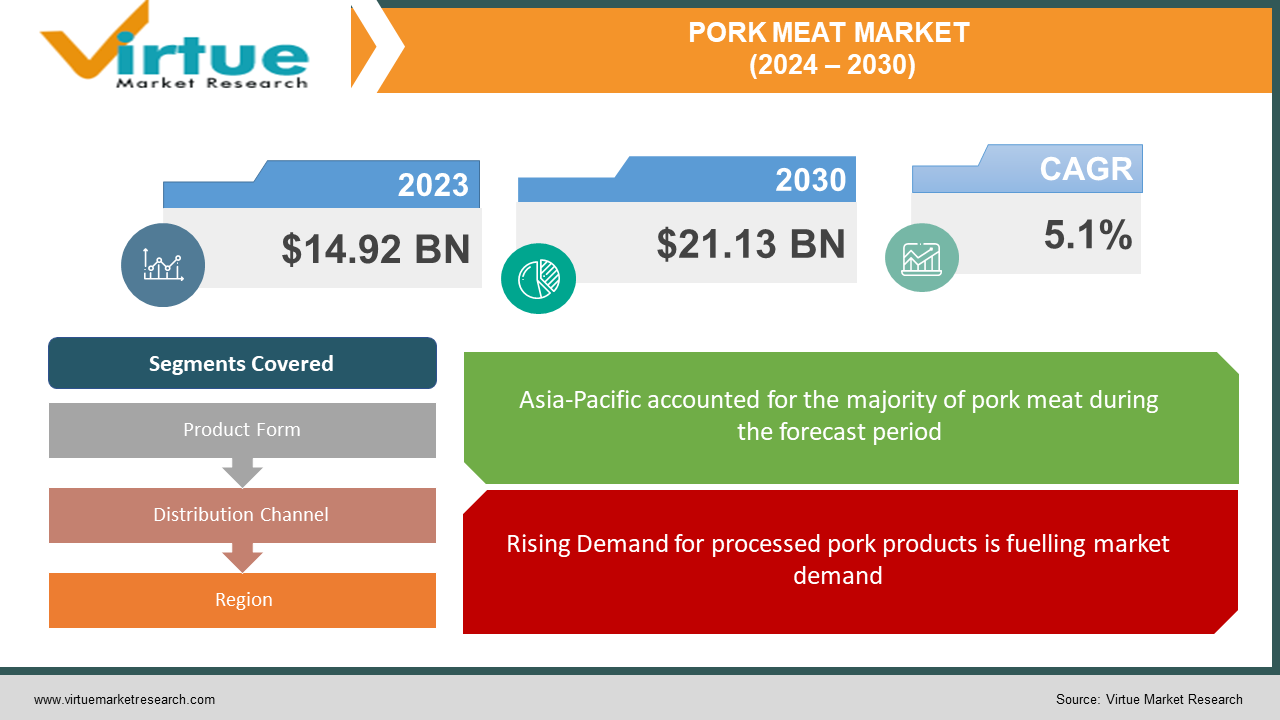

Pork Meat Market Size (2024 – 2030)

The Pork Meat Market was valued at USD 14.92 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 21.13 billion by 2030, growing at a CAGR of 5.1%.

The meat derived from a domestic pig is referred to as pork, and it serves as a widely embraced dietary staple globally, with the exception of certain Middle Eastern countries. Pork possesses not only an enticing flavor but also a commendable nutritional composition. Furthermore, it serves as a valuable source of protein and fats, containing significant amounts of selenium, vitamin B, and thiamin. This nutritional profile makes it a preferred choice for individuals dedicated to building muscle mass, particularly among fitness enthusiasts. The popularity of pork extends to its frequent inclusion as a preferred option in fast food establishments and restaurants. Numerous quick-service restaurants now feature pork as a topping for items such as French fries and burgers.

Pork is the designated culinary term for the flesh of a pig and stands as the most widely consumed meat across the globe. It is consumed in both freshly prepared and preserved forms, with curing being a method to prolong the shelf life of pork products. Preserved variations include ham, gammon, bacon, and sausage.

Key Market Insights:

Pork stands as the foremost and extensively consumed meat globally, serving as a primary protein source for millions across diverse cultures within the dynamic global swine industries. Its affordability, surpassing that of other meat sources, constitutes a pivotal factor contributing to its widespread consumption. The increasing size of the middle-class demographic, rising disposable income, and evolving consumer preferences collectively contribute to the escalating demand for pork.

