Power MOSFET Market Size (2024 – 2030)

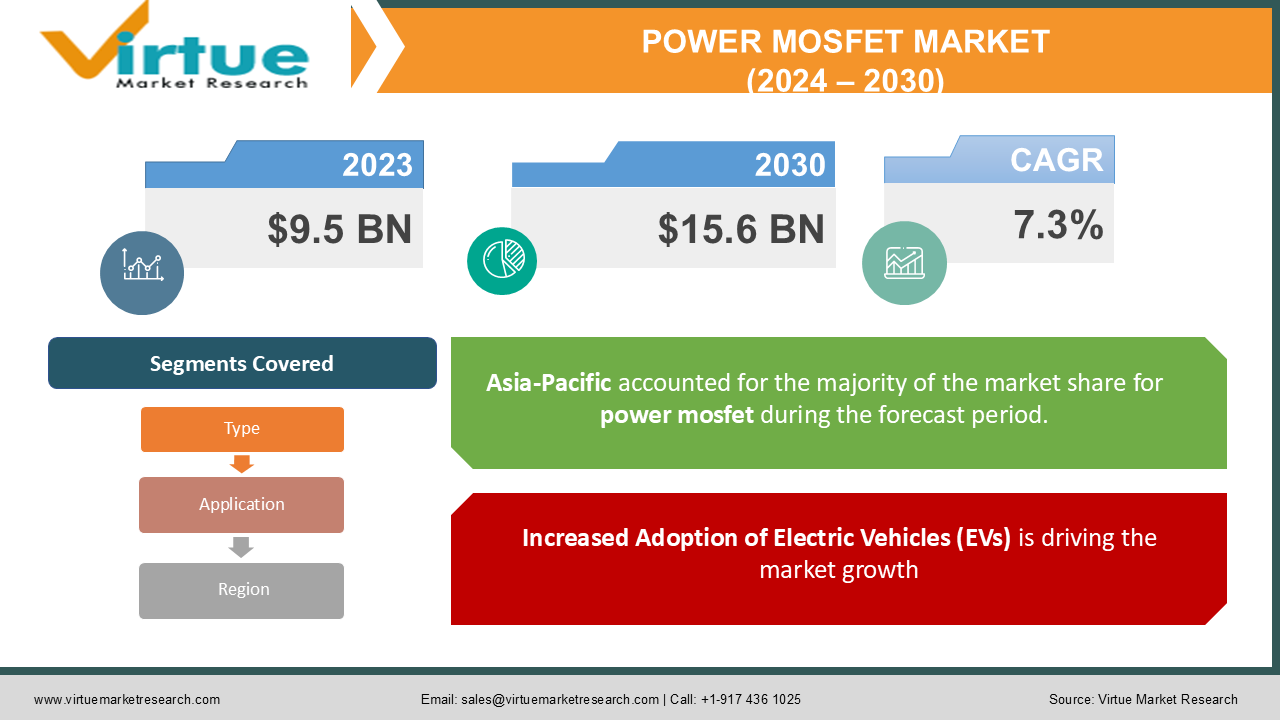

The Global Power MOSFET Market was valued at USD 9.5 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. The market is expected to reach USD 15.6 billion by 2030.

Power MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors) are essential semiconductor devices used for switching and amplifying electronic signals in various applications. Their importance in power management, efficiency improvements, and miniaturization of electronic components drives their demand in key sectors, including automotive, consumer electronics, and industrial applications.

Key Market Insights:

The demand for electric vehicles (EVs) is a major growth driver for power MOSFETs, as these components play a crucial role in controlling the flow of electricity in EV powertrains and charging systems. In 2023, the automotive sector accounted for approximately 30% of the overall market share.

Consumer electronics, such as smartphones, tablets, and laptops, are increasingly using power MOSFETs for battery management and energy efficiency. The consumer electronics sector contributed around 25% to the global market in 2023.

The rise of renewable energy systems, including solar inverters and wind turbines, is creating opportunities for power MOSFET applications in energy conversion and management systems, supporting the transition to clean energy.

