Powdered Stevia Market Size (2024 – 2030)

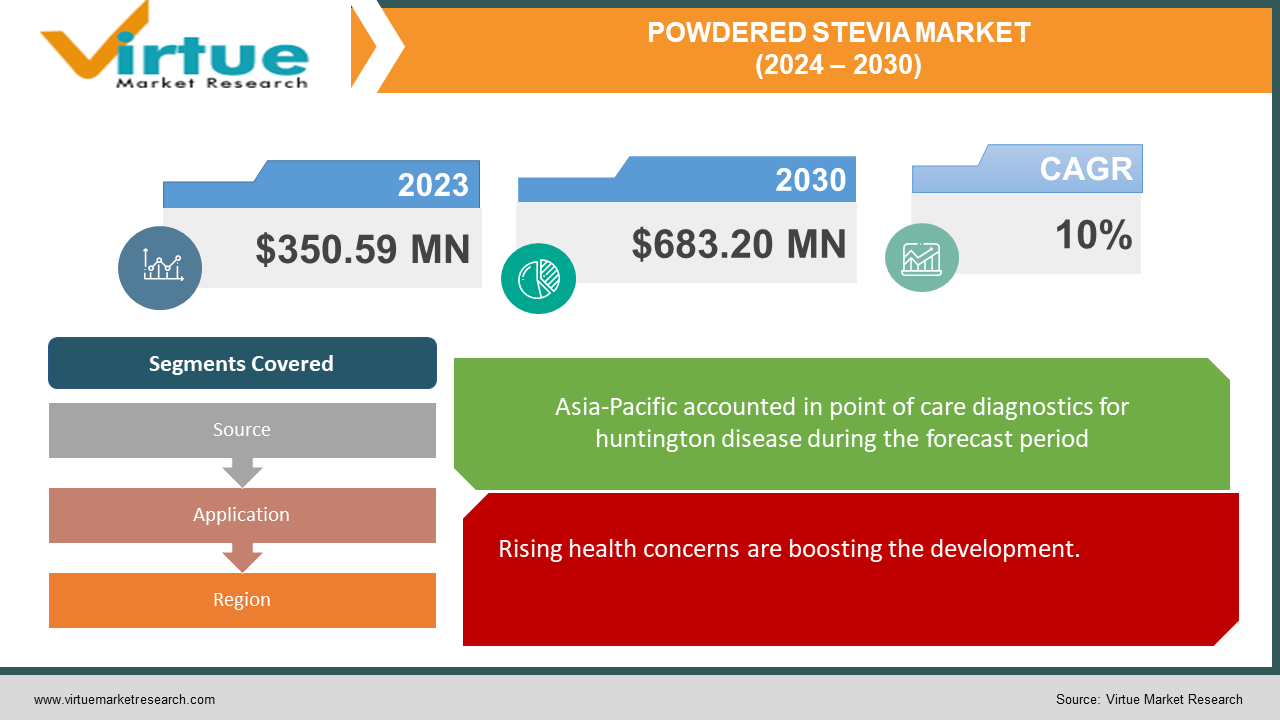

The global powdered stevia market was valued at USD 350.59 million in 2023 and will grow at a CAGR of 10% from 2024 to 2030. The market is expected to reach USD 683.20 million by 2030.

The leaves of the South American native Stevia rebaudiana plant are used to make stevia, a natural sweetener with no calories. The powder form of stevia is light to white and dissolves in water but not in oils. It tastes clean and sweet, with a different sweetness profile than sucrose. The Food and Drug Administration of the United States has declared stevia sweeteners to be generally recognized as safe (GRAS).

Key Market Insights:

As per NHS, numerous sterols and antioxidants present in stevia, such as kaempferol, have been shown in trials to lower the incidence of pancreatic cancer by 23%. The analysis by Statista projects that the value of the stevia market in the United States will reach around 83.6 million dollars by 2024. Stevia has 200–300 times the sweetness of regular table sugar. For the same amount of sweetness as other common sweeteners, it usually takes around 20 percent of the land and far less water. Research by the Department of Health and Human Services indicates that Americans consume 16 percent of their total calories from added sugars on average.

Global Powdered Stevia Market Drivers:

Rising health concerns are boosting the development.