Pork Meat Market Drivers:

Rising Demand for processed pork products is fuelling market demand.

The surging demand for animal protein and a preference for low-fat, high-protein diets have been instrumental in a notable upswing in the global consumption of pork and other animal proteins. Concurrently, there is an increasing inclination among consumers towards processed pork products, such as bacon, hams, and sausages, driven by considerations of convenience and food preferences. Moreover, individuals mindful of their health are incorporating pork meat into their diets, acknowledging its substantial protein content and nutritional advantages.

The expansion of the pork meat market is closely linked to shifts in the worldwide food consumption patterns. The proliferation of the retail market, coupled with the widespread availability of packaged pork meat through various sales channels, contributes significantly to the convenience factor for consumers, thereby propelling sales figures. Nevertheless, the rise in the adoption of veganism and the enforcement of stringent laws against animal cruelty emerge as primary constraints for the global pork meat market. Conversely, the growing popularity of organic pork meat and the demand for clean label products are anticipated to present lucrative opportunities for expansion and foster growth in the global pork meat market.

Pork Meat Market Restraints and Challenges:

The pork meat market faces a substantial challenge from recurrent disease outbreaks, including instances such as swine flu or African swine fever. These outbreaks have the potential to result in widespread culling of swine populations, the imposition of trade restrictions, and heightened consumer concerns. Consequently, the repercussions of such outbreaks significantly impact both the supply and demand dynamics within the pork meat market.

The growing prominence of plant-based meat presents a challenge to the pork meat market. With an increasing number of consumers embracing vegan or plant-based lifestyles for health reasons, there is a potential shift away from the conventional consumption of traditional pork meat.

A notable challenge impeding the growth of the pork meat market is the rising population adhering to a vegan lifestyle. This trend is particularly pronounced in countries such as the US, Australia, Germany, India, and others, where there has been a discernible increase in the global vegan demographic. Notably, individuals following veganism abstain from consuming any products derived from animals, contributing to its status as one of the fastest-growing lifestyle and dietary movements.

In the UK, the number of vegans has surged by over 300% in the past decade, showcasing the expanding influence of veganism. Additionally, there is a growing prevalence of veganism among the younger demographic, with approximately 40% of the total vegan population in the UK falling within the age group of 15-34 years. Industry players are responding to this trend by introducing new vegan product categories to capitalize on the expanding potential within the vegan consumer base. Consequently, these factors have a detrimental impact on the pork meat market, and this trend is expected to impede market growth throughout the forecast period.

Pork Meat Market Opportunities:

The rise in popularity of plant-based and lab-grown meat products is gaining momentum, posing a challenge to the conventional dominance of pork in the market. In response to evolving consumer preferences, the industry is actively embracing innovation and sustainability to adapt to these changing trends.

Additionally, there are observable shifts in wine pairing preferences that align with changing consumer choices. As the demand for healthier and leaner pork cuts increases, there is a growing preference for lighter, more acidic wines to complement and balance the flavors.

PORK MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Product Form, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cranswick Plc, Bridgford Foods Corp., Dawn Pork and Bacon, China Yurun Food Group Ltd., Danish Crown AS, Hormel Foods Corp., Gordon Food Service Inc., New Hope Liuhe Co. Ltd., Tyson Foods Inc., Iowa Select Farms |

Pork Meat Market Segmentation: By Product Form

-

Fresh/Chilled

-

Frozen

-

Canned/Preserved

The frozen segment has secured the highest market share, experiencing significant growth attributed to the rapid increase in the consumption of meat, poultry, and seafood. Meanwhile, the chilled segment is anticipated to exhibit a more moderate growth rate throughout the forecast period. This growth in the chilled segment can be attributed to consumer preferences, as there is a tendency for consumers to favor chilled pork over frozen meat.

Pork Meat Market Segmentation: By Distribution Channel

-

Hypermarket/Supermarket

-

Convenience Stores

-

Specialty Stores

-

Online Retailing

-

Other Distribution Channels

The growth of the market is expected to be positively influenced by the increased convenience in the offline segment. This segment comprises supermarkets, hypermarkets, specialty stores, hard discount stores, and convenience stores. Major retail chains like Tesco Plc (Tesco), Walmart Inc. (Walmart), and Target Corp. (Target) play a significant role by dedicating a separate retailing segment for pork meat in their stores. Additionally, market players are employing promotional and marketing strategies, including branding through signages and offering discounts on product packages within their stores. Established retail outlets such as Walmart and Walgreens have been consistently featuring pork meat on their shelves, with substantial investments in brick-and-mortar organized retail stores to enhance their regional and global market shares. Consequently, these factors contribute to the growth of the offline segment, thereby driving overall market growth during the forecast period.

