Polyols in Animal Feed Market Industry Market size (2024 - 2030)

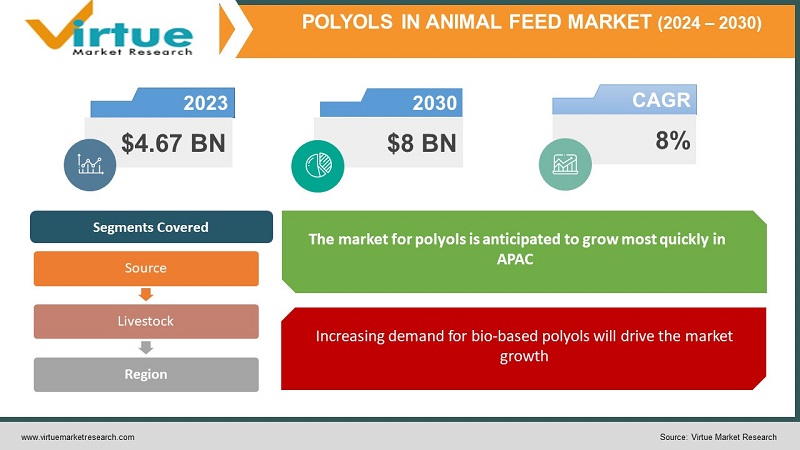

Global Polyols in Animal Feed Market is valued at USD 4.67 Billion in 2023 and is projected to reach a market size of USD 8 Billion by 2030. The market is projected to grow with a CAGR of 8% per annum during the period of analysis (2024 - 2030).

Industry Overview

Food components classified as food-grade polyols are frequently found in a variety of fermented food products. They are a crucial component in the creation of many culinary products. The production of polyols involves the hydrogenation or fermentation of several types of carbohydrates. The rise in the volume of consumption of these products by the pharmaceutical industry is one of the key factors anticipated to propel the growth of the market for food-grade polyols during the forecast period. Additionally, the market for food-grade polyols is expected to develop as a result of people's growing interest in craft beer and other alcoholic beverages. In addition, expanding export markets in developing nations is a result of improved trade laws, economic expansion, and demographic trends.

The market for food-grade polyols is expected to experience a slow expansion over the forecast period due to increased awareness of the harmful effects of excessive polyol consumption. Additionally, the rising demand for this product made from molasses and sugarcane will likely create more prospects for the market for food-grade polyols to expand during the ensuing years. The market for food-grade polyols may face more challenges shortly due to the severe rules on the use of polyols.

Impact of Covid-19 on the Industry

There are significant medical, societal, and economic issues as a result of the COVID-19 pandemic. The feed industry is focused on producing healthy goods for animals utilizing feed additives to prevent diseases by giving immune support, just as the medical community is focused on generating effective diagnostic and medical treatments.

The global market was seen to experience a fall in 2020 as a result of the COVID-19 pandemic epidemic spreading to more regions and countries, lockdowns in various nations, closure of international borders, and delays in cross-border transit that have hampered the supply chain. The number of persons who can cooperate in small areas is constrained by social isolation and other measures adopted by regional governments. As a result, the COVID-19 pandemic had a significant negative impact in 2020, which was reflected in the market growth for feed additives. In the years ahead, up until 2026, the market for feed additives would gradually experience a minor increase as the constraints of government policies are projected to diminish.

Market Drivers

Increasing demand for bio-based polyols will drive the market growth

The growing desire for environmentally friendly items has raised the market for goods made of renewable polyurethanes. These days, polyurethane foams for automotive applications are made from natural oil polyols (NOPs), the same raw materials that are used to manufacture alkyd paints. Given that they share the same structural and physical characteristics as existing polyols and are made from sustainable raw materials, bio-based polyols can be used in place of them. In terms of sustainability and a decrease in reliance on petroleum, materials generated from plants have several advantages over traditional polyols. Additionally, several big corporations are experimenting with the development and marketing of bio-based polyols to take advantage of the future potential of these polyols in response to regulatory authorities' rising demand to use environmentally friendly products.

An increase in demand and consumption of livestock-based products will drive the market growth

The demand for and consumption of livestock-based goods like dairy and dairy-based products, meat, and eggs is predicted to rise, which will raise the need for feed additives to support farm animals' growth and development. Due to its great demand, low production costs, and low product pricing in both developed and emerging nations, poultry meat is the main factor driving the expansion of global meat production. Furthermore, there is a growing preference for animal-sourced protein in the form of either meat, eggs, or milk as a result of increased knowledge about the dynamics of food nutrients, particularly protein, on total physical and mental growth and development. This encourages the use of feed additives since it improves the nutritional value of the feed.