Technological advancements in power management and the growing emphasis on energy efficiency are driving the adoption of low-voltage MOSFETs in applications requiring precision and reliability.

The Asia-Pacific region dominated the global market, with over 45% of the total market share in 2023, driven by significant production of consumer electronics and growing automotive and industrial sectors in China, Japan, and South Korea.

Global Power MOSFET Market Drivers:

Increased Adoption of Electric Vehicles (EVs) is driving the market growth The global shift toward electric vehicles is one of the primary drivers of the power MOSFET market. As automotive manufacturers focus on reducing carbon emissions and meeting government mandates for zero-emission vehicles, electric vehicles (EVs) are witnessing significant growth. Power MOSFETs play a vital role in EV powertrain systems, including motor control, battery management, and charging systems. The increasing need for high-efficiency and reliable switching devices in EVs has led to the widespread adoption of power MOSFETs in both low-voltage and high-voltage applications. Additionally, the demand for fast-charging infrastructure is further boosting the need for power MOSFETs that can handle higher power loads. For instance, fast-charging stations, which operate at higher voltages, rely on power MOSFETs for efficient energy conversion and voltage regulation. As the EV market continues to grow rapidly, especially in regions like North America, Europe, and Asia-Pacific, the demand for power MOSFETs is expected to increase substantially.

Growth in Consumer Electronics is driving the market growth The consumer electronics sector is one of the largest end-users of power MOSFETs. With the rising demand for smartphones, laptops, tablets, and wearable devices, manufacturers are focusing on enhancing the energy efficiency and performance of electronic devices. Power MOSFETs are integral components in battery management systems, voltage regulation, and power amplification, enabling these devices to function more efficiently while consuming less power. As consumers continue to seek devices with longer battery life and faster charging capabilities, the use of power MOSFETs in consumer electronics is becoming increasingly essential. The trend towards miniaturization and the need for compact, energy-efficient power management solutions are further driving the adoption of MOSFETs in this sector. Moreover, the introduction of 5G technology is expected to accelerate the demand for power MOSFETs in communication devices, as the need for higher processing power and faster data transmission grows.

Rising Investments in Renewable Energy is driving the market growth The global push towards renewable energy sources, such as solar and wind, is another significant driver of the power MOSFET market. Power MOSFETs are widely used in energy conversion systems, such as solar inverters and wind turbine controllers, to manage and regulate the flow of electricity. These devices are critical for improving the efficiency and reliability of renewable energy systems, helping to maximize power output and reduce energy losses. Governments worldwide are investing heavily in renewable energy projects to meet sustainability goals and reduce dependence on fossil fuels. This surge in renewable energy investments is driving the demand for advanced power management solutions, including power MOSFETs. For example, in solar power systems, MOSFETs are used to convert DC electricity generated by solar panels into AC electricity, which can be used by the grid or stored in batteries. The growing focus on energy efficiency and reducing greenhouse gas emissions is expected to create significant opportunities for power MOSFET manufacturers in the renewable energy sector.

Global Power MOSFET Market Challenges and Restraints:

High Cost of Advanced Power MOSFETs is restricting the market growth While power MOSFETs are essential for a wide range of applications, the high cost of advanced MOSFET technologies, such as GaN (gallium nitride) and SiC (silicon carbide) MOSFETs, poses a challenge to their adoption in certain sectors. GaN and SiC MOSFETs offer superior performance in high-voltage and high-temperature applications compared to traditional silicon-based MOSFETs. However, these advanced materials are more expensive to produce, which limits their use in cost-sensitive industries, such as consumer electronics. The high cost of GaN and SiC MOSFETs can also impact the profitability of manufacturers and end-users, particularly in emerging markets where cost constraints are more pronounced. As a result, many industries continue to rely on traditional silicon-based MOSFETs, even though they may not offer the same level of performance as GaN and SiC devices. This cost barrier is expected to slow the widespread adoption of advanced power MOSFETs, particularly in markets where price sensitivity is a critical factor.

