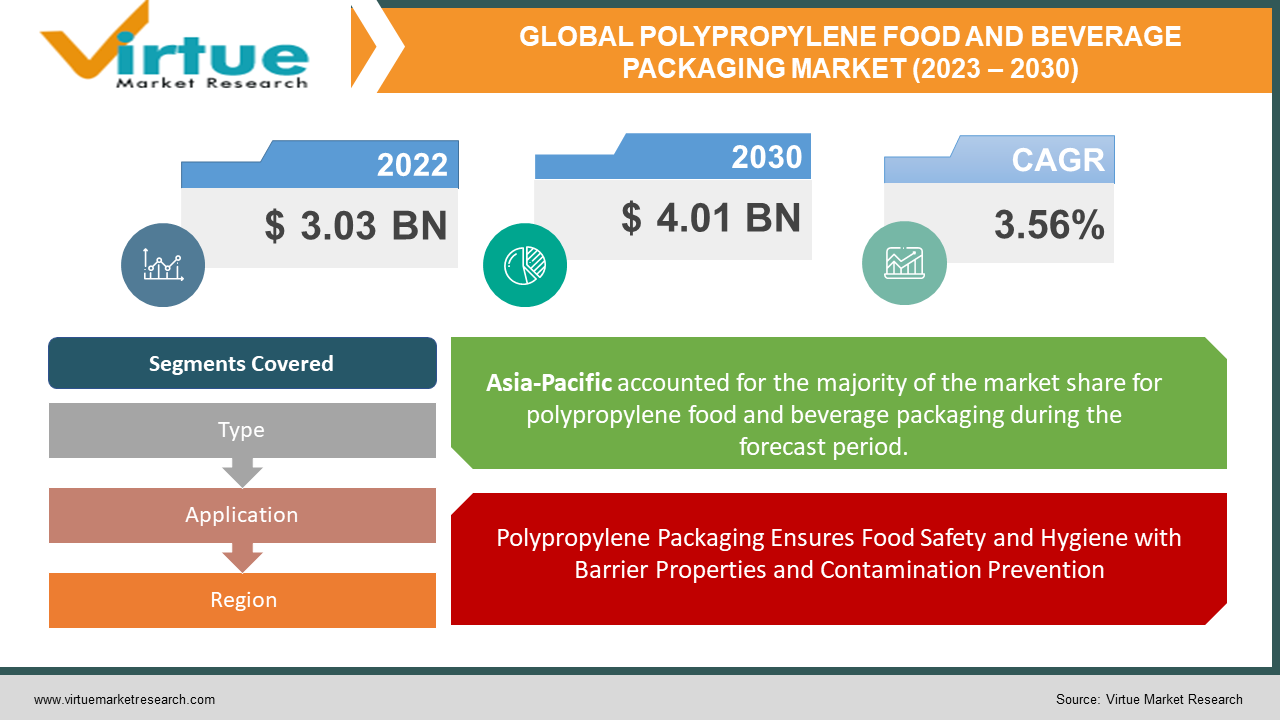

Polypropylene food and beverage packaging Market Size (2023 - 2030)

The Global Polypropylene food and beverage packaging Market was estimated at USD 3.03 Billion in 2022 and is anticipated to be a value of USD 4.01 Billion by 2030, growing at a fast CAGR of 3.56% during the forecast period 2023-2030.

