Pre-Painted Metal Market Size (2024-2030)

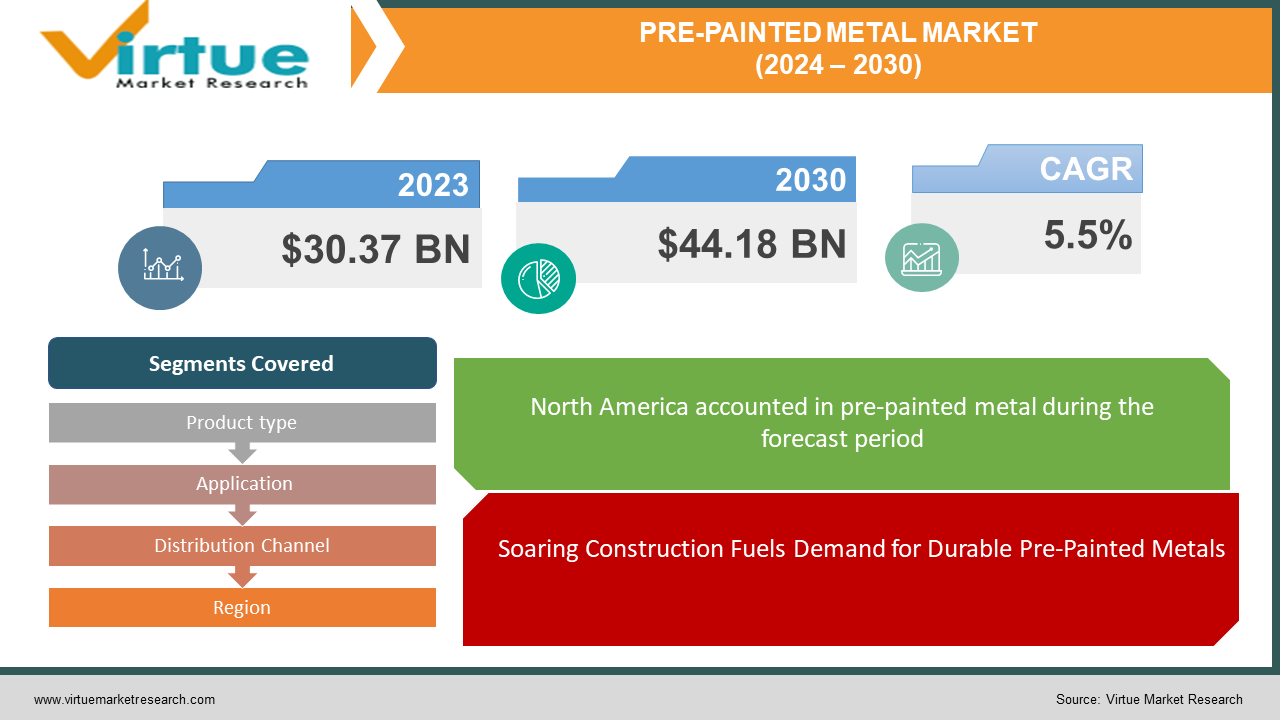

The Pre-Painted Metal Market was valued at USD 30.37 billion in 2023 and is projected to reach a market size of USD 44.18 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.5%.

The pre-painted metal market is on a roll, driven by the construction industry's preference for attractive, long-lasting, and low-maintenance materials. This translates to pre-painted metals being increasingly used in building projects, from roofs and siding to wall panels. Their versatility extends beyond construction, finding applications in appliances, vehicles, and even consumer goods like electronics and furniture. Steel is the king of the pre-painted metal market due to its strength and durability, while aluminum offers a lighter alternative for weight-conscious applications. The competition in this market is fierce, with a mix of major and minor players battling for a share of the pie. With a focus on aesthetics and functionality driving demand, the future of the pre-painted metal market looks bright.

Key Market Insights:

The pre-painted metal market is riding a wave of growth, fueled by the construction industry's demand for attractive and functional materials. This translates to a wider range of applications for pre-painted metals in building projects. They are increasingly used beyond just roofs and siding, finding their way into wall panels, appliances, vehicles, and even consumer goods like electronics and furniture. They can withstand harsh weather conditions and require minimal maintenance, leading to cost savings in the long run. Additionally, the wide variety of colors and finishes available allows architects and designers to create visually appealing buildings.

The competition in this market is fierce, with a mix of major and minor players vying for market share. This competitive landscape can lead to innovation in pre-painted metals and potentially lower prices for consumers. Steel remains the dominant player due to its strength, but aluminum offers a lighter alternative for weight-sensitive applications.

