Power Transmission Equipment Market Size (2024 – 2030)

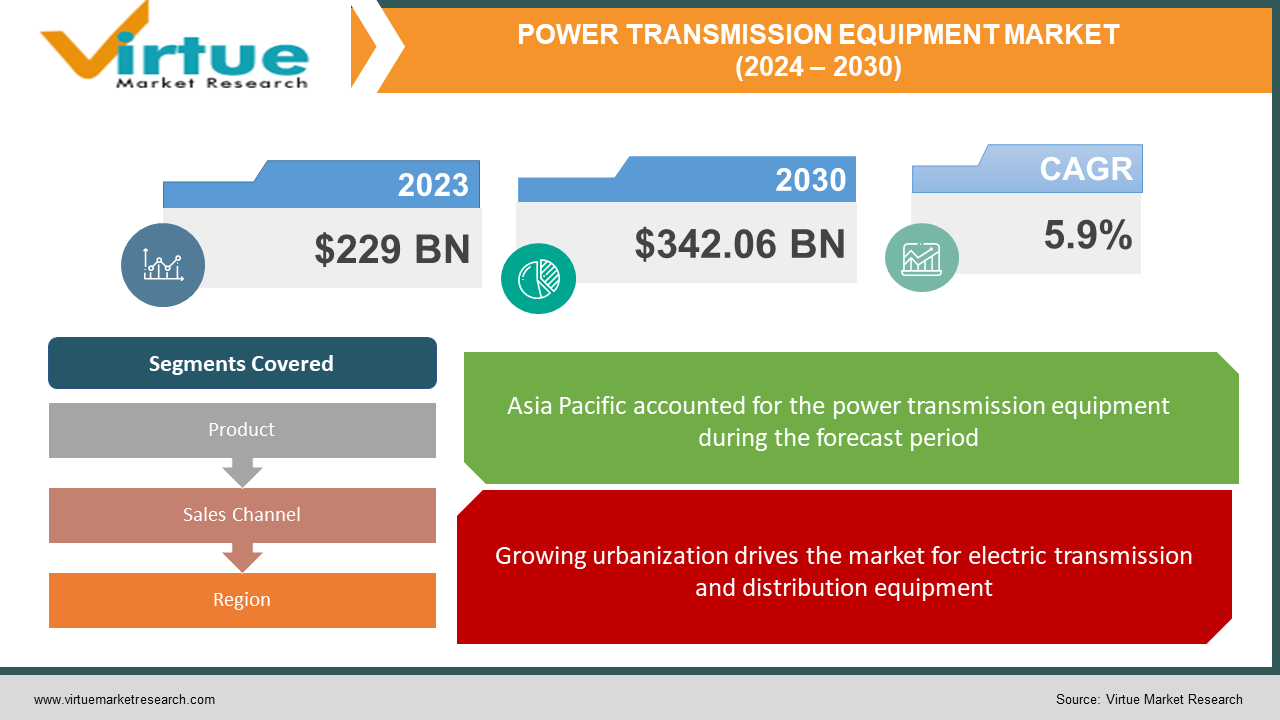

The Global Power Transmission Equipment Market was valued at USD 229 billion in 2023 and is projected to reach a market size of USD 342.06 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 5.9%.

The moments of electrical energy through the interlinked lines are known as transmission networks. It is a type of electric transmission. Electric transmission and distribution types of equipment are some of the most significant parts of power generation, transmission, and distribution systems. The continuous development of the transmission and distribution equipment to achieve the future requirements of the power grid. In recent years, the energy industry has emphasized renewable sources to meet the power demand. The transmission networks permit the flow of electrical energy. It consists of switches, transmitters, insulators, capacitors, etc. The growing infrastructure development in the housing and commercial sectors will result in a greater necessity for electric power transmission and distribution equipment. Enhancing technological facilitation across the world will be expected to boost the market demand for the electric power transmission and distribution equipment market.

Key Market Insights:

-

According to the Edison Electric Institute (EEI), annual electric vehicle sales in the USA are estimated to surpass 1.2 million by 2025. Electric vehicles are expected to be responsible for 9% of the global electricity demand by 2050. Hence, the widening applications of electricity in the transportation industry will further stretch the electric power transmission, control, and distribution market.

-

In September 2023, as per the International Energy Agency, a France-based autonomous intergovernmental organization, in Colombia, the total net electricity production achieved 7.0 terawatt-hours (TWh) in June 2023, resulting in a 1.1% increase on a year-to-date basis. Therefore, the growing electricity demand is propelling the growth of the electric power transmission, control, and distribution market.

-

Advancements in materials science have resulted in the development of more efficient and durable transmission lines and equipment. The combination of IoT, AI, and Big Data analytics in grid operations has further altered the way electricity is transmitted and distributed.

