Polymer Ultrafiltration Membranes Market Size (2024 – 2030)

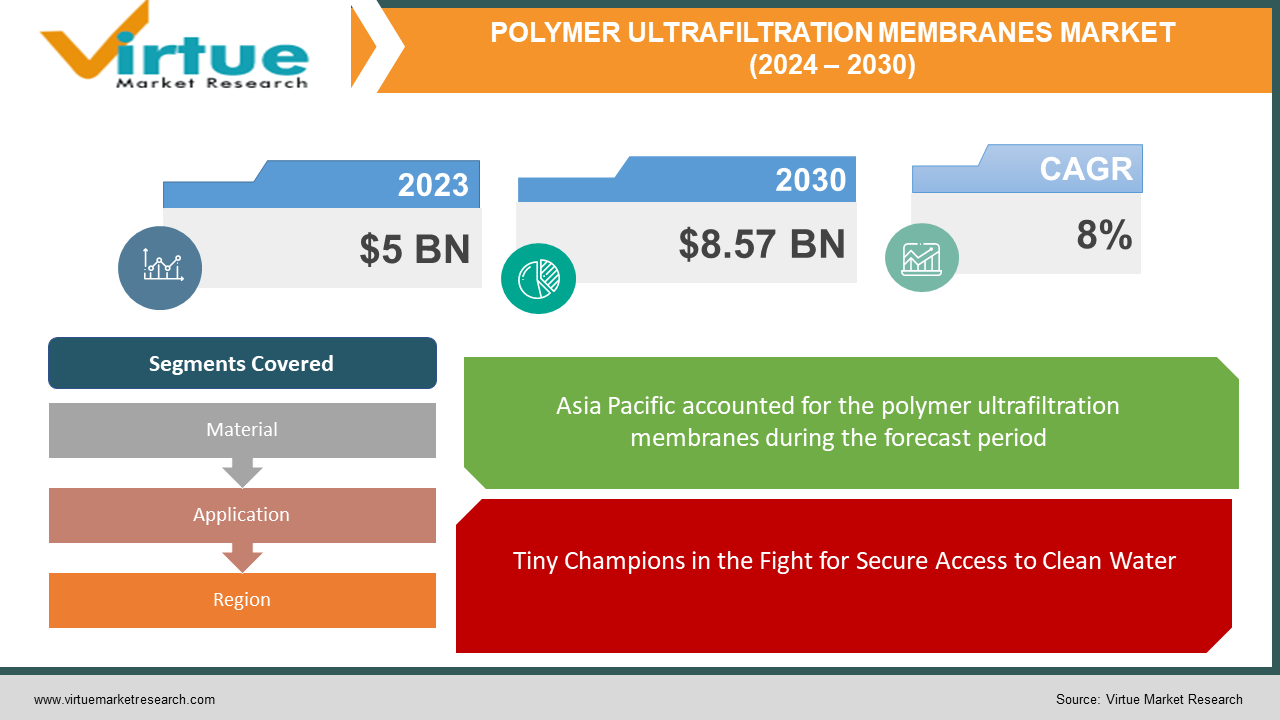

The global Polymer Ultrafiltration membrane market size was exhibited at USD 5 billion in 2023 and is projected to hit around USD 8.57 billion by 2030, growing at a CAGR of 8% during the forecast period from 2024 to 2030.

Polymer ultrafiltration membranes serve as microscopic sieves in the purification of water. They are made from adaptable polymers such as polysulfone and polyamide. These membranes are useful instruments in a variety of sectors because they exclude undesirable particles and pollutants. Ultrafiltration is essential for a variety of processes, including the treatment of wastewater and municipal water, as well as the production of semiconductors, food, and pharmaceuticals. The market for these membranes is expected to develop significantly in the upcoming years as laws tighten and the need for clean water increases.

