Global Polyurethane Structural Adhesives Market Size (2024-2030)

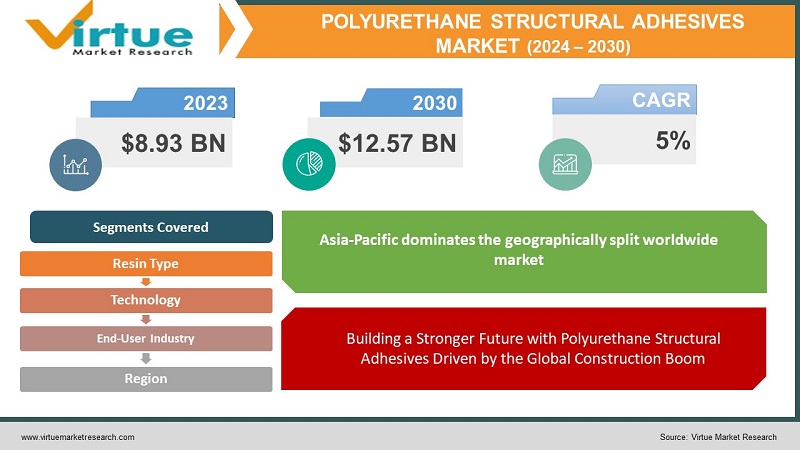

The Global Polyurethane Structural Adhesives Market was valued at USD 8.93 billion in 2023 and is projected to reach a market size of USD 12.57 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5%.

Structural adhesives made of polyurethane are strong and adaptable glues. They are excellent at joining a variety of materials together, including concrete, wood, plastic, and metal. These adhesives are flexible, which makes them resistant to vibration and impact, unlike certain rigid adhesives. This makes them ideal for circumstances where the connection will be under stress. Additionally, they are strong and resilient to UV radiation, chemicals, and moisture, making them perfect for outdoor use. With a variety of formulas available, you may pick a polyurethane adhesive that provides exceptional strength for demanding applications or dries quickly for tasks that need to be completed swiftly.

Key Market Insights:

With a CAGR of 6.9%, the worldwide structural adhesives market is expected to grow from its 2020 valuation of USD 14.3 billion to USD 27.9 billion by 2030.

With about 41.88% of the worldwide market for polyurethane adhesives in 2023, the Asia Pacific region presently has the biggest market share. Due to an increase in building activity, Europe is predicted to grow at the quickest rate between 2024 and 2028, with a projected CAGR of 6.15%.

With 40% of the world's population expected to require homes by 2030, the market for polyurethane adhesives is expected to be significantly driven by rising building activity worldwide. Because polyurethane structural adhesives are widely used in laminating applications for flexible food packaging, the packaging industry holds a significant market share of 27.49% in 2023.

The increasing demand for sustainable construction practices and more stringent environmental laws aligns with a huge potential for the development of eco-friendly green adhesives with low volatile organic compounds (VOCs) and bio-based components. The ultimate cost of polyurethane adhesives can be affected by changes in the price and availability of raw ingredients, which could reduce their competitiveness in comparison to other adhesives.

Global Polyurethane Structural Adhesives Market Drivers:

Building a Stronger Future with Polyurethane Structural Adhesives Driven by the Global Construction Boom

One of the main drivers of the polyurethane structural adhesives market is the construction industry. A global upsurge in building activity is caused by the perfect storm of growing industrial development and urbanization. With 40% of the world's population expected to need new housing, an astounding 96,150 new homes will be needed every day. Polyurethane structural adhesives, the preferred option for joining a variety of building elements like metal, wood, and concrete, have a great deal of potential as a result. The world needs strong, long-lasting relationships to construct the massive amounts of new homes and infrastructure that it requires. In essence, there is a huge need for new buildings due to the expanding construction sector, and polyurethane structural adhesives are well-positioned to face the task of keeping everything together.

The need for high-performance polyurethane structural adhesives is being driven by emerging economies.

The industrialization and infrastructure development of emerging economies, such as China and India, is booming now. great-performance adhesives that can survive the rigors of these projects are in great demand because of this fast increase. With their well-known strength, resilience, and adaptability, polyurethane structural adhesives are the perfect choice to satisfy this expanding need. These adhesives are essential to the construction industry because they help to secure panels, prefabricated buildings, and building components together, assuring the durability and stability of newly constructed structures. These adhesives are also used by the automobile industry to attach parts to cars, which helps to lighten cars and increase fuel economy. Outside of these industries, polyurethane structural adhesives are used in a variety of production processes for furniture, appliances, and electronics component bonding. The rise in industrial activity in these developing nations is anticipated to have a significant role in propelling the expansion of the worldwide polyurethane structural adhesives market in the upcoming years.

