Powdered Lycopene Food Colors Market Size (2024 – 2030)

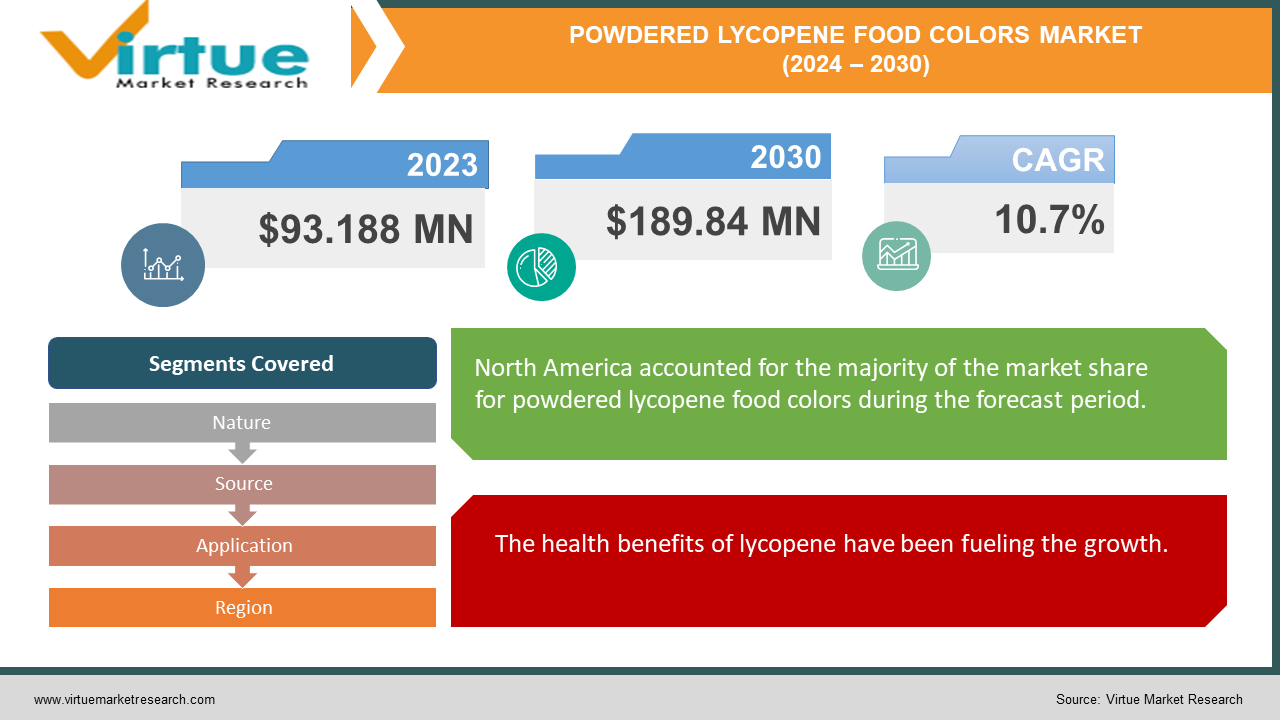

The global powdered lycopene food colors market was valued at USD 93.188 million and is projected to reach a market size of USD 189.84 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10.7%.

A red, bioactive pigment called lycopene is naturally present in plants, particularly tomatoes, fruits, algae, and fungi. With eleven conjugated double bonds, this unsaturated acyclic carotenoid gives it a rich red hue and antioxidant properties. The duodenum and stomach are where lycopene is absorbed since it is fat-soluble. This is used as an additive in processed meat, poultry, edible casings, completely preserved fish, semi-preserved fish, dried and/or heat-coagulated egg products, preserved eggs, sweets made with eggs, and tabletop sweeteners, all of which contain lycopene as an ingredient. In the past, its application was primarily restricted to the food and beverage industry. Research on its benefits contributed to its popularity. Presently, the market has witnessed a notable boost due to regulatory approvals and application diversity. In the future, with an extensive focus on research and developmental activities, immense expansion is anticipated.

