Precious Metals Alloys Market Size (2023-2030)

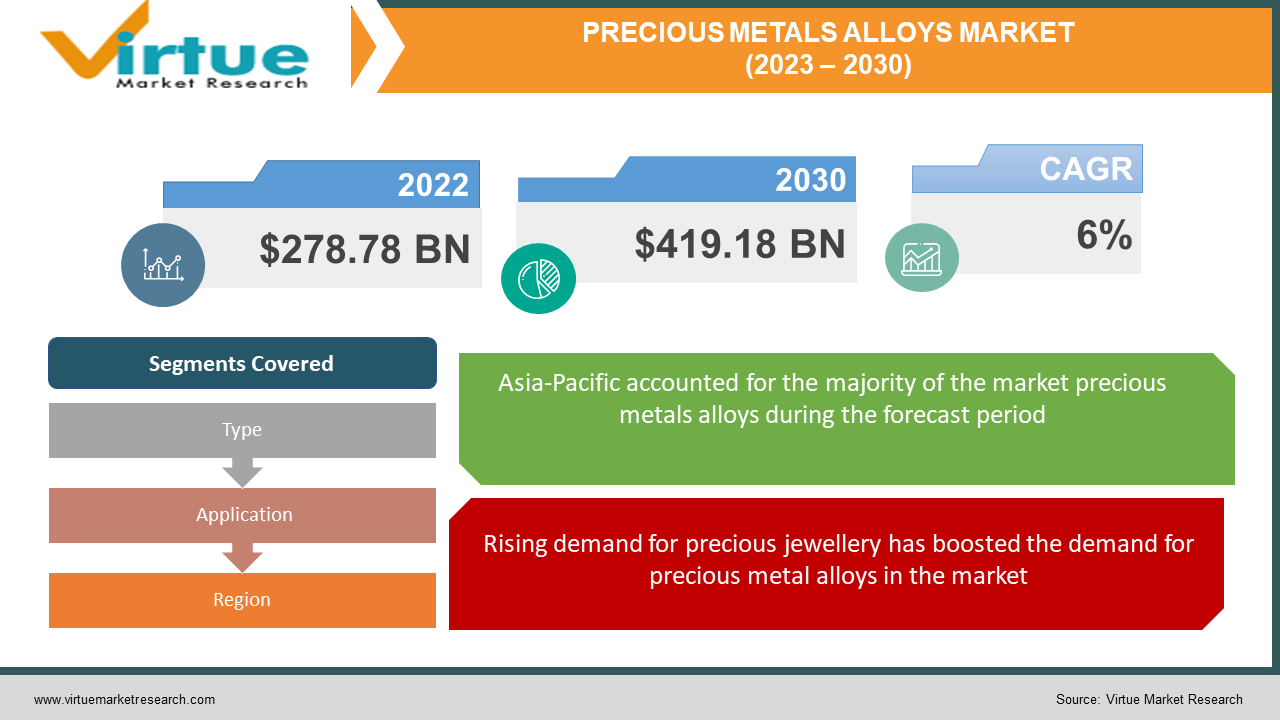

The Global Precious Metals Alloys Market was valued at USD 278.78 Billion and is projected to reach a market size of USD 419.18 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

Precious metal alloys are a combination of various precious metals such as gold, silver, platinum, palladium, and others that are created to enhance the properties of metals such as strength, durability, colour, resistance to corrosion, and others. Further, these are widely used in various industries such as jewellery, electronics, healthcare, automotive, and others. Additionally, rising demand for precious jewellery has increased the usage of precious metals alloys such as white gold and rose gold. Furthermore, due to properties like resistance to corrosion and durability, precious metal alloys are increasingly used in the electronics industry for making circuits and connectors.

Global Precious Metals Alloys Market Drivers:

Rising demand for precious jewellery has boosted the demand for precious metal alloys in the market.

The jewellery industry has boosted the growth of precious metal alloys by making different types of jewellery from these metals. Consumer preferences and fashion trends have contributed towards the demand for new jewellery designs and make, which has further increased the demand for precious metals alloys in the market. This includes the rising demand for rose gold in engagement rings, fashion jewellery, necklaces, and others. Further, the demand for stylish and sleek jewellery for parties and special occasions has increased the demand for minimalistic jewellery, increasing the demand for precious metals like platinum and white gold. Moreover, wedding culture and traditions in countries such as India, have increased the demand for 22 or 24-karat gold jewellery, thus contributing to the growth of the precious metals alloys industry.