The global powdered stevia market is flourishing due in large part to a rising tide of health consciousness. Consumers are actively ditching sugar and artificial sweeteners in favor of natural alternatives, and stevia perfectly fits the bill. Derived from the stevia plant, this zero-calorie sweetener offers a guilt-free way to satisfy one's sweet tooth. This resonates with health-focused individuals seeking to manage weight, control blood sugar, or simply avoid the negative health effects linked to excessive sugar consumption. Stevia's natural origin provides an edge over artificial sweeteners, which can raise safety concerns. Furthermore, the taste profile of stevia is evolving, with manufacturers developing new formulations to address aftertaste issues and create a more sugar-like experience. This increasing palatability, coupled with its health benefits, makes stevia a compelling option for consumers seeking a natural and healthy way to sweeten their food and beverages.

The growing popularity of low-calorie and sugar-free diets is contributing to their success.

The global powdered stevia market is surging due to a growing public health crisis: the rise of obesity and diabetes. As these conditions become increasingly prevalent, consumers are desperately seeking tools to manage their weight and blood sugar. This has fueled a significant demand for low-calorie and sugar-free products, and stevia is emerging as a powerful natural solution. Unlike sugar, stevia boasts zero calories and doesn't trigger spikes in blood sugar levels, making it a perfect choice for weight management and diabetic diets. Studies suggest stevia may even improve insulin sensitivity and help regulate blood sugar, offering a potential preventative measure for those at risk of developing diabetes. This scientific backing, coupled with its natural origin, positions stevia as a safe and effective alternative to traditional sugar and artificial sweeteners. As awareness grows about the detrimental effects of excess sugar consumption, stevia's role as a healthy sweetener is likely to become even more prominent in the fight against obesity and diabetes.

Regulatory restrictions on artificial sweeteners are accelerating the growth rate.

The global powdered stevia market is reaping the benefits of a growing wariness towards artificial sweeteners. In many countries, consumers are voicing concerns about the safety of these synthetic sugar substitutes, leading them to seek out more natural alternatives. Stevia swoops in perfectly to address this shift in preference. Unlike artificial sweeteners with question marks surrounding their long-term health effects, stevia boasts a pedigree as a natural sweetener derived from the stevia plant. This not only resonates with health-conscious consumers but also aligns with a general trend toward embracing natural ingredients. Furthermore, regulatory bodies in some countries are tightening restrictions on artificial sweeteners, further propelling consumers towards natural options like stevia. This shift in consumer behavior and regulatory landscape presents a golden opportunity for the powdered stevia market, with stevia emerging as a natural and potentially safer solution for sweetening food and beverages.

Global Powdered Stevia Market Challenges and Restraints:

Regulatory obstacles can be a major barrier.

The global powdered stevia market faces a significant hurdle in the form of a regulatory patchwork across different countries. Unlike a standardized set of rules, stevia use and approval processes vary greatly depending on the region. This inconsistency can be a major headache for businesses. Strict laws that impose rigorous testing requirements or strict purity requirements can seriously hinder the release of new products and the entry of stevia-based goods into the market. Even worse, unclear guidelines shrouded in ambiguity create uncertainty for businesses. They might invest in developing and producing a stevia-infused product, only to face roadblocks or delays due to unforeseen regulatory hurdles in a specific target market. This uncertainty discourages investment and slows down overall market expansion for powdered stevia.

Consumer acceptance is another issue.

Stevia's natural appeal doesn't always translate to universal tastebud approval. Despite its zero-calorie advantage, some consumers find its taste off-putting. A lingering aftertaste is often described as bitter or licorice-like. This can be a major deterrent, especially for those accustomed to the familiar sweetness of traditional sugar. Furthermore, taste preference is subjective. There's a segment of consumers who simply enjoy the taste of sugar, regardless of its drawbacks to their health. This inherent preference for sugar's taste profile can be a significant challenge for the stevia market to overcome. Manufacturers are constantly innovating to improve stevia's palatability, but some consumers may still require a shift in perspective to fully embrace this natural sweetener.

Limited product varieties can create losses.

