Global Prebiotics Gummy Vitamins Market Size (2024 – 2030)

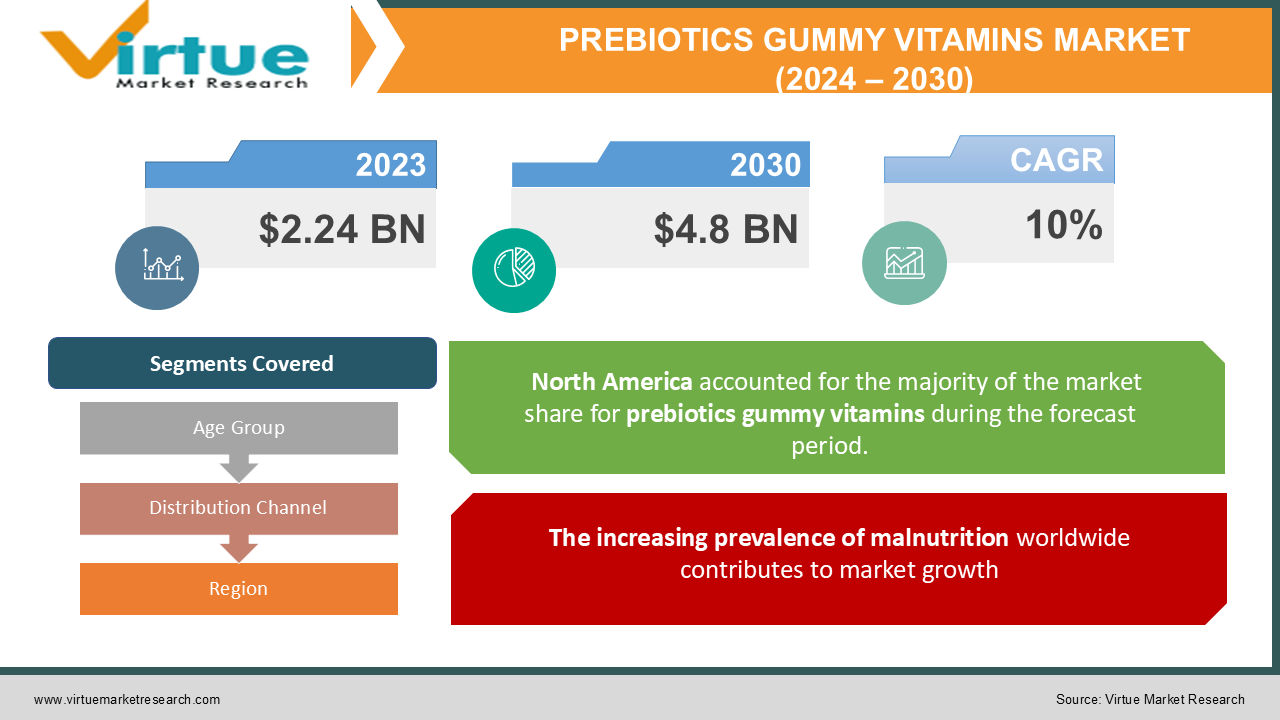

In 2023, the Global Prebiotics Gummy Vitamins Market was valued at USD 2.24 billion and is projected to reach a market size of USD 4.8 billion by 2030. The market is projected to grow with a CAGR of 10% per annum during the period of analysis (2024 - 2030).

Industry Overview

A gummy vitamin is a soft, tiny, chewy dietary supplement that resembles candy and is packed with vitamins and nutrients. They were developed for young people and the elderly who dislike taking pills and prefer dry supplements over liquid ones. Gummies are more tempting than conventional pills and available in a variety of flavours. Gelatine, sugar, water, corn starch, and other colourings are used in their production. Some of the popular flavours of gummy vitamins are raspberry, lemon, and orange. The usage of vitamin supplements is accepted in most countries. To improve the effectiveness of such multivitamin supplements, prebiotic gummy vitamins contain a variety of healthy bacteria, including lactobacillus, Bifidobacterium, bacillus coagulant, and others.

Prebiotics multivitamins that contain these kinds of bacteria (lactobacillus, Bifidobacterium, bacillus coagulant, and others) support immunological function, prevent pathogen colonization in the colon, and regulate melatonin to generate short-chain fatty acids. They improve health and compensate for a poor diet. People who have trouble swallowing pills frequently turn to gummy vitamins because they are easy to chew. Gummy vitamins can be beneficial and help with nutrient absorption for some people, particularly those who have nutrient deficiencies. Nutrient absorption issues are brought on by celiac disease, Crohn's disease, chronic pancreatitis, or cystic fibrosis as well as damage to the intestine from an infection, inflammation, trauma (injury), or surgery. Lactase deficiency, or lactose intolerance.