Global Polyurethane Structural Adhesives Market Restraints and Challenges:

Despite its strength, the worldwide market for polyurethane structural adhesives is confronted with obstacles that limit its unbridled expansion. First off, the price and availability of raw materials might fluctuate, which could affect the adhesives' ultimate cost and make them less appealing when compared to alternatives. Second, the usage of specific ingredients in polyurethane adhesives may be restricted by global environmental rules. This requires reformulation, which increases complexity and expense, to comply with the requirements. Additionally, because they have less of an impact on the environment, eco-friendly substitutes like water-based adhesives are becoming more and more popular, posing a threat to the industry. Finally, more study and development of safer formulations are required due to possible health issues linked with certain of the adhesives' constituents.

Global Polyurethane Structural Adhesives Market Opportunities:

The worldwide market for polyurethane structural adhesives offers promising prospects for expansion. The development of green adhesives is one important field. Manufacturers may create low-VOC and bio-based polyurethane adhesives to take advantage of the rising consumer demand for sustainable products. Stricter environmental rules and an increased emphasis on green building standards are a perfect match for this. Furthermore, there is a growing need for high-performance adhesives in industries like construction and automotive due to the fast industrialization and infrastructure development of rising nations like China and India. This presents opportunities for polyurethane adhesives. The aerospace industry's development of lightweight composites and other novel materials opens new applications for creative polyurethane adhesives that can glue these cutting-edge materials together. The potential uses of polyurethane structural adhesives can be further expanded by research and development efforts that result in new formulations with greater bond strength, quicker cure periods, and enhanced resilience to harsh environments.

POLYURETHANE STRUCTURAL ADHESIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By resin Type, end user, technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M (US), Avery Dennison Corporation (US), Dow (US), Franklin International, Inc. (US), H.B. Fuller Company (US), Henkel AG & Co. KGaA (Germany), Huntsman International LLC (US), Sika AG (Switzerland) |

Global Polyurethane Structural Adhesives Market Segmentation:

Global Polyurethane Structural Adhesives Market Segmentation: By Resin Type:

- Polyurethane

- Epoxy

- Acrylic

- Cyanoacrylate

- Others

Because of its strength and adaptability, polyurethane dominates the global market for polyurethane structural adhesives. Yet, eco-friendly substitutes for polyurethane are the market category that is expanding the quickest. The market for low-VOC and bio-based adhesives is anticipated to develop at the fastest rate due to tighter environmental laws and an increase in sustainable construction practices.

Global Polyurethane Structural Adhesives Market Segmentation: By End-User Industry:

- Construction

- Automotive

- Aerospace

- Wind Energy

- Packaging

- Manufacturing

- Other Industries

Due to the ongoing requirement for buildings, the construction industry dominates the worldwide polyurethane structural adhesives market; however, the fastest-growing industry is probably a tie between wind energy and aerospace. Due to their reliance on lightweight materials and their rapid growth particularly in Asia-Pacific both sectors require high-performance adhesives for reliable bonding. This increases the need for novel polyurethane compositions made specifically for these cutting-edge uses.

Global Polyurethane Structural Adhesives Market Segmentation: By Technology:

- Solvent-Based

- Water-Based

- Hot Melt

- Others

In the global market for polyurethane structural adhesives, there is growing competition between technologies. Currently ranked first, solvent-based adhesives have a long history of strength, but their high volatile organic compound emissions may provide a challenge. Water-based adhesives are expected to increase at the quickest rate since they have fewer volatile organic compounds (VOCs) and fit in well with green construction trends. The eco-friendly adhesive market is predicted to be led by water-based adhesives as environmental restrictions get stricter and sustainability becomes more important.

Global Polyurethane Structural Adhesives Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific dominates the geographically split worldwide market for polyurethane structural adhesives. The need for these high-performance adhesives is being driven by this region's increasing industrialization, infrastructure expansion, and booming building activity in nations like China and India. As well-established markets, North America and Europe are not far behind Asia-Pacific, whose rapidly expanding economies are making it the region's front-runner.

COVID-19 Impact Analysis on the Global Polyurethane Structural Adhesives Market:

The global market for polyurethane structural adhesives saw a wild ride because of the COVID-19 epidemic. At first, lockdowns and limitations on business operations led to a precipitous drop in demand. The production of automobiles stopped, construction projects stagnated, and other important sectors dependent on these adhesives came to a complete stop. Lockdowns and travel restrictions caused shortages and price volatility of raw materials and finished products, creating disruptions to the supply chain. A pleasant recovery occurred as the epidemic subsided and economies reopened. The need for polyurethane structural adhesives surged due to pent-up demand in the building industry and other industries. Fascinatingly, the epidemic also brought with it unanticipated possibilities. During this time, there was a greater emphasis on sustainability, which gave manufacturers an opportunity to make and market low-VOC, environmentally friendly polyurethane adhesives that would comply with increasingly stringent environmental standards. Furthermore, the pandemic-driven surge in e-commerce created a greater demand for adhesives that are robust and adaptable for use in packaging applications. In summary, there was a mixed result from the COVID-19 epidemic on the market for polyurethane structural adhesives. Although the initial shock led to a brief fall, the post-pandemic rebound and the increased focus on sustainability have created opportunities for remarkable growth in the future. The manufacturers who can adjust to this changing market and make investments in cutting-edge, environmentally sustainable solutions will stand to gain a lot of ground.