Key Market Insights:

Lycopene is a naturally occurring red pigment that is present in fruits and tomatoes. It is highly valued in food and beverage applications due to its antioxidant qualities and health advantages.

The market is driven by the potential adverse effects, stability problems, and cost limitations, as well as the health advantages of lycopene and the growing desire for natural components.

The increasing demand for nutraceutical and functional goods, as well as the developments in encapsulation, formulation, and extraction technologies, present opportunities.

Due to the robust food industry and strong economy, North America, led by the United States and Canada, dominates the market. Driven by increasing health consciousness and urbanization, the fastest-growing market is in Asia-Pacific, which includes China and India.

Powdered Lycopene Food Color Market Drivers:

The health benefits of lycopene have been fueling the growth.

The plant pigment lycopene gives fruits like tomatoes, watermelons, and sweet red peppers their red hue. It is an antioxidant with many health advantages. Firstly, it can protect our heart health by lowering blood pressure, increasing the bioavailability of nitric oxide, which dilates blood vessels, and guarding against oxidative damage to the cardiovascular system. Additionally, it could aid in preventing stroke and myocardial infarction. Secondly, lycopene ingestion over time may aid in the prevention of skin cancer. According to studies, people who consume tomato paste regularly can prevent up to 40% of UV skin damage from harmful sun rays. However, it should be noted that this is not equivalent to sunscreen. Thirdly, lycopene is advantageous to bone health, particularly in the elderly. According to a few studies, osteoporosis and disorders connected to the bones were more common among elderly women who did not consume enough lycopene. Apart from this, lycopene may help decrease cholesterol, control blood sugar, and prevent certain cancers. All these benefits make lycopene an ideal substitute to be added to various food products.

Demand for natural ingredients has been on the rise.

Customers are increasingly drawn to natural and clean-label items. Customers are looking for food items created with natural ingredients due to concerns about their health and well-being, as there has been growing knowledge of the possible hazards linked with artificial additives and colorants. Powdered lycopene that comes from tomatoes or other natural sources is safer and healthier than artificial food coloring. As such, the risk of chronic illnesses like diabetes, cancer, high blood pressure, cholesterol, etc. is reduced. The need for powdered lycopene food coloring in a variety of food and beverage applications is being driven by customer preferences for natural ingredients.

Powdered Lycopene Food Colors Market Restraints and Challenges:

Cost constraints, stability, and possible side effects are the main issues that the market is currently facing.

The extraction of powdered lycopene is challenging. This required advanced infrastructure, equipment, and other resources. The expenses for purification, extraction, and other raw materials are relatively higher. Small and medium-sized industries might face obstacles in this regard. Secondly, lycopene is a sensitive compound. It is prone to degradation when exposed to sunlight, rain, and other environmental conditions. Manufacturers must take suitable steps to ensure the purity and shelf life of this product. Thirdly, it is necessary to provide the right information to the public. Lycopene and lycopene supplements need to be avoided during pregnancy, breastfeeding, and before and after immediate surgeries. Additionally, lycopenemia may result from consuming significant levels of lycopene through diet or supplementation. An orange or crimson skin color caused by lycopenemia goes away after consuming a diet low in lycopene. However, more research is required to find other possible ill effects.

Powdered Lycopene Food Colors Market Opportunities:

The increasing interest in functional and nutraceutical products has been providing the market with an ample number of possibilities. Lycopene has antioxidants that benefit heart health. By incorporating this into food products targeted at maintaining health and skin, a broader consumer base can be achieved. Additionally, diverse applications can be created by innovating product offerings. This compound can be used in confectionery, beverages, and dairy products to increase their nutritional value. Secondly, emerging economies provide many opportunities. These areas have a growing healthcare and food & beverage sector. By using this compound in such countries, greater revenue can be achieved. Furthermore, continuous improvements in encapsulation, formulation, and extraction technologies present chances to improve the stability, use, and functionality of powdered lycopene food coloring. Companies may increase the potential uses of powdered lycopene in the food sector by investing in research and development activities that aim to discover new ways to solve issues related to color stability, solubility, and processing compatibility.

