change. They also made Jim Currie the COO to help lead the way.

In January 2024, Heraeus Precious Metals kicked off a new Hydrogen Systems business that provides components made from precious metals for fuel cells and electrolyzers. This shows how important platinum-group metals are for green hydrogen efforts.

Key Players:

- Freeport‑McMoRan

- Polyus Gold International

- Newmont Corporation

- Barrick Gold Corporation

- Anglo American Platinum Limited

- Kinross Gold Corporation

- Gold Fields Limited

- Fresnillo plc

- Sibanye‑Stillwater Limited

- Wheaton Precious Metals Corp.

Chapter 1. Precious Metals Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Precious Metals Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Precious Metals Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Packaging TYPE Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Precious Metals Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Precious Metals Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Precious Metals Market – By Metal Type

6.1 Introduction/Key Findings

6.2 Gold

6.3 Silver

6.4 Platinum Group Metals (PGMs)

6.5 Y-O-Y Growth trend Analysis By Metal Type

6.6 Absolute $ Opportunity Analysis By Metal Type , 2025-2030

Chapter 7. Precious Metals Market – By End User

7.1 Introduction/Key Findings

7.2 Electronics

7.3 Medical / Dentistry

7.4 Automotive

7.5 Aerospace

7.6 Oil & Gas

7.7 Chemicals

7.8 Others

7.9 Y-O-Y Growth trend Analysis By End User

7.10 Absolute $ Opportunity Analysis By End User , 2025-2030

Chapter 8. Precious Metals Market – By Application / Usage

8.1 Introduction/Key Findings

8.2 Jewelry

8.3 Investment

8.4 Industrial

8.5 Others

8.6 Y-O-Y Growth trend Analysis Application / Usage

8.7 Absolute $ Opportunity Analysis Application / Usage , 2025-2030

Chapter 9. Precious Metals Market , BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Metal Type

9.1.3. By Application / Usage

9.1.4. By End User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Metal Type

9.2.3. By Application / Usage

9.2.4. By End User

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Metal Type

9.3.3. By Application / Usage

9.3.4. By End User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Application / Usage

9.4.3. By End User

9.4.4. By Metal Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Application / Usage

9.5.3. By Metal Type

9.5.4. By End User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Precious Metals Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Freeport‑McMoRan

10.2 Polyus Gold International

10.3 Newmont Corporation

10.4 Barrick Gold Corporation

10.5 Anglo American Platinum Limited

10.6 Kinross Gold Corporation

10.7 Gold Fields Limited

10.8 Fresnillo plc

10.9 Sibanye‑Stillwater Limited

10.10 Wheaton Precious Metals Corp.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

People see them as safe investments; they’re used in various industries, and central banks are buying them up.

The electronics sector, car exhaust systems, renewable energy, and jewelry.

There are new uses for green hydrogen, nanotech, and solar energy combined with electric vehicles.

Asia-Pacific is on top, with North America and Europe not far behind.

More use of platinum for hydrogen, silver in solar and 5G, and an increase in metal-backed ETFs.