Polymer Based Green Composites Market Size (2024-2030)

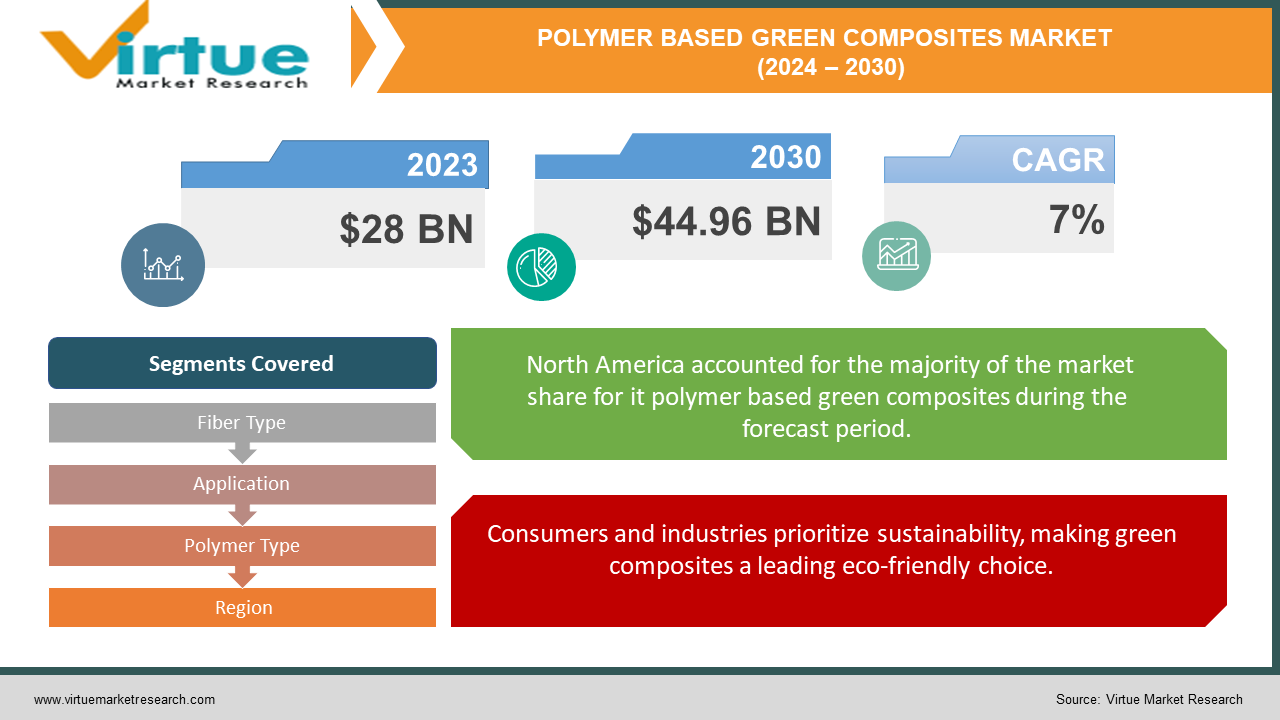

The polymer-based Green Composites Market was valued at USD 28 billion in 2023 and is projected to reach a market size of USD 44.96 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7%.

Polymer-based green composites are revolutionizing material science by offering a sustainable alternative to traditional composites. Made from natural fibers like flax, hemp, and wood flour, combined with biodegradable polymers derived from plants, these composites boast impressive eco-credentials. Their popularity is surging due to a growing focus on environmental responsibility.

Key Market Insights:

Biodegradability is a key selling point, with these composites decomposing naturally – a significant advantage over traditional options. Europe is expected to surpass USD 5.3 billion by 2032, driven by increased research activities, government policies supporting electric vehicles, and strong automotive and aerospace sectors

According to several reports, the construction sector dominated with 56% of the overall market volume in 2023, using natural fibers for various building materials

However, there are challenges to overcome before widespread adoption. Green composites often come with a higher price tag compared to traditional materials. Additionally, while research is ongoing to improve performance, some green composites might not fully match the performance level of traditional composites in specific applications. Moisture sensitivity in certain natural fibers can also be an obstacle, affecting the overall consistency of the composite.

The Polymer Based Green Composites Market Drivers:

Consumers and industries prioritize sustainability, making green composites a leading eco-friendly choice.

Consumers and industries are increasingly environmentally conscious, actively seeking out sustainable alternatives. Green composites perfectly cater to this demand by utilizing renewable resources like natural fibers and biodegradable polymers. This shift towards eco-friendly materials positions green composites as a frontrunner in the market.

Biodegradability offers a natural solution to plastic pollution, attracting environmentally responsible manufacturers.

A Natural Solution to Plastic Pollution: Unlike traditional composites derived from petroleum, green composites offer a significant environmental benefit – biodegradability. This means they decompose naturally at the end of their lifespan, unlike traditional plastics that linger in landfills for centuries. This advantage is a major selling point for manufacturers with a strong commitment to environmental responsibility and tackling plastic pollution, a major global concern.