The Pre-Painted Metal Market Drivers:

Soaring Construction Fuels Demand for Durable Pre-Painted Metals

The surging construction industry, particularly in developing economies, is a key driver. Pre-painted metals perfectly cater to this sector's needs with their exceptional durability. They can withstand harsh weather conditions and require minimal maintenance, translating to significant cost savings for construction projects in the long run. This makes them a highly attractive choice for roofing, siding, and wall panels.

Pre-Painted Metals Functionality beyond Construction with Functional Advantages

Their impressive resistance to corrosion makes them ideal for a variety of applications. From appliances exposed to moisture to vehicles enduring harsh weather, pre-painted metals offer a reliable and long-lasting solution. They are even finding their way into the exterior components of consumer goods.

Architects and designers are increasingly turning to pre-painted metals due to their aesthetic appeal.

The wide variety of colors and finishes available allows for the creation of visually striking and contemporary buildings. This newfound focus on aesthetics in construction, coupled with the functionality of pre-painted metals, is a major driver of market growth.

The competitive Landscape Drives Innovation and Potentially Lower Prices

The pre-painted metal market is a battleground for established and emerging companies, fostering innovation and potentially lower prices for consumers. This fierce competition can lead to the development of new pre-painted metal products with improved functionalities or properties. Additionally, it can drive down prices as companies vie for market share, making pre-painted metals a more accessible option for various applications.

The Pre-Painted Metal Market Restraints and Challenges:

While the pre-painted metal market basks in its growth surge, headwinds exist that can disrupt its trajectory. A major challenge lies in the fluctuating prices of raw materials like steel and aluminum. These volatile costs directly impact production and ultimately the final price for consumers. Additionally, setting up a pre-painted metal production line requires a hefty initial investment. This can be a barrier for new players and smaller companies, potentially stifling competition and innovation in the market.

Environmental concerns also pose a hurdle. The pre-painting process often involves chemicals and solvents, raising environmental red flags. Stringent regulations and a growing focus on sustainability can make things difficult for manufacturers. Proper management of pre-painted metal scrap disposal is another environmental consideration.

Pre-painted metals also face competition from alternative materials like plastic, fiber cement, and even pre-cast concrete in some applications. These alternatives may offer lower costs or specific advantages depending on the project's needs.

The Pre-Painted Metal Market Opportunities:

The pre-painted metal market isn't just about weathering challenges, it's also a canvas brimming with opportunities. A major growth area is the construction boom in developing economies. Pre-painted metals perfectly align with the needs of these regions due to their durability, aesthetics, and cost-effectiveness, making them ideal for various building projects.

Sustainability, a double-edged sword, presents both challenges and exciting possibilities. While stricter regulations require eco-friendly processes, it also opens doors for innovation. Manufacturers can develop sustainable pre-painting technologies and coatings to cater to the rising demand for green building materials.

PRE-PAINTED METAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ArcelorMittal, Tata BlueScope Steel, Haomei, SSAB, Nippon Steel Corporation, UNICOIL, MMK Group, Impol, NLMK |

Pre-Painted Metal Market Segmentation: By Product Type

-

Steel

-

Aluminium

-

Others

Steel reigns supreme in the pre-painted metal market due to its strength and durability, making it the dominant player across various applications. However, aluminum is the rising star, experiencing the fastest growth. Its lighter weight makes it ideal for weight-sensitive applications in transportation and construction, particularly building facades. This trend is likely to continue as sustainability and fuel efficiency become ever-increasing priorities.

Pre-Painted Metal Market Segmentation: By Application

-

Construction

-

Consumer Electronics

-

Transportation

-

Others

The dominant application segment in the pre-painted metal market is 'Construction', encompassing roofing, siding, wall panels, and architectural elements. Due to a lack of data on growth rates by segment, the fastest-growing segment cannot be determined definitively. However, the construction boom in emerging economies is expected to significantly contribute to the overall market growth.

Pre-Painted Metal Market Segmentation: By Distribution Channel

-

Online

-

Offline

The dominant distribution channel for pre-painted metals is the traditional, offline method with established distribution networks. This channel offers readily available materials through distributors, retailers, and metal service centers, the online segment is experiencing the fastest growth, providing a convenient option for consumers and businesses to directly access a wider variety of pre-painted metals.

Pre-Painted Metal Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North American pre-painted metal market is well-established, boasting strong players and a focus on high-quality, long-lasting products. This focus on quality ensures that pre-painted metals meet the rigorous performance standards expected in the region.

A mature market, Europe prioritizes sustainability alongside functionality. Manufacturers are increasingly developing eco-friendly pre-painting processes and coatings to comply with stringent environmental regulations. This focus on sustainability positions Europe as a leader in innovative pre-painted metal solutions.