Market Restraints

Volatile prices of raw materials

Polyurethane polyols are made using the main intermediate chemicals or raw ingredients such as propylene oxide, ethylene oxide, adipic acid, and carboxylic acid. The production process leading to finished polyurethane goods is immediately impacted by any change in the price of these essential raw materials. The majority of these raw materials are derivatives of petroleum and are therefore susceptible to changes in commodity prices. The price of oil has been very erratic. This has mostly been caused by rising global demand and Middle East geopolitical upheaval in recent years. The supply of ethylene oxide and propylene oxide was constrained as a result of the volatility in crude oil prices.

POLYOLS IN ANIMAL FEED MARKET INDUSTRY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Source, Livestock, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE (Germany), Covestro AG (Germany), Royal Dutch Shell Plc (Netherlands), The Dow Chemical Company (US), Mitsui Chemicals (Japan), Wanhua Chemicals Group (China), LANXESS AG (Germany), Huntsman Corporation (US), Stepan Company (US), Repsol SA (Spain) |

Global Polyols in Animal Feed Market- By Source

-

Sugarcane

-

Molasses

-

Grains

-

Fruits

Based on the Source of production, the global polyols in the animal feed market are segmented into sugarcane, molasses, grains, and fruits. The sugarcane segment is projected to grow with the highest CAGR during the period of analysis. This is due to the mass production of sugarcane and the low cost of production.

Global Polyols in Animal Feed Market- By Livestock

-

Poultry

-

Ruminants

-

Swine

-

Aquatic animals

-

Other livestock (equine and pet food)

According to livestock, the poultry segment is anticipated to be the largest and expanding the fastest in the market for feed additives. Demand for chicken feed additives is rising as a result of growing customer demand for a particular color of meat and yolk and growing worries about animal health.

Global Polyols in Animal Feed Market- By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

During the forecast period, the market for polyols is anticipated to grow most quickly in APAC. China, Japan, India, South Korea, Thailand, Indonesia, and the Rest of APAC make up the APAC region. Due to rising consumer spending and income levels, the region's expanding automotive, electronic & electrical, and construction industries are likely to help drive up demand for polyols. Building panels, doors, windows, foam for vehicle seats, furniture, and carpets used in the building and automotive industries are all frequently made with polyols.

Global Polyols in Animal Feed Market- By Companies

-

BASF SE (Germany)

-

Covestro AG (Germany)

-

Royal Dutch Shell Plc (Netherlands)

-

The Dow Chemical Company (US)

-

Mitsui Chemicals (Japan)

-

Wanhua Chemicals Group (China)

-

LANXESS AG (Germany)

-

Huntsman Corporation (US)

-

Stepan Company (US)

-

Repsol SA (Spain)

NOTABLE HAPPENINGS IN THE GLOBAL POLYOLS IN ANIMAL FEED MARKET IN THE RECENT PAST:

-

Product Launch: - In 2021, A new item called KemTRACE Chromium-OR, a chromium propionate feed additive for swine, cattle, broiler, and horse diets, was introduced by Kemin Industries.

-

Product Launch: - In 2021, ADM introduced NutriPass L, an encapsulated lysine supplement that is available to cows through their digestive tracts and is rumen-stable. NutriPass gives breastfeeding cows and growing cattle a steady and regular source of metabolizable lysine through efficient encapsulation.

-

businessesss Collaboration: - In 2019, For the US and Canadian distribution of its polyurethane goods, BASF SE worked with Azelis Americas, LLC (US). The company will benefit from this agreement by expanding its distribution network in these two nations.

Chapter 1.GLOBAL POLYOLS IN ANIMAL FEED MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.GLOBAL POLYOLS IN ANIMAL FEED MARKET– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.GLOBAL POLYOLS IN ANIMAL FEED MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.GLOBAL POLYOLS IN ANIMAL FEED MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL POLYOLS IN ANIMAL FEED MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.GLOBAL POLYOLS IN ANIMAL FEED MARKET– By Source

6.1. Sugarcane

6.2 Molasses

6.3. Grains

6.4. Fruits

Chapter 7.GLOBAL POLYOLS IN ANIMAL FEED MARKET– By Livestock

7.1. Poultry

7.2. Ruminants

7.3. Swine

7.4. Aquatic animals

7.5. Other livestock (equine and pet food)

Chapter 8. GLOBAL POLYOLS IN ANIMAL FEED MARKET– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9.GLOBAL POLYOLS IN ANIMAL FEED MARKET– Key Players

9.1. BASF SE (Germany)

9.2. Covestro AG (Germany)

9.3. Royal Dutch Shell Plc (Netherlands)

9.4. The Dow Chemical Company (US)

9.5. Mitsui Chemicals (Japan)

9.6. Wanhua Chemicals Group (China)

9.7. LANXESS AG (Germany)

9.8. Huntsman Corporation (US)

9.9. Stepan Company (US)

9.9. Repsol SA (Spain)

Download Sample

Choose License Type

2500

4250

5250

6900