POWDERED LYCOPENE FOOD COLORS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.7% |

|

Segments Covered |

By Nature, Source, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, DSM Nutritional Products AG, Allied Biotech Corporation, Lycored Ltd., Kancor Ingredients Ltd., Sensient Technologies Corporation, Naturex SA (now part of Givaudan), Chr. Hansen Holding A/S, DDW, The Color House, Vidya Herbs Pvt. Ltd. |

Powdered Lycopene Food Colors Market Segmentation: By Nature

-

Organic

-

Conventional

The conventional segment is the largest. This is because crops like tomatoes, watermelon, guava, etc. can be produced in a shorter period. Fertilizers, chemicals, and other growth hormones are used to produce a higher yield. Moreover, conventional produce is often more accessible and affordable. The organic category is the fastest-growing. This is because of the increasing awareness about the benefits of this product. The yield is grown without the aid of any chemicals. A lot of studies have proved that organic crops tend to have higher nutrition and risk the prevalence of many diseases. Manufacturers are following clean labeling practices to attract health-conscious customers. Strategies are being taken to make this produce available in supermarkets. Additionally, cost-effective options are being commercialized.

Powdered Lycopene Food Colors Market Segmentation: By Source

-

Tomato

-

Watermelon

-

Guava

-

Pink Grape

-

Others

Tomatoes are the largest and fastest-growing source. Since they are the most consumed and least expensive raw material, tomatoes are the primary source of lycopene. 4–10 milligrams of lycopene are present in a 130-gram serving of fresh tomatoes. Technological developments in extraction have simplified and reduced the cost of lycopene extraction from tomatoes while maintaining the fruit's color and nutritional value. These developments support the rise of tomato-derived powdered lycopene by making it more accessible and affordable. Furthermore, lycopene derived from tomatoes has a well-established supply chain, is well-researched, and is well-known to consumers. As a result, compared to other sources, powdered lycopene generated from tomatoes probably has the most market share.

Powdered Lycopene Food Colors Market Segmentation: By Application

-

Bakery & Confectionery Products

-

Beverages

-

Packaged Food/Frozen Products

-

Dairy Food Products

-

Others

Beverages are the largest and fastest-growing application. Many beverage items include lycopene, a natural food colorant, taste enhancer, and nutritional supplement. The demand for functional drinks enhanced with vitamins, antioxidants, and other bioactive substances is rising. The use of powdered lycopene in functional beverage formulations is encouraged by the rising demand for natural and safe ingredients. It is well-known for its antioxidant qualities and possible health advantages. Instead of consuming artificial ingredients and colorants, consumers are shifting more and more toward natural and organic beverage alternatives. This need for clean-label goods is met by powdered lycopene, which is sourced naturally from plants like tomatoes and is rapidly expanding in the beverage industry. Besides, with a busy lifestyle, ready-to-drink beverages have gained prominence. Manufacturers have been using this compound in these beverages to enhance their nutritional profile.

Powdered Lycopene Food Colors Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest growing market. The United States and Canada are at the forefront. This dominance is because of the well-established economy. This makes it easier for the region to fund and invest in various projects. The tomato is a popular fruit consumed in North America. As such, lycopene is extracted in higher amounts. The food and beverage industry in this region is enormously contributing to its success. Besides, prominent companies like Chr. Hansen Holding A/S, Sensient Technologies Corporation, Givaudan, and DDW The Color House are present in this area. They have a global presence, leading to greater revenue. Asia-Pacific is the fastest-growing market. Countries like China, India, Japan, and South Korea are at the top. Urbanization has led to a change in the standard of living. This had created better incomes. Technological advancements have led to better purification and extraction. Besides, consumer awareness about the health advantages has helped increase demand. Organic produce is on the rise. Furthermore, the food processing industry is expanding, providing more opportunities.

