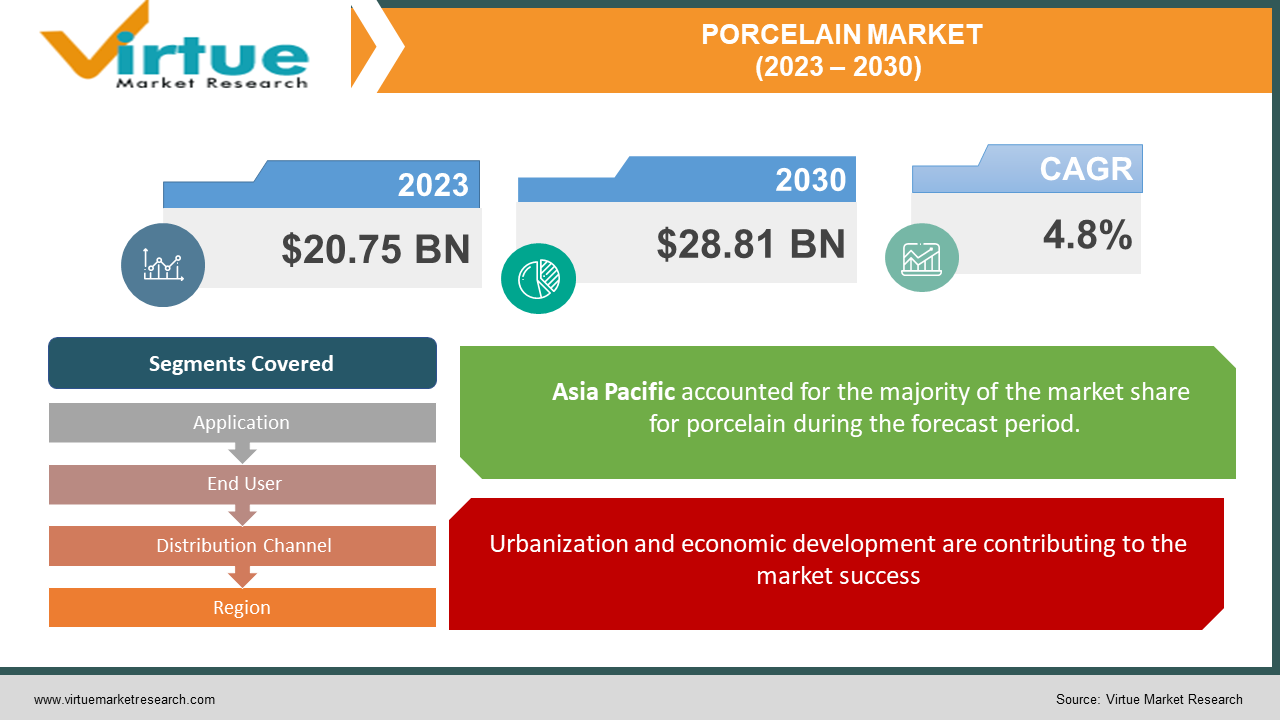

Porcelain Market Size (2023 – 2030)

The Global Porcelain Market was valued at USD 20.75 billion and is projected to reach a market size of USD 28.81 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.8%.

When raw materials are heated to temperatures between 1,200 and 1,400 °C in a kiln, they are transformed into porcelain which is a ceramic substance. Porcelain has had an ancient history. It is mainly used in furniture which includes tables and cabinets. Presently, a lot of innovations and aesthetics are added to make it appealing. In the future, with a rising focus on sustainability, this market can have potential alternatives with the aid of 3D printing and computer-aided design (CAD). During the forecast period, this market is set to see a notable growth.

Key Market Insights:

Analysts suggest within the hard surfaces sector, porcelain is likely to be material to see the most growth between 2023 and 2030, with sales predicted to increase by 46%.

Kitchen projects are said to be responsible for 74.9% of worktop sales, with 10.6% of sales being attributed to bathroom projects, 10% to contract business, with the remaining 4.5% being used in furniture construction.

Ceramic’s share of the commercial market increased slightly to 14.8% in 2020, up from 13.7% in 2019.

Between 2020 and 2021 the exports of Porcelain Tableware grew by 23.3%, from $5.7 billion to $7.03 billion.

Due to the current economic recession, a 15% decrease was seen in the annual sales of these products affecting the furniture and building industry. To tackle this, manufacturers are trying to implement effective cost-reduction strategies.

Porcelain Market Drivers:

Urbanization and economic development are contributing to the market success.

