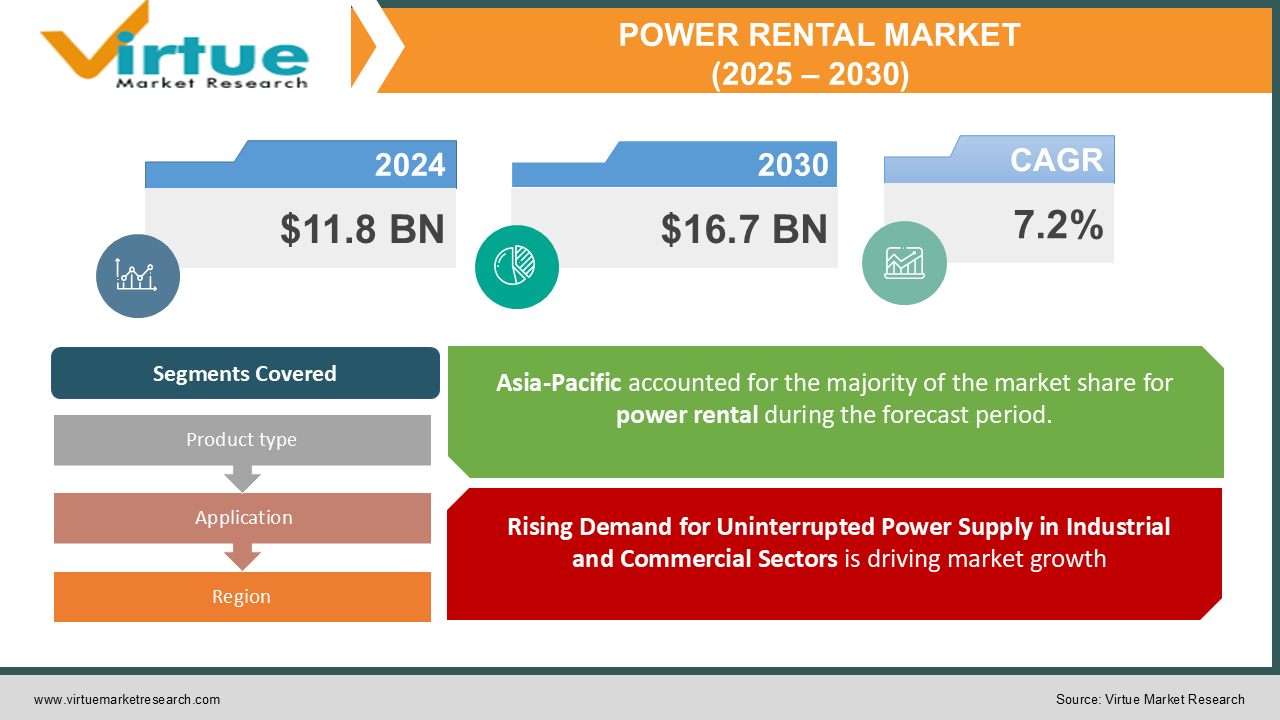

Power Rental Market Size (2025 – 2030)

The Global Power Rental Market was valued at USD 11.8 billion in 2024 and will grow at a CAGR of 7.2% from 2025 to 2030. The market is expected to reach USD 16.7 billion by 2030

The Power Rental Market focuses on the temporary leasing of power generation equipment, such as diesel and gas generators, to industries, events, construction sites, and utilities that require backup or additional power. This market is experiencing significant growth due to increasing power outages, rising infrastructure development projects, and growing demand for uninterrupted power supply in various industries. The demand for power rental services is also being driven by the growing reliance on renewable energy, as many companies require backup solutions during periods of low energy production.

Key Market Insights

-

The Asia-Pacific region is expected to witness the highest growth, with a CAGR of 8.1% from 2025 to 2030, due to rapid industrialization and increasing energy demand in emerging economies.

-

The demand for power rental solutions in the oil & gas sector is expected to grow by 6.5% annually, as companies seek temporary power solutions for offshore and onshore exploration activities.

-

Hybrid power solutions combining diesel generators with battery storage are gaining popularity, with a projected market share of 15% by 2030, as industries move toward sustainable power solutions.

-

The temporary power solutions market for data centers is projected to grow at a CAGR of 7.8% due to increasing cloud computing and internet usage.

-

North America remains a key market, accounting for 30% of the total market share in 2024, driven by frequent power outages and the increasing demand for emergency power solutions.

Global Power Rental Market Drivers

Rising Demand for Uninterrupted Power Supply in Industrial and Commercial Sectors is driving market growth:

Industries such as construction, oil & gas, manufacturing, and data centers require continuous power supply to maintain productivity and prevent financial losses caused by power outages. Many regions worldwide experience frequent power shortages due to aging grid infrastructure, extreme weather conditions, or high electricity demand exceeding supply. This has led industries to rely on power rental solutions to ensure uninterrupted operations. The construction sector, in particular, requires temporary power solutions for on-site activities, as many projects are located in remote areas without grid access. Additionally, the rapid expansion of cloud computing and internet services has increased the demand for backup power solutions for data centers. As businesses continue to prioritize reliability and efficiency, the power rental market is expected to grow significantly in the coming years.

