Polymer Foams Market Size (2025 – 2030)

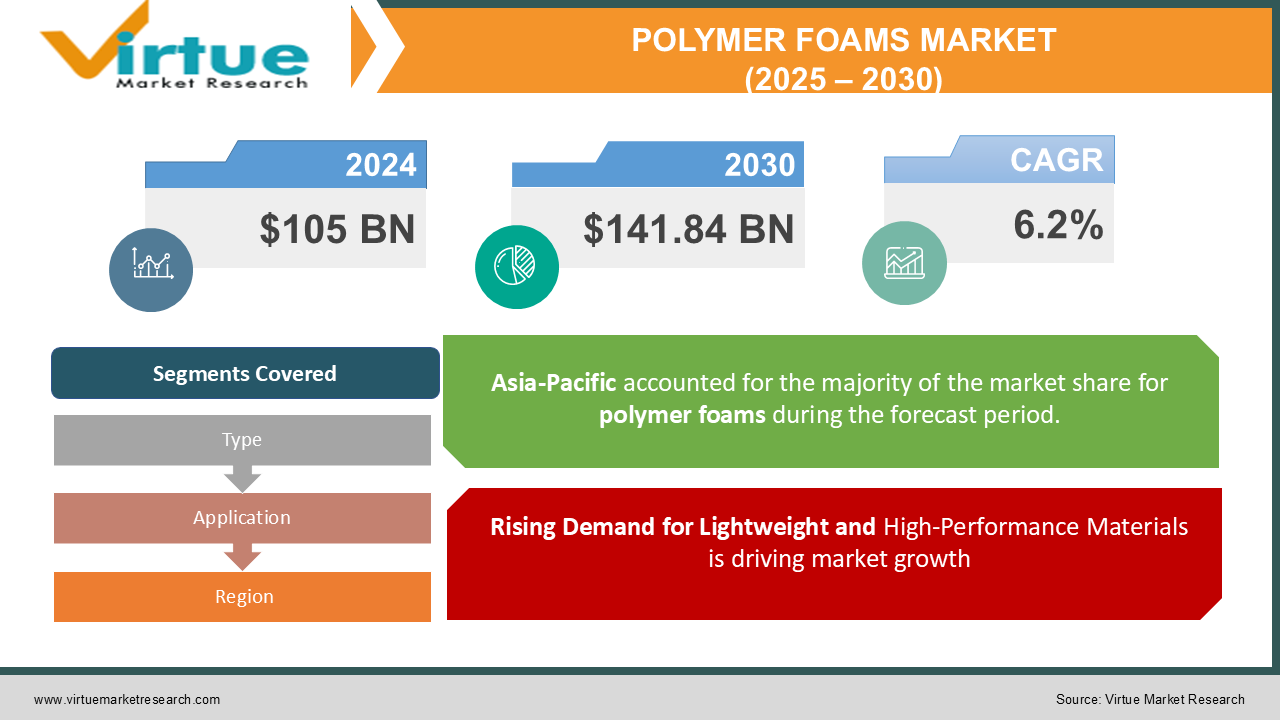

The Global Polymer Foams Market was valued at USD 105 billion in 2024 and will grow at a CAGR of 6.2% from 2025 to 2030. The market is expected to reach USD 141.84 billion by 2030.

The Polymer Foams Market focuses on lightweight, durable, and versatile foam materials widely used across industries such as packaging, automotive, construction, and furniture. These foams provide insulation, cushioning, and structural support, driving their demand across applications. The market growth is fueled by increasing infrastructure development, rising demand for lightweight automotive materials to improve fuel efficiency, and the growing use of polymer foams in packaging due to their protective properties.

Key Market Insights

-

The demand for polyurethane (PU) foams dominates the market, accounting for over 35% of total polymer foam consumption in 2024 due to their extensive use in furniture, construction, and automotive applications.

-

The Asia-Pacific region leads the market, contributing nearly 45% of global revenue in 2024, driven by rapid industrialization, urbanization, and high consumer demand for packaging and construction materials.