Pork Meat Market Segmentation: by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

In the Asia-Pacific region, particularly in countries like China and Japan, the consumption of pork meat is notably high, influenced by environmental conditions and consumer food preferences. This region has also observed an upsurge in the consumption of processed and convenience meat products, attributed to busy lifestyles and the concurrent rise in disposable income. Additionally, the growing tourism industry has led to an increased demand for pork meat in food service establishments and franchises.

Conversely, Europe and North America are anticipated to experience a steady growth rate throughout the forecast period, primarily due to the presence of a substantial number of local players in the pork meat market.

COVID-19 Pandemic: Impact Analysis

In 2020, amidst the COVID-19 pandemic, the global pork meat market experienced a substantial deceleration in growth. This downturn was attributed to the shutdown of slaughterhouses, labor shortages, and disruptions in the supply of feed and other inputs. However, in 2021, the commencement of large-scale vaccination campaigns facilitated the easing of lockdowns and travel restrictions, subsequently enabling the resumption of operations in slaughterhouses. These developments are anticipated to propel the market during the forecast period.

Latest Trends/ Developments:

-

In December 2022, JBS SA executed an acquisition agreement with TriOak Foods, a pork supplier based in the United States. The strategic move was undertaken to secure a consistent supply of premium pork for JBS SA.

-

In February 2022, Benestar Brands, a North America-based company specializing in pork rinds, tortilla chips, and pretzel bread products, announced the acquisition of 4505 Meats, a San Francisco-based company known for its expertise in producing pork rinds and other protein-based snacks.

-

In January 2022, JBS SA further expanded its global presence through the acquisition of Rivalea Australia Pty Ltd, an Australia-based pork processor. This acquisition not only strengthened JBS's position in Australia but also established the company as a leader in pork processing in the country. The deal included the addition of significant brands to JBS's portfolio and enhanced the company's export capabilities.

Key Players:

These are top 10 players in the Pork Meat Market :-

-

Cranswick Plc

-

Bridgford Foods Corp.

-

Dawn Pork and Bacon

-

China Yurun Food Group Ltd.

-

Danish Crown AS

-

Hormel Foods Corp.

-

Gordon Food Service Inc.

-

New Hope Liuhe Co. Ltd.

-

Tyson Foods Inc.

-

Iowa Select Farms

Chapter 1. Pork Meat Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pork Meat Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pork Meat Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pork Meat Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pork Meat Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pork Meat Market – Product Type

6.1 Introduction/Key Findings

6.2 Fresh/Chilled

6.3 Frozen

6.4 Canned/Preserved

6.5 Y-O-Y Growth trend Analysis Product Type

6.6 Absolute $ Opportunity Analysis Product Type, 2024-2030

Chapter 7. Pork Meat Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Hypermarket/Supermarket

7.3 Convenience Stores

7.4 Specialty Stores

7.5 Online Retailing

7.6 Other Distribution Channels

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Pork Meat Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Pork Meat Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cranswick Plc

9.2 Bridgford Foods Corp.

9.3 Dawn Pork and Bacon

9.4 China Yurun Food Group Ltd.

9.5 Danish Crown AS

9.6 Hormel Foods Corp.

9.7 Gordon Food Service Inc.

9.8 New Hope Liuhe Co. Ltd.

9.9 Tyson Foods Inc.

9.10 Iowa Select Farms

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The surging demand for animal protein and a preference for low-fat, high-protein diets have been instrumental in a notable upswing in the global consumption of pork and other animal proteins.

The top players operating in the Pork Meat Market are - Cranswick Plc, Bridgford Foods Corp., Dawn Pork and Bacon, China Yurun Food Group Ltd., Danish Crown AS, Hormel Foods Corp., Gordon Food Service Inc., New Hope Liuhe Co. Ltd., Tyson Foods Inc., Iowa Select Farms.

There are observable shifts in wine pairing preferences that align with changing consumer choices. As the demand for healthier and leaner pork cuts increases, there is a growing preference for lighter, more acidic wines to complement and balance the flavors.

In December 2022, JBS SA executed an acquisition agreement with TriOak Foods, a pork supplier based in the United States. The strategic move was undertaken to secure a consistent supply of premium pork for JBS SA.

Europe and North America are anticipated to experience a steady growth rate throughout the forecast period, primarily due to the presence of a substantial number of local players in the pork meat market.