Supply Chain Disruptions is restricting the market growth The global semiconductor industry has faced significant supply chain disruptions in recent years, particularly during the COVID-19 pandemic. These disruptions have affected the availability of raw materials, manufacturing capacities, and the timely delivery of electronic components, including power MOSFETs. The semiconductor shortage has had a ripple effect across various industries, including automotive, consumer electronics, and industrial manufacturing, leading to delays in production and product launches. While the semiconductor industry is gradually recovering, supply chain vulnerabilities remain a concern for power MOSFET manufacturers. The reliance on specialized raw materials and complex manufacturing processes makes the power MOSFET market particularly susceptible to disruptions. Additionally, geopolitical tensions and trade restrictions between major semiconductor-producing countries, such as the U.S. and China, can further exacerbate supply chain challenges. Addressing these supply chain issues will be critical for ensuring the continued growth and stability of the global power MOSFET market.

Market Opportunities:

The global power MOSFET market is set to witness substantial growth in the coming years, driven by advancements in technology and the increasing adoption of power management solutions across various sectors. One of the key opportunities lies in the growing demand for electric vehicles (EVs) and the development of next-generation battery technologies. Power MOSFETs play a crucial role in controlling the flow of electricity in EV powertrains, ensuring efficient energy management and battery performance. As governments worldwide continue to implement stringent emissions regulations and promote the transition to electric mobility, the demand for power MOSFETs in the automotive sector is expected to surge. In addition to EVs, the renewable energy sector presents a significant growth opportunity for power MOSFET manufacturers. The increasing deployment of solar and wind power systems requires advanced power management solutions to optimize energy conversion and distribution. Power MOSFETs are essential components in inverters, converters, and energy storage systems, helping to improve the efficiency and reliability of renewable energy systems. As the world transitions to clean energy, the demand for power MOSFETs in renewable energy applications is expected to rise rapidly. Furthermore, the emergence of GaN (gallium nitride) and SiC (silicon carbide) MOSFETs is creating new opportunities for high-performance applications in industries such as telecommunications, aerospace, and defense. These advanced MOSFETs offer superior performance in high-voltage and high-temperature environments, making them ideal for applications requiring fast switching speeds and high power densities. As the demand for more efficient and reliable power management solutions grows, GaN and SiC MOSFETs are expected to gain traction in high-end applications.

POWER MOSFET MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Infineon Technologies AG, Toshiba Corporation, STMicroelectronics, ON Semiconductor, Vishay Intertechnology, Inc., Mitsubishi Electric Corporation, Renesas Electronics Corporation, NXP Semiconductors, ROHM Semiconductor, IXYS Corporation |

Power MOSFET Market Segmentation: By Type

-

Low Voltage Power MOSFET

-

High Voltage Power MOSFET

The Low Voltage Power MOSFET segment is the most dominant in the global market due to its widespread use in consumer electronics and automotive applications. Low voltage MOSFETs are crucial for energy-efficient power management in devices such as smartphones, laptops, and electric vehicles. With the growing demand for compact, high-performance electronics, this segment is expected to continue leading the market.

Power MOSFET Market Segmentation: By Application

-

Automotive

-

Consumer Electronics

-

Industrial

The Automotive sector is the most dominant application in the power MOSFET market, driven by the increasing adoption of electric vehicles (EVs) and the need for efficient power management in automotive systems. Power MOSFETs are essential for controlling the flow of electricity in EV powertrains, ensuring optimal battery performance and energy efficiency.