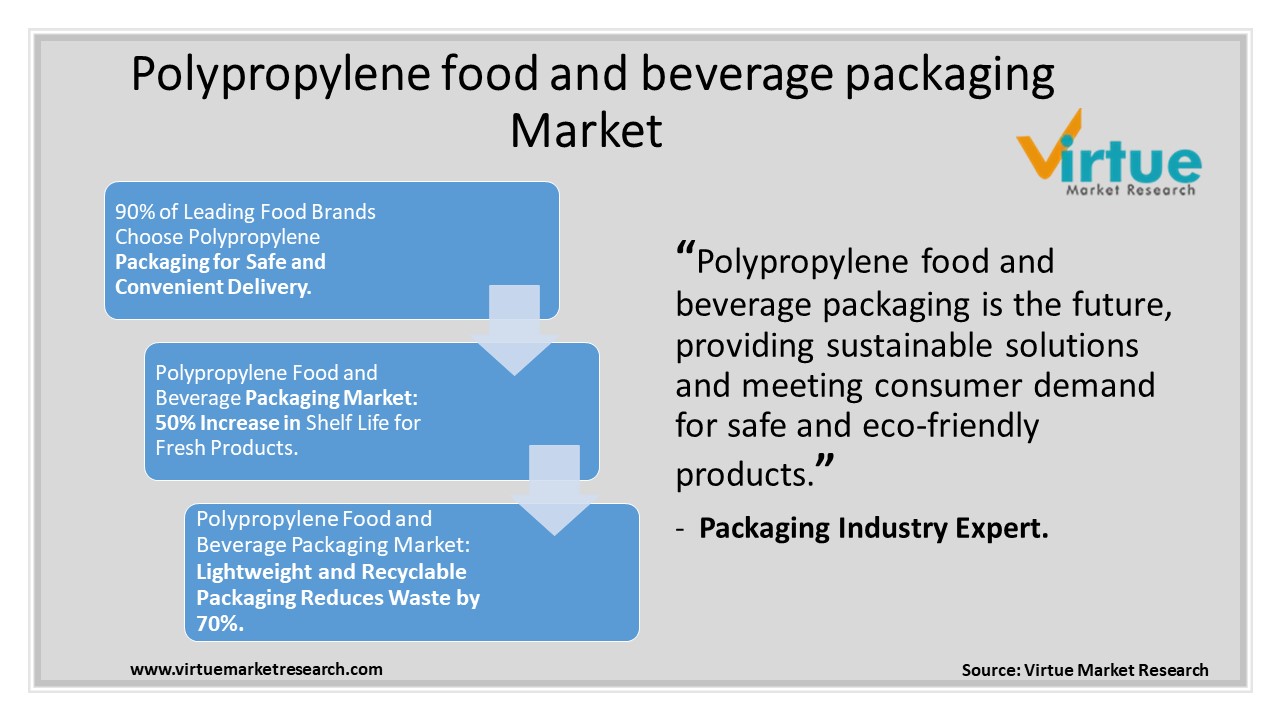

The industry that creates packaging options for food and beverage items using polypropylene (PP) material is known as the polypropylene food and beverage packaging market. Because of its outstanding qualities, polypropylene is a flexible and frequently used plastic polymer that is a great choice for packaging applications in the food and beverage industry. Numerous benefits that polypropylene packaging provides contribute to its widespread use in the market. In the first place, it offers efficient food and beverage product protection and preservation. Strong barrier qualities of the material keep pollutants, gases, and moisture from degrading the quality and freshness of the packed items. This contributes to maintaining product integrity across the supply chain and extending the shelf life of perishable goods.

The market is significantly influenced by technological progress, which results in the creation of creative polypropylene packaging options. To improve customer convenience, manufacturers are using features including resealable closures, simple-to-open designs, and microwave-safe packaging. Additionally, these developments allow for vivid printing, transparency, and a variety of sizes and forms, which aid in successful product differentiation and branding.

Global Polypropylene Food and beverage packaging Market Drivers:

Polypropylene Packaging Ensures Food Safety and Hygiene with Barrier Properties and Contamination Prevention:

- Consumption of packaged food and drinks has significantly increased as a result of urbanization, changing lifestyles, and rising customer desire for convenience. Packaging made of polypropylene has several benefits, including being lightweight, strong, and having great barrier qualities, which makes it the perfect material for food and beverage packaging. There is a rising demand for eco-friendly packaging materials due to rising environmental awareness and laws supporting sustainable packaging. Many food and beverage firms utilize polypropylene because it is a recyclable material that is simple to manufacture and repurpose. In the food and beverage sector, cleanliness and food safety are top priorities. Excellent barrier characteristics of polypropylene packaging help to keep contaminants out and the items' freshness intact. The integrity and security of packaged foods and drinks are ensured by their resistance to moisture, chemicals, and temperature changes.

The Benefits of Polypropylene Packaging in the Food and Beverage Industry:

- Innovative polypropylene packaging solutions have been created as a result of ongoing improvements in packaging technology. To improve customer convenience and product distinction, manufacturers are introducing features like resealable closures, simple-to-open designs, and microwave-safe packaging. When it comes to product branding and drawing customers' attention to products on shop shelves, packaging is essential. Polypropylene packaging provides design flexibility, enabling elegant and eye-catching package solutions. It offers choices for vivid printing, transparency, and a range of sizes and forms, allowing for efficient branding and product distinction. Compared to alternatives like glass or metal, polypropylene is a more affordable choice for packaging. Because it is lightweight and simple to create, food and beverage industries may save money on shipping costs.