COVID-19 Impact Analysis on the Global Powdered Lycopene Food Colors Market:

The outbreak of the virus had a mixed impact on the market. The new normal included social isolation, movement restrictions, and lockdowns. Transportation, logistics, and the supply chain were all impacted by this. Remote work was the main focus. As a result, manufacturing and production were stopped. Safety regulations created operating difficulties. An economic recession was seen. A great number of people lost their jobs. Restaurants, hotels, and other eateries had to close. The food and beverage industry incurred losses due to this. The bulk of the funds were supposed to be applied to healthcare-related projects. This caused delays in collaborations and launches. Many only made purchases for necessities. However, on the other hand, health became a priority. People started to look out for healthy options that enhanced their immunity. There was an elevation in home cooking. This led to people purchasing food colorants, including powdered lycopene. E-commerce helped with the sales. Retailers focus on having a good virtual presence. Besides, several research studies were conducted to study the potential of lycopene against the coronavirus. Post-pandemic, the market has continued to grow owing to the relaxation of rules and regulations.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this. Veganism is a recent trend that is benefiting this market. Vegan diets include plant-based foods only. A lot of people were made aware of the cruelties faced by the animal industry in the extraction of products like milk and eggs. As a result, companies came up with vegan substitutes for the same. Animals cannot naturally produce lycopene; only plants and microbes can. It is a highly unsaturated hydrocarbon and a carotenoid. Synthetic lycopene is also available as a dietary supplement, which is technically vegan-friendly. It is frequently used as a natural colorant in vegan products in place of artificial or animal-derived ones.

Key Players:

-

BASF SE

-

DSM Nutritional Products AG

-

Allied Biotech Corporation

-

Lycored Ltd.

-

Kancor Ingredients Ltd.

-

Sensient Technologies Corporation

-

Naturex SA (now part of Givaudan)

-

Chr. Hansen Holding A/S

-

DDW, The Color House

-

Vidya Herbs Pvt. Ltd.

Chapter 1. Powdered Lycopene Food Colors Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Deployment Models

1.5 Secondary Deployment Models

Chapter 2. Powdered Lycopene Food Colors Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Powdered Lycopene Food Colors Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Powdered Lycopene Food Colors Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Powdered Lycopene Food Colors Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Powdered Lycopene Food Colors Market – By Nature

6.1 Introduction/Key Findings

6.2 Organic

6.3 Conventional

6.4 Y-O-Y Growth trend Analysis By Nature

6.5 Absolute $ Opportunity Analysis By Nature, 2024-2030

Chapter 7. Powdered Lycopene Food Colors Market – By Source

7.1 Introduction/Key Findings

7.2 Tomato

7.3 Watermelon

7.4 Guava

7.5 Pink Grape

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Source

7.8 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 8. Powdered Lycopene Food Colors Market – By Application

8.1 Introduction/Key Findings

8.2 Bakery & Confectionery Products

8.3 Beverages

8.4 Packaged Food/Frozen Products

8.5 Dairy Food Products

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Powdered Lycopene Food Colors Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Nature

9.1.3 By Source

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Nature

9.2.3 By Source

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Nature

9.3.3 By Source

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Nature

9.4.3 By Source

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Nature

9.5.3 By Source

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Powdered Lycopene Food Colors Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 DSM Nutritional Products AG

10.3 Allied Biotech Corporation

10.4 Lycored Ltd.

10.5 Kancor Ingredients Ltd.

10.6 Sensient Technologies Corporation

10.7 Naturex SA (now part of Givaudan)

10.8 Chr. Hansen Holding A/S

10.9 DDW, The Color House

10.10 Vidya Herbs Pvt. Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global powdered lycopene food color market was valued at USD 93.188 million and is projected to reach a market size of USD 189.84 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10.7%.

Health benefits and demand for natural ingredients are the main factors propelling the global powdered lycopene food color market.

Based on the source, the global powdered lycopene food color market is segmented into tomato, watermelon, guava, pink grape, and others.

North America is the most dominant region for the global powdered lycopene food color market.

BASF SE, DSM Nutritional Products AG, and Allied Biotech Corporation are the key players operating in the global powdered lycopene food color market.