Impact of Covid-19 on the industry

The COVID-19 crisis affected the entire gummy supplement market because many retailers had to close or reduce their hours of operation. In reaction to the pandemic, for instance, Walmart declared that it will change its store hours, while other businesses intended to temporarily close their locations. To assist employees in cleaning stores and replenishing goods overnight, many businesses cut their operating hours. Due to the aforementioned reasons, consumers are looking into retail options they can access from their homes, which is increasing interest among online distributors.

Market Drivers

The increasing prevalence of malnutrition worldwide contributes to market growth

Whether brought on by demographic changes, terrorism, conflict, or climate change, malnutrition is one of the biggest problems the developing world is currently experiencing. Malnutrition is mostly brought on by poverty on a global scale. In 2021, 1.9 billion adults will be overweight or obese, while 462 million will be underweight. The World Health Organization estimates that undernutrition will be responsible for 45% of deaths in children mal the age of five. UNICEF estimates that 50 million children will have wasting, the most serious form of malnutrition, by the end of 2021. To reduce this kind of malnutrition, it is advantageous to combine beneficial bacteria like lactobacillus, Bifidobacterium, and bacillus coagulants with functional prebiotics.

Increasing Demand for Nutraceuticals Aid Market Growth

Ipsos' October 2021 poll of 28 nations found that 23,000 persons were still pursuing a more active and varied approach to health. According to the Hartman Group's 2021 Health & Wellness report, two-thirds of U.S. adults who say their views on health and wellness have changed this year are more concerned about their immediate and long-term health, 60% are more concerned about their mental health, 56% are more concerned about being physically active, and 42% are more concerned about aging. Prebiotics Gummy Vitamins Industry is estimated to develop over the forecast period of 2022–2030 as a result of the rising demand for nutraceuticals.

Market Restraints

Supply Chain Disruption of Raw Materials Hampering the Market Growth

The majority of pharmaceutical businesses that also produce allopathic medicines in the same facility also produce nutraceutical items. Due to the abundance of raw materials, China and India are the leading producers of nutraceutical products. However, because there is no effective regulating body to maintain the quality of raw materials, the business is growing quickly and dominating the market. According to the food-safety-helpline, several formulas consistently use low-quality basic materials. Additionally, the cost of raw materials is steadily rising. For example, Biotin prices in North America grew significantly from the second week of January from USD452965/MT to USD464690/MT in March 2022, according to Chemanalyst.

PREBIOTICS GUMMY VITAMINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Age Group, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Boli Naturals LLC, Nutra Solutions, Makers Nutrition, LLC,4Procaps Group., Ferro,Bayer AG, Ferrara Candy Company,, Ernest Jackson, Vitakem Nutraceutical Inc.,Contract NUTRA |

Global Prebiotics Gummy Vitamins- By Age Group

-

Adult

-

Children

The Prebiotics Gummy Vitamins Market may be further divided into children and adults depending on age group. In 2021, the adult market segment commanded a sizable market share. The need for prebiotic gummy vitamins is brought on by adults' increased risk of chronic disease due to busy lifestyles and consumption of poor meals. Prenatal use of prebiotics and gummy vitamins is also becoming more widespread because it is the most effective way to provide women with the various nutrients they need. Numerous major market players introduced their products to meet the growing demand for vitamins among mothers before and after pregnancy as a result of the rising demand. For instance, in June 2022, NutriBears Gummies introduced its three variants—Multivitamin, Calcium + Vitamin D, and Vitamin D—in the Indian market.

However, over the projected period of 2022–2030, the Children’s sector is predicted to develop at the quickest CAGR of 10.7%. This is the result of parents' growing worry for their children's health. Children need vitamins and minerals for proper growth, development, and maturation. Children's growth and development may be hampered by a lack of vitamins and minerals in their diets. Functional prebiotics mixed with helpful bacteria like lactobacillus, Bifidobacterium, bacillus coagulant, and other functional components is efficient at reducing this type of malnutrition. The countries with the lowest coverage of vitamin A supplements in 2020 were Pakistan, Afghanistan, Yemen, Mauritania, Benin, Nigeria, Tanzania, and Sudan, according to data from the United Nations Children's Fund (UNICEF). Prebiotics Gummy Vitamins Market Size has increased due to the increased demand for vitamin supplements for youngsters globally.