Recent Trends and Developments in the Global Polyurethane Structural Adhesives Market:

The global market for polyurethane structural adhesives is changing due to innovative technology, sustainability, and fascinating new uses. The emergence of green adhesives is a major trend. Global environmental rules are becoming increasingly stringent, and manufacturers are placing a higher priority on creating environmentally responsible products. This covers bio-based adhesives derived from renewable resources and low-VOC formulations. The increasing need for responsible manufacturing and sustainable construction practices is well-matched by these green adhesives. Additionally, material innovation is generating buzz. Advanced adhesives that can successfully join these new materials are becoming more and more necessary as lightweight materials like composites are developed for use in wind energy and aerospace sectors. In response, producers are creating polyurethane adhesives with enhanced strength and adhesion qualities to satisfy the requirements of these innovative uses. Another important word is efficiency. Another important word is efficiency. The industrial and construction sectors are raging for lower labor costs and quicker production cycles. This is pushing the development of polyurethane adhesives that are more compatible with automated dispensing systems and have quicker cure periods. The market is also being impacted by the emergence of Industry 4.0. Manufacturers are using data analytics to increase overall process efficiency, forecast equipment maintenance requirements, and optimize formulas. The development of more accurate and focused adhesives is made possible by this data-driven methodology. The Asia-Pacific area is expanding, especially China and India. High-performance polyurethane adhesive demand is being driven by these markets' boom in infrastructure development and construction. In conclusion, the global market for polyurethane structural adhesives is embracing innovation, sustainability, and new uses, guaranteeing a promising future for these adaptable adhesives.

Key Players:

- 3M (US)

- Avery Dennison Corporation (US)

- Dow (US)

- Franklin International, Inc. (US)

- H.B. Fuller Company (US)

- Henkel AG & Co. KGaA (Germany)

- Huntsman International LLC (US)

- Sika AG (Switzerland)

Chapter 1. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET– BY Resin Type

6.1. Introduction/Key Findings

6.2. Polyurethane

6.3. Epoxy

6.4. Acrylic

6.5. Cyanoacrylate

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Resin Type

6.8. Absolute $ Opportunity Analysis By Resin Type , 2024-2030

Chapter 7. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET– BY TECHNOLOGY

7.1. Introduction/Key Findings

7.2. Solvent-Based

7.3. Water-Based

7.4. Hot Melt

7.5. Others

7.4. Y-O-Y Growth trend Analysis By TECHNOLOGY

7.5. Absolute $ Opportunity Analysis By TECHNOLOGY , 2024-2030

Chapter 8. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET– BY End-User

8.1. Introduction/Key Findings

8.2. Construction

8.3. Automotive

8.4. Aerospace

8.5. Wind Energy

8.6. Packaging

8.7. Manufacturing

8.8. Other Industries

8.9. Y-O-Y Growth trend Analysis End-User

8.10. Absolute $ Opportunity Analysis End-User , 2024-2030

Chapter 9. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By TECHNOLOGY

9.1.3. By Resin Type

9.1.4. By End-User

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By TECHNOLOGY

9.2.3. By End-User

9.2.4. By Resin Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By TECHNOLOGY

9.3.3. By Resin Type

9.3.4. By End-User

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By TECHNOLOGY

9.4.3. By Resin Type

9.4.4. By End-User

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By TECHNOLOGY

9.5.3. By Resin Type

9.5.4. By End-User

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL POLYURETHANE STRUCTURAL ADHESIVES MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 3M (US)

10.2. Avery Dennison Corporation (US)

10.3. Dow (US)

10.4. Franklin International, Inc. (US)

10.5. H.B. Fuller Company (US)

10.6. Henkel AG & Co. KGaA (Germany)

10.7. Huntsman International LLC (US)

10.8. Sika AG (Switzerland)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Polyurethane Structural Adhesives Market was valued at USD 8.93 billion in 2023

The worldwide Global Polyurethane Structural Adhesives Market growth is estimated to be 5% from 2024 to 2030

The Global Polyurethane Structural Adhesives Market is segmented By Resin Type (Polyurethane, Epoxy, Acrylic, Cyanoacrylate, Others); By End-User Industry (Construction, Automotive, Aerospace, Wind Energy, Packaging, Manufacturing, Other Industries); By Technology (Solvent-Based, Water-Based, Hot Melt, Others) and by region.

The future of the polyurethane structural adhesives industry is promising. Anticipate a rise in environmentally friendly alternatives, sophisticated compositions for novel materials, and accelerated curing periods to enhance productivity in building and production

Due to lockdowns and suspended building projects, the COVID-19 pandemic initially resulted in a decrease in demand for polyurethane structural adhesives. However, when economies recovered and sustainability became more of a priority, the market recovered, and eco-friendly adhesives became more popular