Global Power Transmission Equipment Market Drivers:

Growing urbanization drives the market for electric transmission and distribution equipment

Rising urbanization and the expanding demand for smart appliances across the world are estimated to drive the development of the electric transmission and distribution equipment market. The rising necessity for electric appliances in the population for an improved lifestyle and convenience pushes the growth of the market. In urbanization, the widening industrialization infrastructure, and commercial area tend to the greater demand for the electric transmission and distribution equipment market. The expanding requirement for technologically advanced electrical equipment for smart houses, offices, etc., and the altering lifestyle habits of people around the globe are estimated to raise the demand growth of the electric transmission and distribution equipment market. The escalation in disposable income and adaptation of digitization positively results in the growth of the electric transmission and distribution equipment market.

Global Power Transmission Equipment Market Restraints and Challenges:

Although there are many advantages and utilizes of electrical power transmission and distribution equipment, there are some market disturbing factors that affect the growth of the overall market. The initial investment of material and installation of the power grid or the electric power generation is costly, at the time of installation amount of security devices are used like a transformer, overhead components, switchgear, etc. It also required the relay, circuit breakers, and contractor to curb a dangerous outbreak. More insulator is required for better connectivity. These elements show that the initial installation cost is greater than expected and would detriment the growth of the electric power transmission and distribution equipment market.

Global Power Transmission Equipment Market Opportunities:

Renewable energy is the best substitute for fossil fuel energy most organizations are looking for deployment in emission-free energy. The increasing consciousness of global warming in the people and the transition in mindset to renewable sources of energy would push the market to renewable energy. There are a few sources of renewable energy like wind, solar, geothermal energy, biomass, etc. Renewable energy lowered fossil fuel use and reduced the charges for electricity. In the recent era, many countries have adopted renewable energy as their primary source of energy and this will positively result in the growth of electric power transmission due to the lowered cost of electricity, thus renewable energy source becomes the upcoming opportunity for electric power transmission and distribution equipment market growth.

POWER TRANSMISSION EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Product, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd., Mitsubishi Electric, Larsen & Turbo, Schneider Electric, Siemens, Kirloskar Group, Eat, Engine, Bharat Heavy Electricals Limited, EDF |

Global Power Transmission Equipment Market Segmentation: By-Products

-

Transformer

-

Power Transformer

-

Distribution Transformer

-

Switchgear

-

Circuit Breaker

-

Fuse

-

Distribution Control Panel

-

Others

-

Insulators & Fittings

-

Cables & Lines

-

Others

The Cables and Lines segment had the biggest market revenue in 2023. The growth of the segment is dedicated to the expansion of the smart grid, power distribution, and power transmission. Cables have insulation, which differentiates them from naked overhead conductors in this regard. Resultantly, the aspect of relative safety may be guaranteed. Flexible power cables are utilized by portable machines, equipment, and electronics. The rated voltage, current, highest working temperature, and intended to utilise of the client are taken into consideration in the design and manufacture of these cables.

The Transformer segment is expected to widen its market share in the estimated period. The growth of the segment was enhanced due to rapid urbanization and industrialization across the globe. The transformer is pivotal a modifying current power transmission and distribution tool that controls voltage. However, the fundamental objective of utilizing transformers was to maintain equilibrium between the power generated at extremely high voltages and the consumption of electricity at very low voltages. Transformers are employed in quite a few industries, including the transmission of electrical energy and the grid for power generation.

Global Power Transmission Equipment Market Segmentation: By Sales Channel

-

Indirect Channel

-

Commercial Distribution

-

Catalog Distribution

-

Retail Box Stores

-

E-commerce

-

Direct Channel

The Indirect Sales Channel led the market with the largest market share in 2023. The segment is enhancing due to the rising number of end-users like commercial, catalog distribution, and e-commerce. In the indirect sales channel, the commercial segment held the maximum part of the market development. Increasing commercialization in urban areas of nations such as the United States, Canada, India, and China results in greater demand in the market. The increasing e-commerce industry also adds to the growth of the market.

The Direct Sales Channel is predicted to grow at a major rate during the predicted period. Enhancing consumer demand by going personally and validating the product lifecycle would push the segment demand.

Global Power Transmission Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific led the market with the greatest revenue share in 2023. The region continues its dominance over the estimated period due to the enhancing industrialization and commercialization across the world. The increasing population growth and the enhancing standards of lifestyle and disposable income of people lead to a greater demand for smart houses, smart appliances, and smart offices would push the demand growth of the electric power transmission and distribution equipment market.

North America has a major market share in the electric power transmission and distribution equipment market. The early and quick adoption of the technology results in the development of the market in the region. The growing adoption of renewable sources of energy for electricity consumption pushes the market to grow. The enhancing investments in electric power transmission and distribution equipment would, along with the existence of major key players in the market, drive the development of the market in the region.