Asia Pacific region currently reigns supreme in the pre-painted metal market, fueled by the construction boom in developing economies. The surge in infrastructure and building projects across the Asia Pacific creates a massive demand for pre-painted metals, making it the current market leader. Their affordability, durability, and aesthetics make them a perfect fit for various construction needs in the region.

As an emerging market, South America is brimming with potential for pre-painted metals. Fueled by increasing urbanization and investments in infrastructure development projects, the demand for pre-painted metals is on the rise. This region presents exciting opportunities for future growth.

COVID-19 Impact Analysis on the Pre-Painted Metal Market:

The global COVID-19 pandemic wasn't kind to the pre-painted metal market. Lockdowns and travel restrictions disrupted the supply chain for raw materials like steel and aluminum, causing production slowdowns and extended lead times. On the demand side, the pandemic triggered economic downturns, leading to delays or cancellations of construction projects. This meant less need for pre-painted metals typically used in building components like roofing, siding, and wall panels. Transportation restrictions also added to the woes, causing delays in deliveries of pre-painted metals and impacting project timelines. Businesses, focused on immediate survival during the pandemic, also reduced investments in projects that utilize pre-painted metals.

However, there were some bright spots. The heightened focus on hygiene during COVID-19 could lead to a long-term rise in demand for pre-painted metals in applications like healthcare facilities, where their easy cleaning properties are a major advantage. The e-commerce boom could also be a factor, potentially increasing demand for pre-painted metals used in appliances and electronics production.

As the global economy recovers, the pre-painted metal market is expected to see a rebound. The revival of the construction industry, particularly in developing economies, will be a key driver of this growth. While the full impact of COVID-19 on the market is still being assessed, the long-term outlook remains optimistic. The ongoing construction boom and the inherent versatility and functionality of pre-painted metals position them for continued success.

Latest Trends/ Developments:

The pre-painted metal market is buzzing with innovation and a focus on sustainability. Manufacturers are prioritizing eco-friendly pre-painting processes and coatings, utilizing water-based paints, low-VOC formulations, and even exploring recycled materials. Functionality is also getting a boost with the development of high-performance pre-painted metals. Imagine pre-painted metals with improved fire resistance, self-healing properties, or even self-cleaning capabilities! Digitalization is transforming the game too. The software allows architects to virtually design with unique colors and finishes, while online platforms offer pre-painted metals directly to consumers and businesses, opening doors for greater customization. Pre-painted metals are also stepping outside their comfort zone. Advancements in pre-painted aluminum could see it used more in lightweight electric vehicles, while unique aesthetics and textures are finding a place in architectural facades and interiors. Finally, the focus on hygiene post-pandemic has led to an interest in pre-painted metals with inherent or integrated antibacterial properties – a potential boon for healthcare facilities, public transportation, and even household appliances. With its commitment to innovation and sustainability, the pre-painted metal market is well-positioned for continued success in the years to come.

Key Players:

-

ArcelorMittal

-

Tata BlueScope Steel

-

Haomei

-

SSAB

-

Nippon Steel Corporation

-

UNICOIL

-

MMK Group

-

Impol

-

NLMK

Chapter 1. Pre-Painted Metal Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pre-Painted Metal Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pre-Painted Metal Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pre-Painted Metal Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pre-Painted Metal Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pre-Painted Metal Market – By Product Type

6.1 Introduction/Key Findings

6.2 Steel

6.3 Aluminium

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Pre-Painted Metal Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online

7.3 Offline

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Pre-Painted Metal Market – By Application

8.1 Introduction/Key Findings

8.2 Construction

8.3 Consumer Electronics

8.4 Transportation

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Pre-Painted Metal Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Distribution Channel

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Distribution Channel

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Distribution Channel

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Distribution Channel

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Distribution Channel

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Pre-Painted Metal Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ArcelorMittal

10.2 Tata BlueScope Steel

10.3 Haomei

10.4 SSAB

10.5 Nippon Steel Corporation

10.6 UNICOIL

10.7 MMK Group

10.8 Impol

10.9 NLMK

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Pre-Painted Metal Market was valued at USD 30.37 billion in 2023 and is projected to reach a market size of USD 44.18 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.5%.

Construction Industry Boom, Functional Benefits beyond Construction, Aesthetics in Construction, Competitive Landscape.

Construction, Consumer Electronics, Transportation, Others.

Asia Pacific region reigns supreme in the Pre-Painted Metal Market, driven by the construction boom in developing economies. This surge in construction creates significant demand for pre-painted metals.

ArcelorMittal, Tata BlueScope Steel, Haomei, SSAB, Nippon Steel Corporation, UNICOIL, MMK Group, Impol, and NLMK are some of the key players.