Technological advancements and the application of precious metals alloys in various industries drive the demand for precious metals alloys in the market.

Advancements in technology have increased the demand for various precious metal alloys, such as platinum, silver, and others. Further, the adoption of electric vehicles has significantly impacted the precious metals alloys industry, such as the use of platinum-based alloys for combustion engines, the use of alloys containing lithium, cobalt, and nickel in electric batteries, and others. In addition, silver-based alloys are used in solar panels due to their high electrical conductivity. Furthermore, technological advancements in medicine and healthcare such as the manufacturing of advanced medical devices and equipment such as pacemakers, dental implants, stents, and others have increased the usage of precious metals alloys such as gold, platinum, and palladium for ensuring durability inside the human body. Moreover, recent technological innovations such as nanotechnology have increased the usage of precious metal alloys that are chemical and corrosion-resistant and enhance the performance of nano-materials. These include gold-silver alloys, gold-palladium alloys for producing carbon nanotubes, graphene, and others.

Global Precious Metals Alloys Market Challenges:

Price volatility can dampen the market demand for precious metal alloys. Precious metals alloys are subject to price fluctuations due to changes in currency rates, geopolitics, and rapid price movements in the market, which can reduce the demand for precious metals alloys in the market.

Further, the prevalence of sustainable alternative materials such as titanium, corten steel, biomaterials, and others can replace conventional metal alloys and decline its market growth.

Global Precious Metals Alloys Market Opportunities:

The Global Precious Metals Alloys Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches and agreements during the forecasted period. Furthermore, the increasing demand for making electrical circuits due to the rising demand for smartphones and the increasing demand for precious metals alloys in the jewellery industry is predicted to develop the market for Precious Metals Alloys and enhance its future growth opportunities.

COVID-19 Impact on the Global Precious Metals Alloys Market:

The pandemic had a significant impact on the precious metals alloys market. Price fluctuations of metals like gold and the closure of jewellery stores reduced the demand for precious metal alloys in the market. Furthermore, shifted consumer preferences towards necessary items, and declined the demand for precious metals alloys. However, precious metal alloys witnessed increased demand from the healthcare industry due to their usage in medical devices. Precious metals alloys were used directly or indirectly in components such as electrodes and sensors, that were widely used in medical devices such as ventilators, diagnostic equipment, scanners, and imaging devices.

Global Precious Metals Alloys Market Recent Developments:

In May 2023, Tanaka Kikinzoku Kogyo KK, a precious metal leader in Japan, announced the launch of a new precious metal alloy called – TF-FS. Moreover, the product possesses excellent hardness, resistance, and durability that can withstand 10 or more times bending.

PRECIOUS METALS ALLOYS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ACI Alloys, PX Group, Heraeus, Thessco, Nobilis Metals, ABI Manufacturing International, Cobb and Lee, Wheaton Precious Metals, Aurident |

Global Precious Metals Alloys Market Segmentation: By Type

-

Gold

-

White Gold

-

Rose Gold

-

Green Gold

-

Platinum

-

Silver

-

Sterling Silver

-

Britannia Silver

-

Others

Based on market segmentation by type, gold occupies the highest share in the market. Gold alloys are widely used in the jewellery industry due to their malleability and ductility. Moreover, they offer flexible customizing options as per the jewellery designs and colours. Further, rose gold is the most popular alloy used in the jewellery industry for creating white or silver-coloured jewellery pieces. It is an alloy of gold and white metal such as nickel and zinc. Further, green gold, an alloy of gold and silver is increasingly used in decorative items. In addition, gold alloys are essentially used in making electrical circuits, connectors, and contacts due to their good conductivity and reliability.

The silver segment is the fastest-growing segment during the forecast period. Silver is widely used in preparing jewellery, kitchen appliances, electrical equipment, and others. Sterling silver is the most common type of silver used in jewellery making and in silverware due to its durability and bright-lustrous appearance. Moreover, Britannia silver, an alloy of silver and copper is increasingly used to make kitchen utensils such as plates, glasses, spoons and forks, and others. Additionally, they are used in decorative and gift items such as coins and god idols.