Key Market Insights:

Due to several important elements coming together, the market for polymer ultrafiltration membranes is expected to grow soon. First off, the world's clean water resources are under tremendous pressure due to the constantly expanding population. By functioning as tiny sieves to filter impurities and turn water into a safe and useable resource for industrial and drinking uses, polymer ultrafiltration membranes provide a potent answer. Second, more stringent wastewater treatment laws are being passed by governments across the globe. Once more, these membranes come to the rescue by offering a productive and affordable method of treating wastewater and guaranteeing that it complies with the most recent environmental regulations. Thirdly, a wide range of sectors are rapidly implementing ultrafiltration technology. These membranes demonstrate their worth and versatility in a variety of applications, from guaranteeing the safety of food and beverages to upholding the strict purity standards in the production of pharmaceuticals and semiconductors. This combination of factors—increasing industry use, more stringent regulations, and rising clean water demand—is anticipated to drive the market ahead. To improve the effectiveness and performance of these membranes and maintain their dominant positions in this thriving market, industry leaders are actively investing in R&D. Overall, polymer ultrafiltration membranes seem to have a promising future because of their potential to meet pressing demands for clean water, ethical wastewater treatment, and cutting-edge industrial procedures.

Global Polymer Ultrafiltration Membranes Market Drivers:

Ultrafiltration Membranes: Tiny Champions in the Fight for Secure Access to Clean Water

Our freshwater resources are under threat from an increasing number of people and expanding enterprises. Traditional sources are under stress as more people use water for drinking and sanitation and as industries need it for manufacturing. Ultrafiltration membranes come to the rescue, thank goodness. By filtering out impurities, these tiny screens turn shady sources of water into pure water fit for drinking and other industrial uses. They are revolutionary in producing food and beverages, pharmaceuticals, and even chips because they effectively purify huge volumes without wasting any. Ultrafiltration membranes will be even more important in ensuring clean water for future generations as the demand for freshwater increases.

Ultrafiltration Membranes: A Solution to Wastewater Problems Aid Us in Adhering and Preserving

Regulating our wastewater problems is on the way! Polluting the environment and harbouring dangerous contaminants is untreated wastewater. More stringent government restrictions are being implemented to counter this, restricting the quantity of toxins that can be released from wastewater. In this battle, ultrafiltration membranes serve as little allies. By eliminating impurities from wastewater, these effective filters guarantee that it complies with the new rules. Beyond merely adhering to regulations, the advantages encompass safeguarding environments from contamination and even preserving freshwater reserves through the repurposing of cleansed wastewater. In a world with ever-tougher rules, ultrafiltration membranes are an essential instrument for responsible wastewater treatment.

Global Polymer Ultrafiltration Membranes Market Restraints and Challenges:

Despite showing promise, there are certain obstacles in the way of the global market for polymer ultrafiltration membranes. One major obstacle is the high initial cost of investment. A significant upfront investment is needed for specialised membranes, pumps, and other equipment for setting up UF systems. Additionally, the energy-intensive routine cleaning and maintenance procedures needed to avoid membrane fouling raise operational costs. The small number of highly qualified workers needed to run and maintain these systems is another barrier. Because of the intricacies of UF technology, skilled workers are required to guarantee maximum effectiveness and performance. Wider commercial acceptance will depend on addressing these issues through developments in membrane technology to cut prices and provide user-friendly devices with less maintenance needs.

Global Polymer Ultrafiltration Membranes Opportunities:

There are a tonne of interesting prospects for the worldwide polymer ultrafiltration membranes market in the future. Innovation is one important field. The goal of current research and development is to create next-generation membranes with improved characteristics. Investigating novel materials with increased durability, better filtering efficiency, and reduced fouling rates is one way to do this. Additionally, developments in the incorporation of nanomaterials promise to produce membranes with increasingly finer separation capabilities, leading to more specialised applications. The growing desalination business offers another chance. Ultrafiltration membranes can be a vital component in desalination operations, providing a workable way to turn saltwater into freshwater that can be used as freshwater becomes scarcer. Lastly, developing nations have enormous possibilities for market expansion. The demand for clean water and efficient wastewater treatment will rise due to the areas' rapid urbanisation and increasing industrial activity, which will make polymer ultrafiltration membrane technology more widely accepted. With present issues resolved and opportunities taken advantage of, the global market for polymer ultrafiltration membranes is expected to have an amazing future.