Global Polypropylene Food and beverage packaging Market Challenges:

Polypropylene packaging has difficulties as sustainability and environmental issues gain attention. Although polypropylene is a recyclable material, infrastructure has to be improved to assure efficient recycling of old packaging. Additionally, the usage of specific kinds of polypropylene packaging may be constrained by changing legislation about plastic waste and single-use plastics, necessitating manufacturer adaptation. Manufacturers may face difficulties as a result of the price volatility of polypropylene resin, a crucial raw material used in packaging production. Resin price fluctuations may affect package manufacturing costs and profit margins. Manufacturers must carefully control the cost of raw materials and investigate methods to lessen the effects of price changes. Alternative packaging materials including paper, metal, and biodegradable materials compete with polypropylene packaging. Each material has a unique set of benefits and could be favored in particular applications. To be competitive in the market, producers of polypropylene packaging must highlight the distinctive advantages of their goods, such as durability, barrier qualities, and affordability.

COVID-19 Impact on the Global Polypropylene Food and beverage packaging Market:

The need for packaged food and beverages has significantly increased as a result of lockdowns, social distance-increasing measures, and changes in consumer behavior. Because of its convenient packaging, extended shelf life, and perceived safety, consumers gravitated toward packaged goods. To secure and preserve the goods, there was a growing need for polypropylene packaging. Food safety and hygiene problems have increased as a result of the epidemic. Consumers are becoming more aware of the materials used in food and beverage packaging. Because of its superior barrier qualities and resistance to pollutants and moisture, polypropylene packaging has emerged as a popular option for preserving the quality and safety of products. Similar to many other sectors, the polypropylene food and beverage packaging industry encountered supply chain interruptions as a result of lockdown procedures, transportation limitations, and labor shortages. Due to these delays in production and difficulties obtaining raw materials, packaging supplies were less readily available and couldn't be delivered on time.

Global Polypropylene Food and beverage packaging Market Recent Developments:

- In February 2022, Amcor created sustainable packaging options based on polypropylene, with an emphasis on lowering the environmental effect of food and beverage packaging. They have created cutting-edge polypropylene packaging with improved recycling and less carbon impact.

- In January 2022, Berry Global introduced a range of polypropylene packaging products, including flexible films and environmentally friendly rigid containers for use in the food and beverage industry. To suit market expectations, these advances intended to offer packaging choices that were lightweight, strong, and ecologically beneficial.

- In August 2021, For the food and beverage business, Mondi introduced several packaging options based on polypropylene. Innovative polypropylene films with superior barrier qualities, moisture resistance, and extended shelf life for perishable goods were among their innovations.

Global Polypropylene Food and beverage packaging Market Segmentation:

GLOBAL POLYPROPYLENE FOOD AND BEVERAGE PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.56% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor Plc, Berry Global Inc., Sealed Air Corporation, Huhtamaki Group, Sonoco Products Company, DS Smith Plc, Mondi Group, Coveris Holdings S.A., RPC Group Plc, Silgan Holdings Inc. |

Global Polypropylene Food and beverage packaging Market Segmentation: By Type

-

Rigid Packaging

-

Flexible Packaging

-

Cups and Containers

-

Trays and Clamshells

-

Lids and Closures

-

Others

Containers, bottles, jars, and trays that preserve their form and structure are referred to as rigid polypropylene packaging. Products that need to be protected from external elements including moisture, gases, and physical harm frequently come in rigid packaging. It offers toughness and durability to maintain the quality of food and beverage items. Films, pouches, bags, and wraps made of flexible polypropylene are readily bent or folded. Flexible packaging is adaptable in terms of size, shape, and convenience elements like resealable closures and simple opening procedures. It enables effective storage, transportation, and portioning of a variety of food and beverage goods. For food and beverage applications such as ready-to-eat meals, salads, soups, yogurt, and drinks, polypropylene cups, and containers are frequently utilized. These cups and containers are microwave-safe, lightweight, and very clear for improved product visibility. Fresh fruit, bakery goods, deli foods, and snacks are all packaged in polypropylene clamshells and trays. They provide consumers with convenience, visibility, and product protection. Lids and closures made of polypropylene are crucial parts of the packaging for jars, bottles, and other containers. They guarantee consumer convenience, tamper-evident features, and product freshness.

