Power Tiller Machine Market Size (2024 – 2030)

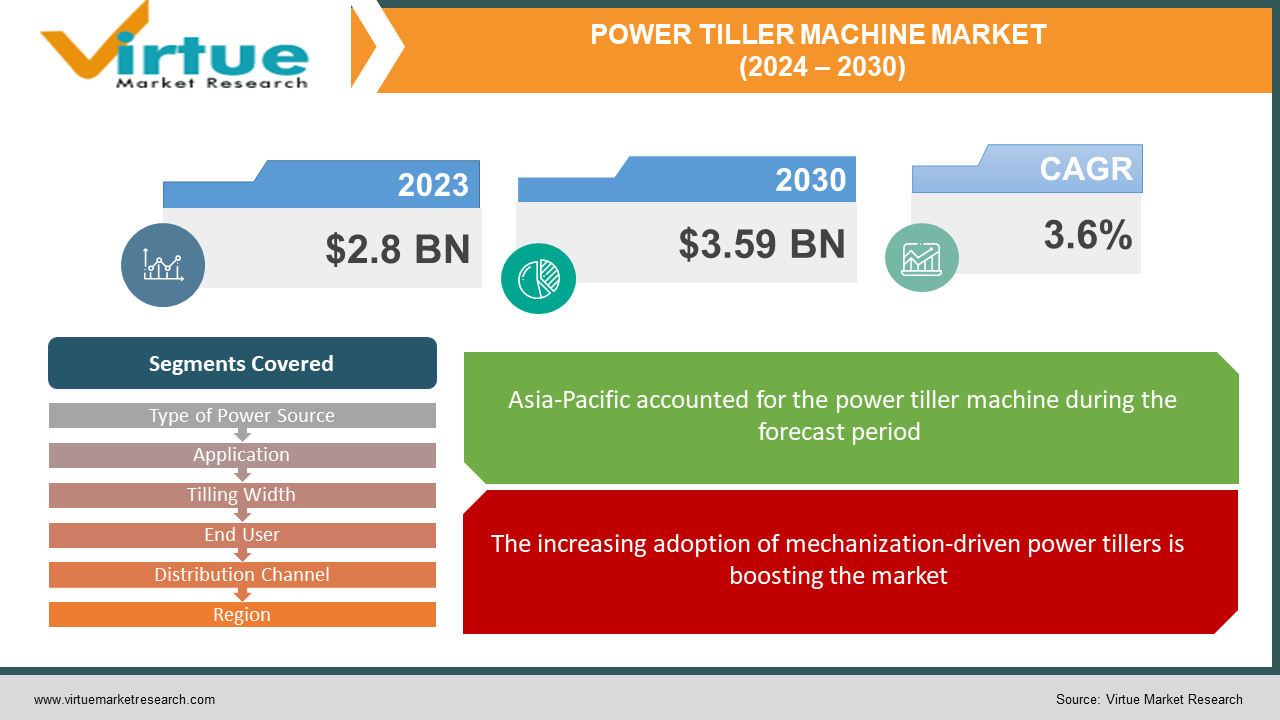

The global power tiller machines market is valued at USD 2.8 billion in 2023 and is likely to top a valuation of USD 3.59 billion by 2030, advancing at a CAGR of 3.6% from 2024 to 2030.

The market for power tillers is a crucial component of the agricultural machinery industry, meeting the changing demands of contemporary farming methods. Current agricultural practices have a significant influence on the need for power tillers, especially in areas where small-scale or subsistence farming is common. Farmers are looking for alternatives to labor-intensive manual procedures, and this is driving trends toward mechanization as a means of increasing production and efficiency. The market for power tillers is expanding due in part to government regulations and incentives that favor farm mechanization. The industry landscape is significantly shaped by ongoing technological improvements, including more durable and fuel-efficient engines.

Key Market Insights:

The market for power tiller machines is displaying dynamic patterns and transitions that are indicative of how agricultural practices are evolving. There is a noticeable increase in the use of electric-powered tillers, which can be attributed to increased environmental awareness and a desire for quieter operations, especially in smaller gardening and agricultural settings. Simultaneously, the business has been defined by technological improvements, with intelligent elements like automated controls and GPS-guided navigation improving farming operations' precision. Additionally, the market offers a wide range of applications, meeting the needs of home gardens or smaller plots that can benefit from more portable and compact tillers, as well as large-scale farming operations using heavy-duty machinery. In addition, the number of Internet sales channels has increased, giving customers easy ways to research, evaluate, and buy. In response to market needs, manufacturers are providing a range of attachments and customization options, enabling farmers to tailor the equipment to crops and soil types. The policies and subsidies of the government that support mechanization and sustainable agriculture have a big impact on how markets operate. In general, the market for power tiller machines is distinguished by technological innovation, competitiveness, and a worldwide environment shaped by local agricultural methods and financial circumstances.