Lightweight properties translate to improved fuel efficiency and performance across various sectors.

Driving Fuel Efficiency and Performance: Green composites boast a lighter weight compared to traditional counterparts. This translates to substantial benefits, particularly in the automotive industry. Every pound shed from a vehicle translates to improved fuel efficiency, a key metric for both manufacturers and consumers striving for environmental and economic sustainability. Additionally, the lightweight nature of green composites can enhance the performance of various products in other sectors.

Government regulations promoting bio-based materials create a supportive environment for market growth.

Governments around the world are increasingly implementing regulations that promote the use of bio-based materials. These regulations aim to reduce dependence on fossil fuels, minimize environmental impact, and encourage the development of sustainable alternatives. Such regulations create a supportive environment for the growth of the green composites market in specific regions, fostering innovation and market expansion.

The Polymer Based Green Composites Market Restraints and Challenges:

Despite the promising outlook for polymer-based green composites, there are hurdles to overcome before widespread adoption. Cost remains a key challenge – currently, green composites often carry a higher price tag compared to traditional materials. This can be a significant barrier for manufacturers, particularly in industries where cost is a major consideration. Furthermore, while research and development are actively improving performance, some green composites might not yet fully match the performance of traditional counterparts in specific applications. This limits their suitability for high-performance requirements in certain sectors. Additionally, moisture sensitivity can be an obstacle. Certain natural fibers used in green composites are susceptible to moisture, which can affect the overall consistency and performance of the final product. Finally, there's a need to bridge the knowledge gap. Compared to traditional materials, awareness about green composites and their benefits might be lower amongst some manufacturers and consumers. Additionally, standardized production and quality control measures are still under development in some regions. Addressing these challenges will be crucial in unlocking the full potential of polymer-based green composites and solidifying their position as a sustainable material solution.

The Polymer Based Green Composites Market Opportunities:

The future of the polymer-based green composites market is brimming with opportunities. Innovation in bio-based polymers is at the forefront, with research delving into new renewable resources to create high-performance green composites with properties tailored for specific applications. This opens doors for lighter, stronger, and more eco-friendly options across various industries. Additionally, advancements in manufacturing techniques, such as improved fiber treatment and optimized composite design, hold the potential to further enhance the performance and cost-effectiveness of green composites, making them even more competitive. The versatility of these composites is another exciting opportunity. As research progresses, green composites can be adapted for a wider range than traditional sectors like construction and automotive. From sporting goods and electronics to even medical devices, the possibilities are vast. Furthermore, with the growing focus on sustainability, life cycle analysis (LCA) is gaining traction.

POLYMER BASED GREEN COMPOSITES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Fiber Type, Application, Polymer Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Flex Form Technologies, TECNARO GMBH, Procotex SA Corporation NV, GreenGran BN, UPM Biocomposites, MCG Biocomposites LLC., ALPAS srl, Total Corbion, NatureWorks, Braskem |

Polymer Based Green Composites Market Segmentation: By Fiber Type

-

Wood fibers

-

Non-wood fibers

-

Other natural fibers

The dominant segment by fiber type in the polymer-based green composites market is likely Wood fibers (jute, hemp, kenaf, sisal, coir) due to their abundance, affordability, and good mechanical properties. However, Non-wood fibers (flax, bamboo) are expected to be the fastest-growing segment due to their superior strength, lower weight, and expanding applications in the automotive and consumer goods industries.

Polymer Based Green Composites Market Segmentation: By Application

-

Automotive

-

Construction

-

Consumer goods

-

Aerospace

-

Agriculture

The dominant segment in the polymer-based green composites market by application is currently Construction. This sector leverages green composites for building materials and furniture, capitalizing on their lightweight and sustainable properties. The Consumer Goods segment is expected to witness the most significant growth in the coming years. This can be attributed to the increasing demand for eco-friendly packaging and various consumer goods made from sustainable materials.

Polymer Based Green Composites Market Segmentation: By Polymer Type

-

Polylactic Acid

-

Polyhydroxybutyrate

-

Starch-based polymers

Currently, Polylactic Acid (PLA) is the dominant segment within the polymer-type sector of the polymer-based green composites market. PLA is popular due to its versatility, good processability, and availability from various renewable resources like corn starch. However, Starch-based polymers are experiencing the most rapid growth due to their potential for cost-effectiveness and wider availability of raw materials. This segment is expected to challenge PLA's dominance in the coming years.

Polymer Based Green Composites Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Currently, North America holds the leading position in the global green composites market. This dominance is attributed to the presence of established automotive and aerospace industries that are actively seeking lightweight and sustainable materials. Stringent environmental regulations and a growing focus on sustainability among consumers further fuel market growth in this region.