With growing economies in developed and developing countries, the incomes especially for middle-class people have been rising. This has piqued their interest in real estate development. Owing luxury products has become easier and people are leaning towards collection of these items to make their houses look good. Porcelain is used for furniture, bathroom tiles, tea cups, tiles, and other decorative items. They have properties like durability, moisture resistance, elasticity, corrosion resistance, and strength making them a popular choice. Shortly, with developing rural and urban areas many people are expected to renovate their homes and generate profits for the market.

The growth of E-commerce is helping the market to expand.

After the pandemic, digital transformation has been observed in almost all the regions. Consumers can purchase goods from the comfort of their house through online mode. This retail ensures customer satisfaction. Moreover, there are various promos, discounts, deals, and advantages of being a member of specific platforms. Consumers get to compare and choose from a wide range of options. The price range is considerable making this an attractive choice. Furthermore, they can order products that are available in other states or internationally. The online channel has been a huge boon for the porcelain market in increasing sales.

Porcelain Market Restraints and Challenges:

Costs, environmental issues, and competition are the main challenges which are faced by the market.

One of the major barriers in the market is the associated costs. Production costs can be very high. Additionally, with rapid technological advancements manufacturers may find it difficult to invest in the new technologies. Moreover, they are more difficult to repair than other traditional materials thereby costing more charge. Secondly, they consume an enormous amount of energy while heating, contributing to greenhouse gas emissions. This results in air pollution as well. Thirdly, competition from alternative and traditional materials like glass, wood, and other plastics can hamper the market growth.

Porcelain Market Opportunities:

The development of eco-friendly porcelain materials is expected to provide the market with an ample number of opportunities. With a shift towards leading a sustainable life, many manufacturers are trying to develop alternatives and unique products. Secondly, artisanal and handcrafted porcelain is being prioritized owing to its significance as well as richness. Many business tycoons and other high-profile people are expressing their interest in the niche craftsmanship. Additionally, this provides employment opportunities to many women in the rural areas allowing them to take care of their household. Thirdly, innovative design and digital printing processes are being accelerated to make attractive products. Furthermore, technological improvements are being made to ensure accuracy and distinctive porcelain.

PORCELAIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Application, End User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Porcelanosa Group, Roca GroupLamosa Group,Mohawk Industries,Grupo Industrial Saltillo (GIS), Email Group, RAK Ceramics, Ceramiche Atlas Concorde, Kajaria Ceramics, Johnson Tiles |

Porcelain Market Segmentation: By Application

-

Flooring

-

Tableware

-

Wall Coverings

-

Decorative items

-

Others

Based on application, porcelain flooring is the largest growing in this market. Tiles made from this ceramic have properties of being water resistant, durable, easy to clean, heat resistant, longevity, versatility, and have an attractive look making them an apt choice for residential and commercial spacing. They roughly hold a share of 35%. Wall coverings are one of the fastest growing. One of the key reasons is their aesthetic appeal. Additionally, they are non-porous, have superior quality, are resistant to fading, and offer personalization as per a client’s need. Moreover, some sustainable designs are available as well encouraging the application scope.

Porcelain Market Segmentation: By End User

-

Construction and Building

-

Food and Beverage

-

Healthcare

-

Electrical and Telecommunications

-

Home Decor

Based on end-user, construction, and the building is the largest growing in this market. Factors like better standard of living, urbanization, industrialization, economic growth, infrastructure development, and rising incomes are helping this sector. During the forecast period, this market is expected to flourish more. However, home décor is one of the fastest-growing segments. This is due to the trend to renovate houses and have visual collectibles, and unique decorations. Moreover, an increase in the number of people pursuing a career in design is boosting the growth. Apart from home décor, the healthcare sector is also growing due to awareness and Governmental initiatives to have toilet facilities and public restrooms in rural as well as urban areas.

Porcelain Market Segmentation: By Distribution Channel

-

Offline

-

Supermarkets/Hypermarkets

-

Specialty stores

-

Others

-

-

Online

Based on the distribution channel, the offline segment is the largest growing in this market. This is because they enable face-to-face interaction, and visual inspection, offer discounts, and are one of the oldest modes of buying means. This keeps the customer satisfied. Additionally, these stores offer customization of color, length, size, and other factors. They hold a share of around 65%. However, after the pandemic, digitalization was the new trend. Online channels are emerging to be the fastest growing with a share of around 30%. This is because an individual can shop from a lot of sites, have access to international brands, and do the buying from his/her home. Various shopping apps are working on enhancing the user experience to ensure customer satisfaction.