Power Tiller Machine Market Drivers:

The increasing adoption of mechanization-driven power tillers is boosting the market.

The market for power tiller machines is significantly influenced by the continued trend of agricultural mechanization, which is motivated by the desire for greater productivity and efficiency. Mechanized solutions are being adopted by farmers more frequently to simplify their operations and lessen their reliance on physical labor.

The adoption of power tillers is driven by labor shortages.

One of the main reasons power tiller machines are becoming more popular is the lack of qualified agricultural labor in many areas. As fewer people are available for manual labor on farms, power tillers' mechanization becomes crucial for efficient and timely field preparation and cultivation.

Government grants are facilitating the expansion.

Governmental involvement is one of the most crucial aspects of any industry. Government programs and funding, like subsidies for buying farm equipment, are important factors that propel the demand for power tiller machines. Government incentives encourage farmers to purchase new equipment, which boosts the market's overall expansion.

Innovations in technology are accelerating the growth rate.

Modern power tiller machines are becoming more and more popular due to ongoing technological developments like enhanced fuel efficiency, precision farming features, and user-friendly interfaces. Technologically upgraded models attract farmers due to their enhanced capabilities and efficiency, which in turn drives market expansion. Besides, to support this, the investments have increased significantly.

Power Tiller Market Restraints and Challenges

Financial barriers prevent the adoption of power tillers.

Power tillers are expensive initially, and there are few ways to finance them, which presents a big problem for farmers, especially those in developing countries. The cost barrier could prevent widespread acceptance and limit the market's growth for power tiller machines as prospective customers become increasingly hesitant due to cost concerns.

Deficits in infrastructure and awareness can create losses.

Inadequate infrastructure, such as poor roads and storage facilities, may limit the effective usage of power tillers. In addition, farmers' ignorance of the benefits and proper application of these tools may contribute to resistance and slow adoption rates.

Environmental concerns and regulatory barriers become issues.

Growing environmental consciousness and concerns about the ecological effects of power tillers, including fuel use and emissions, may lead to stricter regulations and shifting consumer preferences. The need to switch to more sustainable practices grows.

Power Tiller Machine Market Opportunities:

Sales of power tillers are predicted to increase, and some promising projects are underway. By utilizing sensors, GPS, and data analytics, integration with precision agriculture offers a promising future since it can increase the effectiveness of tillage operations. Customization for small-scale farming is another significant option since affordable, versatile, and small power tiller models have been created specifically to satisfy the needs of smaller landholdings. Investing in electric or hybrid power tillers can assist you in embracing sustainability and staying up to date with the worldwide agricultural trend toward environmental consciousness. By increasing acceptability and understanding, programs designed to instruct and train farmers on the benefits and proper application of power tillers can further facilitate market expansion.

POWER TILLER MACHINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.6% |

|

Segments Covered |

By Type of Power Source, Application, Tilling Width, End User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AGCO Corporation, Claas KGaA mbH, CNH Industrial NV, Deere & Company, Eurometal MIO, Exel Industries, Iseki & Co., Ltd, Kuhn North America Inc, Mahindra & Mahindra Ltd., Sharp Garuda Farm Equipments Pvt. Ltd |

Power Tiller Machine Market Segmentation: By Type of Power Source

-

Gasoline-Powered Tillers

-

Electric-Powered Tillers

Different varieties of power tiller machines are available to accommodate varying user preferences and environmental considerations. Because of their dependability and adaptability, gasoline-powered tillers are the largest growing. They are frequently used for small to medium-sized gardening or farming jobs. Electric-powered tillers are the fastest-growing. The increased popularity of electric-powered tillers can be attributed to their quieter operation and environmentally beneficial character. These electric tillers are especially well-suited for tiny spaces, offering users who value sustainability and noise reduction in their gardening and farming operations an eco-friendly substitute. Customers can select equipment that meets their unique requirements and environmental values thanks to the wide range of alternatives available in power tillers.