The global powdered stevia market faces a growth hurdle due to a current lack of variety compared to sugar-sweetened options. Consumers accustomed to the vast array of sugar-laden products might find the selection of stevia-infused alternatives underwhelming. This limited variety can be a significant turn-off, especially for those seeking specific products like cookies, chocolates, or yogurts sweetened with stevia. The current gap restricts market growth as it fails to cater to the diverse preferences of health-conscious consumers. While the availability of stevia-based products is increasing, it still lags behind the sheer abundance of sugar-sweetened options. Bridging this gap will be crucial for the stevia market to flourish. Manufacturers must expand their offerings to encompass a wider range of stevia-sweetened products, catering to different taste preferences and dietary needs. This will broaden the appeal of stevia and attract a larger consumer base.

Global Powdered Stevia Market Opportunities:

The powdered stevia market is blooming with opportunity, driven by a surge in health consciousness and a growing demand for natural sweeteners. Consumers are ditching sugar and artificial sweeteners in favor of stevia's zero-calorie sweetness. This resonates with health-focused individuals battling obesity or diabetes and seeking to manage their weight or blood sugar. Stevia's natural origin provides a clear edge over artificial sweeteners with potential safety concerns. Furthermore, the taste profile of stevia is evolving, with manufacturers addressing aftertaste issues and creating a more sugar-like experience. This increasing palatability, coupled with its health benefits, makes stevia a compelling option for sweetening food and beverages. Another key opportunity lies in the rising public health crisis of obesity and diabetes. Stevia's zero-calorie nature and lack of impact on blood sugar make it a powerful tool for weight management and diabetic diets. Studies even suggest potential benefits for blood sugar regulation. This scientific backing positions stevia as a safe and effective solution, particularly as awareness grows about the dangers of excess sugar consumption. Regulatory restrictions on artificial sweeteners in some countries present another opportunity. With consumers wary of these synthetic alternatives, stevia emerges as a natural and potentially safer solution. Manufacturers can capitalize on this shift by highlighting the natural aspects of stevia in their marketing strategies. Advancements in stevia extraction and formulation techniques can lead to more cost-effective production of high-quality powdered stevia. Furthermore, manufacturers must focus on improving palatability and expanding product variety. By creating a wider range of stevia-infused products that cater to diverse taste preferences and dietary needs, the powdered stevia market can capture a larger consumer base and solidify its position as a healthy and natural alternative to sugar.

POWDERED STEVIA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill (US), Ingredion Incorporated (US), Tate & Lyle PLC (UK), PureCircle Ltd (Malaysia), GLG Life Tech Corporation (Canada), Archer Daniels Midland Company (US), Morita Kagakau Kogyo Co., Ltd (Japan), Sunwin Stevia International, Inc. (China), S&W Seed Co (US), Evolva Holdings SA (Switzerland) |

Powdered Stevia Market Segmentation: By Source

-

Organic Stevia

-

Conventional Stevia

Conventional stevia is the largest growing segment. It offers a more cost-effective option for price-conscious consumers. In addition, the demand is fueled by its established supply networks and broad availability. For many years, traditional stevia has been used by several food and beverage makers as a natural sweetener in their goods. Organic stevia is the fastest-growing category. This appeals to those who prioritize natural ingredients and a clean label, even if it means paying a premium for the certification. This segment thrives on the growing consumer desire for transparency and traceability in their food.

Powdered Stevia Market Segmentation: By Application

-

Dairy

-

Bakery & Confectionery

-

Food

-

Beverages

-

Table Top Sweeteners

-

Pharmaceutical Products

-

Others

The beverage segment is the largest and fastest-growing application. As consumers increasingly seek healthier beverage options, beverage manufacturers are reformulating their products to reduce sugar content and meet consumer demands for natural sweeteners. This has led to a growing market for powdered stevia in beverages, including both alcoholic and non-alcoholic drinks.

Powdered Stevia Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing market. The area leads the world market for powdered stevia due to several variables, including population density, shifting dietary habits, and rising health consciousness. Powdered stevia provides a natural, low-calorie substitute for conventional sweeteners like cane sugar, which are extensively eaten in nations like China, Japan, and India. The region's rapidly growing food and beverage industry and the growing demand for low-sugar and functional beverages are also propelling market development.

