Global Polyolefin Polystyrene Foam Market Size (2024 – 2030)

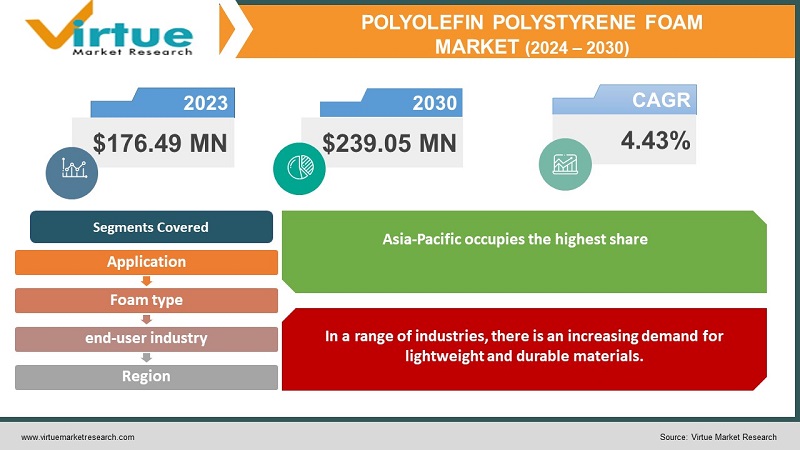

According to the report published by Virtue Market Research in Global Polyolefin Polystyrene Foam Market was valued at USD 176.49 million and is projected to reach a market size of USD 239.05 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.43%.

Growing uses in numerous industries, such as packaging, furniture, bedding, and automotive, are likely to fuel polymer foam demand. Polymer foams are exceedingly lightweight and adaptable, as well as being extremely durable, mildew resistant, and dermatologically friendly.

Boburethane (PU) foams are long-lasting, lightweight, adaptable, resistant to corrosion and vibration, recyclable, and provide a great degree of geometric flexibility. PU foams are increasingly being used in automobile seat cushions. Gasket seals, armrests, headrests, cushioned instrument panels, airbags, and other components are used to build lightweight, fuel-efficient, and long-lasting constructions.

The environmental advantages of polymer foam include high recyclability, clean incineration for pollution removal, less waste, and increased sustainability. Man governments and federal authorities are increasingly worried, about the impact of isocyanates on health particularly about their use in the production of polyurethane. The development of bio-based polyols and nontoxic isocyanates represents an advancement that is anticipated to drive the demand, for polymer foams across various applications.

Key Market Insights:

In the coming years, there is a growth, in the demand for polyolefin polystyrene foam in emerging markets like China and India at a CAGR of 6.5%. This can be attributed to the development and urbanization in these countries, which is driving the need for lightweight and long-lasting materials, across various industries.

The share of EVs, in light vehicle sales globally, rose to 8.3% in 2021 compared to 4.2% recorded the year before. Due, to these factors it is expected that the global polyolefin foam market will experience growth throughout the projected timeframe.

Polyolefin polystyrene foam has become highly sought after, in the industry because of its nature and durability. It finds application in components like seat cushions, headliners, and door panels.

The market, for polyolefin polystyrene foam is projected to experience growth in developed regions like the United States and Europe. The demand is expected to increase by 5.5% during the forecast period.

In the construction industry polyolefin polystyrene foam is gaining popularity due to its insulation and acoustic properties. It serves purposes in construction applications such as roofing, wall insulation, and underlayment.

Looking ahead future market growth is expected to be driven by technologies, like flame retardant polyolefin polystyrene foam.

Polyolefin Polystyrene Foam Market Drivers:

In a range of industries, there is an increasing demand for lightweight and durable materials.

Polyolefin polystyrene foam is a durable material that finds applications, across industries including packaging, construction, automotive, and electronics. It is also commonly used in consumer goods like toys, sports equipment, and kitchenware.

The growing demand for long-lasting materials in sectors plays a crucial role in driving the market for polyolefin polystyrene foam. For instance, it is widely employed in packaging to safeguard products during transportation and handling while also providing insulation to maintain freshness. In the construction industry, it helps insulate buildings for energy efficiency and serves as an option for creating durable yet lightweight building components such as roofing panels and wall insulation. Additionally, the automobile sector benefits from this material by utilizing it to manufacture car parts, like seat cushions, headliners, and door panels.

Emerging markets' construction and packaging sectors are expanding.

In growing economies, like China, India, and Brazil there is an increase in the building and packaging sectors. The expanding population and urban development in these countries are the factors behind this growth. The polyolefin polystyrene foam industry is particularly influenced by the expanding construction and packaging industries, in these emerging regions.

