Polyfilm Market Size (2024 – 2030)

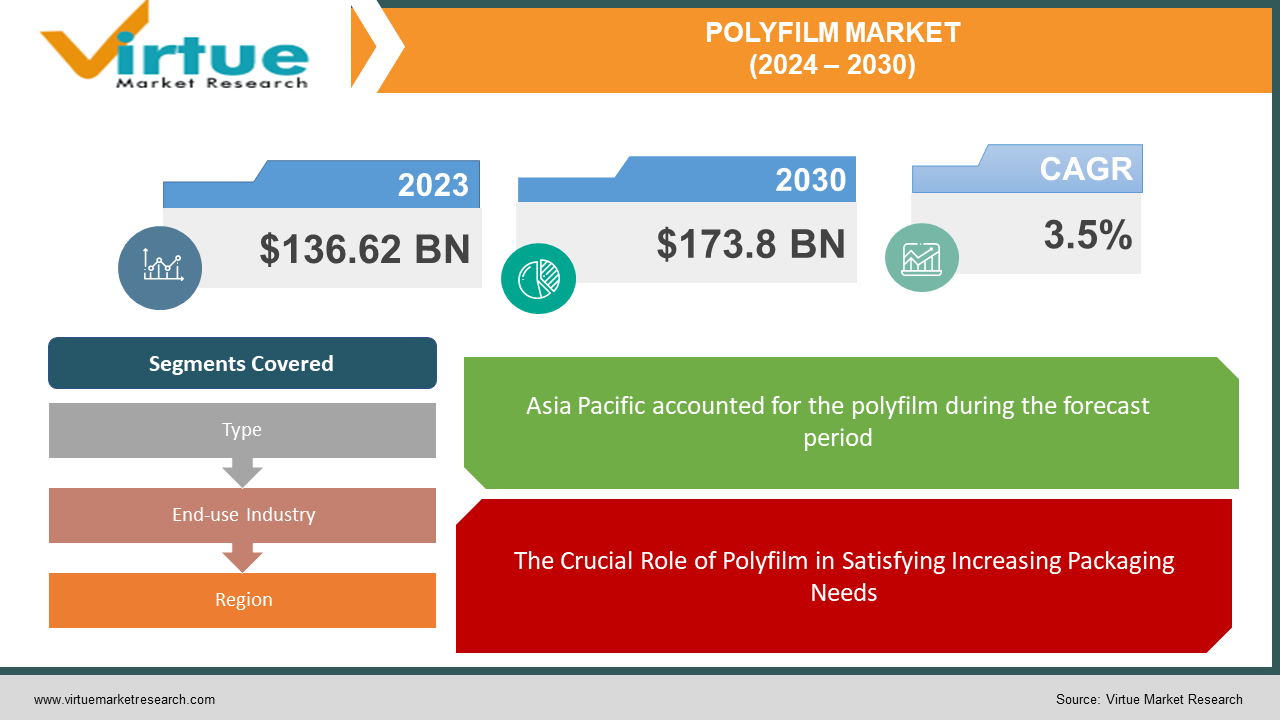

The Global Polyfilm Market was valued at USD 136.62 billion and is projected to reach a market size of USD 173.8 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 3.5% between 2024 and 2030.

The market's growth trajectory for polyfilm is closely associated with the increasing demand in several industries, including food packaging and medical applications, among others. Specifically, BoPP (Biaxially Oriented Polypropylene) polyfilms are expected to have substantial growth during the projected year. Due to their cost-effectiveness and favorable qualities, they have gradually replaced traditional cellophane in food packaging, which has led to a boom in demand. BoPP polyfilms are a popular option for packaging solutions because of their excellent barrier qualities, durability, and adaptability.

In addition, shrink-wrap films are becoming more and more popular, particularly for use in kitchens. Shrink wrap films give different food items convenience, freshness, and preservation capabilities, hence the projection period expects strong growth in this area. Furthermore, the growing inclination towards shrink film bags is being driven by the growing demand for food packaging that can be carried on the move. These backpacks meet the changing demands of customers who want convenience without sacrificing style. The increasing pace of life has led to a greater need for practical and economical packaging solutions. Polyfilms, especially shrink wrap and BoPP films, are essential in fulfilling these changing needs. The development of the polyfilm market is illustrative of the inventiveness and adaptability of the sector, opening doors for long-term expansion and significance in a wide range of applications.

Key Market Insights:

The growing need for packaging solutions, especially in the food industry where shelf life extension is critical, is driving the global polyfilm market. The Asia Pacific area and other developing economies are seeing increasing urbanization and rising disposable incomes, which is driving this expansion and emphasizing the need for innovative packaging technology. Furthermore, single-serve packaging and convenience foods are driving consumer preferences, which is driving market expansion. With the development of biodegradable films and the adoption of sustainable methods, the industry is primed for growth despite obstacles including fluctuating raw material prices and environmental concerns. n order to meet market demands and environmental imperatives, stakeholders are increasingly funding research and development to develop innovative eco-friendly solutions. This collaborative effort across the supply chain positions the polyfilm market for sustained expansion while addressing sustainability challenges.