The platinum segment occupies a significant share of the market. Platinum alloys are a combination of metals like palladium, ruthenium, and iridium that possess properties like durability, resistance to corrosion and chemicals. These are widely used in the dental industry for making dental crowns, restorations, and others due to their biocompatibility and durability. Further, due to their aesthetic appeal platinum alloys are used in the jewellery industry to create minimal jewellery pieces such as rings and jewellery sets.

Global Precious Metals Alloys Market Segmentation: By Application

-

Jewellery

-

Electronics

-

Healthcare

-

Automotive

-

Investment

-

Others

Based on market segmentation by application, the jewellery segment occupies the highest share of the market. The jewellery industry is one of the largest consumers of precious metal alloys as it utilizes different types of alloys in making jewellery pieces such as gold, platinum, and silver. Moreover, these alloys are widely used in making rings, necklaces, earrings, and bracelets due to their lustrous appearance, versatility, and flexibility.

The automotive segment is anticipated to be the fastest-growing segment during the outlook period. The automotive industry uses precious metal alloys in a catalytic converter to reduce carbon emissions, in electrical contacts, sensors, and connectors. Further, these alloys are widely used in the battery systems and charging infrastructure of electric vehicles due to their good conductivity and high-voltage resistance.

The healthcare segment occupies a significant share of the market. Precious metal alloys such as titanium and stainless-steel alloys are widely used in medical devices and equipment such as implants, dental prosthetics, diagnostic equipment, and others ensuring enhanced performance and patient safety.

Global Precious Metals Alloys Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

Based on market segmentation by region, Asia-Pacific occupies the highest share of the market. Owing to the increase in smartphone and other electronic device consumption, there is an increase in demand for precious metal alloys in the region. These include the use of metal alloys such as gold alloys, palladium alloys, and silver-based alloys in various components of smartphones such as circuits, camera bezels, connectors, switches, and camera modules. Leading countries in this market include China, Japan, and India. Moreover, the growing jewellery industry has contributed to the demand for metal alloys such as sterling silver and rose gold jewellery in the region. North America is the fastest-growing segment during the forecast period. Due to the rising demand for metal alloys from the automotive industry in the region such as for electric vehicles and commercial vehicles, there is an increased demand for precious metals alloys in the region. These include the use of metal alloys in catalytic converters, electrical contacts, terminals, and decorative trims of cars.

Global Precious Metals Alloys Market Key Players:

-

ACI Alloys

-

PX Group

-

Heraeus

-

Thessco

-

Nobilis Metals

-

ABI Manufacturing International

-

Cobb and Lee

-

Wheaton Precious Metals

-

Aurident

Chapter 1. Precious Metals Alloys Market – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sour

1.5 Secondary Sources

Chapter 2. Precious Metals Alloys Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Precious Metals Alloys Market – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Precious Metals Alloys Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Precious Metals Alloys Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6.Precious Metals Alloys Market - By Type

6.1 Gold

6.1.1 White Gold

6.1.2 Rose Gold

6.1.3 Green Gold

6.2 Platinum

6.3 Silver

6.3.1 Sterling Silver

6.3.2 Britannia Silver

6.4 Others

Chapter 7. Precious Metals Alloys Market - By Application

7.1 Jewellery

7.2 Electronics

7.3 Healthcare

7.4 Automotive

7.5 Investment

7.6 Others

Chapter 8. Precious Metals Alloys Market – By Region

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Latin America

8.5 The Middle East

8.6 Africa

Chapter 9. Precious Metals Alloys Market – Key players

9.1 ACI Alloys

9.2 PX Group

9.3 Heraeus

9.4 Thessco

9.5 Nobilis Metals

9.6 ABI Manufacturing International

9.7 Cobb and Lee

9.8 Wheaton Precious Metals

9.9 Aurident

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Precious Metals Alloys Market was estimated to be worth USD 263 Billion in 2022 and is anticipated to reach a value of USD 419.18 Billion by 2030, growing at a fast CAGR of 6% during the forecast period 2023-2030.

Consumer demand for healthy and nutritious food and culinary versatility are the market drivers for Global Precious Metals Alloys Market.

Gold, Silver, Platinum, and others are the segments under the Global Precious Metals Alloys Market by type.

Asia-Pacific dominates the market for Global Precious Metals Alloys Market.

North America is the fastest-growing region in the Global Precious Metals Alloys Market.