Expansion of Infrastructure and Construction Projects is driving market growth:

Governments and private sector investments in large-scale infrastructure projects, such as highways, airports, and commercial buildings, are driving the demand for temporary power solutions. Many infrastructure projects are undertaken in remote locations where grid power is either unavailable or unreliable. Power rental companies provide an immediate solution, ensuring continuous power for construction equipment, lighting, and other operational needs. Emerging economies, particularly in Asia-Pacific, Africa, and the Middle East, are experiencing a boom in infrastructure development, further fueling market growth. Additionally, events such as music festivals, sporting events, and exhibitions require temporary power setups, further boosting the demand for power rental services. With ongoing urbanization and industrialization, the power rental market is expected to witness steady growth over the next decade.

Growing Adoption of Hybrid and Renewable Power Solutions is driving market growth:

Environmental concerns and stringent government regulations on carbon emissions are driving the transition from traditional diesel generators to hybrid and renewable energy-based rental solutions. Companies are increasingly integrating solar, wind, and battery storage systems with traditional generators to reduce fuel consumption and emissions. Hybrid power rental solutions provide improved efficiency and lower operational costs while complying with environmental standards. Moreover, regulatory bodies in regions such as Europe and North America are implementing policies to encourage the adoption of low-emission power solutions. The growing emphasis on corporate sustainability and green energy initiatives is pushing businesses to seek eco-friendly power rental solutions, contributing to market expansion.

Global Power Rental Market Challenges and Restraints

High Operating and Maintenance Costs of Power Rental Equipment is restricting market growth:

One of the major challenges facing the power rental market is the high cost of operating and maintaining rental power equipment. Diesel and gas generators require regular maintenance, including fuel refilling, lubrication, and periodic servicing to ensure optimal performance. These operational costs add to the overall expense for end-users, making power rental solutions less attractive compared to grid power or permanent power installations. Additionally, fluctuating fuel prices impact the cost-effectiveness of rented power equipment, leading to uncertainty in rental pricing. Companies operating in the power rental sector must invest in predictive maintenance technologies and efficient fuel management systems to minimize costs and remain competitive.

Stringent Environmental Regulations on Emissions is restricting market growth:

Government regulations aimed at reducing carbon emissions and pollution from fossil fuel-based generators pose a significant challenge to the power rental industry. Many regions have imposed strict emission standards, requiring rental companies to invest in low-emission or alternative energy solutions. Diesel generators, which currently dominate the market, are subject to regulatory scrutiny, and many companies are being forced to adopt gas-powered or hybrid alternatives. Compliance with these regulations adds to operational costs and requires companies to upgrade their equipment, impacting profitability. While the shift toward cleaner energy sources presents an opportunity for innovation, it also poses a financial burden for smaller rental companies struggling to meet regulatory requirements.

Market Opportunities

The increasing adoption of digital technologies in power rental operations presents a significant growth opportunity. Many power rental companies are integrating IoT and remote monitoring solutions into their rental fleet to enhance efficiency, track fuel consumption, and predict maintenance needs. These technologies help reduce downtime and operational costs, making power rental solutions more attractive to end-users. Additionally, the rise of smart grids and microgrid solutions is expected to drive demand for power rental services as industries and commercial establishments look for flexible and scalable power solutions. The growing use of power rental equipment in disaster response and emergency relief operations further strengthens market opportunities, as governments and humanitarian organizations seek reliable temporary power solutions for critical situations.

POWER RENTAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aggreko, Caterpillar Inc., Atlas Copco,United Rentals, Cummins Inc., Herc Rentals, APR Energy, Generac Power Systems, Kohler Co., Rental Solutions & Services |

Power Rental Market Segmentation - By Product Type

-

Diesel Generators

-

Gas Generators

-

Hybrid Generators

Diesel generators remain the dominant fuel type, holding a 60% market share in 2024, due to their reliability and ability to provide high-power output. However, environmental concerns are driving the adoption of gas and hybrid generators, which are expected to gain market share in the coming years.

Power Rental Market Segmentation - By Application

-

Industrial

-

Construction

-

Oil & Gas

-

Events

-

Utilities

-

Data Centers

The industrial sector is the largest application segment, accounting for 40% of market demand. The need for uninterrupted power in manufacturing, construction, and oil & gas industries continues to drive demand for rental power solutions. Additionally, the growing reliance on data centers for cloud computing and digital services is contributing to market expansion.

Power Rental Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in the power rental market, accounting for 35% of global revenue in 2024. The region's rapid industrialization, urbanization, and increasing infrastructure development projects are driving demand for temporary power solutions. Countries such as China, India, and Indonesia are experiencing significant growth in the construction and manufacturing sectors, creating strong demand for power rental services. Additionally, frequent power shortages in many parts of the region have led businesses to seek backup power solutions. Government investments in renewable energy and hybrid power systems are further expected to influence market growth in Asia-Pacific.