Global Polyfilm Market Drivers:

The Crucial Role of Polyfilm in Satisfying Increasing Packaging Needs.

The packaging sector relies heavily on polyfilm, especially in the area of food preservation, which is fueling rapid expansion. Because of its exceptional capacity to prolong its shelf life and its versatility, both manufacturers and customers find it to be a preferred option. Its versatility in meeting a variety of packaging needs—from perishables to non-food items—and meeting a broad range of market demands further emphasizes its supremacy. The importance of polyfilm in maintaining product freshness and shelf life on store shelves is growing as the demand for packaged goods rises on a global scale. Its effectiveness in maintaining the quality of products not only raises consumer happiness but also helps firms compete more broadly in a crowded market. This mutually beneficial relationship between polyfilm and the packaging sector emphasises how essential it is to address the growing packaging demands of both businesses and consumers in the modern world, demonstrating its continued dominance and significance in the market.

Fulfilling the Requirements of Changing Consumer Trends.

Due to consumers' shifting preferences for convenience, the polyfilm market is seeing tremendous growth. This change is visible in the rising demand, especially in the food and beverage industry, for ready-to-eat meals and single-serve packaging. As a key component of the packaging design solution for these evolving consumer behaviors, polyfilms provide unmatched diversity and usefulness. While ready-to-eat meals serve busy lives looking for quick and simple meal solutions, single-serving packaging is becoming more popular as a reflection of consumers' need for portion control and on-the-go convenience. In addition to offering effective barrier qualities to maintain the quality and freshness of these products, polyfilms also give a range of customizable alternatives to satisfy various packaging needs. The market for polyfilms is predicted to increase steadily as long as consumer tastes keep changing and producers adjust to satisfy the increasing demand for packaging options that prioritize convenience. This emphasises how important polyfilms are to meeting and adapting to the changing needs of today's consumers.

Global Polyfilm Market Restraints and Challenges:

The polyfilm industry is confronted with a variety of obstacles, such as strict environmental laws and growing sustainability worries brought on by plastic pollution. More stringent laws and prohibitions on non-recyclable materials may limit industry expansion, particularly considering how challenging it is to recycle polyfilms. Manufacturers need to embrace innovation and sustainable techniques, including creating biodegradable films, to comply with regulations and satisfy the needs of consumers who care about the environment. Another major obstacle is the market's susceptibility to changes in the price of raw materials, especially those sourced from petroleum. Changes in the price of oil have a direct effect on production costs, which could squeeze manufacturer profits and prevent market expansion. Navigating this pricing volatility and maintaining growth in the polyfilm business would need employing mitigating tactics including investigating substitute materials and putting cost-saving measures in place.

Global Polyfilm Market Opportunities:

Growing environmental concerns are fueling strong demand for environmentally friendly packaging options, and biodegradable polyfilms made from renewable materials are showing promise as a key avenue for industry growth. These ecologically friendly substitutes help ensure that stronger rules are followed in addition to satisfying the needs of environmentally conscious consumers. Simultaneously, developments in polyfilm technology present bright futures; these advances are concentrated on improving qualities including strength, barrier protection, and printability. Additionally, innovations in recycling technologies have the potential to strengthen polyfilm sustainability and successfully address environmental concerns. Manufacturers may expand their market reach and uncover new uses by embracing technical improvements and prioritizing research and development. This will also enable them to meet the growing need for ecologically friendly packaging solutions.

POLYFILM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.5% |

|

Segments Covered |

By Type, End-use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Jindal Poly Films, Formosa Plastics Corporation, Uflex Limited, SRF Limited, Cosmo Films, Taghleef Industries, Polyplex Corporation, POLIFILM Group, Treofan Group, LyondellBasell Industries |

Global Polyfilm Market Segmentation: By Type

-

LLDPE

-

Poly LDPE Shrink Film

-

HDPE Poly Film

-

Other

The Global Ployfilm Market is Segmented by Type, LLDPE held the largest market share last year and is poised to maintain its dominance throughout the forecast period. In the polyfilm industry, LLDPE (Linear Low-Density Polyethylene) is unique because of its remarkable blend of qualities, which include strength, flexibility, transparency, and puncture resistance, making it perfect for a wide range of packaging applications. Because it is more affordable than other varieties of polyfilm, producers in a variety of industries find it to be a desirable option, which has led to its widespread use. Moreover, LLDPE's versatility is improved and it may successfully suit certain packaging needs due to its adaptability, which enables blending with other resins to customize qualities. Its widespread use in high-growth industries like food packaging, where it prolongs shelf life, and agriculture, where it's applied in silage wraps and greenhouse coverings, highlights its superiority and confirms its standing as the go-to option in important growth areas.