The Asia Pacific region is expected to witness the fastest growth in the green composites market in the coming years. This is due to a combination of factors, including rapid economic development, rising disposable incomes, and increasing government investments in infrastructure projects. Additionally, the presence of a large and growing automotive industry in this region creates significant demand for lightweight and sustainable materials like green composites.

COVID-19 Impact Analysis on the Polymer Based Green Composites Market:

The COVID-19 pandemic cast a complex shadow on the polymer-based green composites market. In the immediate aftermath, global supply chains for both raw materials and finished green composites were severely disrupted by lockdowns and travel restrictions. This led to a ripple effect of temporary shortages, causing price fluctuations and creating uncertainty within the market. Production facilities faced closures or significant reductions in capacity due to pandemic restrictions, further limiting the supply of green composites and hindering market growth momentum.

However, amidst these short-term challenges, there are glimmers of long-term potential for the polymer-based green composites market. The pandemic has served as a stark reminder of the importance of environmental sustainability, potentially leading to a long-term shift in consumer and business behavior. With a heightened awareness of environmental issues, there's a chance for a surge in demand for sustainable materials like green composites. Consumers and businesses alike may become more environmentally conscious, actively seeking eco-friendly alternatives in various sectors. The booming e-commerce landscape presents another exciting opportunity for green composites, particularly in packaging applications. As online shopping continues its relentless growth trajectory, the demand for sustainable packaging solutions like those made from green composites is likely to rise significantly.

Latest Trends/ Developments:

The world of polymer-based green composites is buzzing with innovation, constantly seeking new ways to be more sustainable and perform even better. Researchers are delving into novel bio-based polymers, exploring resources like lignin, a byproduct of paper production, to create high-performance bio-resins. Additionally, advancements in using microorganisms to produce biopolymers offer a more sustainable and efficient production method. The concept of a circular economy, where materials are used for extended periods, is gaining traction. This translates to the development of new recycling technologies for green composites, minimizing waste and maximizing their lifespan. Another exciting trend is the integration of nanotechnology. These trends paint a picture of a dynamic market constantly evolving, and by embracing innovation and focusing on sustainability across the entire value chain, green composites are poised to become a leading material choice for a more sustainable future.

Key Players:

-

Flex Form Technologies

-

TECNARO GMBH

-

Procotex SA Corporation NV

-

GreenGran BN

-

UPM Biocomposites

-

MCG Biocomposites LLC.

-

ALPAS srl

-

Total Corbion

-

NatureWorks

-

Braskem

Chapter 1. Polymer Based Green Composites Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Polymer Based Green Composites Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Polymer Based Green Composites Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Polymer Based Green Composites Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Polymer Based Green Composites Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Polymer Based Green Composites Market – By Fiber Type

6.1 Introduction/Key Findings

6.2 Wood fibers

6.3 Non-wood fibers

6.4 Other natural fibers

6.5 Y-O-Y Growth trend Analysis By Fiber Type

6.6 Absolute $ Opportunity Analysis By Fiber Type, 2024-2030

Chapter 7. Polymer Based Green Composites Market – By Application

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Construction

7.4 Consumer goods

7.5 Aerospace

7.6 Agriculture

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Polymer Based Green Composites Market – By Polymer Type

8.1 Introduction/Key Findings

8.2 Polylactic Acid

8.3 Polyhydroxybutyrate

8.4 Starch-based polymers

8.5 Y-O-Y Growth trend Analysis By Polymer Type

8.6 Absolute $ Opportunity Analysis By Polymer Type, 2024-2030

Chapter 9. Polymer Based Green Composites Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Fiber Type

9.1.3 By Application

9.1.4 By By Polymer Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Fiber Type

9.2.3 By Application

9.2.4 By Polymer Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Fiber Type

9.3.3 By Application

9.3.4 By Polymer Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Fiber Type

9.4.3 By Application

9.4.4 By Polymer Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Fiber Type

9.5.3 By Application

9.5.4 By Polymer Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Polymer Based Green Composites Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Flex Form Technologies

10.2 TECNARO GMBH

10.3 Procotex SA Corporation NV

10.4 GreenGran BN

10.5 UPM Biocomposites

10.6 MCG Biocomposites LLC.

10.7 ALPAS srl

10.8 Total Corbion

10.9 NatureWorks

10.10 Braskem

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Polymer Based Green Composites Market was valued at USD 28 billion in 2023 and is projected to reach a market size of USD 44.96 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 7%.

Surging Demand for Sustainable Products, Biodegradability Advantage, Lightweight Properties, Government Regulations as a Catalyst for Green Growth.

Automotive, Construction, Consumer goods, Aerospace, Agriculture.

North America holds the leading position in the global green composites market, driven by established automotive and aerospace industries seeking lightweight and sustainable materials.

Flex Form Technologies, TECNARO GMBH, Procotex SA Corporation NV, GreenGran BN, UPM Biocomposites, MCG Biocomposites LLC., ALPAS srl, Total Corbion, NatureWorks, Braskem.