Power Tiller Machines Market Segmentation: By Application

-

Agricultural Tillers

-

Garden Tillers

The varied needs of both small-scale and large-scale farming operations are catered for by power tiller machines. Agricultural tillers are the largest application. Large-scale farming tillers are designed to cover enormous areas; they have strong engines and wide tilling widths to ensure effective and efficient soil cultivation. On the other hand, garden tillers are the fastest-growing segment. These nimble tillers are ideal for household gardens and smaller agricultural areas. These little tillers have all the features to cultivate tiny areas, and they're designed to fit through tight gaps with ease. The design's adaptability meets the different needs of users involved in more specialized gardening as well as larger-scale farming operations.

Power Tiller Machines Market Segmentation: By Tilling Width

-

Wide-width Tillers

-

Narrow-width Tillers

Power tiller machines are designed to meet the various needs of farming techniques, from small-scale gardens to large-scale operations. Wide-width agricultural tillers are the largest segment. They are made to be as efficient as possible on vast tracts of land. They have broader tilling widths that allow them to cover a lot more ground in one pass and maximize output. Conversely, narrow-width tillers are the fastest-growing category. They are the main attraction for smaller gardens or spaces that are constrained. These little devices emphasize mobility, which makes them ideal for working in tight locations and producing high-quality soil cultivation. Farmers and gardeners can select equipment suited to the unique scale and spatial limits of their cultivation demands by contrasting wide and narrow tilling widths.

Power Tiller Machines Market Segmentation: By End User

-

Farmers

-

Homeowners/Gardeners

Farmers are the largest end-users in the market. Heavy-duty tillers are designed for dependable operation. They have enormous tilling widths and powerful engines, which make them essential for large-scale farming where productivity is crucial. Homeowners and gardeners are the fastest-growing category. The machines used here are lighter and more compact tillers made specifically to meet the specific needs of small-scale agriculture and home gardening. These little devices prioritize portability and user-friendliness over efficiency, offering a useful alternative for individuals operating in cramped areas. With the availability of both heavy-duty and small tillers, gardeners and farmers can choose gardening tools that are exactly right for the size and kind of their cultivation projects.

Power Tiller Machines Market Segmentation: By Distribution Channel

-

Retail Stores

-

Online Platforms

Power tiller machines can be obtained through many retail channels. These channels include traditional brick-and-mortar establishments that specialize in gardening and agricultural equipment, as well as the increasingly popular online e-commerce platforms. Retail stores are the largest growing channel. This is because of their easy availability. People can access these machines and visually inspect the quality. Besides, traditional storefronts provide a more tactile purchasing experience by enabling customers to examine and contrast several models. Online platforms are the fastest-growing channels. E-commerce platforms offer a plethora of options, comprehensive product information, and the convenience of doorstep delivery, enabling users to conveniently browse and purchase power tillers from the comfort of their homes. With both options available, customers are guaranteed to select the channel of purchase that best fits their needs, be it the physical experience of in-store shopping or the easy accessibility of online purchases.

Power Tiller Machines Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The largest market share is possessed by the Asia-Pacific region. Agriculture is one of the main occupations in this region. As such., necessary steps are taken to make sure that the yield produced is enormous. The need for tillers is anticipated to increase in China, India, and other developed regions due to the rising popularity of gardening, the expansion of landscaping businesses, the number of newly constructed private residential units, and the number of single-family homes that are already in existence. Throughout the projection period, the fastest growth is anticipated in the North American region. Demand in the area is predicted to be stimulated by the rapid development of the residential and non-residential construction sectors, as well as rising income levels. Particularly in developing nations like the United States and Canada, the agriculture sector is rapidly modernizing.

COVID-19 Impact Analysis on the Global Power Tiller Machines Market:

The global market for power tillers has been significantly impacted by the COVID-19 outbreak. Lockdowns, limitations, and a lack of labor caused the first supply chain disruption, which presented difficulties for manufacturers and caused a brief halt in output. However, a relatively speedy recovery was made possible by the agriculture sector's crucial status, quick adaptation to new safety procedures, and essentiality. Farmers' purchasing power has been impacted by the pandemic's economic effects, which have affected market demand for power tillers. In various areas, careful spending has resulted from shifting priorities, income volatility, and economic uncertainties. In contrast, the market for power tillers has benefited from greater government backing in some areas to encourage agriculture and provide food security.