-

Rising demand for eco-friendly and biodegradable polymer foams is accelerating innovation, with bio-based foams projected to grow at a CAGR of 9.5% between 2025 and 2030.

-

The packaging industry remains a major consumer of polymer foams, accounting for 30% of global demand, with expanding e-commerce and food packaging sectors driving growth

Global Polymer Foams Market Drivers

Rising Demand for Lightweight and High-Performance Materials is driving market growth:

The demand for lightweight materials has surged across multiple industries, particularly in automotive, aerospace, and construction, where reducing weight enhances performance, fuel efficiency, and sustainability. Polymer foams offer an excellent combination of low density, high strength, and superior insulation, making them indispensable in these sectors. The automotive industry has been a significant driver of polymer foam adoption, as manufacturers strive to meet stringent fuel efficiency regulations and carbon emission targets by replacing heavy metal components with lightweight polymer-based alternatives. In aerospace, polymer foams are widely used for interior cabin components, offering durability and fire resistance without adding unnecessary weight. Additionally, the construction industry relies on polymer foams for thermal insulation, soundproofing, and shock absorption in modern building structures. With global initiatives to promote energy-efficient and sustainable construction materials, the demand for polymer foams is expected to continue growing, further propelling market expansion.

Expanding Applications in the Packaging Industry is driving market growth: Polymer foams have gained significant traction in the packaging industry due to their protective properties, cost-effectiveness, and ability to preserve product integrity during transportation. The rise of e-commerce and global trade has accelerated demand for innovative packaging solutions that ensure product safety while minimizing material usage and waste. Expanded polystyrene (EPS), polyethylene (PE) foams, and polyurethane (PU) foams are widely used in packaging applications ranging from food containers to fragile electronics and industrial equipment. The growing emphasis on sustainability has also led to the development of biodegradable and recyclable polymer foams, addressing environmental concerns while meeting regulatory standards. The shift towards sustainable packaging solutions, coupled with increasing consumer awareness of eco-friendly products, is expected to drive further adoption of polymer foams in the packaging industry.

Technological Advancements and Innovation in Foam Production is driving market growth: Advancements in foam manufacturing technologies have significantly improved the properties, sustainability, and cost-effectiveness of polymer foams, driving market growth. Innovations such as microcellular foaming, 3D printing, and nanocomposite-based foams have enabled the production of high-performance foams with enhanced mechanical properties and reduced environmental impact. The introduction of bio-based polymer foams, derived from renewable resources such as plant-based polyols, has gained traction among manufacturers and consumers seeking sustainable alternatives. Additionally, improvements in foam recycling technologies have helped reduce waste generation and comply with stringent environmental regulations. As research and development efforts continue to focus on enhancing the durability, recyclability, and functionality of polymer foams, the market is expected to witness continuous expansion, with new applications emerging across industries.

Global Polymer Foams Market Challenges and Restraints

Environmental Concerns and Regulatory Challenges is restricting market growth: The polymer foams industry faces increasing scrutiny due to concerns about plastic waste, recyclability, and the environmental impact of foam production. Many polymer foams, particularly expanded polystyrene (EPS) and polyurethane (PU), are non-biodegradable and contribute significantly to landfill waste. Governments worldwide have imposed strict regulations and bans on single-use foam packaging, compelling manufacturers to develop eco-friendly alternatives. The European Union’s Circular Economy Action Plan and various state-level restrictions in the United States have further pressured foam producers to transition towards sustainable and recyclable materials. Despite ongoing innovations in biodegradable and bio-based foams, the high costs of production and limited scalability of sustainable alternatives remain significant challenges. Companies must navigate complex regulatory landscapes while ensuring cost-effective compliance with evolving environmental policies, which can hinder market growth and profitability.