Power MOSFET Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region dominated the global power MOSFET market in 2023, accounting for over 45% of the market share. This dominance is attributed to the region's large consumer electronics manufacturing base, particularly in countries like China, Japan, and South Korea. The growing automotive and industrial sectors in the region are also contributing to the increased demand for power MOSFETs. Additionally, the Asia-Pacific region is home to some of the leading power MOSFET manufacturers, further solidifying its position as the most dominant market.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the global power MOSFET market. On one hand, the widespread disruption of global supply chains and semiconductor manufacturing led to delays in production and shortages of electronic components, including power MOSFETs. Industries such as automotive and consumer electronics experienced significant slowdowns due to factory closures and reduced consumer demand during the early stages of the pandemic. However, the pandemic also accelerated the adoption of digital technologies, remote working, and online education, leading to increased demand for electronic devices such as laptops, tablets, and smartphones. This surge in demand for consumer electronics created opportunities for power MOSFET manufacturers, as these devices rely heavily on power management components for efficient operation. In the automotive sector, the pandemic initially led to a decline in vehicle production and sales. However, as economies began to recover, the demand for electric vehicles (EVs) surged, driven by government incentives and the growing emphasis on sustainability. This resurgence in the EV market positively impacted the demand for power MOSFETs, particularly in EV powertrain systems and charging infrastructure.

Latest Trends/Developments:

Several key trends and developments are shaping the global power MOSFET market. One of the most significant trends is the increasing adoption of GaN (gallium nitride) and SiC (silicon carbide) MOSFETs. These advanced materials offer superior performance in high-voltage and high-temperature applications compared to traditional silicon-based MOSFETs. GaN and SiC MOSFETs are particularly suited for applications requiring fast switching speeds and high power densities, such as electric vehicles, renewable energy systems, and telecommunications. As the demand for more efficient and reliable power management solutions grows, GaN and SiC MOSFETs are expected to gain traction in high-performance applications. Another important trend is the growing focus on energy efficiency in consumer electronics and industrial applications. Power MOSFETs are essential for managing power consumption in devices such as smartphones, laptops, and IoT (Internet of Things) devices. As consumers and businesses prioritize energy efficiency to reduce costs and environmental impact, the demand for power MOSFETs in energy-efficient devices is expected to increase. The automotive industry is also witnessing significant developments in the use of power MOSFETs, particularly in electric vehicles (EVs). As automakers invest in developing next-generation EVs, the demand for high-performance power MOSFETs is increasing. Power MOSFETs are critical for controlling the flow of electricity in EV powertrains, ensuring efficient energy management and battery performance. The growing emphasis on fast-charging infrastructure for EVs is further driving the need for power MOSFETs that can handle higher power loads.

Key Players:

-

Infineon Technologies AG

-

Toshiba Corporation

-

STMicroelectronics

-

ON Semiconductor

-

Vishay Intertechnology, Inc.

-

Mitsubishi Electric Corporation

-

Renesas Electronics Corporation

-

NXP Semiconductors

-

ROHM Semiconductor

-

IXYS Corporation

Chapter 1. Power MOSFET Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Power MOSFET Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Power MOSFET Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Power MOSFET Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Power MOSFET Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Power MOSFET Market – By Types

6.1 Introduction/Key Findings

6.2 Low Voltage Power MOSFET

6.3 High Voltage Power MOSFET

6.4 Y-O-Y Growth trend Analysis By Types

6.5 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Power MOSFET Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Consumer Electronics

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Power MOSFET Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Power MOSFET Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Infineon Technologies AG

9.2 Toshiba Corporation

9.3 STMicroelectronics

9.4 ON Semiconductor

9.5 Vishay Intertechnology, Inc.

9.6 Mitsubishi Electric Corporation

9.7 Renesas Electronics Corporation

9.8 NXP Semiconductors

9.9 ROHM Semiconductor

9.10 IXYS Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Power MOSFET Market was valued at USD 9.5 billion in 2023 and is expected to reach USD 15.6 billion by 2030, growing at a CAGR of 7.3% during the forecast period.

Key drivers include the increased adoption of electric vehicles (EVs), the growth of the consumer electronics sector, and rising investments in renewable energy projects.

The market is segmented by Type (Low Voltage Power MOSFET, High Voltage Power MOSFET) and Application (Automotive, Consumer Electronics, Industrial).

The Asia-Pacific region is the most dominant, accounting for over 45% of the market share in 2023, driven by strong demand from the automotive, consumer electronics, and industrial sectors.

Leading players include Infineon Technologies AG, Toshiba Corporation, STMicroelectronics, ON Semiconductor, and Vishay Intertechnology, Inc., among others.