POLYMER ULTRAFILTRATION MEMBRANES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M Company, Asahi Kasei Corporation Danaher Corporation, Dow Chemical Company, DuPont de Nemours, Inc. Honeywell International Inc., Hydranautics ,LG Chem Ltd., Pentair PLC, Toray Industries, Inc. |

Global Polymer Ultrafiltration Membranes Market Segmentation: By Material

-

Polysulfone (PSF)

-

Polyamide (PA)

-

Cellulose Acetate (CA)

-

Other Materials

Because of its low cost, excellent chemical resistance, and thermal stability, polysulfone (PSF) currently commands the largest market share. When compared to more recent materials, its growth rate might not be the fastest, though. The segment with the greatest growth potential is other materials. It consists of substances such as polyethersulfone (PES), polyacrylonitrile (PAN), and particularly innovative substances like nanocomposites. These more recent materials are appealing for a range of applications because they have higher filtering effectiveness, greater durability, and reduced fouling rates.

Global Polymer Ultrafiltration Membranes Market Segmentation: By Application

-

Water Treatment

-

Food and Beverage Processing

-

Pharmaceutical and Biotechnology

-

Semiconductor Manufacturing

-

Other Applications

Water treatment is now the market leader in the global polymer ultrafiltration membranes industry, driven by tighter regulations and an ever-increasing need for clean water. Still, the title of the fastest-growing category is up for grabs. While well-established applications such as pharmaceuticals and food and beverage processing continue to grow steadily, the Other Applications segment, which includes a wide range of industries like textiles and oil and gas treatment, is expected to experience significant growth because of ongoing advancements in membrane technology that are creating new and exciting opportunities for UF applications

Global Polymer Ultrafiltration Membranes Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region dominates the geographically segmented global market for polymer ultrafiltration membranes. This supremacy is the result of government programmes centred around water infrastructure, increasing industry, and population growth. North America has a well-established market, while Asia-Pacific is growing at a rapid pace due to more stringent laws and a greater need for clean water. The potential for desalination solutions, infrastructure investments, and rising environmental consciousness have led to promising developments across Europe, South America, the Middle East, and Africa. All things considered; this market seems to have a promising future worldwide.

COVID-19 Impact Analysis on the Global Polymer Ultrafiltration Membranes Market:

A brief shadow was cast on the global market for polymer ultrafiltration membranes by the development of COVID-19. Market expansion was hindered in the early stages of the epidemic by a slowdown in industrial activity and supply chain disruptions. Projects involving the treatment of water were delayed, and demand for certain non-essential applications dropped. The pandemic also brought up unanticipated possibilities. The need for clean water expanded because of the increased emphasis on cleanliness and hygiene, especially in healthcare facilities. During this crucial period, ultrafiltration membranes were essential in maintaining the purity of the water. New applications for UF membranes have also been made possible by research into wastewater treatment strategies to eliminate any virus residues in sewage systems. Long-term COVID-19 effects on the market for polymer ultrafiltration membranes are anticipated to be favourable as the world economy improves. Future market expansion is probably going to be driven by a renewed focus on water security and public health. It is anticipated that investments in water infrastructure projects and more stringent wastewater treatment standards would foster an atmosphere that is conducive to the ongoing deployment of ultrafiltration technology.