Fluctuations in Raw Material Prices and Supply Chain Disruptions is restricting market growth: The polymer foams market is highly dependent on raw materials derived from petrochemical sources, making it susceptible to price volatility and supply chain disruptions. The fluctuating costs of crude oil, which influence the prices of polymer resins such as polyurethane, polystyrene, and polyethylene, pose a challenge for foam manufacturers. Additionally, global supply chain disruptions, including transportation bottlenecks and raw material shortages, have impacted production capacities and increased costs for foam producers. The COVID-19 pandemic exacerbated these challenges, causing delays in raw material procurement and affecting overall market stability. Manufacturers are increasingly exploring alternative raw materials and diversifying their supply chains to mitigate these risks. However, maintaining cost efficiency while ensuring consistent product quality remains a significant challenge for industry players.

Market Opportunities

The growing focus on sustainable and eco-friendly polymer foams presents a significant opportunity for market expansion. Consumers and industries are increasingly prioritizing environmentally responsible materials, prompting manufacturers to invest in biodegradable, bio-based, and recyclable foam solutions. The emergence of plant-based polyols, recycled polyurethane foams, and compostable foam alternatives has opened new avenues for innovation and market penetration. The medical sector also presents substantial growth potential, with polymer foams being used for medical cushioning, orthopedic supports, and advanced wound care solutions. Additionally, the increasing adoption of polymer foams in aerospace applications, particularly for interior components and insulation, is driving demand for high-performance lightweight materials. The construction industry’s shift towards energy-efficient buildings further fuels the need for advanced polymer foam insulation solutions. As industries continue to embrace sustainability, regulatory compliance, and technological advancements, the polymer foams market is poised for sustained growth, offering lucrative opportunities for manufacturers and stakeholders.

POLYMER FOAMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE Dow Inc., Recticel Group, Arkema S.A., Zotefoams PLC, Huntsman Corporation, Sekisui Chemical Co., Ltd., Toray Industries, Inc., SABIC, JSP Corporation |

Polymer Foams Market Segmentation - By Type

• Polyurethane (PU) Foam

• Polystyrene (PS) Foam

• Polyethylene (PE) Foam

• Polypropylene (PP) Foam

• Polyvinyl Chloride (PVC) Foam

• Others

The most dominant segment in the polymer foams market is polyurethane (PU) foam. PU foams are widely used in furniture, bedding, automotive interiors, and insulation applications due to their versatility, lightweight nature, and superior cushioning properties. The demand for PU foams continues to grow, driven by increasing consumer preference for comfort-enhancing products and energy-efficient building materials.

Polymer Foams Market Segmentation - By Application

• Packaging

• Automotive

• Construction

• Furniture and Bedding

• Medical

• Others

The most dominant application segment is the packaging industry. Polymer foams are extensively used in protective packaging, food containers, and cushioning materials due to their lightweight and shock-absorbing properties. The rise of e-commerce and sustainable packaging trends has further propelled demand for innovative foam-based packaging solutions.

Polymer Foams Market Segmentation - By Region

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

The Asia-Pacific region dominates the polymer foams market. Rapid industrialization, urbanization, and expanding end-use industries such as construction, automotive, and packaging drive the region’s market growth. China, India, and Japan are the key contributors, with high demand for lightweight materials in infrastructure and consumer goods. Government initiatives supporting sustainable materials and increasing foreign investments in the region further accelerate polymer foam adoption.

COVID-19 Impact Analysis on the Polymer Foams Market

The COVID-19 pandemic had a significant impact on the polymer foams market, disrupting the supply chain and leading to reduced industrial activities. Fluctuating raw material prices and manufacturing halts further affected production. Despite these challenges, the demand for polymer foams saw some relief from increased medical applications, such as foam-based personal protective equipment (PPE), hospital mattresses, and packaging materials. These applications partially mitigated the negative effects on the market as the healthcare sector experienced an uptick in demand due to the global health crisis. As economies started to recover and industrial activities resumed, the polymer foams market began to rebound. The recovery of key sectors such as construction and automotive played a pivotal role in this resurgence. The construction industry, driven by infrastructure development and residential construction projects, saw increased use of polymer foams for insulation, soundproofing, and lightweight materials. The automotive sector, on the other hand, leveraged polymer foams for lightweight components and improved vehicle comfort, further accelerating market growth. The polymer foams market is expected to continue to recover and grow in the coming years, supported by innovations in material science and a shift towards more sustainable products. With demand in sectors like packaging, automotive, and construction, along with increasing awareness about energy efficiency and sustainability, the market is poised for a steady expansion. The evolution of applications and advancements in production technology are expected to drive demand further, marking a strong path toward growth and resilience for the polymer foams market in a post-pandemic world.