Porcelain Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, Asia Pacific is the largest growing holding a share of around 33%. Countries like China, India, and Japan are the leading regions. This is mainly due to the robust manufacturing hubs, presence of companies, technological advancements, urbanization, economic improvements, numerous construction projects, rising middle class, Governmental initiatives regarding hygiene, demand, and intricate work in the rural areas. North America is one of the fastest-growing regions with the United States and Canada at the forefront. This region holds a share of around 25%. The emerging key players, expanding manufacturing facilities, investments, increasing residential construction, incorporation of sustainable initiatives, and rising demand are the main reasons.

COVID-19 Impact Analysis on the Global Porcelain Market:

The outbreak of the virus hurt the market. Lockdowns, movement restrictions, and social isolation were the new norm. Most of the companies and manufacturing units had to shut down unless they were categorized as essential workers. Due to financial restraints, layoffs were common and people lost their jobs. Import-export trade was affected due to disruptions in supply chain, transportation, and logistics. Moreover, the construction industry saw a decline and as a result, there were very few renovations or development of houses. Furthermore, the tourism industry had to undergo losses. This affected the porcelain market as there were no tourists who expressed their interest in buying these ceramics. As per a report, sales of ceramic tiles decreased by nearly 5% in 2020, falling to $2.844 billion from $2.994 billion the year before. However, post-pandemic, with the upliftment of lockdowns and relaxation of guidelines, this market started to pick up during the fourth quarter. Besides, online retail helped smaller firms and companies to sell their products and generate income. A report suggests that online retail for porcelain products grew by 25% during the latter half of 2020.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heftily to improve existing innovations alongside maintaining competitive pricing. This has further resulted in increased enlargement.

Ongoing efforts are being made to make minimalistic designs requiring less maintenance of porcelain. Customization is being given prominence to help in the market progress. Experimentation is being made with the construction of walls, tops, and other furniture pieces.

Key Players:

-

Porcelanosa Group

-

Roca Group

-

Lamosa Group

-

Mohawk Industries

-

Grupo Industrial Saltillo (GIS)

-

Email Group

-

RAK Ceramics

-

Ceramiche Atlas Concorde

-

Kajaria Ceramics

-

Johnson Tiles

In September 2023, the Turkish group Kaleseramik renewed its longstanding partnership with System Ceramics (Coesia Group). This longstanding partnership included the supply of systems and machinery and ongoing support with all aspects of machine maintenance and software updates.

In January 2022, Panariagroup Industrie Ceramiche renewed its collaboration with System Ceramics for the renovation of the Fiorano Modenese Plant. The goal was to focus on technological innovation and sustainable development.

Chapter 1. Porcelain Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Porcelain Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Porcelain Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Porcelain Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Porcelain Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Porcelain Market – By Application

6.1 Introduction/Key Findings

6.2 Flooring

6.3 Tableware

6.4 Wall Coverings

6.5 Decorative items

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 7. Porcelain Market – By End User

7.1 Introduction/Key Findings

7.2 Construction and Building

7.3 Food and Beverage

7.4 Healthcare

7.5 Electrical and Telecommunications

7.6 Home Decor

7.7 Y-O-Y Growth trend Analysis By End User

7.8 Absolute $ Opportunity Analysis By End User, 2023-2030

Chapter 8. Porcelain Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Offline

8.3 Supermarkets/Hypermarkets

8.4 Specialty stores

8.5 Others

8.6 Online

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2023-2030

Chapter 9. Porcelain Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By End User

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By End User

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By End User

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By End User

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By End User

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Porcelain Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Porcelanosa Group

10.2 Roca Group

10.3 Lamosa Group

10.4 Mohawk Industries

10.5 Grupo Industrial Saltillo (GIS)

10.6 Email Group

10.7 RAK Ceramics

10.8 Ceramiche Atlas Concorde

10.9 Kajaria Ceramics

10.10 Johnson Tiles

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Porcelain Market was valued at USD 19.8 billion and is projected to reach a market size of USD 28.81 billion by the end of 2030.

Urbanization as well as economic development and growth of E-commerce are the main drivers driving the Global Porcelain Market.

Based on End User, the Global Porcelain Market is segmented into Construction and Building, Food and Beverage, Healthcare, Electrical and Telecommunications, and Home Decor.

Asia Pacific is the most dominant region for the Global Porcelain Market.

Porcelanosa Group, Roca Group, and Lamosa Group are the key players operating in the Global Porcelain Market.