Polyolefin polystyrene foam finds application, in the construction industry to enhance building insulation and energy efficiency. Additionally, it is employed in fabricating lightweight building elements such, as roofing panels and wall insulation. The packaging sector utilizes polyolefin polystyrene foam to safeguard products from damage during transportation and handling while also providing insulation to maintain product freshness.

In developing countries, disposable income and living standards are rising.

Disposable income and living standards are, on the rise in developing nations leading to an increased desire for consumer goods like toys, athletic equipment, and household items. The market for polyolefin polystyrene foam is benefiting from this trend since it is widely used in a variety of consumer products. Overall the growing disposable income and improved living standards in developing countries are fueling the demand, for polyolefin polystyrene foam.

Polyolefin Polystyrene Foam Market Challenges:

The fluctuating prices of materials, like polyethylene (PE) and polypropylene (PP) which are used to manufacture polyolefin foam, have an impact on the growth of the market. When raw material prices suddenly surge it puts pressure on companies. Reduces profitability within the industry.

Polyolefin foam manufacturers face challenges in establishing pricing strategies due to the nature of raw material costs. Abrupt and unforeseen changes, in these costs can lead to pricing instability in the products. This makes it difficult to maintain profit margins and competitive pricing in the market ultimately posing a risk to market positioning and overall profitability.

Polyolefin Polystyrene Foam Market Opportunities:

Material Technology Advances- Ongoing research and development activities are likely to produce innovative polymer foam compositions with improved qualities and broader uses, resulting in new growth prospects throughout the forecast period.

The rising construction sector, particularly in developing nations, presents enormous prospects for polymer foam applications in insulation, roofing, and structural components. Polymer foams are being used in construction projects because of the increased demand for energy-efficient and lightweight materials.

POLYOLEFIN POLYSTYRENE FOAM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.43% |

|

Segments Covered |

By Foam type, end-user industry, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arkema Group, Armacell International S.A., BASF SE, Borealis AG, Fritz Nauer AG, Koepp Schaum GmbH, JSP Corporation, Polymer Technologies, Inc., Recticel NV, Rogers Corporation |

Polyolefin Polystyrene Foam Market Segmentation: By Foam type

-

Polyethylene (PE) foam

-

Polypropylene (PP) foam

-

Ethylene vinyl acetate (EVA) foam

In 2022, based on market segmentation by foam type, Polyethylene (PE) foam occupies the highest share of about 60% in the market. It is well-known for its lightweight, long-lasting, and water-resistant qualities. Ethylene vinyl acetate (EVA) foam, known as the expanding type of polyolefin polystyrene foam is expected to experience a compound annual growth rate (CAGR) exceeding 6% within the projected timeframe. EVA foam is well-liked for its softness, flexibility, and ability to absorb shocks.

Polyolefin Polystyrene Foam Market Segmentation: By end-user industry

-

Packaging

-

Automotive

-

Construction

-

Footwear

-

Bedding and furniture

-

Other end-user industries

In 2022, based on market segmentation by end-user industry, packing occupies the highest share of about 30% in the market. It is well-known for being lightweight, robust, and water-resistant. Construction is the fastest-growing end-user market for polyolefin polystyrene foam, with a CAGR of more than 5% projected during the projection period. Construction industry growth in emerging regions is fuelling demand for polyolefin polystyrene foam in this area.

Polyolefin Polystyrene Foam Market Segmentation: By application

-

Thermal insulation

-

Impact protection

-

Soundproofing

-

Buoyancy

-

Cushioning

-

Other applications

In 2022, based on market segmentation by application, Thermal insulation occupies the highest share of about 50% in the market. Impact protection is the fastest-growing use of polyolefin polystyrene foam, with a CAGR of more than 6% projected for the forecast period. The growing demand for lightweight and long-lasting impact protection materials in a range of industries is propelling this application forward.

Polyolefin Polystyrene Foam Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, based on market segmentation by region, Asia-Pacific occupies the highest share of about 40% of the market. Strong economic expansion and urbanization in Asia-Pacific emerging economies such as China and India are increasing the demand for polyolefin polystyrene foam in the region. In Asia-Pacific, polyolefin polystyrene foam is utilized in a range of industries, including packaging, construction, and automobile.

South America is the fastest-growing area in the polyolefin polystyrene foam market. During the projection period, it is expected to increase at a CAGR of more than 6%. South America's growing construction and packaging sectors are pushing up demand for polyolefin polystyrene foam. In South America, polyolefin polystyrene foam is utilized in a range of construction applications such as insulation, roofing, and underlayment.