COVID-19 Impact Analysis on the Global Powdered Stevia Market

The COVID-19 pandemic had a surprisingly positive impact on the global powdered stevia market. Fueled by a surge in health consciousness during lockdowns, consumers sought out ways to boost their well-being. This led to a rise in demand for natural and sugar-free products, perfectly aligning with stevia's strengths. People stocked up on essentials like pantry staples, and with concerns about sugar intake and potential blood sugar fluctuations, stevia became a popular choice for home baking and sweetening beverages. Additionally, the temporary disruption of supply chains for some sugar-based products created a gap that stevia helped to fill. This resulted in a significant increase in stevia sales and a boost to the overall market. However, there were also challenges. Disruptions in stevia leaf production and processing due to lockdowns and travel restrictions were a concern. Additionally, the economic downturn caused by the pandemic might have led some price-sensitive consumers to opt for cheaper sweeteners. Despite these challenges, the overall impact of COVID-19 on the powdered stevia market was positive, accelerating its growth and highlighting its potential as a healthy and natural sweetener option.

Latest trends/Developments

The powdered stevia market is abuzz with innovation and adaptation, constantly evolving to meet consumer preferences. A key trend is the focus on improved taste and functionality. Manufacturers are developing new stevia blends and extraction techniques to minimize the lingering aftertaste and create a more sugar-like experience. Additionally, there's a growing interest in stevia leaf extracts with specific functionalities, like enhanced sweetness or masking bitterness in other ingredients. Furthermore, the market is witnessing a rise in organic and clean-label stevia options, catering to health-conscious consumers who prioritize natural ingredients. On the application front, the beverage industry remains a major driver, with stevia finding its way into a wider range of sugar-free drinks. However, there's also a growing focus on incorporating stevia into baked goods, confectionery, and even yogurts, offering consumers a broader selection of stevia-sweetened treats. Sustainability is another emerging trend, with manufacturers exploring eco-friendly stevia leaf cultivation and processing methods to meet the demands of environmentally conscious consumers. As innovation continues and stevia's versatility is further explored, the powdered stevia market is poised for exciting growth in the years to come.

Key Players:

-

Cargill (US)

-

Ingredion Incorporated (US)

-

Tate & Lyle PLC (UK)

-

PureCircle Ltd (Malaysia)

-

GLG Life Tech Corporation (Canada)

-

Archer Daniels Midland Company (US)

-

Morita Kagakau Kogyo Co., Ltd (Japan)

-

Sunwin Stevia International, Inc. (China)

-

S&W Seed Co (US)

-

Evolva Holdings SA (Switzerland)

Chapter 1. POWDERED STEVIA MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. POWDERED STEVIA MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. POWDERED STEVIA MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. POWDERED STEVIA MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. POWDERED STEVIA MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. POWDERED STEVIA MARKET – By Source

6.1 Introduction/Key Findings

6.2 Organic Stevia

6.3 Conventional Stevia

6.4 Y-O-Y Growth trend Analysis By Source

6.5 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. POWDERED STEVIA MARKET – By Application

7.1 Introduction/Key Findings

7.2 Dairy

7.3 Bakery & Confectionery

7.4 Food

7.5 Beverages

7.6 Table Top Sweeteners

7.7 Pharmaceutical Products

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. POWDERED STEVIA MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Source

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Source

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Source

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Source

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Source

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. POWDERED STEVIA MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargill (US)

9.2 Ingredion Incorporated (US)

9.3 Tate & Lyle PLC (UK)

9.4 PureCircle Ltd (Malaysia)

9.5 GLG Life Tech Corporation (Canada)

9.6 Archer Daniels Midland Company (US)

9.7 Morita Kagakau Kogyo Co., Ltd (Japan)

9.8 Sunwin Stevia International, Inc. (China)

9.9 S&W Seed Co (US)

9.10 Evolva Holdings SA (Switzerland)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global powdered stevia market was valued at USD 350.5908 million in 2023 and will grow at a CAGR of 10% from 2024 to 2030. The market is expected to reach USD 683.20 million by 2030.

Rising health concerns, the growing popularity of low-calorie and sugar-free diets, and regulatory restrictions on artificial sweeteners are the reasons that are driving the market.

Based on source, the market is divided into organic and conventional.

Asia-Pacific is the most dominant region for the global powdered stevia market.

Cargill, Ingredion Incorporated, Tate & Lyle PLC, PureCircle Ltd., and GLG Life Tech Corporation are the major players in the global powdered stevia market.