COVID-19 Impact Analysis on the Global Power Transmission Equipment Market:

The electric transmission and distribution equipment market facing a drop in market value due to the effect of COVID-19. The pandemic caused a detrimental impact on economic activities around the globe, which affected the market development of electric transmission and distribution equipment. The lockdown caused due to the pandemic interrupted the supply chain and raw material manufacturing, which affected the manufacturing activity of the transmission and distribution equipment. Industries and the commercial sector faced a fall in the demand owing to the lockdown but the residential segment saw a rise in the demand for energy as people stayed at home to follow social distancing norms. This extends an opportunity for the electric transmission and distribution equipment market to widen in the residential sector. With lockdown uplifted from most nations, the market is expected to grow at a faster speed due to the increase in demand.

Latest Trends:

SCADA Systems restructuring the relay and Industrial Control Industry

The relay and industrial control industry is increasingly adopting SCADA (Supervisory Control and Data Acquisition) procedures to enhance process efficiency and productivity. SCADA systems are applied to remotely monitor industrial processes such as power generation, fabrication, and refining via coded signals over cloud channels. The applications of these SCADA systems are estimated to rise mainly due to their scalability, ease of upgrading, the emergence of global smart grid projects, and the widened use of cloud technologies. The market is also benefitting from the greater demand for energy and renewable resource projects. For example, in May 2022, Electronics Corporation of India Limited (ECIL), an India-origin government-owned company introduced programmable logic controller (PLC) and supervisory control and data acquisition (SCADA) software. The launch of PLC and SCADA software is anticipated to strengthen the adoption of automation and controls across a range of industries and to enhance the effectiveness and dependability of industrial processes by facilitating real-time monitoring and control.

Increasing emphasis on Product Innovations

Primary companies operating in the power generation, transmission, and control equipment market are stressing innovative products such as main spring linear generators to offer reliable services to their customers. A linear generator is a type of electrical generator that converts mechanical energy, particularly linear (straight-line) motion, directly into electrical energy. The Mainspring Linear Generator utilizes a low-temperature, uniform reaction that handles peak temperatures below the levels in which NOx forms (1500°C), impacting near-zero NOx emissions.

Key Players:

-

ABB Ltd.

-

Mitsubishi Electric

-

Larsen & Turbo

-

Schneider Electric

-

Siemens

-

Kirloskar Group

-

Eaton

-

Engine

-

Bharat Heavy Electricals Limited

-

EDF

Recent Developments

-

In May 2023, India’s biggest electric power transmission company “Powergrid” partnered and signed the Memorandum of Understanding (MoU) with Safdarjung Hospital and VMMC to offer medical equipment for urology cancer patients. The deed was signed the give financial support to Safdarjung Hospital and VMMC to facilitate advanced medical equipment.

-

In May 2023, researchers from Oregon State University mentioned that smart meters are the aim of electric grid destabilization. Smart meters are electrical devices. A smart meter is a digital gadget that collects information about power use and transmits it to a nearby utility through a communications network.

-

In May 2023, the first and largest battery energy storage from TotalEnergies was launched in Europe. The project, which is estimated to be online by the end of next year, will get 40 Intensium Max High Energy lithium-ion containers from TotalEnergies battery subsidiary company Saft.

-

In May 2023, a market pioneer in automating and managing energy, Schneider Electric announced the launch of circuit breaker ‘EvoPact’ for its medium voltage equipment.

Chapter 1. Power Transmission Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Power Transmission Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Power Transmission Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Power Transmission Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Power Transmission Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Power Transmission Equipment Market – By Product

6.1 Introduction/Key Findings

6.2 Transformer

6.3 Power Transformer

6.4 Distribution Transformer

6.5 Switchgear

6.6 Circuit Breaker

6.7 Fuse

6.8 Distribution Control Panel

6.9 Others

6.10 Insulators & Fittings

6.11 Cables & Lines

6.12 Others

6.13 Y-O-Y Growth trend Analysis By Product

6.14 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Power Transmission Equipment Market – By Sales Channel

7.1 Introduction/Key Findings

7.2 Indirect Channel

7.3 Commercial Distribution

7.4 Catalog Distribution

7.5 Retail Box Stores

7.6 E-commerce

7.7 Direct Channel

7.8 Y-O-Y Growth trend Analysis By Sales Channel

7.9 Absolute $ Opportunity Analysis By Sales Channel, 2024-2030

Chapter 8. Power Transmission Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Sales Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Sales Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Sales Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Sales Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Sales Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Power Transmission Equipment Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 ABB Ltd.

9.2 Mitsubishi Electric

9.3 Larsen & Turbo

9.4 Schneider Electric

9.5 Siemens

9.6 Kirloskar Group

9.7 Eaton

9.8 Engine

9.9 Bharat Heavy Electricals Limited

9.10 EDF

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Power Transmission Equipment Market was valued at USD 229 billion in 2023 and is projected to reach a market size of USD 342.06 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 5.9%.

The growing urbanization is propelling the Global Power Transmission Equipment Market.

Global Power Transmission Equipment Market is segmented based on Product, Sales Channel, and Region.

Asia-Pacific is the most dominant region for the Global Power Transmission Equipment Market.

ABB Ltd., Mitsubishi Electric, Larsen & Turbo, Schneider Electric, Siemens, and Kirloskar Group are a few of the key players operating in the Global Power Transmission Equipment Market.