COVID-19 Impact Analysis on the Global Polyolefin Polystyrene Foam Market:

The outbreak caused a significant decline in demand in many industries, including automobile, construction, and consumer goods. Movement restrictions, economic uncertainty, and decreased consumer spending all had an influence on the market for polyolefin foam products in a variety of applications. The need for foam materials in the automotive industry, in particular, has decreased dramatically.

Latest Trends/ Developments:

Polyolefin foam is widely utilized in the industry as a material, for ceilings and sound absorption. It finds applications in components like bumpers, body panels, trims, dashboards, door claddings, climate control systems, cooling systems, air intake manifolds, and battery cases. The global automotive industry is continuously striving to reduce the weight of vehicles as it leads to enhanced fuel efficiency and improved performance. Polyolefin foams offer a solution for achieving this objective by being used in both private vehicles. They are extensively employed in buses, coaches, and other larger vehicles to help reduce their weight.

As per OICA data for 2021 worldwide motor vehicle production increased from 777.11 million units in 2020 to 801.45 million units in 2021 – a growth of over 3%. Among the vehicle manufacturers globally were China, the United States, Japan, India, South Korea Germany, and Mexico.

According to EV Volumes statistics for 2021; vehicle (EV) sales reached an impressive figure of 6.75 million units – marking a staggering growth of 108% compared to the previous year's sales of around 3.24 million. Because of these factors, it is expected that the global polyolefin foam market will experience growth throughout the projected timeframe.

Key Players:

-

Arkema Group

-

Armacell International S.A.

-

BASF SE

-

Borealis AG

-

Fritz Nauer AG

-

Koepp Schaum GmbH

-

JSP Corporation

-

Polymer Technologies, Inc.

-

Recticel NV

-

Rogers Corporation

Chapter 1. Polyolefin Polystyrene Foam Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Polyolefin Polystyrene Foam Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Polyolefin Polystyrene Foam Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Polyolefin Polystyrene Foam Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Polyolefin Polystyrene Foam Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Polyolefin Polystyrene Foam Market– By Foam type

6.1 Introduction/Key Findings

6.2 Polyethylene (PE) foam

6.3 Polypropylene (PP) foam

6.4 Ethylene vinyl acetate (EVA) foam

6.5 Y-O-Y Growth trend Analysis By Foam type

6.6 Absolute $ Opportunity Analysis By Foam type, 2024-2030

Chapter 7. Polyolefin Polystyrene Foam Market– By End-user industry

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Automotive

7.4 Construction

7.5 Footwear

7.6 Bedding and furniture

7.7 Other end-user industries

7.8 Y-O-Y Growth trend Analysis By End-user industry

7.9 Absolute $ Opportunity Analysis By End-user industry, 2024-2030

Chapter 8. Polyolefin Polystyrene Foam Market– By Application

8.1 Introduction/Key Findings

8.2 Thermal insulation

8.3 Impact protection

8.4 Soundproofing

8.5 Buoyancy

8.6 Cushioning

8.7 Other applications

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Polyolefin Polystyrene Foam Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Foam type

9.1.3 By End-user industry

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Foam type

9.2.3 By End-user industry

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Foam type

9.3.3 By End-user industry

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 ByFoam type

9.4.3 By End-user industry

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 ByFoam type

9.5.3 By End-user industry

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Polyolefin Polystyrene Foam Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Good Shepherd Convent (Baguio City, Philippines)

10.2 Eng Bee Tin (Manila, Philippines)

10.3 Mamita's (Quezon City, Philippines)

10.4 House of Polvoron (Manila, Philippines)

10.5 Red Ribbon (Philippines, with international locations)

10.6 Goldilocks (Philippines, with international locations)

10.7 Rodilla's Yema Cake (Taguig City, Philippines)

10.8 Barrio Fiesta (Philippines, with international locations)

10.9 Kusina ni Maria (Antipolo City, Philippines)

10.10 Violet Crumble (Australia, known for Ube Halaya products)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

According to the report published by Virtue Market Research in Global Polyolefin Polystyrene Foam Market was valued at USD 176.49 million and is projected to reach a market size of USD 239.05 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.43%.

In a range of industries, there is an increasing demand for lightweight and durable materials, Emerging markets' construction and packaging sectors are expanding, In developing countries, disposable income, and living standards are rising are the Global Polyolefin Polystyrene Foam Market Drivers.

Automotive, Construction, Packaging, Footwear, Bedding and furniture, and other end-user industries are the segments under the Global Polyolefin Polystyrene Foam Market by end-user industries.

Asia-Pacific is the most dominant region for the Global Polyolefin Polystyrene Foam Market.

South America is the fastest-growing region in the Global Polyolefin Polystyrene Foam Market.