Global Polypropylene Food and beverage packaging Market Segmentation: By Application

-

Food Packaging

-

Beverage Packaging

-

Food Service and Catering

-

Others

For ready-to-eat meals, polypropylene packaging is frequently utilized, including microwaveable trays and containers. Snacks, chocolates, candies, and other confectionery products are frequently packaged in polypropylene films and bags. Fruits, vegetables, and salads benefit from polypropylene films and containers that help keep them fresh and increase their shelf life. Milk, yogurt, butter, cheese, and other dairy products are packaged in polypropylene. Meat, poultry, and seafood goods are packaged in polypropylene films and trays to ensure their safety and hygienic handling. Water bottles are frequently made with polypropylene because of their strength and low weight. For the packaging of carbonated drinks, juices, sports drinks, and other non-alcoholic beverages, polypropylene bottles, cups, and closures are used. Alcoholic drinks including beer, wine, and spirits are packaged using polypropylene products like bottles, caps, and labels. The food sector uses polypropylene containers, cups, and lids for takeout and delivery services.

Global Polypropylene Food and beverage packaging Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

The industry in the Asia-Pacific region is fuelled by strict laws governing food safety and sustainability, as well as by rising consumer demand for prepared meals and convenience. The market in this region is also driven by an increase in packaged food and beverage consumption, a growing urban population, changing lifestyles, and rising disposable incomes. The growing middle class, urbanization, and rising acceptance of contemporary retail formats are the main market drivers in this area and include nations that are part of both the African continent and the Middle East. The market in the region is impacted by the expanding packaged food and beverage sector, quick urbanization, and the developing food and beverage industry.

Global Polypropylene Food and beverage packaging Market Key Players:

-

Amcor Plc

-

Berry Global Inc.

-

Sealed Air Corporation

-

Huhtamaki Group

-

Sonoco Products Company

-

DS Smith Plc

-

Mondi Group

-

Coveris Holdings S.A.

-

RPC Group Plc

-

Silgan Holdings Inc.

Chapter 1. Polypropylene Food and beverage packaging Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Polypropylene Food and beverage packaging Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Polypropylene Food and beverage packaging Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Polypropylene Food and beverage packaging Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Polypropylene Food and beverage packaging Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Polypropylene Food and beverage packaging Market - By Type

6.1 Rigid Packaging

6.2 Flexible Packaging

6.3 Cups and Containers

6.4 Trays and Clamshells

6.5 Lids and Closures

6.6 Others

Chapter 7. Polypropylene Food and beverage packaging Market - By Application

7.1 Food Packaging

7.2 Beverage Packaging

7.3 Food Service and Catering

7.4 Others

Chapter 8. Polypropylene Food and beverage packaging Market - By Region

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Rest of the World

Chapter 9. Polypropylene Food and beverage packaging Market - Key Players

9.1 Amcor Plc

9.2 Berry Global Inc.

9.3 Sealed Air Corporation

9.4 Huhtamaki Group

9.5 Sonoco Products Company

9.6 DS Smith Plc

9.7 Mondi Group

9.8 Coveris Holdings S.A.

9.9 RPC Group Plc

9.10 Silgan Holdings Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Polypropylene food and beverage packaging Market was estimated at USD 3.03 Billion in 2022 and is anticipated to be a value of USD 4.01 Billion by 2030, growing at a fast CAGR of 3.56% during the forecast period 2023-2030.

The Global Polypropylene food and beverage packaging Market is driven by Increasing Demand for Packaged Food and Beverages, Growth of E-commerce and Online Food Delivery, Focus on Sustainability and Environmental Regulations, and Safety and Hygiene Concerns.

The Segments under the Global Polypropylene food and beverage packaging Market by the application are Food Packaging, Beverage Packaging, Food Service and Catering, and Others.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Polypropylene food and beverage packaging Market.

Amcor Plc, Berry Global Inc., and Sealed Air Corporation are the three major leading players in the Global Polypropylene food and beverage packaging Market.