Global Prebiotics Gummy Vitamins- By Distribution Channel

-

Supermarkets

-

Hypermarkets

-

Speciality Stores

-

Retail Stores

-

Online Stores

Based on the distribution channels, the market for prebiotic gummy vitamins may be further divided into supermarkets, hypermarkets, specialty shops, retail outlets, online retailers, and others. In 2021, the Supermarket industry enjoyed a commanding market share. This can be attributed to the rise in supermarkets around the world. Because customers can get all of their necessities in one location and save time and money, the supermarket category is expanding. To improve the shopping experience for customers, several supermarkets update themselves with automation such as digital inventory management, cashier-less counters, and others. These elements increase the number of shoppers who visit supermarkets and fuel the expansion of the prebiotics gummy vitamins market share.

However, over the projected period of 2022–2030, the Online Stores category is anticipated to develop at the quickest CAGR of 11.2%. The availability of prebiotics and gummy vitamins on websites like Amazon, Flipkart, and other online shopping platforms, as well as the rising internet penetration, are to blame for this. The Food Industry Association estimates that in 2020, sales per customer transaction will be $42.04 for in-store purchases and $110 for online ones. Due to convenient doorstep delivery of high-quality products, the majority of consumers prefer online shopping. Due to these factors, the online store segment expands and drives the prebiotic gummy vitamin market over the projected period of 2022–2030.

Global Prebiotics Gummy Vitamins- By Geography & Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

The market for prebiotics and gummy vitamins can be further divided into North America, Europe, Asia-Pacific, South America, and the Rest of the World depending on geography. In 2021, North America dominated the market with a 37% share. This is because prebiotic supplements are becoming more and more popular among consumers who are concerned about their health as well as children and women. According to a survey by Archer Daniels Midland Company (ADM) from 2021, 79% of American consumers believe that consuming supplements is beneficial for their overall health. The Council for Responsible Nutrition (CRN) estimates that in the United States in 2020, adults aged 35 to 54 will use dietary supplements at a rate of 81%. The growing need for supplements in this region helps grow the Prebiotics Gummy vitamins Market Size in this region.

Global Prebiotics Gummy Vitamins- By Companies

-

Boli Naturals LLC

-

Nutra Solutions

-

Makers Nutrition, LLC,

-

4Procaps Group.

-

Ferro,

-

Bayer AG,

-

Ferrara Candy Company,

-

Ernest Jackson,

-

Vitakem Nutraceutical Inc.,

-

Contract NUTRA

NOTABLE HAPPENINGS IN THE GLOBAL PREBIOTICS GUMMY VITAMINS MARKET IN THE RECENT PAST:

-

Regulatory Approval: - In 2022, The Belgian food safety authority granted permission for the Ferrero plant in Arlon, Belgium, to resume operations (AFSCA). The factory has undergone rigorous cleaning and food safety checks before this reopening. The plant started the process of reopening, which will result in the manufacturing lines gradually restarting over the following few weeks.

-

Business Partnership: - In 2022, A multi-year strategic partnership between Ginkgo Bioworks and Bayer AG's Biological Powerhouse is intended to advance Bayer's biologics strategy of leveraging the open innovation ecosystem while accelerating the development of a diverse portfolio of high-quality microbial-based solutions for growers globally.

-

Merger & Acquisition: - In 2021, The pharmaceutical firm and Procaps companies, a premier global integrated healthcare provider, finalized the acquisition of Union Acquisition Corp. II. Procaps is valued at about $1.1 billion in this transaction, with gross cash proceeds of about $160 million. In addition to inorganic development through accretive acquisitions, the funds are anticipated to finance both organic growth through capacity expansion, plant improvements, working capital investments, e-Health platform improvements, and R&D costs.

Chapter 1. Global Prebiotics Gummy Vitamins – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Prebiotics Gummy Vitamins – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Global Prebiotics Gummy Vitamins – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Global Prebiotics Gummy Vitamins - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Global Prebiotics Gummy Vitamins – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Global Prebiotics Gummy Vitamins – By Age Group

6.1 Introduction/Key Findings

6.2 Adult

6.3 Children

6.4 Y-O-Y Growth trend Analysis By Age Group

6.5 Absolute $ Opportunity Analysis By Age Group, 2024-2030

Chapter 7. Global Prebiotics Gummy Vitamins – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets

7.3 Hypermarkets

7.4 Speciality Stores

7.5 Retail Stores

7.6 Online Stores

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Global Prebiotics Gummy Vitamins , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Age Group

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Age Group

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Age Group

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Age Group

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Age Group

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Global Prebiotics Gummy Vitamins – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Boli Naturals LLC

9.2 Nutra Solutions

9.3 Makers Nutrition, LLC,

9.4 4Procaps Group.

9.5 Ferro,

9.6 Bayer AG,

9.7 Ferrara Candy Company,

9.8 Ernest Jackson,

9.9 Vitakem Nutraceutical Inc.,

9.10 Contract NUTRA

Download Sample

Choose License Type

2500

4250

5250

6900