Latest Trends/ Developments:

In July 2022, in Pune, India, VST Tillers Tractors Limited (VST) opened its first-ever, state-of-the-art Experience Centre. The experience center is expected to feature the complete product line, which includes tractors, power tillers, power weeders, brush cutters, power reapers, rice transplanters, hedge trimmers, rotary tillers, and attachments, to provide customers with a hands-on look at VST's cutting edge farm equipment.

In June 2022, Kirloskar Oil Engines Limited (KOEL) unveiled a new power tiller with engines that use K-Cool technology. The self-starting engines of the 12 HP and 15 HP power tillers allow them to operate constantly.

Key Players:

-

AGCO Corporation

-

Claas KGaA mbH

-

CNH Industrial NV

-

Deere & Company

-

Eurometal MIO

-

Exel Industries

-

Iseki & Co., Ltd

-

Kuhn North America Inc

-

Mahindra & Mahindra Ltd.

-

Sharp Garuda Farm Equipments Pvt. Ltd

Chapter 1. Power Tiller Machines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Power Tiller Machines Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Power Tiller Machines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Power Tiller Machines Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Power Tiller Machines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Power Tiller Machines Market – By Type of Power Source

6.1 Introduction/Key Findings

6.2 Gasoline-Powered Tillers

6.3 Electric-Powered Tillers

6.4 Y-O-Y Growth trend Analysis By Type of Power Source

6.5 Absolute $ Opportunity Analysis By Type of Power Source, 2024-2030

Chapter 7. Power Tiller Machines Market – By Application

7.1 Introduction/Key Findings

7.2 Agricultural Tillers

7.3 Garden Tillers

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Power Tiller Machines Market – By Tilling Width

8.1 Introduction/Key Findings

8.2 Wide-width Tillers

8.3 Narrow-width Tillers

8.4 Y-O-Y Growth trend Analysis Organization Size

8.5 Absolute $ Opportunity Analysis Organization Size, 2024-2030

Chapter 9. Power Tiller Machines Market – By End User

9.1 Introduction/Key Findings

9.2 Farmers

9.3 Homeowners/Gardeners

9.4 Y-O-Y Growth trend Analysis End-User

9.5 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Power Tiller Machines Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 Retail Stores

10.3 Online Platforms

10.4 Y-O-Y Growth trend Analysis By Distribution Channel

10.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. Power Tiller Machines Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Type of Power Source

11.1.2.1 By Application

11.1.3 By Tilling Width

11.1.4 By Texture

11.1.5 By Distribution Channel

11.1.6 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Type of Power Source

11.2.3 By Application

11.2.4 By Tilling Width

11.2.5 By End User

11.2.6 By Texture

11.2.7 By Distribution Channel

11.2.8 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Type of Power Source

11.3.3 By Application

11.3.4 By Tilling Width

11.3.5 By End User

11.3.6 By Texture

11.3.7 By Distribution Channel

11.3.8 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Type of Power Source

11.4.3 By Application

11.4.4 By Tilling Width

11.4.5 By End User

11.4.6 By Texture

11.4.7 By Distribution Channel

11.4.8 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Type of Power Source

11.5.3 By Application

11.5.4 By Tilling Width

11.5.5 By End User

11.5.6 By Texture

11.5.7 By Distribution Channel

11.5.8 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Power Tiller Machines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 AGCO Corporation

12.2 Claas KGaA mbH

12.3 CNH Industrial NV

12.4 Deere & Company

12.5 Eurometal MIO

12.6 Exel Industries

12.7 Iseki & Co., Ltd

12.8 Kuhn North America Inc

12.9 Mahindra & Mahindra Ltd.

12.10 Sharp Garuda Farm Equipments Pvt. Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global power tiller machine market was valued at USD 2.8 billion and is projected to reach a market size of USD 3.59 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.6%.

Agriculture mechanization, labor shortages, government assistance & subsidies, and technological developments are the market drivers of the global power tiller machine market.

The global power tiller machine market is segmented based on the type of power source, application, tilling width, end user, distribution channel, and region.

Asia-Pacific is the most dominant region for the global power tiller machine market.

AGCO Corporation, Claas KGaA mbH, CNH Industrial NV, Deere & Company, Eurometal MIO, Exel Industries, Iseki & Co., Ltd., Kuhn North America Inc., Mahindra & Mahindra Ltd., Sharp Garuda Farm Equipments Pvt. Ltd.