Recent Trends and Developments in the Global Polymer Ultrafiltration Membranes Market:

Innovation in membrane materials is one area of particular importance. The goal of research and development is to produce next-generation membranes with improved characteristics. Investigating cutting-edge materials like nanocomposites, which provide higher filtration effectiveness, enhanced durability, and reduced fouling rates, is one way to do this. These developments may result in less maintenance requirements, more effective water treatment procedures, and the ability of UF technology to handle novel separation problems. The application of modern manufacturing techniques is becoming more popular. The use of 3D printing technology by manufacturers to produce membranes with unique pore sizes and structures is growing. This enhances performance and efficiency by enabling customised filtration solutions for certain applications. Novel approaches to surface modification of membranes are being investigated to improve their antifouling capabilities, lower operating expenses, and increase membrane longevity. The increasing emphasis on sustainability is having an impact on market trends as well. Demand for energy-efficient UF processes is growing. Improved permeability membranes are being developed by manufacturers to enable lower operating pressures and lower energy use. Additionally, studies are being conducted to investigate recyclable and bio-based materials for membrane construction, encouraging a greener use of this technology. The global polymer ultrafiltration membranes market is poised to achieve notable advancements in efficiency, sustainability, and application versatility by leveraging these trends and developments. This will solidify the market's position as a crucial technology for a wide range of industrial processes, including the production of clean water and responsible wastewater treatment.

Key Players:

-

3M Company

-

Asahi Kasei Corporation

-

Danaher Corporation

-

Dow Chemical Company

-

DuPont de Nemours, Inc.

-

Honeywell International Inc.

-

Hydranautics

-

LG Chem Ltd.

-

Pentair PLC

-

Toray Industries, Inc.

Chapter 1. POLYMER ULTRAFILTRATION MEMBRANES MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. POLYMER ULTRAFILTRATION MEMBRANES MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. POLYMER ULTRAFILTRATION MEMBRANES MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. POLYMER ULTRAFILTRATION MEMBRANES MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. POLYMER ULTRAFILTRATION MEMBRANES MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. POLYMER ULTRAFILTRATION MEMBRANES MARKET – By Material

6.1 Introduction/Key Findings

6.2 Polysulfone (PSF)

6.3 Polyamide (PA)

6.4 Cellulose Acetate (CA)

6.5 Other Materials

6.6 Y-O-Y Growth trend Analysis By Material

6.7 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 7. POLYMER ULTRAFILTRATION MEMBRANES MARKET – By Application

7.1 Introduction/Key Findings

7.2 Water Treatment

7.3 Food and Beverage Processing

7.4 Pharmaceutical and Biotechnology

7.5 Semiconductor Manufacturing

7.6 Other Applications

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. POLYMER ULTRAFILTRATION MEMBRANES MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Material

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Material

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Material

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Material

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Material

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. POLYMER ULTRAFILTRATION MEMBRANES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 3M Company

9.2 Asahi Kasei Corporation

9.3 Danaher Corporation

9.4 Dow Chemical Company

9.5 DuPont de Nemours, Inc.

9.6 Honeywell International Inc.

9.7 Hydranautics

9.8 LG Chem Ltd.

9.9 Pentair PLC

9.10 Toray Industries, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Polymer Ultrafiltration Membranes Market size is valued at USD 5 billion in 2023.

The worldwide Global Polymer Ultrafiltration Membranes Market growth is estimated to be 8 % from 2024 to 2030.

The Global Polymer Ultrafiltration Membranes Market is segmented By Material (Polysulfone (PSF), Polyamide (PA), Cellulose Acetate (CA), and Other Materials), By Application (Water Treatment, Food and Beverage Processing, Pharmaceutical and Biotechnology, Semiconductor Manufacturing, Other Applications) and Region.

With trends like the development of next-generation membranes for better filtration and lower costs, integration of advanced manufacturing for customized solutions, and an increasing focus on sustainable practices with energy-efficient processes and bio-based materials, the global polymer ultrafiltration membranes market has enormous potential going forward.

Although the COVID-19 epidemic first slowed down demand and upset supply chains, it also brought attention to the need for clean water and wastewater treatment, which had a long-term positive effect on the market's focus on public health and water security.