Latest Trends/Developments

Sustainability trends are playing a crucial role in reshaping the polymer foams industry, prompting manufacturers to shift towards more eco-friendly alternatives. With increasing concerns about environmental impact, there is a growing focus on developing bio-based, recyclable, and biodegradable foams. This shift is driven by both consumer demand for sustainable products and the need for companies to comply with tightening environmental regulations. As a result, more companies are investing in research and development to create foams that reduce environmental footprints while maintaining high performance. In addition to sustainability, innovations in the polymer foams market are fueling significant growth. The demand for lightweight foams in electric vehicles (EVs) is increasing, as these foams help reduce vehicle weight and improve energy efficiency. This trend is closely aligned with the broader shift toward EVs and sustainable transportation solutions. Similarly, the rise of 3D-printed foams has opened up new possibilities for customization, design flexibility, and reduced waste in manufacturing processes. These advancements are contributing to the expansion of the polymer foams market, particularly in sectors requiring precise and tailored materials. Another area of growth is the development of high-performance foams for aerospace applications. These foams are designed to withstand extreme conditions while providing lightweight, durable solutions for aviation and space industries. The aerospace sector’s increasing demand for advanced materials is driving further innovation in the polymer foams space. Moreover, regulatory policies that promote circular economy practices are encouraging companies to adopt more sustainable production methods and develop products that can be reused, recycled, or biodegraded. These regulations are influencing market strategies, pushing companies to integrate circularity into their supply chains and product designs. This evolving landscape is helping to create a more sustainable, innovative, and efficient polymer foams industry.

Key Players

-

BASF SE

-

Dow Inc.

-

Recticel Group

-

Arkema S.A.

-

Zotefoams PLC

-

Huntsman Corporation

-

Sekisui Chemical Co., Ltd.

-

Toray Industries, Inc.

-

SABIC

-

JSP Corporation

Chapter 1. Polymer Foams Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Polymer Foams Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Polymer Foams Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Polymer Foams Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Polymer Foams Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Polymer Foams Market – By Type

6.1 Introduction/Key Findings

6.2 Polyurethane (PU) Foam

6.3 Polystyrene (PS) Foam

6.4 Polyethylene (PE) Foam

6.5 Polypropylene (PP) Foam

6.6 Polyvinyl Chloride (PVC) Foam

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Polymer Foams Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Automotive

7.4 Construction

7.5 Furniture and Bedding

7.6 Medical

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Polymer Foams Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Polymer Foams Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Dow Inc.

9.3 Recticel Group

9.4 Arkema S.A.

9.5 Zotefoams PLC

9.6 Huntsman Corporation

9.7 Sekisui Chemical Co., Ltd.

9.8 Toray Industries, Inc.

9.9 SABIC

9.10 JSP Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Polymer Foams Market was valued at USD 105 billion in 2024 and will grow at a CAGR of 6.2% from 2025 to 2030. The market is expected to reach USD 141.84 billion by 2030.

Key drivers include rising demand for lightweight materials, expanding packaging applications, and technological advancements in foam production.

The market is segmented by product type (PU, PS, PE, PP, PVC foams) and application (packaging, automotive, construction, furniture, medical).

The Asia-Pacific region dominates the market, contributing nearly 45% of global revenue due to industrialization and high consumer demand.

Key players include BASF SE, Dow Inc., Recticel Group, Arkema S.A., Zotefoams PLC, and Huntsman Corporation.