COVID-19 Impact Analysis on the Power Rental Market

The COVID-19 pandemic had a mixed impact on the global power rental market. During the initial phases of the pandemic in 2020, strict lockdown measures, supply chain disruptions, and delays in industrial and construction projects led to a decline in demand for rental power solutions. Many large-scale events, such as concerts, sports tournaments, and exhibitions, which significantly contribute to the power rental industry, were either canceled or postponed, resulting in revenue losses for rental companies. Additionally, the slowdown in the oil & gas sector due to reduced fuel demand led to lower investments in offshore and onshore exploration activities, further reducing the need for temporary power solutions in this segment. However, as the pandemic progressed, certain industries witnessed a surge in demand for power rental services. The healthcare sector required emergency power backup solutions for hospitals, COVID-19 treatment centers, and vaccine storage facilities. Governments and humanitarian organizations deployed temporary power solutions to support makeshift medical centers and testing sites. Furthermore, the increased reliance on digital services during lockdowns boosted the demand for power rental solutions in data centers to ensure uninterrupted operations. As global economies gradually reopened and construction and industrial activities resumed, the power rental market began to recover in 2021. The post-pandemic period saw increased investments in infrastructure projects, particularly in developing nations, further driving market growth. Additionally, many companies have since prioritized contingency planning for future disruptions, leading to a rise in long-term rental agreements for power backup solutions. The pandemic accelerated the adoption of digital monitoring and remote management technologies, allowing power rental providers to enhance service efficiency and reduce operational downtime. Overall, while the pandemic posed short-term challenges, it also reinforced the importance of reliable temporary power solutions, which will contribute to long-term market expansion.

Latest Trends/Developments

The global power rental market is witnessing significant advancements and innovations driven by technological improvements, environmental concerns, and changing industry requirements. One of the most prominent trends is the increasing adoption of hybrid and renewable power rental solutions. Companies are integrating solar panels, battery storage systems, and gas-powered generators with traditional diesel generators to improve efficiency and reduce carbon emissions. This shift aligns with global sustainability goals and helps businesses comply with stringent emission regulations. Hybrid power solutions are particularly gaining traction in remote areas where fuel transportation costs are high. Another key trend is the digital transformation of power rental services. Many rental companies are incorporating IoT-based monitoring and predictive maintenance systems into their equipment. These technologies allow real-time tracking of generator performance, fuel consumption, and maintenance needs, minimizing operational downtime and optimizing costs. Remote monitoring solutions also enable service providers to offer proactive maintenance and reduce the risk of unexpected failures. The demand for power rental solutions in the data center industry is also on the rise. With the rapid expansion of cloud computing, 5G networks, and edge computing, data centers require reliable power backup solutions to ensure uninterrupted operations. Many rental power providers are now offering customized solutions for data centers, including UPS systems and battery storage, to enhance reliability. Additionally, the construction sector continues to be a major driver for power rental services. The resurgence of large-scale infrastructure projects in emerging economies is fueling demand for temporary power solutions. Governments and private investors are heavily investing in smart cities, transportation networks, and commercial buildings, all of which require reliable and scalable power solutions.

Key Players

-

Aggreko

-

Caterpillar Inc.

-

Atlas Copco

-

United Rentals

-

Cummins Inc.

-

Herc Rentals

-

APR Energy

-

Generac Power Systems

-

Kohler Co.

-

Rental Solutions & Services

Chapter 1. Power Rental Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Power Rental Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Power Rental Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Power Rental Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Power Rental Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Power Rental Market – By Product Type

6.1 Introduction/Key Findings

6.2 Diesel Generators

6.3 Gas Generators

6.4 Hybrid Generators

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Power Rental Market – By Application

7.1 Introduction/Key Findings

7.2 Industrial

7.3 Construction

7.4 Oil & Gas

7.5 Events

7.6 Utilities

7.7 Data Centers

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Power Rental Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Power Rental Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Aggreko

9.2 Caterpillar Inc.

9.3 Atlas Copco

9.4 United Rentals

9.5 Cummins Inc.

9.6 Herc Rentals

9.7 APR Energy

9.8 Generac Power Systems

9.9 Kohler Co.

9.10 Rental Solutions & Services

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Power Rental Market was valued at USD 11.8 billion in 2024 and is projected to reach USD 16.7 billion by 2030, growing at a CAGR of 7.2%.

Key drivers include rising demand for uninterrupted power supply, expansion of infrastructure projects, and increasing adoption of hybrid and renewable power solutions.

The market is segmented by fuel type (diesel, gas, hybrid) and by application (industrial, construction, oil & gas, events, utilities, data centers).

Asia-Pacific leads the market with a 35% share, driven by industrialization, infrastructure development, and increasing power demand in emerging economies.

Leading players include Aggreko, Caterpillar Inc., Atlas Copco, United Rentals, Cummins Inc., Herc Rentals, APR Energy, and Generac Power Systems.