Global Polyfilm Market Segmentation: By End-use Industry

-

Agriculture

-

Polyfilm Packaging Market

-

Building & Construction

-

Consumer Goods

-

Other

The Global Ployfilm Market is Segmented by End Use Industry, Agriculture held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The burgeoning demand for food, propelled by the ever-expanding global population, coupled with the need for enhanced agricultural efficiency to meet this demand, serves as a significant driver in the polyfilm market. Polyfilms demonstrate remarkable versatility in agricultural applications, serving as indispensable tools for modern farming practices. From greenhouse films enabling controlled environments for optimal plant growth to mulch films regulating soil conditions and silage wraps preserving forage, polyfilms offer a diverse array of benefits crucial for maximizing agricultural productivity. Moreover, ongoing technological advancements tailored specifically for agricultural use, such as films with enhanced light diffusion or temperature control properties, further solidify polyfilms' position in the market. Their cost-effectiveness compared to traditional methods, along with the potential for improved yields and resource conservation, underscores their role in maximizing returns on investment for farmers while ensuring food security amidst increasing global food demand and evolving agricultural practices.

Global Polyfilm Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Global Ployfilm Market is Segmented by Region, Asia-Pacific held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The global polyfilm market showcases dominance in North America, with the region commanding a substantial market share. The increasing utilization of specialty polyfilms across various end-use industries drives market growth, with North America expected to remain highly lucrative for products like CPP films, PE polyfilms, PVC polyfilm rolls, and shrink polyfilms. In contrast, Asia Pacific presents promising opportunities for polyfilm manufacturers, fueled by factors such as rising e-commerce penetration, growing disposable income, and a flourishing agriculture sector. Anticipated increases in demand for polyfilms in packaging, particularly in the food industry, coupled with the rise of e-commerce platforms, are expected to propel market growth in the Asia Pacific region. Shrink films, specifically, are poised for heightened demand in the food sector, offering new prospects for manufacturers. The Asia Pacific polyfilm market is projected to witness steady growth, driven by these factors, and is estimated to reach a significant valuation by the end of the forecast period.

COVID-19 Impact Analysis on the Global Polyfilm Market:

The global polyfilm market was taken by surprise by the COVID-19 pandemic. Production and distribution were hampered by lockdowns, which caused supply chains to break and necessitated temporary industrial closures. Furthermore, the recession reduced demand for polyfilms in several businesses. Not every industry was impacted equally, though. The surge in food sales via the Internet, resulting from limitations on staying at home, increased the need for polyfilm wrapping. In a similar vein, the hygiene industry saw a boom in packaged sanitizers and disinfectants that needed polyfilm materials. These growth areas helped to offset the overall loss to some extent. The polyfilm market is anticipated to recover and retake its pre-pandemic growth trajectory as economies progressively return to normal and consumer behaviors adjust to the post-pandemic environment.

Latest Trends/ Developments:

The global polyfilm market is experiencing dynamic shifts driven by several key trends. The prominent rise of biodegradable polyfilms, crafted from renewable resources, underscores a growing consumer and regulatory preference for sustainable packaging solutions. Simultaneously, the emergence of functional polyfilms with enhanced properties such as extended shelf life, antimicrobial capabilities, and self-healing attributes reflects ongoing innovation within the industry. Advancements in recycling technologies offer promising solutions to address plastic waste concerns, while the surge in e-commerce is prompting the development of polyfilms tailored to meet the specific needs of online retailers, emphasizing puncture resistance and printability for secure product delivery. These trends collectively highlight the market's adaptability to evolving customer demands, environmental imperatives, and technological advancements, with a clear focus on sustainability and innovation shaping the future trajectory of the polyfilm industry.

Key players:

-

Jindal Poly Films

-

Formosa Plastics Corporation

-

Uflex Limited

-

SRF Limited

-

Cosmo Films

-

Taghleef Industries

-

Polyplex Corporation

-

POLIFILM Group

-

Treofan Group

-

LyondellBasell Industries

Chapter 1. POLYFILM MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. POLYFILM MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. POLYFILM MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. POLYFILM MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. POLYFILM MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. POLYFILM MARKET – By Type

6.1 Introduction/Key Findings

6.2 LLDPE

6.3 Poly LDPE Shrink Film

6.4 HDPE Poly Film

6.5 Other

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. POLYFILM MARKET – By End-use Industry

7.1 Introduction/Key Findings

7.2 Agriculture

7.3 Polyfilm Packaging Market

7.4 Building & Construction

7.5 Consumer Goods

7.6 Other

7.7 Y-O-Y Growth trend Analysis By End-use Industry

7.8 Absolute $ Opportunity Analysis By End-use Industry, 2024-2030

Chapter 8. POLYFILM MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By End-use Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By End-use Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By End-use Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By End-use Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By End-use Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. POLYFILM MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Jindal Poly Films

9.2 Formosa Plastics Corporation

9.3 Uflex Limited

9.4 SRF Limited

9.5 Cosmo Films

9.6 Taghleef Industries

9.7 Polyplex Corporation

9.8 POLIFILM Group

9.9 Treofan Group

9.10 LyondellBasell Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the global polyfilm market is expected to be valued at US$ 136.62 billion.

Through 2030, the global polyfilm market is expected to grow at a CAGR of 3.5%.

By 2030, the global polyfilm market is expected to grow to a value of US$ 173.3 billion.

The Asia-Pacific is predicted to lead the market for global poly film.

The global polyfilm market has segments of Type, End-use, and Region.